by Calculated Risk on 2/02/2020 11:10:00 AM

Sunday, February 02, 2020

January 2020: Unofficial Problem Bank list Decreased to 64 Institutions

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for January 2020.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for January 2020. During the month, the list declined by three to 64 banks after four removals and one addition. Aggregate assets were little changed at $51.3 billion. A year ago, the list held 78 institutions with assets of $55.2 billion.The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and has steadily declined since then to below 100 institutions.

Enforcement actions were terminated against First Community National Bank, Cuba, MO ($130 million); SunSouth Bank, Dothan, AL ($107 million); Lafayette State Bank, Mayo, FL ($106 million); and Sunrise Bank Dakota, Onida, SD ($52 million). Added this month was Texas Citizens Bank, National Association, Pasadena, TX ($521 million).

Saturday, February 01, 2020

Schedule for Week of February 2, 2020

by Calculated Risk on 2/01/2020 08:11:00 AM

The key report scheduled for this week is the January employment report.

Other key indicators include January ISM manufacturing and non-manufacturing surveys, the December trade deficit, and January vehicle sales.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.5, up from 47.2 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.5, up from 47.2 in December.Here is a long term graph of the ISM manufacturing index.

The PMI was at 47.2% in December, the employment index was at 45.1%, and the new orders index was at 46.8%.

10:00 AM: Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices for January.

Early: the BEA will release Light vehicle sales for January. The consensus is for light vehicle sales to be 16.8 million SAAR in January, up from 16.7 million in December (Seasonally Adjusted Annual Rate).

Early: the BEA will release Light vehicle sales for January. The consensus is for light vehicle sales to be 16.8 million SAAR in January, up from 16.7 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

10:00 AM: Corelogic House Price index for December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 159,000 payroll jobs added in January, down from 202,000 added in December.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $48.0 billion. The U.S. trade deficit was at $43.1 billion in November.

10:00 AM: the ISM non-Manufacturing Index for January.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, down from 216,000 last week.

8:30 AM: Employment Report for January. The consensus is for 161,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

8:30 AM: Employment Report for January. The consensus is for 161,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.There were 145,000 jobs added in December, and the unemployment rate was at 3.5%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In December the year-over-year change was 2.108 million jobs.

Note: The annual benchmark revision will be released with the January report. The preliminary estimate of the Benchmark revision "indicates a downward adjustment to March 2019 total nonfarm employment of -501,000".

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, January 31, 2020

Fannie Mae: Mortgage Serious Delinquency Rate unchanged in December

by Calculated Risk on 1/31/2020 04:09:00 PM

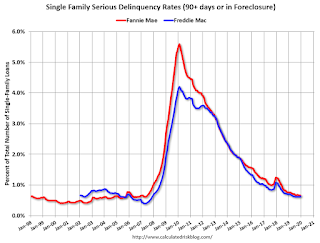

Fannie Mae reported that the Single-Family Serious Delinquency was unchanged at 0.66% in December, from 0.66% in November. The serious delinquency rate is down from 0.76% in December 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This matches last month as the the lowest serious delinquency rate for Fannie Mae since June 2007.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.48% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.11% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.35% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q1 GDP Forecasts: 1.0% to 2.7%

by Calculated Risk on 1/31/2020 11:47:00 AM

From Merrill Lynch

GDP growth is likely to slow to 1.0% qoq saar in 1Q 2020. [Jan 31 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.5% for 2020:Q1 [Jan 31 estimate]And from the Altanta Fed: GDPNow

The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 2.7 percent on January 31. [Jan 31 estimate]CR Note: These very early estimates suggest real GDP growth will be between 1.0% and 2.7% annualized in Q1.

Q4 2019 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 1/31/2020 09:35:00 AM

The BEA has released the underlying details for the Q4 initial GDP report this morning.

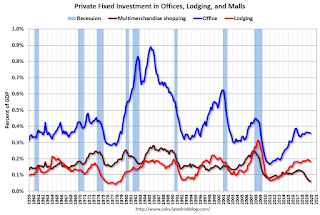

The BEA reported that investment in non-residential structures decreased at a 10.1% annual pace in Q4.

Investment in petroleum and natural gas exploration decreased in Q4 compared to Q3, and was down 19% year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices decreased in Q4, but was up 3% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 32% year-over-year in Q4 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q4, but lodging investment was up 1% year-over-year.

