by Calculated Risk on 5/07/2019 01:48:00 PM

Tuesday, May 07, 2019

Seattle Real Estate in April: Sales unchanged YoY, Inventory up 124% YoY from Low Levels

The Northwest Multiple Listing Service reported Northwest MLS Housing Report for April Signals Good News for Home Buyers

Housing activity during April signaled good news for buyers in Western Washington as inventory continued to grow, the rate of price increases was slowing in many areas (and even decreasing in a few counties), and mortgage rates remained low.The press release is for the Northwest. In King County, sales were down 1% year-over-year, and active inventory was up 78% year-over-year.

Northwest Multiple Listing Service statistics for last month show a 28.5 percent overall increase in active listings compared to the same month a year ago, a 5.8 percent gain in pending sales, and a 2.4 percent rise in median prices for sales of single family homes and condos that closed during April. The volume of closings dipped slightly (down 1.9 percent).

emphasis added

In Seattle, sales were unchanged year-over-year, and inventory was up 124% year-over-year from very low levels. This is another market with inventory increasing sharply year-over-year, but months-of-supply in Seattle is still on the low side at 1.9 months.

BLS: Job Openings Increased to 7.5 Million in March

by Calculated Risk on 5/07/2019 10:08:00 AM

Notes: In March there were 7.488 million job openings, and, according to the March Employment report, there were 6.211 million unemployed. So, for the thirteen consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (over 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings rose to 7.5 million on the last business day of March, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.7 million and 5.4 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.1 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in March at 3.4 million. The quits rate was 2.3 percent. The quits level was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in March to 7.488 million from 7.142 million in February.

The number of job openings (yellow) are up 9% year-over-year.

Quits are up 3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was still a solid report.

CoreLogic: House Prices up 3.7% Year-over-year in March

by Calculated Risk on 5/07/2019 09:16:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports March Home Prices Increased by 3.7% Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.7% year over year from March 2018. On a month-over-month basis, prices increased by 1% in March 2019. (February 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Looking ahead, after some initial moderation in early 2019, the CoreLogic HPI Forecast indicates home prices will begin to pick up and increase by 4.8% on a year-over-year basis from March 2019 to March 2020. On a month-over-month basis, home prices are expected to decrease by 0.3% from March 2019 to April 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The U.S. housing market continues to cool, primarily due to some of our priciest markets moving into frigid waters,” said Dr. Ralph McLaughlin, deputy chief economist at CoreLogic. “But the broader market looks more temperate as supply and demand come into balance. With mortgage rates flat and inventory picking up, we expect more buyers to take advantage of easing housing market headwinds.”

emphasis added

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since 2012.

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since 2012.The year-over-year comparison has been positive for seven consecutive years since turning positive year-over-year in February 2012.

Monday, May 06, 2019

Tuesday: Job Openings

by Calculated Risk on 5/06/2019 07:27:00 PM

From Matthew Graham at Mortgage News Daily: Lowest Mortgage Rates in a Month

Mortgage rates dropped noticeably this morning as financial markets opened sharply changed from Friday's latest levels thanks to Trump trade tweets over the weekend. The stock market dropped to its lowest levels in several weeks before bouncing back as the day progressed. As money flew out of stocks, it found a safe haven in the bond market. Mortgage rates are most directly affected by the bond market, and when demand for bonds increases, rates fall.Tuesday:

The average lender was offering its best rates in roughly a month this morning. You'd have to go back to April 10th to see anything lower. [30YR FIXED - 4.25%]

emphasis added

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for March from the BLS.

• At 10:00 AM, Corelogic House Price index for February.

• At 3:00 PM, Consumer Credit from the Federal Reserve.

Update: Framing Lumber Prices Down 35% Year-over-year

by Calculated Risk on 5/06/2019 03:23:00 PM

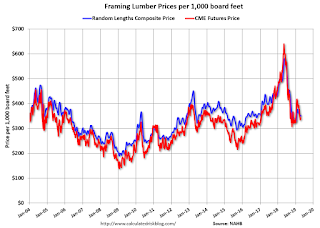

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down about 35% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through April 26, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 31% from a year ago, and CME futures are down 40% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

When will I make another "Big" economic call?

by Calculated Risk on 5/06/2019 12:11:00 PM

A short note: Over the years, I've made several significant economic calls. For example, I predicted a recession in 2007, a recovery in 2009 (link is first in a series of posts), the top for housing prices in early 2006 and the bottom for housing prices in early 2012. I do not have a crystal ball, and I've missed some calls - but by watching the data closely, I've been pretty lucky overall.

