by Calculated Risk on 5/14/2020 08:44:00 PM

Thursday, May 14, 2020

Friday: Retail Sales, Industrial Production, Job Openings

Friday:

• At 8:30 AM ET, Retail sales for April is scheduled to be released. The consensus is for 11.6% decrease in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 11.5% decrease in Industrial Production, and for Capacity Utilization to decline to 64.0%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for May).

• At 10:00 AM, Job Openings and Labor Turnover Survey for March from the BLS.

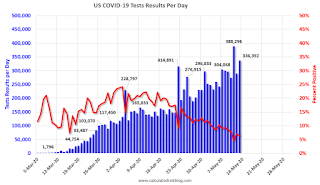

May 14 Update: US COVID-19 Test Results: Virginia Separates Out Antibody Tests

by Calculated Risk on 5/14/2020 05:20:00 PM

Virginia was including antibody testing with PCR (diagnostic) testing. For test and trace, PCR testing is the key. From Virginia Department of Health: Virginia Department of Health Releases Disaggregated Testing Data; No Differences in Trends

The Virginia Department of Health today released testing data broken out by PCR (diagnostic) and antibody (serology) tests. Antibody tests make up less than nine percent of overall tests. When these tests are removed from total results, there is minimal change in the percent positive of tests and no difference in overall trends.It is possible that other states are also including antibody tests in their daily test reports. If so, it would be helpful if they separated the tests. (Thanks to all the states for the hard work)

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 366,944 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.9% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

The Changing Mix of Light Vehicle Sales

by Calculated Risk on 5/14/2020 12:11:00 PM

The low gasoline prices made me take another look at the mix of vehicles being sold.

This graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs through April 2020.

Over time the mix has changed toward more and more towards light trucks and SUVs.

Only when oil prices are high, does the trend slow or reverse.

Recently oil prices have fallen sharply, and the percent of light trucks and SUVs was up to 77% in April 2020.

UCI Professor Chris Schwarz on the Economy at 1 PM ET

by Calculated Risk on 5/14/2020 11:48:00 AM

UCI Professor Chris Schwarz and I have presented together before.

He will be offering his thoughts on the economy at 10 AM PT (1 PM ET).

You can register here.

Hotels: Occupancy Rate Declined 55.9% Year-over-year, Slight Increase Week-over-week

by Calculated Risk on 5/14/2020 10:02:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 9 May

STR data for 3-9 May 2020 showed continues modest gains in U.S. hotel occupancy compared with previous weeks, but a similar level of year-over-year decline in the three key performance metrics.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 5-11 May 2019, the industry recorded the following:

• Occupancy: -55.9% to 30.1%

• Average daily rate (ADR): -42.1% to US$76.35

• Revenue per available room (RevPAR): -74.4% to US$22.95

“The industry reported its fourth consecutive week-to-week increase in demand as the slow and steady ascent in national occupancy continued,” said Jan Freitag, STR’s senior VP of lodging insights. “More people are flying, as shown in daily checkpoint counts from the TSA, and more people are staying in hotels for a variety of purposes—the weekly number of rooms sold topped 10 million for the first time since the end of March. The markets benefiting more from leisure sources in areas with more relaxed distancing measures will see a sharper recovery line than others. Overall, the recovery will be uneven across the country.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Note: I added 2001 to show the impact on hotel occupancy after 9/11.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Weekly Initial Unemployment Claims decrease to 2,981,000

by Calculated Risk on 5/14/2020 08:35:00 AM

UPDATE: From Bloomberg: U.S. Jobless Claims in Millions Again, Connecticut Corrects Data

Later in the day, however, Connecticut corrected its figure to show 29,846 claims, rather than the 298,680 shown in the federal report, indicating an error inflated the national figures.The DOL reported:

In the week ending May 9, the advance figure for seasonally adjusted initial claims was 2,981,000, a decrease of 195,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 3,169,000 to 3,176,000. The 4-week moving average was 3,616,500, a decrease of 564,000 from the previous week's revised average. The previous week's average was revised up by 7,000 from 4,173,500 to 4,180,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 4,173,500.

