by Calculated Risk on 3/13/2020 01:53:00 PM

Friday, March 13, 2020

High Frequency Data: Movie Box Office

There are some sectors that will be hit hard over the next several months: hotels, airlines, restaurants, movie theaters, sporting events, and convention centers. People will probably avoid these places as part of social distancing.

I already track weekly hotel occupancy data from STR, and the occupancy data is starting to show a sharp decline due to COVID-19. I'll also be posting updates on monthly visitor and convention traffic in Las Vegas.

For high frequency data, I'm going to start tracking domestic box office numbers from Box Office Mojo every Friday.

This data shows cumulative domestic box office for this year (red) and the maximum and minimum for the previous four years.

This data is through the week ending March 12, 2020. (The last few weeks were revised slightly)

There are many factors impacting box office numbers, but this will give an idea if people are avoiding theaters. Note that some potential block busters have been moved to the Fall, and that will keep down box office sales.

Currently 2020 is tracking close to the minimum of the previous four years, but hasn't collapsed yet.

From Merrill: Flirting with Recession

by Calculated Risk on 3/13/2020 11:28:00 AM

A few excerpts from Merrill Lynch research:

The economy will flirt with recession in the coming months with negative GDP in 2Q, we believe. Growth is expected to remain soft in 3Q with recovery starting thereafter.Note that that data was for February. March will be much worse.

…

We now expect the Fed to cut 100bp at the March FOMC meeting, bringing rates to zero.

…

Based on BAC aggregated card data, we estimate that retail sales ex-autos contracted by 0.2% month-over-month (mom) seasonally adjusted in February. At first glance, it seems pretty good, all things considered. However, remember that the retail sales aggregate is not a comprehensive measure of consumer spending as it excludes most services with the exception of restaurants. Importantly, it does not include travel-related services which have declined meaningfully over February. On a monthly and seasonally adjusted basis, airline spending tumbled 11.2% mom, lodging down 9.1% mom and cruises down 18.6% mom in February.

emphasis added

Goldman Sachs also expects the Fed to cut rates to zero:

We now expect the FOMC to cut the funds rate 100bp on March 18, a faster return to the crisis-era 0-0.25% rate than under our previous call for two 50bp steps in March and April.

Preliminary March Consumer Sentiment Declines to 95.9 from 101.0

by Calculated Risk on 3/13/2020 10:06:00 AM

From the University of Michigan, Surveys of Consumers chief economist, Richard Curtin:

Consumer sentiment fell in early March due to the spreading coronavirus and the steep declines in stock prices. … The component of the Sentiment Index that posted the greatest loss involved judgements about prospects for the economy during the year ahead; this component fell by 29 points, accounting for 83% of the total point decline in early March. … While the most effective containment efforts are widespread closures and self-isolation, those same actions have the largest negative impact on the economy and significantly increase the probability that the pandemic will be followed by a recession that lasts longer than the virus.Not a huge decline - yet.

Thursday, March 12, 2020

Mortgage Equity Withdrawal Positive in Q4

by Calculated Risk on 3/12/2020 03:39:00 PM

Note 1: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

Note 2: There have been reports showing an increase in cash out refinances, but it isn't showing up significantly in the Fed's Flow of Funds report.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q4 2019, the Net Equity Extraction was $29 billion, or a 0.70% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been mostly positive for the last four years. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward - but nothing like during the housing bubble.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $86 billion in Q4.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Fed's Flow of Funds: Household Net Worth Increased in Q4

by Calculated Risk on 3/12/2020 02:20:00 PM

The Federal Reserve released the Q4 2019 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits rose to $118.4 trillion during the fourth quarter of 2019. The value of directly and indirectly held corporate equities increased $2.6 trillion and the value of real estate increased $0.1 trillion.

Household debt increased 4.1 percent at an annual rate in the fourth quarter of 2019. Consumer credit grew at an annual rate of 4.5 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 3.1 percent.

Click on graph for larger image.

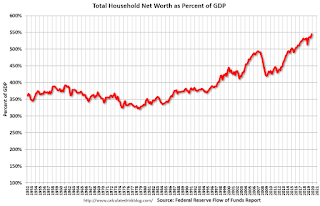

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

Net Worth as a percent of GDP decreased slightly in Q4.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

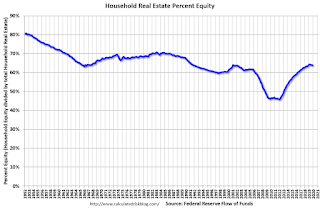

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2019, household percent equity (of household real estate) was at 63.8% - down from Q3.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 63.8% equity - and about 2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $86 billion in Q4.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 48.8% (the lowest since 2001), down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, decreased slightly in Q4, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

Note: Household net worth looks to decline sharply in Q1 2020.