Sometimes people ask me when I'll make another call. I don't know; I'm very data dependent!

But I was wondering if these count? Back in December 2015, I wrote The Endless Parade of Recession Calls. I concluded:

Looking at the economic data, the odds of a recession in 2016 are very low (extremely unlikely in my view). Someday I'll make another recession call, but I'm not even on recession watch now.That was correct. And earlier this year I wrote an update to that post.

My view now: a recession in 2019 is very unlikely. I'm still not on recession watch!So far that looks correct too.

Someday I'll make another "Big" call, but I don't know when.

How to Report the Monthly Employment Number excluding Temporary Census Hiring

by Calculated Risk on 5/06/2019 10:29:00 AM

The Census Bureau will soon start hiring temporary workers for the 2020 Census. Temporary hiring will really increase in March, April and May of 2020, and then the jobs will finish in a few months. These are real jobs - frequently second jobs, or taken by seniors and students - but they will only last a few months.

Since these are temporary, and only happen every ten years with the decennial Census, it makes sense to adjust the headline monthly Current Employment Statistics (CES) by Census hiring to determine the underlying employment trend.

The correct adjustment method is to take the headline number and subtract the change in the number of Census 2020 temporary and intermittent workers. The BLS reports the number of Census temporary workers here: Census 2020 temporary and intermittent workers and Federal government employment

As an example, in May 2010, the Census hired 411 thousand temporary workers. The BLS reported (since revised)

"Total nonfarm payroll employment grew by 431,000 in May, reflecting the hiring of 411,000 temporary employees to work on Census 2010, the U.S. Bureau of Labor Statistics reported today."So the underlying trend was +20,000 jobs in May 2010 (as originally reported).

For June 2010, the number of temporary Census hires declined by 225,000. The BLS reported

"Total nonfarm payroll employment declined by 125,000 in June, and the unemployment rate edged down to 9.5 percent, the U.S. Bureau of Labor Statistics reported today. The decline in payroll employment reflected a decrease (-225,000) in the number of temporary employees working on Census 2010."So the underlying trend was +100,000.

Some readers will notice that this is mixing SA and NSA data! Usually that is not appropriate, but in this special case, based on the methods used by the BLS, this is correct.

I checked with the BLS, and they agree in this situation it is correct. Here is my question (back in March 2010) and the BLS response:

9:34 Michele Walker (BLS-CES) -So starting soon (as hiring ramps up), the correct way to report the headline number is ex-Census.

Submitted via email from Bill: Hi. The headline payroll number is seasonally adjusted, and the hiring for the 2010 Census is NSA. How would you suggest adjusting for the 2010 Census hiring to determine the underlying trend?

Thanks for your question Bill.

There is an adjustment made for the 2010 Census. Before seasonally adjusting the estimates, BLS makes a special modification so that the Census workers do not influence the calculation of the seasonal factors. Specifically, BLS subtracts the Census workers from the not-seasonally adjusted estimates before running seasonal adjustment using X-12. After the estimates have been seasonally adjusted, BLS adds the Census workers to the seasonally adjusted totals. Therefore, to determine the underlying trend of the total nonfarm (TNF) employment estimates (minus the Census workers), simply subtract the Census employment from the seasonally adjusted TNF estimate.

BTW, it is widely reported that there have been 103 consecutive months with positive job growth (a record). However, if you use the ex-Census numbers, it is 110 consecutive months! The job streak started during the decennial Census, but was masked by the temporary Census layoffs. As an example, the BLS reported a negative 64,000 jobs in September 2010, however the number of temporary Census workers declined by 76,000 that month, so ex-Census the number of jobs added in September 2010 was 12,000.

Black Knight Mortgage Monitor for March: National Delinquency Rate Nearing Record Low

by Calculated Risk on 5/06/2019 09:01:00 AM

Black Knight released their Mortgage Monitor report for March today. According to Black Knight, 3.65% of mortgages were delinquent in March, down from 3.73% in March 2018. Black Knight also reported that 0.51% of mortgages were in the foreclosure process, down from 0.63% a year ago.

This gives a total of 4.16% delinquent or in foreclosure.

