by Calculated Risk on 2/04/2020 12:15:00 PM

Tuesday, February 04, 2020

U.S. Heavy Truck Sales down 11% Year-over-year in January

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the January 2020 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again in 2016 - mostly due to the weakness in the oil sector - and bottomed at 363 thousand SAAR in October 2016.

Click on graph for larger image.

Following the low in 2016, heavy truck sales increased to a new all time high of 575 thousand SAAR in September 2019. However heavy truck sales have declined since then and are off 11% year-over-year.

Heavy truck sales were at 467 thousand SAAR in January, down from 473 thousand SAAR in December, and down from 527 thousand SAAR in January 2019. The recent weakness is probably due to the weakness in manufacturing and the decline in oil prices.

BEA: January Vehicles Sales increased to 16.8 Million SAAR

by Calculated Risk on 2/04/2020 09:22:00 AM

The BEA released their estimate of January vehicle sales this morning. The BEA estimated light vehicle sales of 16.84 million SAAR in January 2020 (Seasonally Adjusted Annual Rate), up 1.2% from the December sales rate, and up 0.8% from January 2019.

Light vehicle sales in 2019 were revised down slightly to 16.95 million, down 1.5% from 17.21 million in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for January 2020 (red).

A small decline in sales last year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 16.84 million SAAR.

Sales have been generally decreasing slightly, but are still at a high level.

CoreLogic: House Prices up 4.0% Year-over-year in December

by Calculated Risk on 2/04/2020 09:02:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports December Home Prices Increased by 4.0% Year Over Year

Home prices nationwide, including distressed sales, increased year over year by 4% in December 2019 compared with December 2018 and increased month over month by 0.3% in December 2019 compared with November 2019.CR Note: The YoY change in the CoreLogic index decreased over the last year, but lately the YoY change has been increasing.

...

“Moderately priced homes are in high demand and short supply, pushing up values and eroding affordability for first-time buyers. Homes that sold for 25% or more below the local median price experienced a 5.9% price gain in 2019, compared with a 3.7% gain for homes that sold for 25% or more above the median.” Dr. Frank Nothaft, Chief Economist for CoreLogic

emphasis added

Monday, February 03, 2020

Tuesday: BEA Vehicle Sales

by Calculated Risk on 2/03/2020 07:17:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Digging Deeper Into Multi-Year Lows

Now, as the new week begins, Treasury yields and MBS alike are indicating slightly higher rates than Friday, but because lenders played it so safe, they were instead able to offer slightly LOWER rates today. Simply put, mortgage rates are even deeper into multi-year lows now, even though the bond market is pointing to slightly higher rates versus last Friday. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED 3.375-3.5%]Tuesday:

emphasis added

• Early: the BEA will release Light vehicle sales for January. The consensus is for light vehicle sales to be 16.8 million SAAR in January, up from 16.7 million in December (Seasonally Adjusted Annual Rate).

• At 10:00 AM ET, Corelogic House Price index for December.

NMHC: Apartment Market Tightness Index Decreased in January

by Calculated Risk on 2/03/2020 04:35:00 PM

The National Multifamily Housing Council (NMHC) released their January report: January Quarterly Survey Indicates Apartment Conditions Mixed

Certain market conditions are loosening, according to the NMHC Quarterly Survey of Apartment Market Conditions, conducted in January 2020. The Sales Volume Index slipped further below the breakeven level (50) to 43, indicating a continued softness in property sales. “This reflects some seasonal decline along with the paucity of available deals, some respondents also noted the negative impact of the new rent laws in New York,” said NMHC Chief Economist Mark Obrinsky.

Additionally, Market Tightness (48) slipped below the breakeven level (50). “Apartment markets showed some softening in line with the slower leasing in the winter months,” noted Obrinsky. “Even so, the Market Tightness Index reading of 48 was the highest January reading in five years, and slightly higher than the January average of 45 in the survey’s 21-year history.”

...

The Market Tightness Index decreased from 54 to 48, indicating the first sign of looser market conditions since January 2019. Nearly one-quarter (23 percent) of respondents reported looser market conditions than three months prior, compared to 18 percent who reported tighter conditions. Over half (59 percent) of respondents felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter, but this may be due to seasonal factors.

