by Calculated Risk on 2/01/2019 12:04:00 PM

Friday, February 01, 2019

Comments on January Employment Report

The headline jobs number at 304 thousand for January was well above consensus expectations of 158 thousand, however the previous two months were revised down 70 thousand, combined. The unemployment rate increased to 4.0%, due to government employees on furlough being counted as unemployed in the household survey (but jobs counted in the establishment survey). Overall this was a strong report.

Earlier: January Employment Report: 304,000 Jobs Added, 4.0% Unemployment Rate

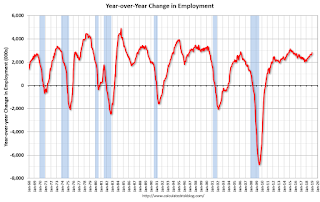

In January, the year-over-year employment change was 2.807 million jobs. That is solid year-over-year growth.

Average Hourly Earnings

Wage growth was at expectations in January. From the BLS:

"In January, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $27.56, following a 10-cent gain in December. Over the year, average hourly earnings have increased by 85 cents, or 3.2 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.2% YoY in January.

Wage growth has generally been trending up.

Prime (25 to 54 Years Old) Participation

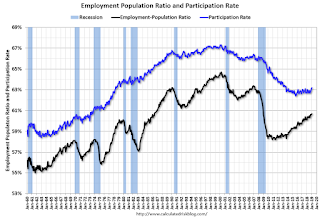

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in December to 82.6%, and the 25 to 54 employment population ratio was unchanged at 79.9%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by about one-half million to 5.1 million in January. Nearly all of this increase occurred in the private sector and may reflect the impact of the partial federal government shutdown."The number of persons working part time for economic reasons has been generally trending down. The number increased sharply in January, probably as a result of the government shutdown. The number working part time for economic reasons suggests there is still a little slack in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that increased sharply to 8.1% in January.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.252 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.306 million in January.

Summary:

The headline jobs number was well above expectations, however the previous two months were revised down. The headline unemployment rate increased to 4.0% due to the government shutdown.

Some of the quirky aspects of the employment report were due to the government shutdown (rise in the unemployment rate, sharp rise in "Part Time for Economic Reasons" workers, and the sharp rise in U-6.) My guess is most of the rise in Part Time was related to private sector workers getting fewer hours due to the shutdown, however some of the increase might be related to government workers taking part time jobs to pay the bills (as a reminder, the establishment report is for jobs - and government employees on furlough taking part time jobs would be counted as having two jobs).

Overall, this was a strong report.

Construction Spending increased in November

by Calculated Risk on 2/01/2019 11:25:00 AM

Note: This is for November. The release of the December report has not been scheduled yet.

From the Census Bureau reported that overall construction spending increased in November:

Construction spending during November 2018 was estimated at a seasonally adjusted annual rate of $1,299.9 billion, 0.8 percent above the revised October estimate of $1,289.7 billion. The November figure is 3.4 percent above the November 2017 estimate of $1,257.3 billion.Private spending increased and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $993.4 billion, 1.3 percent above the revised October estimate of $980.4 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $306.5 billion, 0.9 percent below the revised October estimate of $309.3 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although has declined recently - and is still 20% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 6% below the peak in March 2009, and 17% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 1%. Non-residential spending is up 4% year-over-year. Public spending is up 7% year-over-year.

This was above consensus expectations, however spending for September and October were revised down.

ISM Manufacturing index Increased to 56.6 in January

by Calculated Risk on 2/01/2019 10:13:00 AM

The ISM manufacturing index indicated expansion in December. The PMI was at 56.6% in January, up from 54.3% in December. The employment index was at 55.5%, down from 56.0% last month, and the new orders index was at 58.2%, up from 51.3%.

From the Institute for Supply Management: January 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in January, and the overall economy grew for the 117th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The January PMI® registered 56.6 percent, an increase of 2.3 percentage points from the December reading of 54.3 percent. The New Orders Index registered 58.2 percent, an increase of 6.9 percentage points from the December reading of 51.3 percent. The Production Index registered 60.5 percent, 6.4-percentage point increase compared to the December reading of 54.1 percent. The Employment Index registered 55.5 percent, a decrease of 0.5 percentage point from the December reading of 56 percent. The Supplier Deliveries Index registered 56.2 percent, a 2.8 percentage point decrease from the December reading of 59 percent. The Inventories Index registered 52.8 percent, an increase of 1.6 percentage points from the December reading of 51.2 percent. The Prices Index registered 49.6 percent, a 5.3-percentage point decrease from the December reading of 54.9 percent, indicating lower raw materials prices for the first time in nearly three years.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 54.0%, and suggests manufacturing expanded at a faster pace in January than in December.