Press Release: Black Knight: Servicers Retained Just 18% of Customers Post-Refinance in Q1 2019, a 13-Year Low; Slight Rate Increase Reduces Refinanceable Population by 1 Million

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, by leveraging its McDash loan-level mortgage performance data in combination with public property records, Black Knight undertook an analysis of mortgage servicer retention rates by looking at consecutive mortgages on a single property before and after a refinance transaction. As Black Knight’s Data & Analytics Division President Ben Graboske explained, retention rates – the share of borrowers who remain with their prior servicer post-refinance – have reached record lows, creating serious challenges in an ever more competitive marketplace.

“In Q1 2019, fewer than one in five homeowners remained with their prior mortgage servicer after refinancing their first lien,” said Graboske. “That is the lowest retention rate we’ve seen since Black Knight began tracking the metric in 2005. Anyone in this industry can tell you that customer retention is key – not only to success, but to survival. The challenge is that everyone is competing for a piece of a shrinking refinance market, the size of which is incredibly rate-sensitive, and therefore volatile in its make-up. Just a month ago, we were reporting that recent rate reductions had swelled the population of eligible refinance candidates by more than half in a single week after hitting a multi-year low just a few months before. Then, with just a slight increase in the 30-year fixed rate – less than one-eighth of a point – 1 million homeowners lost their rate incentive to refinance – almost 20% of the total eligible market.

“This is critical, because refinances driven by a homeowner seeking to reduce their rate or term have always been servicers’ ‘bread and butter’ when it comes to customer retention. Offering lower rates to qualified existing customers is a good, and relatively simple, way to retain their business. Unfortunately, the market has shifted dramatically away from such rate/term refinances. In fact, nearly 80% of 2018 refinances involved the customer pulling equity out of their home – and more than two-thirds of those raised their interest rate to do so. Retention battles are no longer won – or lost – based on interest rates alone. A simple ‘in the money analysis’ doesn’t provide the insight necessary to retain customers and can’t take the place of accurately identifying borrowers who are likely to refinance and offering them the correct product. Rather, understanding equity position – and the willingness to utilize that equity – is key to accurately identifying attrition risk and reaching out to retain that business.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the Q1 90 day National delinquency inventory over time.

From Black Knight:

• 90-day delinquencies are down 4% YTD in 2019 and have fallen below 500K for the first time since 2006The second graph shows foreclosure sales over time:

...

• With the national delinquency rate just 0.17% above the all-time low in March 2005, we may well be on pace to a new record low if external impacts on performance subside

• Foreclosure sales fell below 39K in Q1 2019 for the first time on record dating back to 2000There is much more in the mortgage monitor.

• Q1 2019's foreclosure sales represented roughly 14% of starting foreclosure inventory

• Declines in foreclosure sales have broadly kept pace with the overall decline in active foreclosure inventory nationwide

…

• Florida led all states with 3.5K foreclosure sales for the quarter followed by New York and New Jersey at 2.4K each

Sunday, May 05, 2019

Sunday Night Futures

by Calculated Risk on 5/05/2019 08:59:00 PM

Weekend:

• Schedule for Week of May 5, 2019

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 46 and DOW futures are down 469 (fair value).

Oil prices were down over the last week with WTI futures at $60.41 per barrel and Brent at $69.23 per barrel. A year ago, WTI was at $71, and Brent was at $75 - so oil prices are down 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.89 per gallon. A year ago prices were at $2.80 per gallon, so gasoline prices are up 9 cents per gallon year-over-year.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 5/05/2019 12:18:00 PM

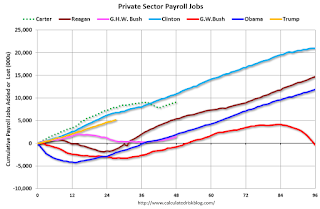

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (27 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 821,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 382,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,979,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,890,000 under President Obama (dark blue).

During the first 27 months of Mr. Trump's term, the economy has added 5,163,000 private sector jobs.

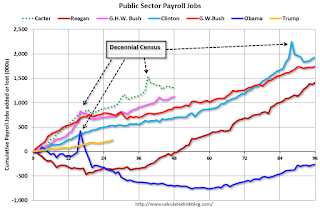

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 269,000 jobs).

During the first 27 months of Mr. Trump's term, the economy has added 237,000 public sector jobs.

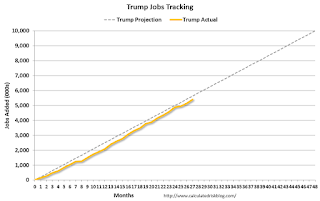

After 27 months of Mr. Trump's presidency, the economy has added 5,400,000 jobs, about 225,000 behind the projection.