This followed three consecutive quarters with tighter conditions.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 2/03/2020 12:31:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined sharply from the record highs in early 2018, and have increased a little lately.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Jan 24, 2020 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 14% from a year ago, and CME futures are up 12% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war was a factor in the sharp decline with reports that lumber exports to China had declined by 40%. Now, with a pickup in housing, lumber prices are moving up again.

Construction Spending Decreased in December

by Calculated Risk on 2/03/2020 10:27:00 AM

From the Census Bureau reported that overall construction spending decreased in December:

Construction spending during December 2019 was estimated at a seasonally adjusted annual rate of $1,327.7 billion, 0.2 percent below the revised November estimate of $1,329.9 billion. The December figure is 5.0 percent above the December 2018 estimate of $1,264.8 billion.Both private and public spending decreased:

The value of construction in 2019 was $1,303.5 billion, 0.3 percent below the $1,307.2 billion spent in 2018.

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $991.2 billion, 0.1 percent below the revised November estimate of $992.2 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $336.4 billion, 0.4 percent below the revised November estimate of $337.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018. Now it is increasing again, but is still 20% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 3% above the previous peak in March 2009, and 28% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 5.5%. Non-residential spending is down slightly year-over-year. Public spending is up 11.5% year-over-year.

This was below consensus expectations of a 0.5% increase in spending, however construction spending for October and November was revised up slightly.

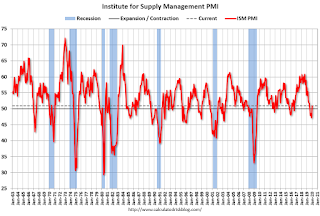

ISM Manufacturing index Increased to 50.9 in January

by Calculated Risk on 2/03/2020 10:05:00 AM

The ISM manufacturing index indicated expansion in January. The PMI was at 50.9% in January, up from 47.2% in December. The employment index was at 46.4%, up from 45.1% last month, and the new orders index was at 52.0%, up from 46.8%.

From the Institute for Supply Management: January 2020 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in January, and the overall economy grew for the 129th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The January PMI® registered 50.9 percent, an increase of 3.1 percentage points from the seasonally adjusted December reading of 47.8 percent. The New Orders Index registered 52 percent, an increase of 4.4 percentage points from the seasonally adjusted December reading of 47.6 percent. The Production Index registered 54.3 percent, up 9.5 percentage points compared to the seasonally adjusted December reading of 44.8 percent. The Backlog of Orders Index registered 45.7 percent, up 2.4 percentage points compared to the December reading of 43.3 percent. The Employment Index registered 46.6 percent, a 1.4-percentage point increase from the seasonally adjusted December reading of 45.2 percent. The Supplier Deliveries Index registered 52.9 percent, a 1.7-percentage point decrease from the December reading of 54.6 percent. The Inventories Index registered 48.8 percent, a decrease of 0.4 percentage point from the seasonally adjusted December reading of 49.2 percent. The Prices Index registered 53.3 percent, a 1.6-percentage point increase from the December reading of 51.7 percent. The New Export Orders Index registered 53.3 percent, a 6-percentage point increase from the December reading of 47.3 percent. The Imports Index registered 51.3 percent, a 2.5-percentage point increase from the December reading of 48.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 48.5%, and suggests manufacturing expanded slightly in January after five months of contraction.

Black Knight Mortgage Monitor for December; "Home-price-growth rate gained steam"

by Calculated Risk on 2/03/2020 08:59:00 AM

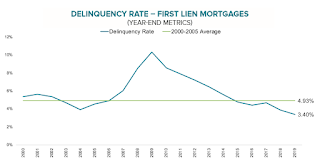

Black Knight released their Mortgage Monitor report for December today. According to Black Knight, 3.40% of mortgages were delinquent in December, down from 3.88% in December 2018. Black Knight also reported that 0.46% of mortgages were in the foreclosure process, down from 0.52% a year ago.

