by Calculated Risk on 12/02/2019 10:05:00 AM

Monday, December 02, 2019

ISM Manufacturing index Decreased to 48.1 in November

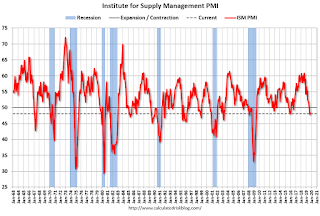

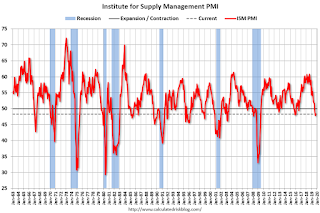

The ISM manufacturing index indicated contraction in November. The PMI was at 48.1% in November, down from 48.3% in October. The employment index was at 46.6%, down from 47.7% last month, and the new orders index was at 47.2%, down from 49.1%.

From the Institute for Supply Management: November 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in November, and the overall economy grew for the 127th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The November PMI® registered 48.1 percent, a decrease of 0.2 percentage point from the October reading of 48.3 percent. The New Orders Index registered 47.2 percent, a decrease of 1.9 percentage points from the October reading of 49.1 percent. The Production Index registered 49.1 percent, up 2.9 percentage points compared to the October reading of 46.2 percent. The Backlog of Orders Index registered 43 percent, down 1.1 percentage points compared to the October reading of 44.1 percent. The Employment Index registered 46.6 percent, a 1.1-percentage point decrease from the October reading of 47.7 percent. The Supplier Deliveries Index registered 52 percent, a 2.5-percentage point increase from the October reading of 49.5 percent. The Inventories Index registered 45.5 percent, a decrease of 3.4 percentage points from the October reading of 48.9 percent. The Prices Index registered 46.7 percent, a 1.2-percentage point increase from the October reading of 45.5 percent. The New Export Orders Index registered 47.9 percent, a 2.5-percentage point decrease from the October reading of 50.4 percent. The Imports Index registered 48.3 percent, a 3-percentage point increase from the October reading of 45.3 percent.

“Comments from the panel were consistent with the previous month, with sentiment improving compared to October. November was the fourth consecutive month of PMI® contraction, at a faster rate compared to the prior month. Demand contracted, with the New Orders Index contracting faster, the Customers’ Inventories Index remaining at ‘too low’ levels and the Backlog of Orders Index contracting for the seventh straight month (and at a faster rate). The New Export Orders Index returned to contraction territory, likely contributing to the faster contraction of the New Orders Index. Consumption (measured by the Production and Employment indexes) contracted, due primarily to lack of demand, but contributed positively (a combined 1.8-percentage point increase) to the PMI® calculation. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in November, due primarily to contraction in inventories that was partially offset by supplier deliveries returning to ‘slowing.’ This resulted in a combined 0.9-percentage point decrease in the Supplier Deliveries and Inventories indexes. Imports contraction softened. Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are less confident that materials received will be consumed in a reasonable time period. Prices decreased for the sixth consecutive month, at a slower rate.”

“Global trade remains the most significant cross-industry issue."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 49.2%, and suggests manufacturing contracted further in November.

Sunday, December 01, 2019

Monday: ISM Manufacturing, Construction Spending

by Calculated Risk on 12/01/2019 06:28:00 PM

Weekend:

• Schedule for Week of December 1, 2019

Monday:

• At 10:00 AM, ISM Manufacturing Index for November. The consensus is for 49.2%, up from 48.3%. The PMI was at 48.3% in October, the employment index was at 47.7%, and the new orders index was at 49.1%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for 0.4% increase in spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 6, and DOW futures are down 64 (fair value).

Oil prices were down over the last week with WTI futures at $55.76 per barrel and Brent at $61.05 barrel. A year ago, WTI was at $51, and Brent was at $60 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.59 per gallon. A year ago prices were at $2.59 per gallon, so gasoline prices are unchanged year-over-year.

Hotels: Occupancy Rate Increased Sharply Year-over-year due to Timing of Thanksgiving

by Calculated Risk on 12/01/2019 12:57:00 PM

Note: Due to the timing of Thanksgiving, the occupancy rate was up sharply YoY last week, and will be down sharply YoY in the report next week.