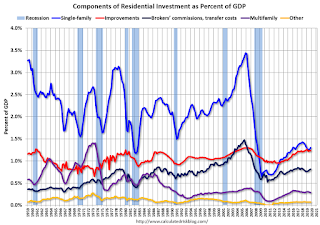

Usually single family investment is the top category, although home improvement was the top category for five consecutive years following the housing bust. Then investment in single family structures was back on top, however it is close between single family and home improvement.

Even though investment in single family structures has increased from the bottom, single family investment is still low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases.

Investment in single family structures was $282 billion (SAAR) (about 1.3% of GDP)..

Investment in multi-family structures decreased in Q4.

Investment in home improvement was at a $268 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.2% of GDP). Home improvement spending has been solid.

Personal Income increased 0.2% in December, Spending increased 0.3%

by Calculated Risk on 1/31/2020 09:02:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $40.7 billion (0.2 percent) in December according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $30.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $46.6 billion (0.3 percent).The December PCE price index increased 1.6 percent year-over-year and the December PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI decreased 0.1 percent in December and Real PCE increased 0.1 percent. The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.2 percent

The following graph shows real Personal Consumption Expenditures (PCE) through December 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was at expectations.

PCE growth was sluggish in Q4, and inflation remains below the Fed's target.

Thursday, January 30, 2020

Friday: Personal Income and Outlays

by Calculated Risk on 1/30/2020 07:37:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for January. The consensus is for a reading of 48.5, up from 48.2 in December.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 99.1.

"Mortgage Rates Basically at Best Levels Since 2016"

by Calculated Risk on 1/30/2020 04:30:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Basically at Best Levels Since 2016

Mortgage rates improved again today as the market continued to react to updates on the coronavirus outbreak. For top tier scenarios, the average lender is now offering rates not seen since 2016, with the slight exception of a few hours during the beginning of September 2019. Even then, today's rates at least match Sept 2019's rates on average. In other words, today is tied for the lowest levels in more than 3 years. [Today's Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.5 -3.625%]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since January 2011.

Not far from the record low levels of late 2012.

This graph is interactive, and you could view mortgage rates back to the mid-1980s - click here for interactive graph.

Q4 GDP: Investment

by Calculated Risk on 1/30/2020 12:54:00 PM

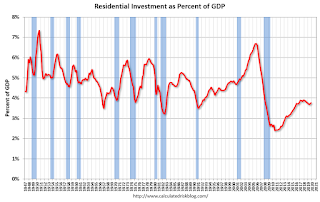

Investment was weak again in Q4, although residential investment picked up (increased at a 5.8% annual rate).

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased in Q4 (5.8% annual rate in Q3). Equipment investment decreased at a 2.9% annual rate, and investment in non-residential structures decreased at a 10.1% annual rate.

On a 3 quarter trailing average basis, RI (red) is up, equipment (green) is negative, and nonresidential structures (blue) is also down.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP increased in Q4. RI as a percent of GDP is close to the bottom of the previous recessions - and I expect RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

HVS: Q4 2019 Homeownership and Vacancy Rates

by Calculated Risk on 1/30/2020 10:09:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2019.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. he Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

"National vacancy rates in the fourth quarter 2019 were 6.4 percent for rental housing and 1.4 percent for homeowner housing. The rental vacancy rate of 6.4 percent was not statistically different from the rate in the fourth quarter 2018 (6.6 percent), but 0.4 percentage points lower than the rate in the third quarter 2019 (6.8 percent). The homeowner vacancy rate of 1.4 percent was not statistically different from the rate in the fourth quarter 2018 (1.5 percent) and virtually unchanged from the rate in the third quarter 2019.

The homeownership rate of 65.1 percent was not statistically different from the rate in the fourth quarter 2018 (64.8 percent) nor from the rate in the third quarter 2019 (also 64.8 percent). "

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 65.1% in Q4, from 64.8% in Q3.

I'd put more weight on the decennial Census numbers. However, given changing demographics, the homeownership rate has bottomed.

The HVS homeowner vacancy was unchanged at 1.4%.

The HVS homeowner vacancy was unchanged at 1.4%. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The rental vacancy rate decreased to 6.4% in Q4.

The rental vacancy rate decreased to 6.4% in Q4.The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate is close to the bottom for this cycle.