by Calculated Risk on 12/24/2020 07:16:00 PM

Thursday, December 24, 2020

December 24 COVID-19 Test Results; Record Hospitalizations

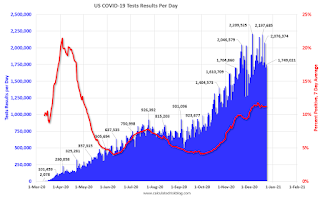

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,889,205 test results reported over the last 24 hours.

There were 199,375 positive tests.

Almost 61,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.6% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

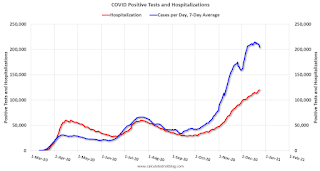

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

Hotels: Occupancy Rate Declined 26.4% Year-over-year

by Calculated Risk on 12/24/2020 02:23:00 PM

From HotelNewsNow.com: STR US hotel results for week ending 19 December

U.S. weekly hotel occupancy decreased slightly from the previous week, according to the latest data from STR through 19 December.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

13-19 December 2020 (percentage change from comparable week in 2019):

• Occupancy: 36.8% (-26.4%)

• Average daily rate (ADR): US$85.50 (-21.9%)

• Revenue per available room (RevPAR): US$31.45 (-42.5%)

The industry also surpassed one billion unsold room nights for the first time on record.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate - see graph above - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

This suggests no improvement over the last 3 months.

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

| 12/5 | -37.9% |

| 12/12 | -37.4% |

| 12/19 | -26.4% |

Review: Ten Economic Questions for 2020

by Calculated Risk on 12/24/2020 09:37:00 AM

Every year, I've posted a disclaimer that a recession could be caused by "An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons" (emphasis added).

Unfortunately 2020 saw one of those "low probability" events, and many of my predictions weren't even close. In a way, this is the point of the predictions. I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong. As an example, when the pandemic hit, I switched from being mostly positive on the economy to calling a recession in early March.

At the end of last year, I posted Ten Economic Questions for 2020. I followed up with a brief post on each question. Here is review (we don't have all data yet, but enough). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2020: Will housing inventory increase or decrease in 2020?

"Since I don't expect any change in fiscal policy during an election year, and monetary policy appears to be on hold - and I don't expect either a strong pickup in the economy (and higher rates) or an economic slump - it seems likely inventory will remain at about the same level through 2020."According to the November NAR report on existing home sales, inventory was down 22% year-over-year in November, and the months-of-supply was at a record low 2.3 months. In 2020, inventory really declined due to a combination of potential sellers keeping their properties off the market during a pandemic, and a pickup in buying due to record low mortgage rates, a move away from multi-family rentals and strong second home buying (to escape the high-density cities).

9) Question #9 for 2020: What will happen with house prices in 2020?

"If inventory remains at close to the same level, it seems likely that price appreciation will increase from the 2019 pace to the mid-single digits."The CoreLogic data for October showed prices up 7.3% year-over-year. The September Case-Shiller data showed prices up 7.0% YoY. With inventory lower than expected, house prices picked up more than expected.

8) Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

"My sense is the pickup that happened in the second half of 2019 will continue, and my guess is starts will be up year-over-year in 2020 by mid-to-high single digits. My guess is new home sales will be over 700 thousand in 2020 (for the first time since 2007) and will also be up mid-to-high single digits."Through November, starts were up 7.0% year-over-year compared to the same period in 2019. New home sales were up 19.1% year--to-date through November. Even with the pandemic, my guess was pretty close on starts - but new home sales were up much more than expected.

7) Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

"My guess is the Fed will stay on hold in 2020 and the FOMC will keep the federal funds rate at 1‑1/2 to 1-3/4 percent."With the onset of the pandemic, the Fed lowered rates to zero in March:

"In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent."6) Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

"although I think core PCE inflation (year-over-year) will increase a little in 2020 (from the current 1.6%), I think too much inflation will still not be a serious concern in 2020."According to the November Personal Income and Outlays report, the November PCE price index increased 1.1 percent year-over-year and the November PCE price index, excluding food and energy, increased 1.4 percent year-over-year. Inflation was lower than expected, and definitely not a concern in 2020.

5) Question #5 for 2020: How much will wages increase in 2020?

I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase to the mid 3% range in 2020 according to the CES.With the pandemic, and the layoffs of many lower wage employees, the wage data isn't very useful in 2020.

4) Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

I expect the overall participation rate to decline in 2020 to just under 63% by the end of the year.The participation rate declined sharply with the pandemic, and the Labor Force Participation Rate was at 61.5% in November.

3) Question #3 for 2020: What will the unemployment rate be in December 2020?

it appears the unemployment rate will decline into the low 3's by December 2020 from the current 3.5%The unemployment rate increased sharply with the pandemic, and the unemployment rates was at 6.7% in November.

2) Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

"my forecast is for gains of around 125,000 to 150,000 payroll jobs per month in 2020 (about 1.5 million to 1.8 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics."Employment decreased sharply with the pandemic, and in November the year-over-year change was negative 9.19 million jobs.

1) Question #1 for 2020: How much will the economy grow in 2020?

These factors suggest real GDP growth probably in the 2% to 2.5% range in 2020.With the pandemic, it appears GDP will be down around 2.5% to 3.0% in 2020.

In 2020, with the impact of the pandemic, many of my predictions weren't close - especially employment and GDP.

Wednesday, December 23, 2020

December 23 COVID-19 Test Results; Record Hospitalizations, December Now Deadliest Month

by Calculated Risk on 12/23/2020 07:04:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,749,021 test results reported over the last 24 hours.

There were 220,834 positive tests.

