by Calculated Risk on 7/08/2019 10:51:00 AM

Monday, July 08, 2019

U.S. Heavy Truck Sales up 12% Year-over-year in June, Near All Time High

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the June 2019 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand in May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 479 thousand SAAR in June 2015.

Heavy truck sales declined again - mostly due to the weakness in the oil sector - and bottomed at 366 thousand SAAR in October 2016.

Click on graph for larger image.

Since 2016, heavy truck sales have increased to near the all time high (the high was 561 in April 2006).

Heavy truck sales were at 544 thousand SAAR in June, up from 537 thousand SAAR in May, and up from 485 thousand SAAR in June 2018.

Merrill: "Data cools call for July cuts"

by Calculated Risk on 7/08/2019 09:25:00 AM

A few excerpts from a Merrill Lynch research note:

The June employment report was strong with job growth of 224K ... leaving us comfortable with our view that the Fed will not cut in July and wait until September to deliver the first rate reduction. … last week's data were extremely important in dictating Fed action. So what did we learn? No fireworks from the G20 meeting, the ISM manufacturing index held in expansion territory at 51.7 and job creation was robust. The combination does not point to an immediate cut. At a minimum, this takes a 50bp cut off the table but should also prompt the Fed to argue for waiting for more data.

This puts the spotlight on Fed Chair Powell at the Semi-Annual Monetary Policy testimony on Wednesday. … We would argue that since the June meeting, the evidence suggests more positive news ... Indeed, even on the inflation front, the data have been better with an upward revision to 1Q core PCE inflation to 1.2% q/q saar from 1.0%, and the University of Michigan long-run inflation expectations revised up to 2.3% from 2.2%. … Powell ... can make the case that the data have been better than expected [and] note that the Fed remains vigilant and stands ready to act to prevent below-trend growth.

Sunday, July 07, 2019

Sunday Night Futures

by Calculated Risk on 7/07/2019 06:38:00 PM

Weekend:

• Schedule for Week of July 7, 2019

Monday:

• At 3:00 PM, Consumer Credit from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $57.63 per barrel and Brent at $64.36 barrel. A year ago, WTI was at $74, and Brent was at $77 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.75 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are down about 4% year-over-year.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 7/07/2019 11:18:00 AM

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

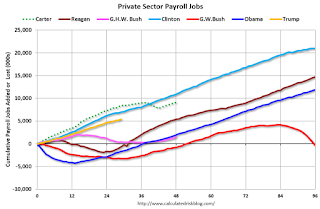

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (29 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 821,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 382,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,979,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,890,000 under President Obama (dark blue).

During the first 29 months of Mr. Trump's term, the economy has added 5,370,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 269,000 jobs).

During the first 29 months of Mr. Trump's term, the economy has added 243,000 public sector jobs.

After 29 months of Mr. Trump's presidency, the economy has added 5,613,000 jobs, about 429,000 behind the projection.

Saturday, July 06, 2019

Schedule for Week of July 7, 2019

by Calculated Risk on 7/06/2019 08:11:00 AM

The key report this week is June CPI.

Fed Chair Jerome Powell will testify on the Semiannual Monetary Policy Report to the Congress on Wednesday and Thursday.

3:00 PM: Consumer Credit from the Federal Reserve.

6:00 AM ET: NFIB Small Business Optimism Index for June.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in April to 7.449 million from 7.474 million in March.

The number of job openings (yellow) were up 5% year-over-year, and Quits were up 4% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C

2:00 PM: FOMC Minutes, Meeting of June 18-19, 2019

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 216 thousand initial claims, down from 221 thousand last week.

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking Committee, Washington, D.C

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.

Friday, July 05, 2019

AAR: June Rail Carloads down 5.3% YoY, Intermodal Down 7.2% YoY

by Calculated Risk on 7/05/2019 04:52:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

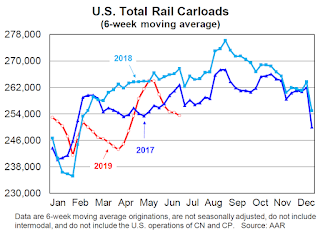

Total U.S. rail carloads in June 2019 were down 5.3% (57,173 carloads) from June 2018, as just 4 of the 20 carload commodities the AAR tracks had carload gains. ... Last year was the best year ever for intermodal, but this year isn’t keeping up. In June 2019, U.S. intermodal originations were down 7.2% from June 2018, their fifth straight decline and the biggest percentage decline since April 2016.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Red is 2019.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

Total U.S. rail carloads were 1.02 million in June 2019, down 5.3%, or 57,173 carloads, from June 2018. It was the fifth straight monthly decline.

