by Calculated Risk on 4/13/2020 11:38:00 AM

Monday, April 13, 2020

What is a Recession? What is a Depression?

People frequently say a recession is two quarters of declining GDP. That is not the definition used by the National Bureau of Economic Research (NBER):

The NBER does not define a recession in terms of two consecutive quarters of decline in real GDP. Rather, a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. For more information, see the latest announcement from the NBER's Business Cycle Dating Committee, dated 9/20/10.I was using the NBER definition when I made a call that a recession started in March 2020. Clearly there has been "a significant decline in economic activity spread across the economy" that will last more than a few months.

But what is a Depression? Back in March 2009, I wrote:

It seems like the "D" word is everywhere. And that raises a question: what is a depression? Although there is no formal definition, most economists agree it is a prolonged slump with a 10% or more decline in real GDP.It appears likely that GDP will slump more than 10% over the next several months, but will the slump be "prolonged"? My current guess is the worst of the economic slump will be in Q2, and then the economy will slowly start to expand. So that wouldn't be "prolonged". Of course, if we try to open the economy too soon - or too quickly without the proper preparedness (testing, masks, guidance) - then the economic damage will be more prolonged.

Black Knight Mortgage Monitor for Febuary; "Unemployment Spike Triggering Surge in Mortgage Forbearance Requests"

by Calculated Risk on 4/13/2020 09:29:00 AM

Black Knight released their Mortgage Monitor report for February today. According to Black Knight, 3.28% of mortgages were delinquent in February, down from 3.89% in February 2019. Black Knight also reported that 0.45% of mortgages were in the foreclosure process, down from 0.51% a year ago.

This gives a total of 3.73% delinquent or in foreclosure.

Press Release: Black Knight: COVID-19 Unemployment Spike Triggering Surge in Mortgage Forbearance Requests; Principal and Interest Advances Could Lead to Servicer Liquidity Challenges

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, in light of the growing impact of the COVID-19 pandemic on the economy, Black Knight drilled down into aspects of its extensive white paper exploring the ramifications of this crisis for the real estate and mortgage industries. As Black Knight Data & Analytics President Ben Graboske explained, any attempt to quantify potential delinquencies from the current situation is challenging, as there have been no true corollaries in history.

“Trying to gauge the impact of COVID-19 on mortgage performance is as much an art right now as a science,” said Graboske. “The fact is that there is no true point of comparison in the nation’s recent history for analysts to model against. That said, there are some historical clues that can help shed light. In the Great Recession, for example, the number of past- due mortgages tripled over four years, increasing by more than 5.5 million, as the unemployment rate rose relatively sharply from 4.5% in 2006 to 10% by the end of 2009. Today, we’ve seen more than 10 million people file for unemployment since the coronavirus was labeled a pandemic on March 11, which should put the unemployment rate at roughly 9.5%. Using the Great Recession as a point of comparison, Black Knight’s AFT modeling team looked at potential delinquencies under different unemployment scenarios, and at 10%, we could expect 2 million new mortgage delinquencies. That would put the total at 4 million delinquencies with a national non-current rate of 7.5%. If unemployment climbs to the 15% recently projected by Goldman Sachs[1], we could be looking at 5.5 million past-due mortgages. Should unemployment reach the 32% projected by the Federal Reserve Bank of St. Louis[2], the non-current rate could spike to nearly 19%, surpassing what we saw during the Great Recession, with 10 million homeowners past due on their mortgages.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National Delinquency Rate.

From Black Knight:

• As of February, the national delinquency rate was 3.28%; just one month removed from its record low and with the rate of improvement accelerating in recent monthsThe second graph shows the impact of COVID-19 on real estate showings:

• Likewise, the national foreclosure rate was only 1 BPS above its all-time low and was trending downward heading into 2020

• Foreclosure starts hit their lowest level on record in February as well and were down by some 20% from the same time last year

• While these historically low levels of past due mortgages provide a strong foundation for the market leading up to the COVID-19 pandemic, they also mean that default servicing staff had been greatly reduced in recent years

• This will compound the challenge that servicers face in managing the wave of new forbearance and deferral requests on the horizon in coming weeks/months

• According to the online home showing service ShowingTime, the number of in-person real estate showings as of March 25 was down nearly 50% from the 2020 peak on March 11There is much more in the mortgage monitor.

