by Calculated Risk on 6/13/2020 08:11:00 AM

Saturday, June 13, 2020

Schedule for Week of June 14, 2020

The key reports this week are Retail sales and Housing Starts.

For manufacturing, the Industrial Production report, and the NY and Philly Fed manufacturing surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -27.5, up from -48.5.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for 8.0% increase in retail sales.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for 8.0% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, decreased by 19.7% on a YoY basis in April.

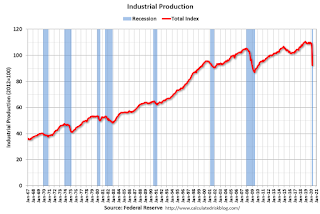

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 3.0% increase in Industrial Production, and for Capacity Utilization to increase to 66.9%.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 45, up from 37. Any number below 50 indicates that more builders view sales conditions as poor than good.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Housing Starts for May.

8:30 AM ET: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.100 million SAAR, up from 0.891 million SAAR in April.

12:00 PM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.450 million initial claims, down from 1.542 million the previous week.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of -25.0, up from -43.1.

10:00 AM: State Employment and Unemployment (Monthly) for May 2020

1:00 PM: Discussion, Fed Chair Jerome Powell, At the Federal Reserve Bank of Cleveland Virtual Discussion on Building a Resilient Workforce During the COVID-19 Era

Friday, June 12, 2020

Seattle Real Estate in May: Sales down 41% YoY, Inventory down 37% YoY

by Calculated Risk on 6/12/2020 06:48:00 PM

The Northwest Multiple Listing Service reported Housing activity in Western Washington shows resiliency as buyers, sellers and brokers adjust to COVID-19 restrictions

Not surprisingly, year-over-year comparisons showed sharp declines. The number of new listings fell nearly 33%, total active listings plummeted nearly 36%, pending sales declined 13.5%, and closed sales dropped about 35%. Prices remained in positive territory, rising about 2.3% from a year ago.There were 5,957 sales in May 2020, down from 9,153 sales in May 2019.

…

“The local real estate market is hot, but it looks different than it traditionally does,” remarked J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “The constraint on available inventory makes it feel like we’re running out of homes to sell.”

Brokers added 9,871 new listings to the MLS database during May, which compares to 14,689 for the same period a year ago. At month-end the selection included 10,357 active listings; that volume was 5,766 fewer than the year ago total of 16,133.

emphasis added

The press release is for the Northwest. In King County, sales were down 41.2% year-over-year, and active inventory was down 40.0% year-over-year.

In Seattle, sales were down 41.2% year-over-year, and inventory was down 36.8% year-over-year.. This puts the months-of-supply in Seattle at just 2.1 months.

The closed sales are for contracts mostly signed in March and April (when showing were limited). There will likely be some rebound in the July report.

June 12 COVID-19 Test Results

by Calculated Risk on 6/12/2020 05:52:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now usually conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 583,961 test results reported over the last 24 hours. This was a new high for the number of test results reported (some states might have had a data dump).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Seat Belts and Face Masks

by Calculated Risk on 6/12/2020 02:16:00 PM

I believe there is a strong parallel here (and an economic argument).

Auto manufacturers started offering seat belts as an option back in the ‘50s and ‘60s. Early research showed that wearing a seat belt dramatically reduced deaths and serious injuries in car crashes. But most people thought they’d never have an accident, so few people bought the optional seat belts.

With the rising costs of preventable deaths and serious injuries in the 1960s, it was easy to show that the savings from mandating seat belts would far outweigh the cost of all cars having seat belts. So, in 1968, the US passed a law mandating seat belts in all new vehicles.

This was strongly opposed by various anti-seat belt groups – this was “socialism” and impinged on their individual freedom. Many people refused to wear the seat belts, so eventually most state required the use of seat belts.

Further research has shown that the savings from mandating seat belts has been enormous in both lives and cost to society.

That brings us to face masks during a pandemic. Studies show that wearing a face mask substantially reduces the spread of the SARS-CoV-2 coronavirus.

Masks offer some protection to the person wearing the mask, but masks offer significant protection to the people that the mask wearer encounters. So, when you pass someone wearing a mask – thank them – they are wearing the mask for you!

Unfortunately, there is a strong anti-mask group in the US. They have harassed public health officials into resigning, and convinced some politicians to make mask wearing optional. These people are making the “socialism” argument and asserting their individual freedom.

The evidence is overwhelming that ubiquitous mask wearing significantly reduces the transmission of the virus, saving lives, reducing medical costs, and boosting the economy. The benefits of wearing masks far outweigh the negligible costs.

The bottom line is the US should follow the lead of other countries and mandate mask wearing during the pandemic – with strong enforcement and significant fines for those not wearing masks.

Q2 GDP Forecasts: Probably Around 40% Annual Rate Decline

by Calculated Risk on 6/12/2020 12:15:00 PM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 40% Q2 decline is around 9% decline from Q1 (SA).

