by Calculated Risk on 2/08/2019 10:32:00 AM

Friday, February 08, 2019

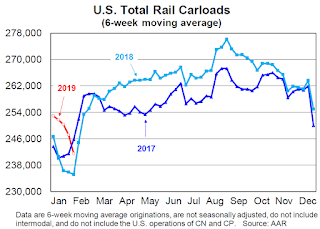

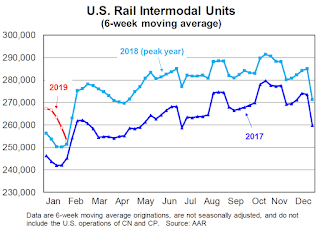

AAR: January Rail Carloads up 1.7% YoY, Intermodal Up 0.5% YoY

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Total U.S. rail carloads were up 1.7%, or 21,054 carloads, in January 2019 over January 2018, while U.S. intermodal volume was up 0.5%, or 6,008 containers and trailers. You can split the five weeks of January 2019 into two parts. In weeks 1-3, total carloads were up 8.1% over last year and intermodal was up 5.7%. In weeks 4-5, though, carloads were down 6.6% (including an 8.4% decline in week 5) and intermodal was down 6.5% (including a 9.6% decline in week 5). Clearly, harsh weather at the end of January hurt rail traffic.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Red is 2019.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads (excluding the U.S. operations of Canadian railroads) originated 1.238 million carloads in January 2019, up 1.7%, or 21,054 carloads, over January 2018. Weekly average total carloads in January 2019 were 247,697, the fewest for any month since January 2018.

In terms of rail carloads, January (which consists of weeks 1-5) had two parts. For weeks 1-3, total carloads were up 8.1% this year over last year. For weeks 4-5, though, they were down 6.6%. The extreme cold this year at the end of January in many parts of the country limited rail operations substantially, though it’s impossible to precisely calculate what carloads would have been if weather had been more normal.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):In addition to carloads, U.S. railroads originated 1.316 million containers and trailers in January 2019, up 0.5% over January 2018. Weekly average intermodal volume in January 2019 was 263,234 units, the most ever for January.Traffic in 2019 was off to a strong start, but then declined sharply due to the weather. AAR expects some "make-up volume" in February.

Like carloads, intermodal suffered from the weather. In the first three weeks of 2019, intermodal volume was up 5.7% over last year; weeks 2 and 3 this year were the highest-volume intermodal weeks in January in history for U.S. railroads. In weeks 4-5, though, intermodal was down 6.5% this year over last year, including a 9.6% decline in week 5, when weather was especially cold in much of the country. Again, it’s not possibly to precisely quantify the impact, but it’s reasonable to expect some make-up volume in February.

Seattle Real Estate in January: Sales Unchanged YoY, Inventory up 168% YoY from Low Levels

by Calculated Risk on 2/08/2019 10:16:00 AM

The Northwest Multiple Listing Service reported Homebuyers resuming search amid improving inventory, attractive terms

KIRKLAND, Washington (February 7, 2019) - Home buyers around Washington state are making their way back to the market, hoping to take advantage of improving inventory, attractive interest rates, and more approachable sellers, according to officials with Northwest Multiple Listing Service.The press release is for the Northwest. In King County, sales were down 3.7% year-over-year, and active inventory was up 144% year-over-year.

Northwest MLS statistics for January show year-over-year improvement in the volume of new listings and total inventory, along with moderating selling prices. Although fewer pending sales (mutually accepted offers) were reported than a year ago (down about 3.3 percent), January was the smallest year-over-year decline since May 2018 when the drop was about 2.7 percent.

Commenting on the MLS statistics summarizing last month's activity, broker Gary O'Leyar said January's post-holiday real estate activity doesn't normally pick up until later in the month, but this year the uptick began early. "January started as a bit of a surprise. Open house activity was very robust, and we saw multiple offers in numerous instances again," reported O'Leyar, the owner of Berkshire Hathaway HomeServices Signature Properties in Seattle.

MLS members added 7,090 new listings of single family homes and condos during January, up from the year-ago figure of 6,805 and nearly doubling December's total of 3,631. At month end there were 11,687 active listings in the database, up more than 45 percent from the year-ago total of 8,037. Listing inventory more than doubled in both King and Snohomish counties.

emphasis added

In Seattle, sales were unchanged year-over-year, and inventory was up 168% year-over-year from very low levels. This is another market with inventory increasing sharply year-over-year, but months-of-supply in Seattle is still on the low side at 2.4 months.

Thursday, February 07, 2019

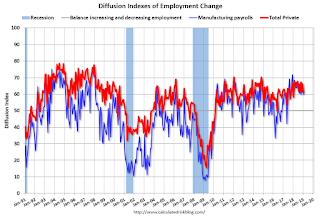

Employment: January Diffusion Indexes

by Calculated Risk on 2/07/2019 01:32:00 PM

I haven't posted this in a few months.

The BLS diffusion index for total private employment was at 61.0 in January, down from 66.3 in December.

