by Calculated Risk on 2/28/2020 09:48:00 AM

Friday, February 28, 2020

Hotels: Occupancy Rate Decreases Year-over-year

From HotelNewsNow.com: STR: US hotel results for week ending 22 February

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 16-22 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 17-23 February 2019, the industry recorded the following:

• Occupancy: -2.1% to 63.2%

• Average daily rate (ADR): +0.7% to US$130.55

• Revenue per available room (RevPAR): -1.4% to US$82.55

Of note, U.S. airport hotels reported a 4.8% decrease in occupancy for the week, which was the steepest decline among all location types tracked by STR. The decline was steeper in airport markets outside of the country’s 10 busiest.

“The obvious question is whether a dip in demand in airport hotels was directly connected to the coronavirus outbreak,” said Jan Freitag, STR’s senior VP of lodging insights. “However, one week of data is not sufficient for STR to make that correlation, especially considering last week was rather weak around the country in general—possibly due to extended vacations after Presidents’ Day.

“We’ve maintained that we do expect to see a coronavirus impact in U.S. hotel performance data, especially in gateway cities that have historically seen a large number of Chinese arrivals. We’ll continue to monitor the data each week. The next few weeks will be especially interesting considering the news to come out of the CDC on Tuesday.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 is off to a decent start, however, STR notes that the new coronavirus could have a significant negative impact on hotels.

Personal Income increased 0.6% in January, Spending increased 0.2%, Core PCE increase 0.1%

by Calculated Risk on 2/28/2020 08:35:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $116.5 billion (0.6 percent) in January according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $101.4 billion (0.6 percent) and personal consumption expenditures (PCE) increased $29.6 billion (0.2 percent).The January PCE price index increased 1.7 percent year-over-year and the January PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI increased 0.5 percent in January and Real PCE increased 0.1 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through January 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above expectations, and the increase in PCE was below expectations.

Note that core PCE inflation was below expectations.

Thursday, February 27, 2020

Friday: Personal Income & Outlays, Chicago PMI

by Calculated Risk on 2/27/2020 10:32:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for February. The consensus is for a reading of 45.8, up from 42.9 in January.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 100.9.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in January, Lowest since 2007

by Calculated Risk on 2/27/2020 04:43:00 PM

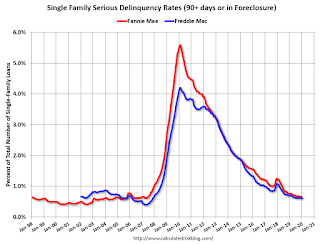

Freddie Mac reported that the Single-Family serious delinquency rate in January was 0.60%, down from 0.63% in December. Freddie's rate is down from 0.70% in January 2019.

This the lowest delinquency rate since November 2007.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for January soon.

NAR: "Pending Home Sales Ascend 5.2% in January"

by Calculated Risk on 2/27/2020 12:57:00 PM

From the NAR: Pending Home Sales Ascend 5.2% in January

Pending home sales rebounded in January, ticking up following a decline in December, according to the National Association of Realtors®. Only the West region reported a minor drop in month-over-month contract activity, while the other three major regions each saw pending home sales grow. Year-over-year pending home sales activity was up in all four regions and thus up nationally compared to one year ago.This was well above expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, grew 5.2% to 108.8 in January. Year-over-year contract signings increased 5.7%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI rose 1.3% to 92.9 in January, 1.2% higher than a year ago. In the Midwest, the index increased 7.3% to 105.3 last month, 6.5% higher than in January 2019.

Pending home sales in the South grew 8.7% to an index of 129.4 in January, a 7.1% increase from January 2019. The index in the West declined 1.1% in January 2020 to 92.6, still a jump of 5.5% from a year ago.

emphasis added

Kansas City Fed: "Tenth District Manufacturing Activity Increased Modestly" in February

by Calculated Risk on 2/27/2020 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Increased Modestly

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity increased modestly, reaching positive territory for the first time in eight months.This was the last of the regional Fed surveys for February.

“Regional factory activity finally expanded again in February,” said Wilkerson. “This was despite over 40 percent of firms reporting some negative effect from the spread of coronavirus so far in 2020.”

...

The month-over-month composite index was 5 in February, higher than -1 in January and -5 in December. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The increase in district manufacturing activity was driven by both durable and non-durable goods plants, particularly food and transportation equipment producers. Most month-over-month indexes moved into positive territory in February, with many reaching their highest levels in over a year. However, the order backlog and employment indexes continued to fall. Year-over-year factory indexes rebounded strongly, with the composite index jumping from -7 to 5. The future composite index remained solid, inching slightly higher from 14 to 16.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will increase further in February.

Q4 GDP Unchanged at 2.1% Annual Rate

by Calculated Risk on 2/27/2020 08:39:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Year 2019 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the fourth quarter of 2019 (table 1), according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP also increased 2.1 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down to 1.7% from 1.8%. Residential investment was revised up from 5.8% to 6.2%. The revisions were small. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was also 2.1 percent. In the second estimate, an upward revision to private inventory investment was offset by a downward revision to nonresidential fixed investment.

emphasis added

Weekly Initial Unemployment Claims Increase to 219,000

by Calculated Risk on 2/27/2020 08:33:00 AM

The DOL reported:

In the week ending February 22, the advance figure for seasonally adjusted initial claims was 219,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 210,000 to 211,000. The 4-week moving average was 209,750, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 209,000 to 209,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 209,750.

This was higher than the consensus forecast.

Wednesday, February 26, 2020

Thursday: GDP, Unemployment Claims

by Calculated Risk on 2/26/2020 07:42:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 211 thousand initial claims, up from 210 thousand the previous week.

• At 8:30 AM, Gross Domestic Product, 4th quarter 2019 (Second estimate). The consensus is that real GDP increased 2.1% annualized in Q4, unchanged from the advance estimate.

• At 8:30 AM, Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders.

• At 11:00 AM, the Kansas City Fed manufacturing survey for February. This is the last of regional manufacturing surveys for February.

Zillow Case-Shiller Forecast: House Price Gains "Back on the Gas"

by Calculated Risk on 2/26/2020 04:58:00 PM

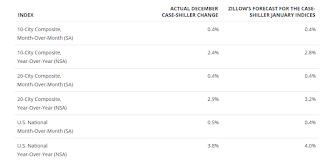

The Case-Shiller house price indexes for December were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: December Case-Shiller Results & January Forecast: Back on the Gas

The final reading of 2019 confirmed that a reacceleration of home price growth has indeed begun, after growth spent nearly the entire calendar year tapping on the brakes.

The national Case-Shiller Home Price Index rose 3.8% year-over-year in December. The smaller 10- and 20-city composite indices grew more slowly, at 2.4% and 2.9% year-over-year, respectively.

...

For-sale inventory remains near its lowest level on record, which has stoked competition for the relatively few homes on the market and nudged prices back upward as a result. The rebound in home price growth is also rooted in the sustained strength of the U.S. economy, which continues to ride a robust labor market, and mortgage rates that finished the year near their lowest levels since 2016 and have fallen even further since.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.0% in January, up from 3.8% in December.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.0% in January, up from 3.8% in December. The Zillow forecast is for the 20-City index to be up 3.2% YoY in January from 2.9% in December, and for the 10-City index to increase to 2.8% YoY compared to 2.4% YoY in December.