This gives a total of 3.86% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: Low Interest Rates Make Housing Most Affordable in Two Years Despite Accelerating Price Growth; Buying Power Up 16% since Late 2018

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. Drawing upon the latest data from the Black Knight Home Price Index (HPI), this month’s report examined home price growth and affordability in the context of today’s lower-interest-rate environment. As Black Knight Data & Analytics President Ben Graboske explained, low interest rates throughout much of the back half of 2019 contributed to sharply accelerating home price growth – but also to improving affordability.

“After falling from nearly 7% year-over-year appreciation in early 2018 to a trough of 3.8% in August 2019, the national home-price-growth rate gained a good deal of steam as mortgage interest rates declined throughout the second half of last year,” said Graboske. “In fact, December marked four consecutive months of home price growth acceleration and the largest single-month acceleration in more than 6.5 years, while the annual rate of appreciation saw nearly a full percentage point increase over the last four months of 2019, closing out the year at 4.7%. The low end of the market, those homes in the bottom 20% by price, saw 6.6% annual growth, nearly three times the rate of the top 20%. That said, higher-priced homes have been more reactive to recent rate declines. The annual growth rate among the top price tier has more than tripled over the past four months – from 0.7% year-over-year in August to 2.3% as of December – while there’s been very little acceleration at the lowest end of the market.

“Still, even with home price growth accelerating, today’s low-interest-rate environment has made home affordability the best it’s been since early 2018. At that time, the housing market was red-hot, with national home price growth at 6.6% and climbing – before rising rates and tightening affordability triggered a pullback in growth rates. That’s not the case today. Despite the average home price increasing by nearly $13,000 from just over a year ago, the monthly mortgage payment required to buy that same home has actually dropped by 10% over that same span due to falling interest rates.

It now requires 20.6% of median monthly income to purchase the same home as it did just over a year ago, the smallest payment-to-income ratio we’ve seen in two years. Put another way, prospective homebuyers can now purchase a home that is $48,000 more expensive than a year ago, while still paying the same in principal and interest. That’s a 16% increase in buying power. Recent history at comparable levels of affordability suggest acceleration in home price growth may well continue in the coming months as this increased buying power puts upward pressure on home prices across the country.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows Black Knight's estimate of the mortgage payment to income ratio.

From Black Knight:

• Even with home price growth accelerating, today’s low interest-rate environment has made home affordability the best it’s been since early 2018The second graph shows the year end national delinquency rate since 2000:

• At that time, the housing market was red-hot, with national home price growth at 6.6% and climbing – before rising rates and tightening affordability triggered a pullback in growth rates

• It now requires 20.6% of median monthly income to purchase the same home as it did just over a year ago, the smallest payment-to-income ratio we’ve seen in two years

• Put another way, prospective homebuyers can now purchase a $48K more expensive home than a year ago while still paying the same in principal and interest, a 16% increase in buying power

• Recent history at comparable levels of affordability suggest acceleration in home price growth may well continue in the coming months as this increased buying power puts upward pressure on home prices across the country

• The national delinquency rate closed out 2019 at 3.4%, the lowest year-end rate of the century and down 12.4% from last yearThere is much more in the mortgage monitor.

• That's also more than 1.5% below the pre-recession average - the largest such spread in the years since the financial crisis

• When the rate of improvement slowed in mid-2019, it appeared the market was approaching a trough in mortgage delinquencies

• However, the rate of improvement picked back up again late in the year, suggesting delinquency rates could fall even further, potentially surpassing the record low hit in May 2019 by early 2020

Sunday, February 02, 2020

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 2/02/2020 11:38:00 PM

Weekend:

• Schedule for Week of February 2, 2020

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.5, up from 47.2 in December.

• Also at 10:00 AM, Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

• At 2:00 PM, Senior Loan Officer Opinion Survey on Bank Lending Practices for January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 20 and DOW futures are up 165 (fair value).

Oil prices were down over the last week with WTI futures at $51.42 per barrel and Brent at $56.19 barrel. A year ago, WTI was at $55, and Brent was at $62 - so oil prices are down 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.46 per gallon. A year ago prices were at $2.27 per gallon, so gasoline prices are up 19 cents per gallon year-over-year.