For manufacturing, the diffusion index was at 59.9, down from 63.2 in December.

Note: Any reading above 60 is very good.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Overall both total private and manufacturing job growth was widespread again in January.

Overall both total private and manufacturing job growth was widespread again in January.

A few Tips on Business Cycle Forecasting

by Calculated Risk on 2/07/2019 09:46:00 AM

Because of my track record, I'm frequently asked about forecasting methods, my current views and what models I use. So here are a few tips.

First, why should someone care about the business cycle? If you are in a cyclical industry, forecasting is helpful with planning. Of course, if you forecast wrong - as people frequently do - then a company might hold back on investments and miss out on some opportunities. Another possible reason to forecast the business cycle is to improve investing performance. If someone could predict recessions and recoveries with reasonable accuracy, they could significantly improve their returns - but, once again, the track record for forecasters is pretty poor. Also forecasting is important for policymakers too (but most of us aren't policymakers).

I've successfully used forecasting as part of a cyclical business planning and also for my own investing. But it only helps if you are correct - so I don't recommend it for most investors - in general, for investing, it is better to just ride out the downturns then to try to time the business cycle. As an example, imagine if you had used ECRI forecasts for investing. You would have been late selling prior to the 2007 recession, and you would have missed a large percentage of the 2009 - 2019 bull market. Not a good result.

Second, many forecasters have an agenda, so be careful. For example, many newsletter writers and bloggers make frequent bearish forecasts. Perhaps they really believe their forecasts, or perhaps they are blinded by the incentives since being bearish garners publicity (and generates clicks and newsletter subscriptions).

Tip #1: Don't bother forecasting the business cycle (for most people). And don't rely on me - I could miss the next down turn (although I'll try to forecast the next recession).

If you are still reading, rely on history. Any reasonably intelligent person can almost always make a cogent argument that a recession is imminent. And yet, most of the time the economy is in expansion and stocks are in a bull market. This means forecasters have to fight through the tendency to be bearish. The economy and market don't care that you have a strong argument for a recession. Expansion is the norm.

Tip #2: Have a bias towards expansion.

Many forecasters start with the results of a model, and then based on the model, start warning that the sky is falling. A recent example was the focus on the yield curve inverting late last year.

This is backwards. My view is a forecaster should start with a story. For example, the Fed is overtightening, or the stock bubble burst will lead to less business investment, or the housing bust will lead to a collapse in the residential investment and a financial crisis. Those were some key stories prior to previous recessions.

Examples of possible stories now: If the Fed kept raising 25 bps a quarter (like last year), maybe rates would be too tight later this year or next year - and a recession might follow. But that doesn't seem to be the current course. Another possible story is the trade war might lead the economy into recession (but the negative impact doesn't seem large enough). Or perhaps the huge fiscal deficit - due to the new tax policy - will lead to much higher rates. Or there is too much corporate debt … and on and on.

This is why I track so many pieces of economic data - it helps me think about possible stories. And when data surprises, I try to take a closer look.

As I noted above, it is always possible to make an argument that a recession is coming, but it is usually wrong.

Tip #3: Start with a story (and try to see if the story makes sense - and the impact large enough to derail the expansion).

When a story makes sense, then it is time to start looking at some leading models. My favorite model uses residential investment as a leading indicator (not perfect, but pretty good). I also follow the yield curve (but it isn't currently as useful in a low interest rate environment).

When I'm on recession watch (due to a strong story and some modeling), then I start looking at some coincident indicators and models that are useful in timing a recession. For example, I start looking at unemployment claims, and some models based on the work of Hamilton, Chauvet, Piger and others.

Tip #4: Use models, but don't be a slave to the models.

Currently I'm not on recession watch. But I could be wrong!

Weekly Initial Unemployment Claims decreased to 234,000

by Calculated Risk on 2/07/2019 08:34:00 AM

The DOL reported:

In the week ending February 2, the advance figure for seasonally adjusted initial claims was 234,000, a decrease of 19,000 from the previous week's unrevised level of 253,000. The 4-week moving average was 224,750, an increase of 4,500 from the previous week's unrevised average of 220,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 224,750.

This was higher than the consensus forecast.

Wednesday, February 06, 2019

Thursday: Unemployment Claims

by Calculated Risk on 2/06/2019 08:58:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 253 thousand the previous week.

• At 3:00 PM, Consumer Credit from the Federal Reserve.

BEA: Q4 GDP to be Released Feb 28th, And Census Update

by Calculated Risk on 2/06/2019 02:58:00 PM

From the BEA: New Dates Set for GDP, Personal Income, and International Trade

Bureau of Economic Analysis data on U.S. gross domestic product, personal income and outlays, and international trade in goods and services that were delayed by the recent lapse in federal funding will be released in late February and early March.CR Note: It appears Q4 GDP will be in the mid-2s. Unfortunately it takes some time to catch up on the data releases.

