by Calculated Risk on 3/06/2020 10:08:00 AM

Friday, March 06, 2020

Las Vegas Real Estate in February: Sales up 23% YoY, Inventory down 39% YoY

Note: Las Vegas will probably see a significant decline in visitor and convention traffic over the next several months due to COVID-19. We will see if this has a significant impact on local real estate. Sales in February were strong, and prices finally hit new highs (there was a huge bubble in Las Vegas).

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices finally break all-time record while supply keeps shrinking; LVR housing statistics for February 2020

The total number of existing local homes, condos and townhomes sold during February was 3,089. Compared to the same time last year, February sales were up 25.7% for homes and up 14.0% for condos and townhomes.1) Overall sales were up 23.2% year-over-year to 3,089 in February 2020 from 2,508 in February 2019.

...

By the end of February, LVR reported 4,240 single-family homes listed for sale without any sort of offer. That’s down 40.6% from one year ago. For condos and townhomes, the 1,214 properties listed without offers in February represented a 30.8% drop from one year ago.

…

Meanwhile, the number of so-called distressed sales remains near historically low levels. The association reported that short sales and foreclosures combined accounted for 2.5% of all existing local property sales in February. That compares to 2.6% of all sales one year ago, 3.8% two years ago and 10.6% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 8,888 in February 2019 to 5,454 in February 2020. Note: Total inventory was down 38.6% year-over-year. This is the fourth consecutive month with a year-over-year decrease in inventory, and that follows 16 consecutive months with a YoY increase in inventory. And months of inventory is still low.

3) Low level of distressed sales.

Trade Deficit decreased to $45.3 Billion in January

by Calculated Risk on 3/06/2020 09:07:00 AM

Note: This data was for January and the outbreak of COVID-19 probably had little or no on impact at that time.

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $45.3 billion in January, down $3.3 billion from $48.6 billion in December, revised.

January exports were $208.6 billion, $0.9 billion less than December exports. January imports were $253.9 billion, $4.2 billion less than December imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in January.

Exports are 26% above the pre-recession peak and up 1% compared to January 2019; imports are 9% above the pre-recession peak, and down 2% compared to January 2019.

In general, trade both imports and exports have moved more sideways or down recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $61.93 per barrel in January, up from $61.34 in December, and up from $54.35 in January 2019.

The trade deficit with China decreased to $26.1 billion in January, from $34.5 billion in January 2019.

February Employment Report: 273,000 Jobs Added (266,000 ex-Census), 3.5% Unemployment Rate

by Calculated Risk on 3/06/2020 08:42:00 AM

From the BLS:

Total nonfarm payroll employment rose by 273,000 in February, and the unemployment rate was little changed at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care and social assistance, food services and drinking places, government, construction, professional and technical services, and financial activities.

...

Federal employment increased by 8,000, reflecting the hiring of 7,000 temporary workers for the 2020 Census.

...

The change in total nonfarm payroll employment for December was revised up by 37,000 from +147,000 to +184,000, and the change for January was revised up by 48,000 from +225,000 to +273,000. With these revisions, employment gains in December and January combined were 85,000 higher than previously reported.

...

In February, average hourly earnings for all employees on private nonfarm payrolls increased by 9 cents to $28.52. Over the past 12 months, average hourly earnings have increased by 3.0 percent.

emphasis added

Click on graph for larger image.

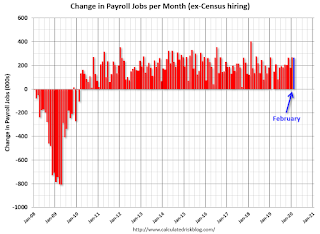

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 266 thousand in February ex-Census (private payrolls increased 228 thousand).

Payrolls for December and January were revised up 85 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.409 million jobs.

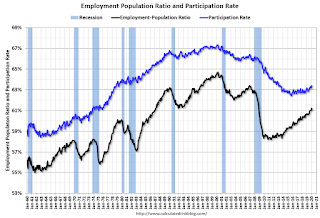

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 63.4% in February. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was unchanged at 63.4% in February. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio decreased to 61.1% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 3.5%.