This was higher than the consensus forecast of 2.5 million.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already increased to a new record high of 22.833 million (SA) and will increase further over the next couple of weeks - and likely stay at a high level until the crisis abates.

Wednesday, May 13, 2020

Thursday: Unemployment Claims

by Calculated Risk on 5/13/2020 08:42:00 PM

Note: the covid19 tracking project suspects that at least one state is including antibody tests in their daily report. If so, the positive rate of virus tests might be higher than reported.

There are still a large number of layoffs every week.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 2.500 million initial claims, down from 3.169 million the previous week.

May 13 Update: US COVID-19 Test Results: Possible Errors Cloud Data

by Calculated Risk on 5/13/2020 05:19:00 PM

This data is from the COVID Tracking Project. These people are doing amazing work. However, @alexismadrigal at the project has noticed a possible error. Alexis wrote yesterday:

We're aware of at least one state including [antibody tests], and this has led us to a broader investigation of which states might have lumped these tests in without telling anyone.If antibody tests were included, then the reported test count is too high - and the reported percent too low.

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 336,392 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.4% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

Hopefully the possible data issue will be clarified soon.

Fannie and Freddie: REO inventory declined in Q1, Down 20% Year-over-year

by Calculated Risk on 5/13/2020 03:11:00 PM

Fannie and Freddie earlier reported results earlier this month for Q1 2020. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 4,168 at the end of Q1 2020, compared to 6,714 at the end of Q1 2019.

For Freddie, this is down 94% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 16,289 at the end of Q1 2020 compared to 18,998 at the end of Q1 2019.

For Fannie, this is down 90% from the 166,787 peak number of REOs in Q3 2010.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q1 2020, and combined inventory is down 20% year-over-year.

This is close to the normal level of REOs.

It takes a long time to go from delinquency to foreclosure to REO. So any increase in REOs from COVID-19 won't happen for a long time. Since underwriting has been fairly solid over the last decade, I don't expect a huge increase in COVID-19 related REOs unless the health crisis goes on for a long period.

Houston Real Estate in April: Sales Down 21.6% YoY, Inventory Unchanged YoY

by Calculated Risk on 5/13/2020 12:16:00 PM

From the HAR: Houston Housing Feels COVID-19’S Sting in April

The Houston real estate market’s strong start to the new year was abruptly interrupted in April as the full impact of the coronavirus outbreak was felt across Texas and the rest of the country. Stay-at-home directives and social distancing weighed on the market as Realtors® began transitioning to virtual open houses and virtual property showings that enabled consumers to safely and conveniently market and tour homes on HAR.com....Sales in Houston set a record in 2019 and were off to a strong start in 2020. However the impact of COVID-19 (and lower oil prices) will be significant. Note that the closed sales in April were for contracts that were mostly signed in February and March.

According to the latest monthly Market Update from the Houston Association of Realtors (HAR), 6,199 single-family homes sold in April compared to 7,666 a year earlier, representing a 19.1 percent decline and ending a nine-month run of positive sales. ... Sales of all property types totaled 7,192, down 21.6 percent from April 2019. Total dollar volume for the month fell 20.4 percent to slightly more than $2.1 billion.

“We were bracing for a rough report and we got it, and the numbers are likely to remain this way until more Realtors® and consumers adapt to the use of virtual technology through HAR.com to safely market, tour and purchase or rent homes,” said HAR Chairman John Nugent with RE/MAX Space Center. “There is definitely no lack of consumer interest in real estate, as property listing views on HAR.com are up almost 60 percent from this time last year.”

...

Pending sales fell 17.6 percent due to market uncertainty, but total active listings, or the total number of available properties, were statistically unchanged at 41,151.

emphasis added