From HotelNewsNow.com: STR: US hotel results for week ending 23 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 17-23 November 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 18-24 November 2018, the industry recorded the following:

• Occupancy: +17.7% to 61.2%

• Average daily rate (ADR): +10.8% to US$124.71

• Revenue per available room (RevPAR): +30.4% to US$76.32

STR analysts note the positive performance is due to the year-over-year comparison with the week of Thanksgiving in 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will decline into the winter.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, November 30, 2019

Schedule for Week of December 1, 2019

by Calculated Risk on 11/30/2019 11:27:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include the November ISM manufacturing and non-manufacturing indexes, November auto sales, and the October trade deficit.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 49.2%, up from 48.3%.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 49.2%, up from 48.3%.Here is a long term graph of the ISM manufacturing index.

The PMI was at 48.3% in October, the employment index was at 47.7%, and the new orders index was at 49.1%.

10:00 AM: Construction Spending for October. The consensus is for 0.4% increase in spending.

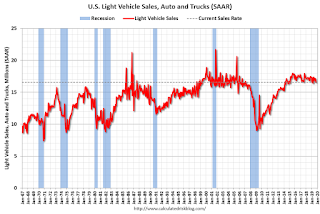

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 16.8 million SAAR in November, up from the BEA estimate of 16.6 million SAAR in October 2019 (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

10:00 AM: Corelogic House Price index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 140,000 jobs added, up from 125,000 in October.

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for a decrease to 54.5 from 54.7.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 213,000 last week.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $49.0 billion. The U.S. trade deficit was at $52.5 billion in September.

8:30 AM: Employment Report for November. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for November. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 148,000 jobs added in October. ex-Census (128,000 including Census jobs), and the unemployment rate was at 3.6%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In October the year-over-year change was 2.093 million jobs.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, November 29, 2019

November 2019: Unofficial Problem Bank list Decreased to 65 Institutions

by Calculated Risk on 11/29/2019 05:00:00 PM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for November 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2019. During the month, the list declined by six to 65 banks after seven removals and one addition. Aggregate assets dropped by $4.3 billion from the month to $51.0 billion. Part of the $4.3 billion decline came from a $2.1 billion decrease in reported assets with the release of third quarter financials earlier this week. A year ago, the list held 75 institutions with assets of $53.9 billion.The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and then steadily declined to below 100 institutions.

Removals this month occurred through merger, action termination, or failure. Banks finding a merger partner include MidSouth Bank, National Association, Lafayette, LA ($1.7 billion Ticker: MSL); Markesan State Bank, Markesan, WI ($118 million); Fort Gibson State Bank, Fort Gibson, OK ($61 million); and The First National Bank of Paducah, Paducah, TX ($44 million). Actions were terminated against The Peoples Bank, Eatonton, GA ($130 million) and The Bank of Houston, Houston, MO ($32 million). Exiting through failure was City National Bank of New Jersey, Newark, NJ ($143 million). Added this month was Beauregard FSB, Deridder, LA ($66 million).

Q4 GDP Forecasts: 0.8% to 2.0%

by Calculated Risk on 11/29/2019 11:28:00 AM

From Goldman Sachs:

[W]e lowered our Q4 GDP tracking estimate by one tenth to +2.0% (qoq ar). (qoq ar). [Nov 27 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 0.8% for 2019:Q4. [Nov 29 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.7 percent on November 27, up from 0.4 percent on November 19. [Nov 27 estimate]CR Note: These early estimates suggest real GDP growth will be between 0.8% and 2.0% annualized in Q4.

STR: Hotel RevPAR "Upcycle Over"

by Calculated Risk on 11/29/2019 11:21:00 AM

From Jan Freitag at HotelNewsNow: Consecutive RevPAR dips make it official: Upcycle over

Let’s look at what we know: RevPAR has now declined two months in a row—three months in the last year, and four months in the prior 13 months. Because everyone likes a record, we keep counting RevPAR growth months and are now at 112 out of the last 116 months.

That 112 months count is the record we had wanted and deserved, right? But of course it is fuzzy math since it was already back in the golden days of September 2018 that RevPAR declined for the first time—102 months since the RevPAR rocket took off in March 2010. Then RevPAR declined again in June (positive months counter: 110), September (112) and now October (112, still).

Is the upcycle over? Yes, it is. Two consecutive months of RevPAR decline are proof. But the other reality is this: annualized RevPAR will likely not decline at all in this cycle. So maybe, if you judge by year-end results, this cycle is not over at all. Our friends from Tourism Economics are clear about their conviction that GDP growth will continue to be positive, with no recession in sight, and this then fuels positive RevPAR growth. Our new 2020 RevPAR growth forecast isn’t pretty, but it’s realistic and realistically positive at +0.5%.