January Employment Report: 304,000 Jobs Added, 4.0% Unemployment Rate (Graphs added)

by Calculated Risk on 2/01/2019 09:21:00 AM

From the BLS:

Total nonfarm payroll employment increased by 304,000 in January, and the unemployment rate edged up to 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in several industries, including leisure and hospitality, construction, health care, and transportation and warehousing.

...

Both the unemployment rate, at 4.0 percent, and the number of unemployed persons, at 6.5 million, edged up in January. The impact of the partial federal government shutdown contributed to the uptick in these measures. Among the unemployed, the number who reported being on temporary layoff increased by 175,000. This figure includes furloughed federal employees who were classified as unemployed on temporary layoff under the definitions used in the household survey.

...

The change in total nonfarm payroll employment for November was revised up from +176,000 to +196,000, and the change for December was revised down from +312,000 to +222,000. With these revisions, employment gains in November and December combined were 70,000 less than previously reported.

...

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $27.56, following a 10-cent gain in December. Over the year, average hourly earnings have increased by 85 cents, or 3.2 percent.

…

[Annual Revision] In accordance with annual practice, the establishment survey data released today have been benchmarked to reflect comprehensive counts of payroll jobs for March 2018. These counts are derived principally from the Quarterly Census of Employment and Wages (QCEW), which counts jobs covered by the Unemployment Insurance (UI) tax system. ... The total nonfarm employment level for March 2018 was revised downward by 1,000 (-16,000 on a not seasonally adjusted basis, or less than -0.05 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 304 thousand in January (private payrolls increased 296 thousand).

Payrolls for November and December were revised down 70 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In January the year-over-year change was 2.807 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in January to 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate increased in January to 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was increased to 60.7% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in January to 4.0%.

This was well above the consensus expectations of 158,000 jobs added, however November and December were down by 70,000 combined. A strong report.

I'll have much more later ...

January Employment Report: 304,000 Jobs Added, 4.0% Unemployment Rate

by Calculated Risk on 2/01/2019 08:34:00 AM

From the BLS:

Total nonfarm payroll employment increased by 304,000 in January, and the unemployment rate edged up to 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in several industries, including leisure and hospitality, construction, health care, and transportation and warehousing.I'll have much more later ...

...

Both the unemployment rate, at 4.0 percent, and the number of unemployed persons, at 6.5 million, edged up in January. The impact of the partial federal government shutdown contributed to the uptick in these measures. Among the unemployed, the number who reported being on temporary layoff increased by 175,000. This figure includes furloughed federal employees who were classified as unemployed on temporary layoff under the definitions used in the household survey.

...

The change in total nonfarm payroll employment for November was revised up from +176,000 to +196,000, and the change for December was revised down from +312,000 to +222,000. With these revisions, employment gains in November and December combined were 70,000 less than previously reported.

...

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $27.56, following a 10-cent gain in December. Over the year, average hourly earnings have increased by 85 cents, or 3.2 percent.

emphasis added

Thursday, January 31, 2019

Friday: Employment Report, ISM Manufacturing, Construction Spending, Auto Sales

by Calculated Risk on 1/31/2019 09:17:00 PM

My January Employment Preview

Goldman: January Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for January. The consensus is for 158,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to be at 54.0, down from 54.1 in December.

• At 10:00 AM, Construction Spending for November. The consensus is for a 0.2% increase in construction spending (The December release hasn't been scheduled).