Hotels: Occupancy Rate Decreased Sharply Year-over-year

by Calculated Risk on 3/12/2020 09:54:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 7 March

Reflecting concerns and cancellations around the COVID-19 outbreak, the U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 1-7 March 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 3-9 March 2019, the industry recorded the following:

• Occupancy: -7.3% to 61.8%

• Average daily rate (ADR): -4.6% to US$126.01

• Revenue per available room (RevPAR): -11.6% to US$77.82

Performance declines were uniform across chain scales, classes and location types.

“The question over the last several weeks was ‘when’, not ‘if’ this impact would hit—well, when has arrived,” said Jan Freitag, STR’s senior VP of lodging insights. “Like so many other areas of the world, concerns around the coronavirus outbreak have now hit U.S. hotel occupancy hard. Not a surprise given the amount of event-related news we have seen, but group cancellations were felt across the markets and classes in addition to consistent declines in the transient segment. ADR is starting to decline as well, rapidly in the case of San Francisco. This is quite likely the beginning of a bad run that will get worse before it gets better.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 is now having a negative impact on occupancy. To date, this is the weakest start for a year since 2013 - and the seasonally important Spring travel season is just beginning.

Weekly Initial Unemployment Claims Decrease to 211,000

by Calculated Risk on 3/12/2020 08:33:00 AM

The DOL reported:

In the week ending March 7, the advance figure for seasonally adjusted initial claims was 211,000, a decrease of 4,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 216,000 to 215,000. The 4-week moving average was 214,000, an increase of 1,250 from the previous week's revised average. The previous week's average was revised down by 250 from 213,000 to 212,750.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 214,000.

This was lower than the consensus forecast.

Note: Companies have just started announcing layoffs related to COVID-19. So we should expect weekly claims to increase in the coming weeks.

Wednesday, March 11, 2020

Thursday: Unemployment Claims, PPI, Flow of Funds

by Calculated Risk on 3/11/2020 07:30:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Rising at Fastest Pace in Years

Mortgage rates continued a relentless surge higher today. The move began in earnest yesterday for two key reasons: bond market panic and mortgage market over-supply. If you take nothing else away from the following, the important part to understand is that rates are absolutely significantly higher than they were this morning, yesterday, and on Monday morning. The pace of that move has been the fastest since the 2 days following the 2016 presidential election, and one of only a handful of 2-day periods with more than a 3/8ths bump to the conventional 30yr fixed rate. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.5-3.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 216 thousand the previous week.

• At 8:30 AM, The Producer Price Index for February from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.2% increase in core PPI.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

Houston Real Estate in February: Sales up 14.9% YoY, Inventory Up 3.8% YoY

by Calculated Risk on 3/11/2020 11:49:00 AM

This is prior to COVID-19 and also prior to the collapse in oil prices.

From the HAR: Houston Home Sales Gain Momentum in February

The Houston real estate market built upon its strong 2020 start by registering an eighth consecutive month of positive home sales in February. Consumer activity was once again largely fueled by some of the lowest interest rates of all time. ...Sales in Houston set a record in 2019 and were off to a strong start in 2020. The decline in oil prices will hit Texas hard, and sales will also likely be impacted by COVID-19 - although record low mortgage rates will help.

According to the latest monthly Market Update from the Houston Association of Realtors (HAR), 6,044 single-family homes sold in February compared to 5,339 a year earlier, accounting for a 13.2 percent increase.

...

Sales of all property types totaled 7,393, up 14.9 percent from February 2019. Total dollar volume for the month jumped 19.4 percent to slightly more than $2.1 billion. .

“The Houston housing market gained momentum in February, thanks largely to record low mortgage rates that some economists say could drop even further,” said HAR Chairman John Nugent with RE/MAX Space Center. “Concerns have been raised about the possible effects the coronavirus outbreak might have on our real estate market and others around the country, and that is something HAR is monitoring. Coronavirus was not a factor in the February housing data, but obviously with the losses that Wall Street has suffered as well as declining oil prices, we are keeping a watchful eye on housing market activity.”

...

Total active listings, or the total number of available properties, rose 3.8 percent to 40,091.. … Single-family homes inventory recorded a 3.5-months supply in February, down fractionally from a 3.6-months supply a year earlier.

emphasis added

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in February, Core PCE below 2%

by Calculated Risk on 3/11/2020 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.7% annualized rate) in February. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for January here. Motor fuel decreased at a 33.5% annualized rate in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.1% annualized rate) in February. The CPI less food and energy rose 0.2% (2.7% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.4%. Core PCE is for January and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.7% annualized and trimmed-mean CPI was at 2.3% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%). This is all pre-COVID-19.