To get to that number, though, I would expect gyrations around the 0% point, meaning we will see plenty more months of mild RevPAR declines balanced by months with tepid RevPAR gains. That is the future we face, and the reality we already live in.

I guess the takeaway from this latest RevPAR decline is simply to heed Douglas Adams’ warning in The Hitchhiker’s Guide to the Galaxy: “Don’t Panic,” inscribed in large friendly letters on its cover.

emphasis added

Thursday, November 28, 2019

Five Economic Reasons to be Thankful

by Calculated Risk on 11/28/2019 08:11:00 AM

With a Hat Tip to Neil Irwin (he started doing this several years ago) ... here are five economic reasons to be thankful this Thanksgiving ...

1) Low unemployment rate.

The unemployment rate was at 3.6% in October. The unemployment rate is down from 3.8% in October 2018 (a year ago), and is down from the cycle peak of 10.0% in October 2009.

This is almost the lowest level for the unemployment rate since 1969 (the unemployment rate was at 3.5% in September)!

Also, this is the largest decline in the unemployment rate, from cycle peak-to-trough, since the BLS started tracking the unemployment rate in 1948. (In the early '80s, the unemployment rate declined from 10.8% to 5.0%; a decline of 5.8 percentage points. The current decline from 10.0% to 3.5% in September is 6.5 percentage points!)

2) Low unemployment claims.

Here is a graph of initial weekly unemployment claims.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims is at 219,750.

The low level of claims suggests relatively few layoffs.

3) Job Openings Near Series High.

There were 7.0 million job openings in September. This is still solid, but down from 7.6 million in September 2018.

For the nineteenth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 5 years).

Also Quits are up 3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

A large number of job openings, and rising quits, are positive signs for the labor market.

4) New Home sales are at a Cycle High.

New home sales were at 733 thousand SAAR (Seasonally Adjusted Annual Rate) in October, and 738 thousand SAAR in September (highest since July 2007).

Sales were up from 557 thousand SAAR in October 2017, and up from the cycle low of 270 thousand SAAR in February 2011.

Since New Home sales are an excellent leading indicator for the economy, the new cycle high suggests no recession in the next year.

5) Household Debt burdens are near record lows.

Household debt burdens have declined sharply since the great recession.

The Household debt service ratio was at 13.2% in 2007, and has fallen to a series low of 9.69% in Q2 2019 (most recent data).

The overall Debt Service Ratio decreased in Q2 2018, and has been mostly moving sideways and is at a series low. Note: The financial obligation ratio (FOR) declined in Q2 and is also near a series low (not shown).

The DSR for mortgages (blue) is also at a series low (since at least 1980). This ratio increased rapidly during the housing bubble, and continued to increase until 2007.

This data suggests aggregate household cash flow has improved.

Happy Thanksgiving to All!

Wednesday, November 27, 2019

Fannie Mae: Mortgage Serious Delinquency Rate decreased slightly in October

by Calculated Risk on 11/27/2019 04:28:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased slightly to 0.67% in October, from 0.68% in September. The serious delinquency rate is down from 0.79% in October 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This matches the delinquency rate in July and August of this year, as the lowest serious delinquency rate for Fannie Mae since June 2007.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.51% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.25% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Zillow Case-Shiller Forecast: Similar YoY Price Gains in October compared to September

by Calculated Risk on 11/27/2019 03:21:00 PM

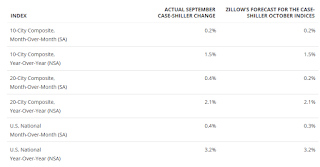

The Case-Shiller house price indexes for September were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: September Case-Shiller Results and October Forecast: Steady as She Goes

The S&P CoreLogic Case-Shiller U.S. National Home Price Index® rose 3.2% year-over-year in September (non-seasonally adjusted), up from 3.1% in August. Annual growth in the smaller 10-city index was unchanged from August, and was up slightly in the 20-city index (to 2.1%, from 2% in August).

…

In the meantime, annual growth in October as reported by Case-Shiller is expected to stay steady in all three major indices. S&P Dow Jones Indices is expected to release data for the October S&P CoreLogic Case-Shiller Indices on Tuesday, Dec. 31.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.2% in October, the same as 3.2% in September.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.2% in October, the same as 3.2% in September. The Zillow forecast is for the 20-City index to be unchanged at 2.1% YoY in October from 2.1% in September, and for the 10-City index to decline to 1.5% YoY compared to 1.5% YoY in September.