...

In 2019 through June, total U.S. carloads were 6.55 million, down 2.9%, or 195,168 carloads, from the first six months of 2018. Since 1988, when our data begin, only 2016 had fewer total carloads in the first half of the year.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. intermodal originations totaled 1.08 million containers and trailers in June 2019, down 7.2%, or 84,002 units, from June 2018. The 7.2% decline was the fifth straight monthly decline and the biggest percentage decline since April 2016. … U.S. intermodal volume in the first half of 2019 was higher than every other year other than 2018 (see the middle right chart below), so it’s not like this year is a catastrophe.

Q2 GDP Forecasts: Around 1.5%

by Calculated Risk on 7/05/2019 11:34:00 AM

From Merrill Lynch:

A widening in the trade deficit and slower than expected inventory build in May were mostly offset by strong vehicle sales in June. On net, the data cut 0.1pp from 2Q GDP tracking, leaving us at 1.7% qoq saar. [July 5 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.5% for 2019:Q2 and 1.7% for 2019:Q3. [July 5 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.3 percent on July 3, down from 1.5 percent on July 1. [July 3 estimate]CR Note: These estimates suggest real GDP growth will be around 1.5% annualized in Q2.

Comments on June Employment Report

by Calculated Risk on 7/05/2019 09:41:00 AM

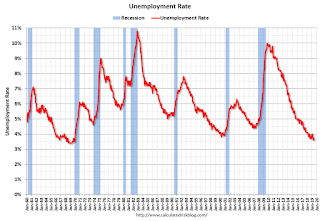

The headline jobs number at 224 thousand for June was above consensus expectations of 165 thousand, however the previous two months were revised down 11 thousand, combined. The unemployment rate increased to 3.7%. Overall this was a decent report. Note: Temporary Decennial Census hiring for June is not available yet (something to watch).

Earlier: June Employment Report: 224,000 Jobs Added, 3.7% Unemployment Rate

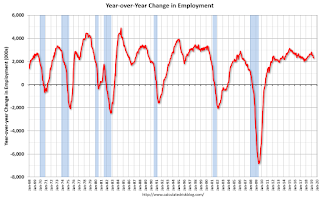

In June, the year-over-year employment change was 2.301 million jobs. That is decent year-over-year growth.

Average Hourly Earnings

Wage growth was below expectations. From the BLS:

"In June, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $27.90, following a 9-cent gain in May. Over the past 12 months, average hourly earnings have increased by 3.1 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.1% YoY in June.

Wage growth has generally been trending up, but has weakened recently.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in June to 82.2% from 82.1% in May, and the 25 to 54 employment population ratio was unchanged at 79.7%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 4.3 million in June. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs. "The number of persons working part time for economic reasons decreased in June to 4.347 million from 4.355 million in May. The number of persons working part time for economic reason has been generally trending down.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.2% in June.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.414 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 1.298 million in May.

Summary:

The headline jobs number was above expectations, however the previous two months were revised down slightly. The headline unemployment rate increase to 3.7%.

Wage growth was a little disappointing.

Overall this was a decent jobs report. The economy added 1,033 thousand jobs through June 2019, down from 1,411 thousand jobs during the first half of 2018. So job growth has slowed.

June Employment Report: 224,000 Jobs Added, 3.7% Unemployment Rate

by Calculated Risk on 7/05/2019 08:40:00 AM

From the BLS:

Total nonfarm payroll employment increased by 224,000 in June, and the unemployment rate was little changed at 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, in health care, and in transportation and warehousing.

...

The change in total nonfarm payroll employment for April was revised down from +224,000 to +216,000, and the change for May was revised down from +75,000 to +72,000. With these revisions, employment gains in April and May combined were 11,000 less than previously reported.

...

In June, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $27.90, following a 9-cent gain in May. Over the past 12 months, average hourly earnings have increased by 3.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 224 thousand in June (private payrolls increased 191 thousand).

Payrolls for April and May were revised down 11 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was 2.301 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was increased in June to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was increased in June to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 60.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was increased in June to 3.7%.

This was above the consensus expectations of 165,000 jobs added, however April and May were revised down by 11,000 combined.

I'll have much more later ...

Thursday, July 04, 2019

Friday: Employment Report

by Calculated Risk on 7/04/2019 10:58:00 PM

Happy 4th!

My June Employment Preview

Goldman: June Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for June. The consensus is for 165,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.