From Merrill Lynch:

2Q GDP is tracking at -39.8% qoq saar. [June 12 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -25.9% for 2020:Q2 and -12.5% for 2020:Q3. [June 12 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -48.5 percent on June 9, up from -53.8 percent on June 4. [June 9 estimate]

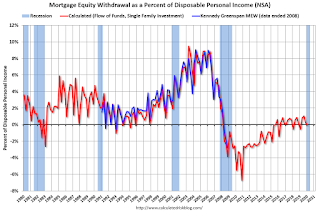

Mortgage Equity Withdrawal Flat in Q1

by Calculated Risk on 6/12/2020 09:30:00 AM

Note 1: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

Note 2: There have been reports showing an increase in cash out refinances, but it isn't showing up significantly in the Fed's Flow of Funds report.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q1 2020, the Net Equity Extraction was -$1 billion, or a -0.03% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been mostly positive for the last four years.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $59 billion in Q1.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declines Slightly for the second consecutive week

by Calculated Risk on 6/12/2020 08:27:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight:

The number of homeowners in active forbearance on their mortgages fell for the second consecutive week. Overall, the number of active forbearance plans is down 77K from last week, and 112K from the peak the week of May 22.

Click on graph for larger image.

As of June 9, 4.66 million homeowners remain in forbearance plans, representing 8.8% of all active mortgages, down from 8.9% last week. Together, the 4.66M represent just over $1 trillion in unpaid principal ($1,028B). Some 7% of all GSE-backed loans and 12.2% of all FHA/VA loans are currently in forbearance plans. GSE loans saw the greatest reduction, with forbearances falling by 47K week-over-week, but decreases were seen across all investor classes – as compared to last week, which saw a decline among government-backed mortgages partially offset by a rise in portfolio and PLS mortgages.

emphasis added

Thursday, June 11, 2020

June 11 COVID-19 Test Results

by Calculated Risk on 6/11/2020 05:52:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now usually conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 420,248 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Houston Real Estate in May: Sales Down 20.7% YoY, Inventory Down 8.3% YoY

by Calculated Risk on 6/11/2020 01:52:00 PM

From the HAR: Coronavirus and Ailing Energy Industry Continue to Impact Houston Real Estate

Houston home sales fell for a second straight month in May as the impact of COVID-19 and related stay-at-home orders continued to play out throughout the market. Growing consumer interest in in-person open houses and property showings, as well as an increase in offers to purchase, demonstrated improving market conditions. The slumping energy industry limited buyers in the luxury home market, which affected the overall average price of single-family homes across the region. Predicting the future of the market remains a challenge, and just this week, the National Bureau of Economic Research declared that the United States has been in a deep recession since February. ...Inventory declined 8.3% year-over-year from 43,096 in May 2019 to 39,516 in May 2020.

According to the latest monthly Market Update from the Houston Association of Realtors (HAR), 6,671 single-family homes sold in May compared to 8,359 a year earlier. That translated to a 20.2 percent decline – the second consecutive monthly decline since the pandemic struck the market. ... Sales of all property types totaled 7,917, down 20.7 percent from May 2019. Total dollar volume for the month fell 25.9 percent to slightly more than $2.2 billion.

“May delivered another mixed bag of data for the Houston housing market given the ongoing coronavirus pandemic on top of strains in the oil patch and the broader recession,” said HAR Chairman John Nugent with RE/MAX Space Center. “We will eventually work our way through these challenges, and already see positive indicators in the form of strong rental activity, solid pending sales numbers and steady attendance at property showings across greater Houston. Historically low interest rates still make conditions appealing to would-be buyers.”

emphasis added

Sales in Houston set a record in 2019 and were off to a strong start in 2020. However the impact of COVID-19 (and lower oil prices) has been significant. Note that the closed sales in May were for contracts that were mostly signed in March and April - so a large decline was expected.

Fed's Flow of Funds: Household Net Worth Decreased $7.4 Trillion in Q1

by Calculated Risk on 6/11/2020 01:24:00 PM

The Federal Reserve released the Q1 2020 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits fell to $110.8 trillion during the first quarter of 2020. The value of directly and indirectly held corporate equities decreased $7.8 trillion and the value of real estate increased $0.4 trillion.

Household debt increased 3.9 percent at an annual rate in the first quarter of 2020. Consumer credit grew at an annual rate of 1.6 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 3.2 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Even with the decline in stock prices in March, household net worth, as a percent of GDP, was higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

Net Worth as a percent of GDP decreased in Q1.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

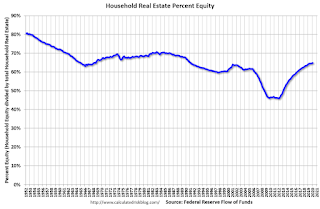

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2020, household percent equity (of household real estate) was at 64.8% - up from Q4.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have less than 64.8% equity - and about 1.82 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $59 billion in Q1.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 49.1% - up from Q4 due to the decline in GDP - but down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, increased in Q1, and is above the average of the last 30 years (excluding bubble).