by Calculated Risk on 2/19/2020 11:00:00 AM

Wednesday, February 19, 2020

Lawler: Early Read on Existing Home Sales in January

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.42 million in January, down 2.2% from December’s preliminary pace (which looks too high) and up 9.9% from last January’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of January was down by about 12.0% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 7.0% from last January.

Note that this month’s release will incorporate benchmark seasonal adjustment revisions, which makes it a little tricky to estimate January’s seasonal adjustment factor.

Last month the National Association of Realtors estimated that existing home sales ran at a seasonally adjusted annual rate of 5.54 million, well above consensus estimates and, surprisingly, well above my estimate based on local realtor/MLS reports released before the NAR report. In looking at realtor/MLS reports released later than those available when I do my “early read,” it does appear as if my earlier sample did not reflect overall national sales. However, it also appears as if the NAR’s estimate overstated sales in the Midwest and the Northeast. If I had had access to all realtor/MLS reports for December sales I would have projected that existing home sales as estimated by the NAR ran at a seasonally adjusted annual rate of 5.50 million.

CR Note: The National Association of Realtors (NAR) is scheduled to release January existing home sales on Friday, February 21, 2020 at 10:00 AM ET. The consensus is for 5.45 million SAAR.

Comments on January Housing Starts

by Calculated Risk on 2/19/2020 09:14:00 AM

Earlier: Housing Starts decreased to 1.567 Million Annual Rate in January

Total housing starts in January were well above expectations and revisions to prior months were positive.

The housing starts report showed starts were down 3.6% in January compared to December, and starts were up 21.4% year-over-year compared to January 2019.

These were blow out numbers! Starts in December were at the highest level for starts since December 2006 (end of the bubble). However, the weather was very nice again in January (just like in December), and the weather probably had a significant impact on the seasonally adjusted housing starts number. The winter months of December and January have the largest seasonal factors, so nice weather can really have an impact.

Single family starts were up 4.6% year-over-year, and multi-family starts were up 71.3% YoY.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 21.4% in January compared to January 2019.

For the year, starts were up 3.2% compared to 2018.

Last year, in 2019, starts picked up in the 2nd half of the year, so the comparisons are easy early in the year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts- although starts are picking up a little again.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Housing Starts decreased to 1.567 Million Annual Rate in January

by Calculated Risk on 2/19/2020 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in January were at a seasonally adjusted annual rate of 1,567,000. This is 3.6 percent below the revised December estimate of 1,626,000, but is 21.4 percent above the January 2019 rate of 1,291,000. Single‐family housing starts in January were at a rate of 1,010,000; this is 5.9 percent below the revised December figure of 1,073,000. The January rate for units in buildings with five units or more was 547,000.

Building Permits:

Privately‐owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,551,000. This is 9.2 percent above the revised December rate of 1,420,000 and is 17.9 percent above the January 2019 rate of 1,316,000. Single‐family authorizations in January were at a rate of 987,000; this is 6.4 percent above the revised December figure of 928,000. Authorizations of units in buildings with five units or more were at a rate of 522,000 in January.

emphasis added

Click on graph for larger image.

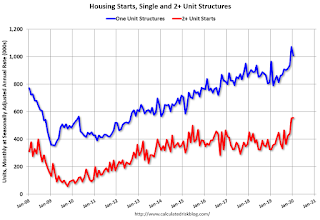

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in January compared to December. Multi-family starts were up 71.3% year-over-year in January.

Multi-family is volatile month-to-month, and had been mostly moving sideways the last several years.

Single-family starts (blue) decreased in January, and were up 4.6% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in January were well above expectations and revisions were positive.

I'll have more later …

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 2/19/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 14, 2020.

... The Refinance Index decreased 8 percent from the previous week and was 165 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“Treasury yields moved slightly higher last week, despite uncertainty surrounding the economic impact from the spread of the coronavirus. The 30-year fixed mortgage increased five basis points to 3.77 percent as a result, causing refinance applications – driven by a 11 percent drop in applications for conventional refinances – to fall,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Even with an 8 percent decline, the refinance index was still at its third highest reading so far this year. Government refinance activity, which tends to lag movements in the conventional market, bucked the overall trend, as VA loan refinances jumped 23 percent.”

Added Kan, “Purchase applications fell 3 percent last week, as there continues to be some pullback after a strong January. Activity was still 10 percent higher than a year ago, but too few options – especially at the lower portion of the market – are slowing some would-be buyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.77 percent from 3.72 percent, with points remaining unchanged at 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

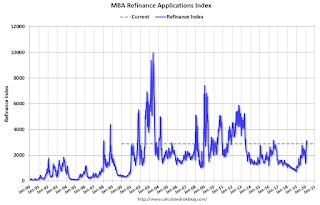

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a 2012 size refinance boom.

