by Calculated Risk on 5/28/2020 05:05:00 PM

Thursday, May 28, 2020

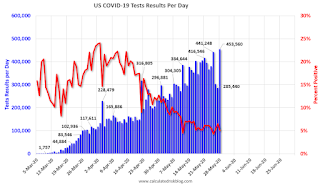

May 28 COVID-19 Test Results: Progress

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is in the lower half of that range. There might be enough to allow test-and-trace in some areas.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 453,560 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.1% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

Hotels: Occupancy Rate Declined 50.2% Year-over-year, Slight Increase Week-over-week

by Calculated Risk on 5/28/2020 04:19:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 23 May

STR data ending with 23 May showed another small rise from previous weeks in U.S. hotel performance. Year-over-year declines remained significant although not as severe as the levels recorded in April.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

17-23 May 2020 (percentage change from comparable week in 2019):

• Occupancy: 35.4% (-50.2%)

• Average daily rate (ADR): US$80.92 (-39.7%)

• Revenue per available room (RevPAR): US$28.67 (-69.9%)

“The steady climb in national occupancy continued, and to no surprise, the highest levels were recorded on Friday and Saturday ahead of Memorial Day,” said Jan Freitag, STR’s senior VP of lodging insights. “Occupancy gains continue to be led by popular leisure markets like the Florida Panhandle, Mobile, Myrtle Beach and Daytona Beach. We even saw a weekday-to-weekend ADR premium in higher occupancy markets.

“What was also noticeable in the week’s data was the higher occupancy levels across all classes of hotels. Economy properties continued to lead, but we also saw the higher-priced end of the market up over 20%. Regardless, Upper Upscale occupancy continues to lag the broader industry as meeting demand is still not returning.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

During 2009 (black line), many hotels were struggling. At this point in the year, the 4-week average in 2009 was 56%. Now it is just at 32%! (The median is 65%).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Freddie Mac: Mortgage Serious Delinquency Rate increased in April

by Calculated Risk on 5/28/2020 01:22:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in April was 0.64%, up from 0.60% in March. Freddie's rate is down from 0.65% in April 2019.

This is the highest serious delinquency rate since last April.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

With COVID-19, this rate will increase significantly in a few months (it takes time since these are mortgages three months or more past due).

Note: Fannie Mae will report for April soon.

Kansas City Fed: "Tenth District Manufacturing Activity Continued to Decline" in May

by Calculated Risk on 5/28/2020 11:06:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued to Decline

Tenth District manufacturing activity continued to decline, but not as sharply compared to last month’s record low. Expectations for future activity rose, but remained slightly negative. Month-over-month price indexes remained negative again in May. Moving forward, District firms expected prices for finished goods to decline and prices for raw materials to increase in the next six months.This was the last of the regional Fed surveys for May.

The month-over-month composite index was -19 in May, up somewhat from the record low of -30 in April, and similar to -17 in March

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The ISM manufacturing index for May will be released on Monday, June 1st. The consensus is for the ISM to increase to 42.5, up from 41.5 in April. Based on these regional surveys, the ISM manufacturing index might even be lower than the consensus in May.

NAR: Pending Home Sales Decrease 21.8% in April

by Calculated Risk on 5/28/2020 10:05:00 AM

From the NAR: Pending Home Sales Slump 21.8% in April

Brought on by the coronavirus pandemic, pending home sales decreased in April, making two straight months of declines, according to the National Association of Realtors®. Every major region experienced a drop in month-over-month contract activity and a decline in year-over-year pending home sales transactions.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 21.8% to 69.0 in April. Year-over-year, contract signings shrank 33.8%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI sank 48.2% to 42.6 in April, 52.6% lower than a year ago. In the Midwest, the index dropped 15.9% to 72.0 last month, down 26.0% from April 2019.

Pending home sales in the South fell 15.4% to an index of 87.6 in April, a 29.6% decrease from April 2019. The index in the West slipped 20.0% in April 2020 to 57.1, down 37.2% from a year ago.

emphasis added

Q1 GDP Revised Down to -5.0% Annual Rate

by Calculated Risk on 5/28/2020 08:44:00 AM

From the BEA: Gross Domestic Product, 1st Quarter 2020 (Second Estimate); Corporate Profits, 1st Quarter 2020 (Preliminary Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 5.0 percent in the first quarter of 2020, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.1 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up to -6.8% from -7.6%. Residential investment was revised down from 21.0% to 18.5%. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the decrease in real GDP was 4.8 percent. With the second estimate, a downward revision to private inventory investment was partly offset by upward revisions to personal consumption expenditures (PCE) and nonresidential fixed investment.

emphasis added

Weekly Initial Unemployment Claims decrease to 2,123,000

by Calculated Risk on 5/28/2020 08:37:00 AM

The DOL reported:

In the week ending May 23, the advance figure for seasonally adjusted initial claims was 2,123,000, a decrease of 323,000 from the previous week's revised level. The previous week's level was revised up by 8,000 from 2,438,000 to 2,446,000. The 4-week moving average was 2,608,000, a decrease of 436,000 from the previous week's revised average. The previous week's average was revised up by 2,000 from 3,042,000 to 3,044,000.The previous week was revised up.

emphasis added

This does not include the 1,192,616 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 2,608,000.

This was close to the consensus forecast of 2.1 million.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already decreased to 21,052,000 (SA) from the record high of 24,912,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 7,793,066 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, May 27, 2020

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 5/27/2020 08:10:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 2.100 million initial claims, down from 2.438 million the previous week.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2020 (Second estimate). The consensus is that real GDP decreased 4.8% annualized in Q1, unchanged from the advance estimate of -4.8%.

• At 8:30 AM, Durable Goods Orders for April from the Census Bureau. The consensus is for a 18.5% decrease in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 15% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May. This is the last of regional manufacturing surveys for May.

May 27 COVID-19 Test Results: Going Backwards

by Calculated Risk on 5/27/2020 05:58:00 PM

In addition to having enough tests for test-and-trace, we also need people to conduct contact tracing. There is a great website that tracks the progress of each towards test-and-trace. The website also has resources on how to implement test-and-trace. This includes software, training resources, a calculator for how many people to hire and more.

My state (California) now has 3,800 contact tracers. That is still too few, but a start!

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is below that range. There might be enough to allow test-and-trace in some areas. However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 285,440 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.5% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

New Home Prices

by Calculated Risk on 5/27/2020 02:59:00 PM

As part of the new home sales report released yesterday, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in April 2020 was $309,900. The average sales price was $364,500."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in April 2020 was $364,500, down 3.4% from March, and down 9.5% from the peak in 2017. The median price was $309,900, down 5.2% from March, and down 9.8% from the peak in 2017.

The average and median house prices are down from 2017 since home builders are offering more lower priced homes.

The second graph shows the percent of new homes sold by price.

The $400K+ bracket increased significantly since the housing recovery started, but has been holding steady recently - and declined over the last couple of months. A majority of new homes (about 59%) in the U.S., are in the $200K to $400K range.