by Calculated Risk on 5/29/2020 11:44:00 AM

Friday, May 29, 2020

Q2 GDP Forecasts: Probably Around 40% Annual Rate Decline

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 40% Q2 decline is around 9% decline from Q1 (SA).

From Merrill Lynch:

Better than expected capex data edged up 2Q GDP tracking to -39.7% qoq saar. [May 29 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -35.5% for 2020:Q2. [May 29 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -51.2 percent on May 29, down from -40.4 percent on May 28. [May 29 estimate]

Real Personal Income less Transfer Payments

by Calculated Risk on 5/29/2020 10:02:00 AM

In the Personal Income & Outlays report for April, the BEA noted that "Personal income increased $1.97 trillion (10.5 percent) in April". This was due to a large increase in transfer payment.

Transfer payments increased by $3 trillion in April. Unemployment insurance increased from $70 billion in March, to $430 billion in April. And "Other" (mostly the CARES Act) increased by $2,600 billion in April.

Without the increase in transfer payments, Personal Income in April would have declined by about 6%.

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

This graph shows real personal income less transfer payments since 1990.

This measure of economic activity decreased 2.8% in March, compared to February, and another 6.3% in April (compared to March).

Black Knight: Mortgage Forbearance Volumes Flatten, Total Roughly Steady at 4.76M

by Calculated Risk on 5/29/2020 09:25:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight: Mortgage Forbearance Volumes Flatten, Total Roughly Steady at 4.76M

The latest data from the McDash Flash Forbearance Tracker shows that forbearance volumes have essentially flattened, and in fact new inflows have slowed to a relative trickle.CR Note: This is 9.0% of all mortgages. The delinquency rate in April increased sharply to 6.45%, but it would have been much higher if so many borrowers in forbearance hadn't made their mortgage payments (unpaid loans in forbearance are counted as delinquent in the survey).

While the leveling off of active forbearance volumes is welcome news, the focus of industry participants – especially servicers and mortgage investors – is already shifting from pipeline growth to pipeline management.

...

As of May 26, 4.76 million homeowners are in forbearance plans, with a net increase of just 7,000 new forbearance plans since last week. That’s in comparison to a 325,000 net increase in the first week of May, and 1.4 million in the first week of April.

Personal Income increased 10.5% in April, Spending decreased 13.6%, Core PCE decreased 0.4%

by Calculated Risk on 5/29/2020 08:38:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $1.97 trillion (10.5 percent) in April according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $2.13 trillion (12.9 percent) and personal consumption expenditures (PCE) decreased $1.89 trillion (13.6 percent).The April PCE price index increased 0.5 percent year-over-year and the April PCE price index, excluding food and energy, increased 1.0 percent year-over-year.

Real DPI increased 13.4 percent in April and Real PCE decreased 13.2 percent. The PCE price index decreased 0.5 percent. Excluding food and energy, the PCE price index decreased 0.4 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through April 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was way above expectations, and the decrease in PCE was below expectations.

Note that core PCE inflation was below expectations.

Thursday, May 28, 2020

Friday: Personal Income & Outlays, Chicago PMI, Fed Chair Jerome Powell

by Calculated Risk on 5/28/2020 08:11:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, April 2020. The consensus is for a 6.5% decrease in personal income, and for a 12.5% decrease in personal spending. And for the Core PCE price index to decrease 0.3%.

• At 9:45 AM, Chicago Purchasing Managers Index for May.

• At 10:00 AM,, University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 73.7.

• At 11:00 AM, Discussion, Fed Chair Jerome Powell, At Griswold Center for Economic Policy Studies Princeton Reunions Talk: A Conversation with Jerome Powell, moderated by Alan Blinder (via webcast)

May 28 COVID-19 Test Results: Progress

by Calculated Risk on 5/28/2020 05:05:00 PM

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is in the lower half of that range. There might be enough to allow test-and-trace in some areas.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

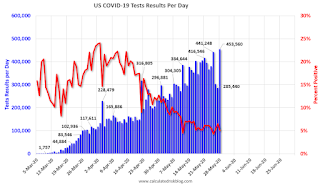

There were 453,560 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.1% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

Hotels: Occupancy Rate Declined 50.2% Year-over-year, Slight Increase Week-over-week

by Calculated Risk on 5/28/2020 04:19:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 23 May

STR data ending with 23 May showed another small rise from previous weeks in U.S. hotel performance. Year-over-year declines remained significant although not as severe as the levels recorded in April.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

17-23 May 2020 (percentage change from comparable week in 2019):

• Occupancy: 35.4% (-50.2%)

• Average daily rate (ADR): US$80.92 (-39.7%)

• Revenue per available room (RevPAR): US$28.67 (-69.9%)

“The steady climb in national occupancy continued, and to no surprise, the highest levels were recorded on Friday and Saturday ahead of Memorial Day,” said Jan Freitag, STR’s senior VP of lodging insights. “Occupancy gains continue to be led by popular leisure markets like the Florida Panhandle, Mobile, Myrtle Beach and Daytona Beach. We even saw a weekday-to-weekend ADR premium in higher occupancy markets.

“What was also noticeable in the week’s data was the higher occupancy levels across all classes of hotels. Economy properties continued to lead, but we also saw the higher-priced end of the market up over 20%. Regardless, Upper Upscale occupancy continues to lag the broader industry as meeting demand is still not returning.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

During 2009 (black line), many hotels were struggling. At this point in the year, the 4-week average in 2009 was 56%. Now it is just at 32%! (The median is 65%).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Freddie Mac: Mortgage Serious Delinquency Rate increased in April

by Calculated Risk on 5/28/2020 01:22:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in April was 0.64%, up from 0.60% in March. Freddie's rate is down from 0.65% in April 2019.

This is the highest serious delinquency rate since last April.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

With COVID-19, this rate will increase significantly in a few months (it takes time since these are mortgages three months or more past due).

Note: Fannie Mae will report for April soon.

Kansas City Fed: "Tenth District Manufacturing Activity Continued to Decline" in May

by Calculated Risk on 5/28/2020 11:06:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued to Decline

Tenth District manufacturing activity continued to decline, but not as sharply compared to last month’s record low. Expectations for future activity rose, but remained slightly negative. Month-over-month price indexes remained negative again in May. Moving forward, District firms expected prices for finished goods to decline and prices for raw materials to increase in the next six months.This was the last of the regional Fed surveys for May.

The month-over-month composite index was -19 in May, up somewhat from the record low of -30 in April, and similar to -17 in March

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The ISM manufacturing index for May will be released on Monday, June 1st. The consensus is for the ISM to increase to 42.5, up from 41.5 in April. Based on these regional surveys, the ISM manufacturing index might even be lower than the consensus in May.

NAR: Pending Home Sales Decrease 21.8% in April

by Calculated Risk on 5/28/2020 10:05:00 AM

From the NAR: Pending Home Sales Slump 21.8% in April

Brought on by the coronavirus pandemic, pending home sales decreased in April, making two straight months of declines, according to the National Association of Realtors®. Every major region experienced a drop in month-over-month contract activity and a decline in year-over-year pending home sales transactions.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 21.8% to 69.0 in April. Year-over-year, contract signings shrank 33.8%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI sank 48.2% to 42.6 in April, 52.6% lower than a year ago. In the Midwest, the index dropped 15.9% to 72.0 last month, down 26.0% from April 2019.

Pending home sales in the South fell 15.4% to an index of 87.6 in April, a 29.6% decrease from April 2019. The index in the West slipped 20.0% in April 2020 to 57.1, down 37.2% from a year ago.

emphasis added