This was well above consensus expectations of 175,000 jobs added, and December and January were revised up by 85,000 combined.

I'll have much more later ...

Thursday, March 05, 2020

Friday: Employment Report, Trade Deficit

by Calculated Risk on 3/05/2020 06:16:00 PM

My February Employment Preview.

Goldman's February Payrolls preview.

Friday:

• At 8:30 AM ET, Employment Report for February. The consensus is for 175,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

• Also at 8:30 AM, Trade Balance report for January from the Census Bureau. The consensus is the trade deficit to be $47.7 billion. The U.S. trade deficit was at $48.9 billion in December.

• At 3:00 PM, Consumer Credit from the Federal Reserve.

Goldman: February Payrolls Preview

by Calculated Risk on 3/05/2020 04:32:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 195k in February ... a 20-30k boost from weather … too early to show a meaningful impact of the coronavirus outbreak on hiring.

We estimate a one tenth decline in the unemployment rate to 3.5% ... We estimate average hourly earnings increased 0.3% month-over-month …

emphasis added

February Employment Preview

by Calculated Risk on 3/05/2020 11:37:00 AM

Special Note: The 2020 Decennial Census will increase hiring in early 2020. In reporting the employment report, the headline number should be reduced (or increased) by the change in Census temporary employment to show the underlying trend. Based on previous Census hiring, I expect the Census hired 10 to 20 thousand temporary workers in February.

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for an increase of 175,000 non-farm payroll jobs, and for the unemployment rate to be unchanged at 3.6%.

Last month, the BLS reported 225,000 jobs added in January (220,000 ex-Census).

Here is a summary of recent data:

• The ADP employment report showed an increase of 183,000 private sector payroll jobs in February. This was above consensus expectations of 170,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index increased in February to 46.9%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased around 35,000 in February. The ADP report indicated manufacturing jobs decreased 4,000 in February.

The ISM non-manufacturing employment index increased in February to 55.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 225,000 in February.

Combined, the ISM surveys suggest employment gains at 190,000, suggesting gains somewhat above consensus expectations.

• Initial weekly unemployment claims averaged 213,000 in February, up slightly from 212,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 211,000, down from 223,000 during the reference week the previous month.

This suggests fewer layoffs (during the reference week) in February than in January.

• The final February University of Michigan consumer sentiment index increased to 101.0 from the January reading of 99.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker decreased in February to 144,000, down from 161,000 in January, suggesting fewer jobs added in February. This suggests job growth below consensus.

• Weather: The weather was mostly warm and dry during the reference period in January, and the San Francisco Fed estimates the favorable weather boosted employment gains in January by about 100,000. It is likely some hiring for February was pulled forward to January, suggesting some payback in the February report.

• Conclusion: In general the various reports suggest employment growth somewhat above expectations, however, factoring in some payback from the nice January weather, I expect employment gains, ex-Census hiring, below expectations.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 3/05/2020 09:22:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 29 February

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 23-29 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 24 February through 2 March 2019, the industry recorded the following:

• Occupancy: -1.7% to 64.1%

• Average daily rate (ADR): +1.6% to US$129.67

• Revenue per available room (RevPAR): -0.2% to US$83.16

Occupancy and ADR declines for the week were most pronounced on the weekend (28-29 February). Also of note, U.S. airport hotels reported a 3.8% decrease in occupancy for the week.

“We continue to monitor performance in proximity to U.S. airports for early indicators of a coronavirus impact,” said Jan Freitag, STR’s senior VP of lodging insights. “What stands out are the demand patterns in airport markets that see a greater volume of international traffic. We saw declines in airport markets like Newark, Chicago, Denver, San Francisco and New York, while markets with a lot of domestic traffic like Orlando, Dallas and Atlanta were actually up for the week. The coming weeks will be important to monitor for more defined trends, especially with increased coverage around the outbreak and potential event schedule adjustments.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 appears to already be having a negative impact on occupancy. To date, this is the weakest start for a year since 2014 - and the seasonally important Spring travel season is just about to begin.