• Likewise, aggregate data from Paragon, Black Knight’s Multiple Listing Service (MLS) platform, shows that as of March 22 online property views by prospective homebuyers were down 24% over the prior two weeks

• While social distancing efforts are likely having an outsized impact on in person showings, the declines in online searches suggest potential trepidation from homeowners about economic uncertainty, rate volatility, and/or job security

Sunday, April 12, 2020

Sunday Night Futures

by Calculated Risk on 4/12/2020 07:05:00 PM

Weekend:

• Schedule for Week of April 12, 2020

• Four High Frequency Indicators for the Eventual Recovery

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 32 and DOW futures are down 250 (fair value).

Oil prices were down over the last week with WTI futures at $22.61 per barrel and Brent at $31.30 barrel. A year ago, WTI was at $64, and Brent was at $72 - so oil prices are down about 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.83 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down $1.00 per gallon year-over-year.

April 12 Update: US COVID-19 Test Results

by Calculated Risk on 4/12/2020 05:02:00 PM

My mistake, there is a testing czar. From Bloomberg: U.S. Testing Capacity in ‘Ballpark’ for May Reopening, Czar Says

Admiral Brett Giroir said in an interview Saturday the U.S. is working on four forms of diagnostics it needs to reopen the economy: widespread surveillance to catch new flare-ups; testing of people who have specific symptoms; contact-tracing for confirmed cases; and antibody testing to know who’s recovered from the virus, which he said is weeks away.I doubt we will be ready by May. I wish he'd identify for the public the bottlenecks in the testing processes. It does sound like he is working on Test-and-Trace, but he is not regularly updating the public on the testing status, and also not providing data on the accuracy, sensitivity and specificity of the various tests (accurate tests are important).

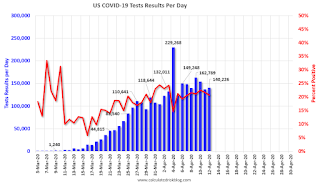

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 140,226 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 21% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

Four High Frequency Indicators for the Eventual Recovery

by Calculated Risk on 4/12/2020 11:48:00 AM

These indicators are for travel and entertainment - some of the sectors that will probably recover very slowly.

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On April 11th there were 93,645 travelers compared to 2,059,142 a year ago.

That is a decline of over 95%.

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through April 11, 2020.

The US was off 100% YoY as of March 21st, although NYC, LA, Chicago, Seattle and San Francisco were all off 100% as of March 17th.

Dining in Seattle and San Francisco declined sharply a week or two ahead of most of the country - and acting early has been shown to minimize the spread of the virus.

As the recovery begins in some areas, I'll include the cities that open first.

Note that the data is noisy and depends on when blockbusters are released.

This data is through the week ending April 9, 2020. Movie ticket sales have been essentially at zero for three weeks.

Basically movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

STR reported hotel occupancy was off 68.5% year-over-year last week, declining to an occupancy rate of 21.6%. This is the lowest weekly occupancy rate on record, even considering seasonality.

Saturday, April 11, 2020

April 11 Update: US COVID-19 Test Results: Still Struggling to Test

by Calculated Risk on 4/11/2020 05:04:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

This is just test results reported daily.

There were 137,181 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 22% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

Test. Test. Test. Protect healthcare workers first!

Schedule for Week of April 12, 2020

by Calculated Risk on 4/11/2020 08:11:00 AM

The key reports this week are March housing starts and retail sales, and weekly unemployment claims.