• All day, Light vehicle sales for January. The consensus is for light vehicle sales to be 17.2 million SAAR in January, unchanged from 17.2 million in December (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency Rate unchanged in December

by Calculated Risk on 1/31/2019 04:11:00 PM

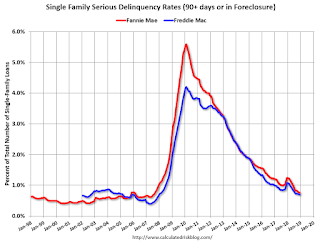

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 0.76% in December, from 0.76% in November. The serious delinquency rate is down from 1.24% in December 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This matches last month ass the lowest serious delinquency rate for Fannie Mae since August 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.69% are seriously delinquent. For loans made in 2005 through 2008 (5% of portfolio), 4.61% are seriously delinquent, For recent loans, originated in 2009 through 2018 (92% of portfolio), only 0.34% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Goldman: January Payrolls Preview

by Calculated Risk on 1/31/2019 04:06:00 PM

A few brief excerpts from a note by Goldman Sachs economists Choi and Hill:

We estimate nonfarm payrolls increased 180k in January, somewhat above consensus of +165k. … while weather likely contributed to last month’s blockbuster report, January was also relatively warm and dry during the reference week. The BLS has also clarified that furloughed and unpaid government workers will be included in tomorrow’s payroll counts (though contractor layoffs could weigh in some industries).

We estimate the unemployment rate increased one tenth to 4.0% in January (vs. consensus of 3.9%), mostly reflecting the furlough of nearly 400k federal workers that the BLS plans to classify as “unemployed on temporary layoff.” ... Finally, we expect average hourly earnings will increase 0.2% month-over-month and 3.1% year-over-year in tomorrow’s report...

emphasis added

January Employment Preview

by Calculated Risk on 1/31/2019 02:50:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for an increase of 158,000 non-farm payroll jobs in January (with a range of estimates between 140,000 to 183,000), and for the unemployment rate to be unchanged at 3.9%.

Last month, the BLS reported 312,000 jobs added in December.

Note on the government shutdown: the Federal jobs will all be counted in the establishment report (headline jobs number), since the employees will be receiving back pay. However, the furloughed employees will be counted as unemployed (on temporary layoff), so the unemployment rate will probably increase.

Note on Revisions: With the January release, the BLS will introduce revisions to nonfarm payroll employment to reflect the annual benchmark adjustment. The preliminary annual benchmark revision showed an upward adjustment of 43,000 jobs, and the preliminary estimate is usually pretty close.

Here is a summary of recent data:

• The ADP employment report showed an increase of 213,000 private sector payroll jobs in December. This was well above consensus expectations of 167,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing and ISM non-manufacturing employment indexes have not yet been released..

• Initial weekly unemployment claims averaged 220,000 in January, up slightly from 219,000 in December. For the BLS reference week (includes the 12th of the month), initial claims were at 212,000, down from 217,000 during the reference week the previous month.

In general, the unemployment claims suggest a solid employment report.

• The final January University of Michigan consumer sentiment index decreased to 90.7 from the December reading of 98.3. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics. The decline in January is probably related to the government shutdown.

• Looking back at the three previous years:

In January 2017, the consensus was for 175,000 jobs, ADP reported 234,000 private sector jobs added, and the BLS reported 200,000 jobs added.

In January 2016, the consensus was for 175,000 jobs, ADP reported 246,000 private sector jobs added, and the BLS reported 227,000 jobs added.

In January 2015, the consensus was for 188,000 jobs, ADP reported 205,000 private sector jobs added, and the BLS reported 151,000 jobs added.

It appears the ADP report is usually too high for January.

• Conclusion: In general these reports suggest a solid employment report, although I expect the unemployment rate to increase due to the government shutdown. My guess is the report will be at or below the consensus, due to good weather in December (some payback in January), and possibly some private sector impact from the government shutdown.

A few Comments on November New Home Sales

by Calculated Risk on 1/31/2019 11:45:00 AM

First, this report was for November (it was almost ready to release when the government shutdown began in December). The December report will probably be released soon, but no release date has been announced yet. Based on other data, I'd expect sales to be weak in December, but talking to builders, I expect a rebound in January.

New home sales for November were reported at 657,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the three previous months were revised up.

Sales in November were down 7.2% year-over-year compared to November 2017.

On Inventory: Months of inventory is now at the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch very closely.

Earlier: New Home Sales increased to 657,000 Annual Rate in November.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are only up 2.7% through November compared to the same period in 2017.

The comparison for November was difficult (sales in November 2017 were very strong). And the comparison in December will also be somewhat difficult. Overall sales might finish the year down from 2017, but it should be close.

This is below my forecast for 2018 for an increase of about 6% over 2017. As I noted early this year, there were downside risks to that forecast, primarily higher mortgage rates, but also higher costs (labor and material), the impact of the new tax law, and other possible policy errors.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I still expect this gap to slowly close. However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.