Almost 58,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.6% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

A few Comments on November New Home Sales

by Calculated Risk on 12/23/2020 12:23:00 PM

New home sales for November were reported at 841,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down sharply.

This was well below consensus expectations of 990,000, but sales were still up 20.8% from November 2019. The last five months were the highest sales rates since 2006.

Earlier: New Home Sales decrease to 841,000 Annual Rate in November.

Click on graph for larger image.

Click on graph for larger image.This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 20.8% year-over-year (YoY) in November. Year-to-date (YTD) sales are up 19.1% (This is even above my optimistic forecast for 2020!).

And on inventory: since new home sales are reported when the contract is signed - even if the home hasn't been started - new home sales are not limited by inventory (except if no lots are available). Inventory for new home sales is important in that it means there will be more housing starts if inventory is low (like right now) - and fewer starts if inventory is too high (not now).

New Home Sales decrease to 841,000 Annual Rate in November

by Calculated Risk on 12/23/2020 10:14:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 841 thousand.

The previous three months were revised down sharply.

Sales of new single-family houses in November 2020 were at a seasonally adjusted annual rate of 841,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.0 percent below the revised October rate of 945,000, but is 20.8 percent above the November 2019 estimate of 696,000.

emphasis added

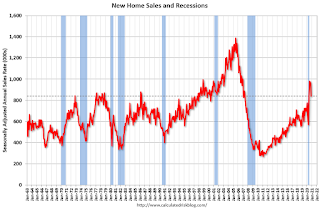

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The last five months saw the highest sales rates since 2006. This is strong year-over-year growth.

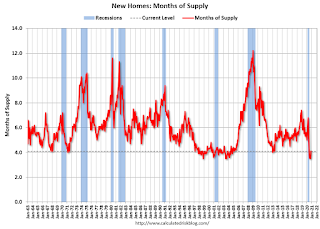

The second graph shows New Home Months of Supply.

The months of supply was increased in November to 4.1 months from 3.5 months in October.

The months of supply was increased in November to 4.1 months from 3.5 months in October. The all time record high was 12.1 months of supply in January 2009. The all time record low is 3.5 months, most recently in September 2020.

This is at the low end of the normal range (about 4 to 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of November was 286,000. This represents a supply of 4.1 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is low, and the combined total of completed and under construction is lower than normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2020 (red column), 55 thousand new homes were sold (NSA). Last year, 50 thousand homes were sold in November.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was well below expectations and sales in the three previous months were revised down sharply. I'll have more later today.

Personal Income decreased 1.1% in November, Spending decreased 0.4%

by Calculated Risk on 12/23/2020 08:51:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income decreased $221.8 billion (1.1 percent) in November according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $218.0 billion (1.2 percent) and personal consumption expenditures (PCE) decreased $63.3 billion (0.4 percent).The decrease in personal income was below expectations, and the decrease in PCE was also below expectations

Real DPI decreased 1.3 percent in November and Real PCE decreased 0.4 percent. The PCE price index had no change. Excluding food and energy, the PCE price index had no change .

The November PCE price index increased 1.1 percent year-over-year and the November PCE price index, excluding food and energy, increased 1.4 percent year-over-year.

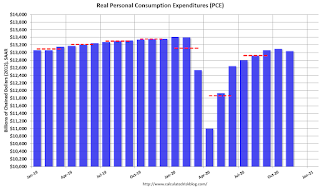

The following graph shows real Personal Consumption Expenditures (PCE) since January 2019 through November 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 6.8% annual rate in Q4 2020. (using the mid-month method, PCE was increasing at 4.0%). However, it appears the economy contracted in December - so PCE growth could be lower than 4%.

Weekly Initial Unemployment Claims decreased to 803,000

by Calculated Risk on 12/23/2020 08:37:00 AM

The DOL reported:

In the week ending December 19, the advance figure for seasonally adjusted initial claims was 803,000, a decrease of 89,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 885,000 to 892,000. The 4-week moving average was 818,250, an increase of 4,000 from the previous week's revised average. The previous week's average was revised up by 1,750 from 812,500 to 814,250.This does not include the 397,511 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 454,471 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 818,250.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 5,457,870 (SA) from 5,766,196 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 9,271,112 receiving Pandemic Unemployment Assistance (PUA) that increased from 9,244,556 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

This was lower than expected.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 12/23/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 18, 2020.

... The Refinance Index increased 4 percent from the previous week and was 124 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 26 percent higher than the same week one year ago.

“Mortgage rates are closing the year at record lows. The 30-year fixed rate – at 2.86 percent – is a full percentage point below a year ago. Last week’s increase in refinance applications was driven by FHA and VA activity, while conventional refinances saw a slight decline. Overall refinance activity was 124 percent higher than in 2019, as borrowers continue to seek lower monthly payments or different loan terms,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications decreased for the second time in three weeks, as both conventional and government applications saw a drop-off. Despite the decline, purchase applications remained 26 percent higher than the same week a year ago, and the average loan balance reached another record high.”

Added Kan, “There are still signs of relative strength in the housing market as 2020 ends. However, housing affordability will be worth monitoring next year. The lower loan size segment of the market – particularly for entry-level and first-time buyers – continues to be impacted by rapidly increasing home prices and tight inventory.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 2.86 percent from 2.85 percent, with points remaining unchanged at 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 26% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, December 22, 2020

Wednesday: New Home Sales, Unemployment Claims, Personal Income & Outlays and more

by Calculated Risk on 12/22/2020 09:11:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 900,000 initial claims, up from 885,000 last week.

• Also at 8:30 AM, Durable Goods Orders for November. The consensus is for a 0.6% increase in durable goods.

• Also at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.2% decrease in personal income, and for a 0.1% decrease in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for 990 thousand SAAR, down from 999 thousand in October.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for December). The consensus is for a reading of 81.0.