For manufacturing, the March Industrial Production report and the April NY and Philly Fed manufacturing surveys will be released this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

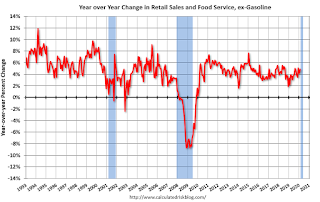

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 3.0% decrease in retail sales.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 3.0% decrease in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis in February.

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -35.0, down from -21.5.

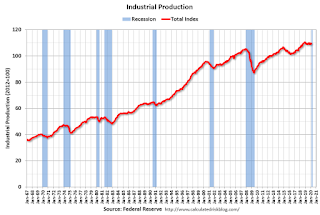

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 4.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 73.7%.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 59, down from 72. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 6.500 million initial claims, down from 6.606 million the previous week.

8:30 AM ET: Housing Starts for March.

8:30 AM ET: Housing Starts for March. This graph shows single and total housing starts since 1968.

The consensus is for 1.307 million SAAR, down from 1.599 million SAAR in February.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of -30.0, down from -12.7.

10:00 AM: State Employment and Unemployment (Monthly) for March 2019

Friday, April 10, 2020

April 10 Update: US COVID-19 Test Results

by Calculated Risk on 4/10/2020 05:17:00 PM

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

This is just test results reported daily.

There were 144,942 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 23% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

Test. Test. Test. Protect healthcare workers first!

Reopening: Milestones, Not Dates

by Calculated Risk on 4/10/2020 03:12:00 PM

It appears the US is close to peak cases per day. Social distancing, hand washing and shelter-in-place orders are workings.

This means we need to redouble our efforts over the next several weeks. Minimize our contacts (social distancing), wash our hands, and wear a mask or face cover whenever we are in public.

We need to shift the reopening discussion away from being date specific to milestone specific. I believe there are two clear milestones that we need to achieve before reopening (these are my suggestions, and I'll defer to the experts on the milestones).

First, Impact on Hospitals and First Responders:

a) We need to return to standard levels of care. Dr. Gottlieb, et. al. described this as "Hospitals in the state are safely able to treat all patients requiring hospitalization without resorting to crisis standards of care"

b) We need to have adequate PPE for all healthcare workers and first responders. We must do everything possible to prevent further deaths of healthcare workers.

c) Healthcare workers and first responders should be able to be tested on demand.

Second, we need a robust Test-and-Trace program:

a) Apple and Google announced today software that can help with contact tracing.

b) We need to increase testing capabilities to several hundred thousand per day (maybe close to a million per day).

c) We need a well trained team to follow-up on tracing, and also to regularly contact all people in self-quarantine.

d) This requires naming someone to head the test-and-trace taskforce with extensive logistics and medical experience (maybe co-chairs). Perhaps the states should name someone.

With clear milestones we can progress toward slowly reopening the economy.

We will need clear guidelines in advance of reopening (mask wearing, minimize groups, etc) and consistent messaging. We can do this.

Q1 GDP Forecasts: Around -7% SAAR

by Calculated Risk on 4/10/2020 11:48:00 AM

Note: The NY Fed Nowcast and Atlanta Fed GDPNow models are based on released data and aren't capturing the collapse in the economy in the 2nd half of March. All forecasts, including the Merrill Lynch and Goldman Sachs forecasts, are for the seasonally adjust annual rate (SAAR) of decline.

From Merrill Lynch:

We continue to expect a 7% decline in 1Q [SAAR Apr 10 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP forecast unchanged at -9.0% (qoq ar). However, we continue to expect the advance reading on April 29th to register a smaller decline of -6.5%, reflecting incomplete source data and non-response bias. [Apr 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.5% for 2020:Q1 and -0.4% for 2020:Q2. [Apr 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 1.0 percent on April 9, down from 1.3 percent on April 2. … There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model. In particular, it does not capture the impact of COVID-19 beyond its impact on GDP source data and relevant economic reports that have already been released. It does not anticipate the impact of COVID-19 on forthcoming economic reports beyond the standard internal dynamics of the model. [Apr 9 estimate]CR Note: These estimate suggest GDP declined around 7% in Q1.