Weekly Initial Unemployment Claims Decrease to 216,000

by Calculated Risk on 3/05/2020 08:32:00 AM

The DOL reported:

In the week ending February 29, the advance figure for seasonally adjusted initial claims was 216,000, a decrease of 3,000 from the previous week's unrevised level of 219,000. The 4-week moving average was 213,000, an increase of 3,250 from the previous week's unrevised average of 209,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 213,000.

This was lower than the consensus forecast.

Wednesday, March 04, 2020

Fed's Beige Book: Economic Actvity Expanded "modest to moderate rate", Coronavirus Impacting Travel

by Calculated Risk on 3/04/2020 02:05:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Richmond based on information collected on or before February 24th, 2020."

Economic activity expanded at a modest to moderate rate over the past several weeks, according to the majority of Federal Reserve Districts. The St. Louis and Kansas City Districts, however, reported no change during this period. Consumer spending generally picked up, but growth was uneven across the nation, including mixed reports of auto sales. Overall, growth in tourism was flat to modest. There were indications that the coronavirus was negatively impacting travel and tourism in the U.S. Manufacturing activity expanded in most parts of the country; however, some supply chain delays were reported as a result of the coronavirus and several Districts said that producers feared further disruptions in the coming weeks. Transportation activity was generally flat to up slightly aside from some Mid-Atlantic ports that saw strong volume growth. U.S. nonfinancial services firms generally experienced mild to moderate growth. Overall loan growth was flat to up modestly, according to most Districts; notable exceptions were St. Louis, New York, and Kansas City, where declines were reported. On the whole, residential home sales picked up modestly. Nonresidential real estate sales and leasing activity varied across Districts. Agricultural conditions were little changed in recent weeks while some declines in natural resource extraction were reported. Outlooks for the near-term were mostly for modest growth with the coronavirus and the upcoming presidential election cited as potential risks.

...

Employment increased at a slight to moderate pace, overall, with hiring constrained by a tight labor market. Insufficient labor lowered growth for many firms and led to delays in construction projects. Several employers changed from temporary to permanent workers in order to attract talent, and firms made efforts to retain workers such as keeping seasonal workers on staff in the off-season. While employment grew across most sectors, manufacturers, retailers, and transportation companies reported lower demand for labor in some Districts. Wages grew at a modest to moderate rate in most Districts, similar to last period, and contacts expected wage growth to continue in this range. Firms reported that the tight labor market and minimum wage increases were putting upward pressure on wages. Companies also spent more on benefits, as the cost of benefits rose and as employers expanded benefits to attract and retain workers.

emphasis added

ISM Non-Manufacturing Index increased to 57.3% in February

by Calculated Risk on 3/04/2020 10:03:00 AM

The February ISM Non-manufacturing index was at 57.3%, up from 55.5% in January. The employment index increased to 55.6%, from 54.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2020 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 121st consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.This suggests faster expansion in February than in January.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 57.3 percent, which is 1.8 percentage points higher than the January reading of 55.5 percent. This represents continued growth in the non-manufacturing sector, at a faster rate. The Non-Manufacturing Business Activity Index decreased to 57.8 percent, 3.1 percentage points lower than the January reading of 60.9 percent, reflecting growth for the 127th consecutive month. The New Orders Index registered 63.1 percent; 6.9 percentage points higher than the reading of 56.2 percent in January. The Employment Index increased 2.5 percentage points in February to 55.6 percent from the January reading of 53.1 percent. The Prices Index reading of 50.8 is 4.7 percentage points lower than the January’s 55.5 percent, indicating that prices increased in February for the 33rd consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector reflected continued growth in February. Most respondents are concerned about the coronavirus and its supply chain impact. They also continue to have difficulty with labor resources. They do remain positive about business conditions and the overall economy.”

emphasis added