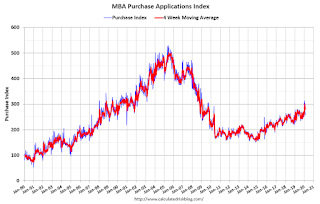

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

Tuesday, February 18, 2020

Wednesday: Housing Starts, PPI, FOMC Minutes

by Calculated Risk on 2/18/2020 06:49:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for January. The consensus is for 1.415 million SAAR, down from 1.608 million SAAR.

• Also at 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.1% increase in core PPI.

• During the day, The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of January 28-29, 2020

Mortgage Rates and Ten Year Yield

by Calculated Risk on 2/18/2020 02:11:00 PM

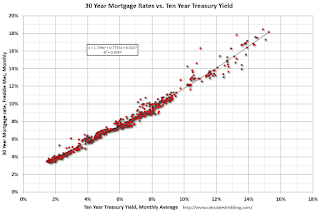

With the ten year yield at 1.55%, and based on an historical relationship, 30-year rates should currently be around 3.5%.

Mortgage News Daily reports that the most prevalent 30 year fixed rate is now at 3.46% for top tier scenarios.

The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

The record low in the Freddie Mac survey was 3.31% in November 2012 (Survey started in 1971).

To fall to 3.31% on the Freddie Mac survey, and based on the historical relationship, the Ten Year yield would have to fall to around 1.4% (but there is some variability in the relationship).

NAHB: Builder Confidence Decreased to 74 in February

by Calculated Risk on 2/18/2020 10:04:00 AM

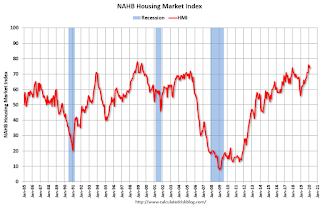

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 74, down from 75 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Remains Solid in February

Builder confidence in the market for newly-built single-family homes edged one point lower to 74 in February, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. The last three monthly readings mark the highest sentiment levels since December 2017.

“Steady job growth, rising wages and low interest rates are fueling demand but builders are still grappling with increasing construction and development costs,” said NAHB Chairman Dean Mon.

“At a time when demand is on the rise, regulatory constraints along with a shortage of construction workers and a dearth of lots are hindering the production of affordable housing in local communities across the nation,” said NAHB Chief Economist Robert Dietz. “And while lower mortgage rates have improved housing affordability in recent months, accelerating price growth due to limited inventory may offset some of that effect.”

...

The HMI index gauging current sales conditions fell one point to 80, the component measuring sales expectations in the next six months was one point lower at 79 and the gauge charting traffic of prospective buyers also decreased one point to 57.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose one point to 63, the Midwest increased one point to 67 and the South moved two points higher to 78. The West fell one point to 83.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was slightly below the consensus forecast, but still another very strong reading.

NY Fed: Manufacturing "Business activity picked up in New York State"

by Calculated Risk on 2/18/2020 08:56:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity picked up in New York State, according to firms responding to the February 2020 Empire State Manufacturing Survey. The headline general business conditions index moved up eight points to 12.9. The new orders index shot up 16 points to 22.1, and the shipments index climbed to 18.9.This was higher than the consensus forecast.

...

The index for number of employees edged down to 6.6, indicating that employment grew to a small degree. The average workweek held near zero, a sign that the average workweek was little changed.

…

Indexes assessing the six-month outlook suggested that optimism about future conditions was somewhat restrained.

emphasis added

Monday, February 17, 2020

Tuesday: Empire State Mfg Survey, Homebuilder Survey

by Calculated Risk on 2/17/2020 06:02:00 PM

Weekend:

• Schedule for Week of February 16, 2020

Tuesday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 5.0, up from 4.8.

• At 10:00 AM, The February NAHB homebuilder survey. The consensus is for a reading of 75, unchanged from 75. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 8 and DOW futures are up 75 (fair value).

Oil prices were up over the last week with WTI futures at $52.33 per barrel and Brent at $57.61 barrel. A year ago, WTI was at $54, and Brent was at $66 - so oil prices are down year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.43 per gallon. A year ago prices were at $2.31 per gallon, so gasoline prices are up 12 cents per gallon year-over-year.

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 2/17/2020 01:36:00 PM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 26% from the peak, and is increasing again (up 11% from low). The number of salesperson's licenses has increased to December 2004 levels.

Brokers' licenses are off 14.3% from the peak and have fallen to December 2005 levels, and may be bottoming.

We are seeing a pickup in Real Estate licensees in California, although the number of Brokers is mostly flat.