A report called Initial Gross Domestic Product for the 4th Quarter and Annual 2018 will be released on Feb. 28 at 8:30 a.m. This “initial” report will take the place of two previously scheduled estimates of 4th quarter GDP – the advance estimate originally set for Jan. 30 and the second estimate that would normally be released Feb. 28.

The combined Feb. 28 report will contain one set of GDP numbers based on the data available from BEA’s data suppliers, including the U.S. Census Bureau, which also was affected by the funding lapse. This will include source data that would have gone into producing BEA’s advance estimate of 4th quarter and annual GDP for 2018, and some – but not all – of the source data that typically feed the second estimate.

A few updated release dates from Census:

Advance Monthly Retail Sales, December [originally scheduled for 01/16/19] 02/14/19

Advance Report on Durable Goods, December [originally scheduled for 01/25/19] 02/21/19

New Residential Construction, December [originally scheduled for 01/17/19] 02/26/19

Housing Vacancies and Home Ownership, 4th Quarter 2018 [originally scheduled for 01/29/19] 02/28/19

Construction Put in Place, December [originally scheduled for 02/01/19] 03/04/19

New Residential Sales, December [originally scheduled for 01/25/19] 03/05/19

Las Vegas Real Estate in January: Sales Down 18% YoY, Inventory up 106% YoY

by Calculated Risk on 2/06/2019 10:57:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices bounce back to $300,000; GLVAR housing statistics for January 2019

Local home prices bounced back to the $300,000 mark for the first time since September while fewer properties changed hands and more homes were on the market than one year ago. So says a report released Wednesday by the Greater Las Vegas Association of REALTORS® (GLVAR) covering activity in the local housing market through January.1) Overall sales were down 18% year-over-year from 2,812 in January 2018 to 2,305 in January 2019.

...

The total number of existing local homes, condos and townhomes sold during January was 2,305. Compared to one year ago, January sales were down 19.4 percent for homes and down 12.5 percent for condos and townhomes. GLVAR reported a total of 42,876 property sales in 2018, down from 45,388 in all of 2017, so Carpenter expects sales numbers may continue to slip this year.

...

With nearly a four-month supply of homes now available for sale, she said the number of local homes listed for sale without offers on them has been increasing for several months. However, she said that is still below what would normally be considered a balanced market. By the end of January, GLVAR reported 7,254 single-family homes listed for sale without any sort of offer. That’s up 95.1 percent from one year ago. For condos and townhomes, the 1,703 properties listed without offers in January represented a 168.6 percent jump from one year ago.

...

The number of so-called distressed sales also continues to drop each year. GLVAR reported that short sales and foreclosures combined accounted for just 2.8 percent of all existing local property sales in January. That’s down from 4.3 percent of all sales one year ago and 11 percent two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 4,352 in January 2018 to 8,957 in January 2019. Note: Total inventory was up 106% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Fewer distressed sales.

Trade Deficit decreased to $49.3 Billion in November

by Calculated Risk on 2/06/2019 08:47:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $49.3 billion in November, down $6.4 billion from $55.7 billion in October, revised.

November exports were $209.9 billion, $1.3 billion less than October exports. November imports were $259.2 billion, $7.7 billion less than October imports.

Click on graph for larger image.

Click on graph for larger image.Exports and imports decreased in December.

Exports are 27% above the pre-recession peak and up 4% compared to November 2017; imports are 12% above the pre-recession peak, and up 3% compared to November 2017.

In general, trade has been picking up, although trade has declined slightly recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $57.54 in November, down from $61.23 in October, and up from $50.10 in November 2017.

The trade deficit with China increased to $37.9 billion in November, from $35.4 billion in November 2017.

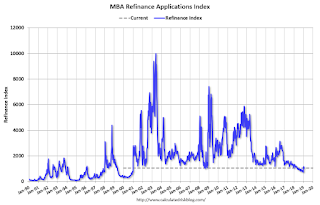

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/06/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 1, 2019. The previous week’s results included an adjustment for the Martin Luther King Jr. Day holiday.

... The Refinance Index increased 0.3 from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 2 percent lower than the same week one year ago.

...

“Mortgage rates for all loan types declined last week, with the 30-year fixed mortgage rate falling seven basis points to 4.69 percent – the lowest rate since April 2018,” said Joel Kan, Associate Vice President of Industry Surveys and Forecasts. “Despite more favorable borrowing costs, and after a three-week surge in activity, purchase applications have slowed over the past two weeks, and are now almost 2 percent lower than a year ago. However, moderating price gains and the strong job market, including evidence of faster wage growth, should help purchase growth going forward.”

Added Kan, “Refinance applications saw a very slight increase compared to the previous week, despite the broad decline in rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.69 percent from 4.76 percent, with points decreasing to 0.45 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Rates would have to fall further for a significant increase in refinance activity.

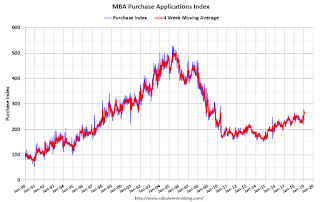

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 2% year-over-year.