by Calculated Risk on 1/04/2019 08:43:00 AM

Friday, January 04, 2019

December Employment Report: 312,000 Jobs Added, 3.9% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 312,000 in December, and the unemployment rate rose to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, food services and drinking places, construction, manufacturing, and retail trade.

...

The change in total nonfarm payroll employment for November was revised up from +155,000 to +176,000, and the change for October was revised up from +237,000 to +274,000. With these revisions, employment gains in October and November combined were 58,000 more than previously reported.

...

In December, average hourly earnings for all employees on private nonfarm payrolls rose 11 cents to $27.48. Over the year, average hourly earnings have increased by 84 cents, or 3.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 312 thousand in December (private payrolls increased 301 thousand).

Payrolls for October and November were revised up 58 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December the year-over-year change was 2.638 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in December to 63.1%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate increased in December to 63.1%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 60.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

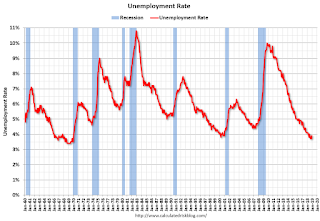

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in December to 3.9%.

This was well above the consensus expectations of 180,000 jobs added, and October and November were revised up 58,000, combined. A strong report.

I'll have much more later ...

Thursday, January 03, 2019

Friday: Employment Report

by Calculated Risk on 1/03/2019 08:02:00 PM

My December Employment Preview

Goldman: December Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for December. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

• Early, Reis Q4 2018 Mall Survey of rents and vacancy rates.

• At 10:15 AM to 12:15 PM, Federal Reserve chairs: Joint Interview, Neil Irwin of the NY Times will interview Fed Chair Jay Powell, and former Fed Chairs Ben Bernanke and Janet Yellen.

Goldman: December Payrolls Preview

by Calculated Risk on 1/03/2019 03:55:00 PM

A few brief excerpts from a note by Goldman Sachs economists Choi and Hill:

We estimate nonfarm payrolls increased 195k in December, somewhat above consensus of +180k. Our forecast reflects a modest slowdown in the trend of job growth, and a weather-related boost worth 25k or more. …

We expect the unemployment rate to remain at 3.7% ... We estimate average hourly earnings increased 0.3% month-over-month and 3.0% year-over-year...

emphasis added

December Employment Preview

by Calculated Risk on 1/03/2019 01:45:00 PM

Note: The Employment report will be released as scheduled, and not postponed by the government shutdown.

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for an increase of 180,000 non-farm payroll jobs in December (with a range of estimates between 160,000 to 200,000), and for the unemployment rate to be unchanged at 3.7%.

Last month, the BLS reported 155,000 jobs added in November.

Here is a summary of recent data:

• The ADP employment report showed an increase of 271,000 private sector payroll jobs in December. This was well above consensus expectations of 175,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in December to 56.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 15,000 in December. The ADP report indicated manufacturing jobs increased 12,000 in December.

The ISM non-manufacturing employment index will be released next week.

• Initial weekly unemployment claims averaged 219,000 in December, down from 228,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 217,000, down from 225,000 during the reference week the previous month.

The increase during the reference week suggests a stronger employment report in December than in November.

• The final November University of Michigan consumer sentiment index increased to 98.3 from the November reading of 97.5. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Looking back at the three previous years:

In December 2017, the consensus was for 190,000 jobs, ADP reported 250,000 private sector jobs added, and the BLS reported 148,000 jobs added.

In December 2016, the consensus was for 175,000 jobs, ADP reported 153,000 private sector jobs added, and the BLS reported 156,000 jobs added.

In December 2015, the consensus was for 200,000 jobs, ADP reported 257,000 private sector jobs added, and the BLS reported 292,000 jobs added.

It appears the consensus is frequently a little high for December.

• Conclusion: In general these reports suggest a solid employment report.

Reis: Office Vacancy Rate unchanged in Q4 at 16.7%

by Calculated Risk on 1/03/2019 12:46:00 PM

Reis reported that the office vacancy rate was at 16.7% in Q4, unchanged from 16.7% in Q3 2018. This is up from 16.4% in Q4 2017, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

The office vacancy rate was flat in the quarter at 16.7%. At year-end 2017 it was 16.4%, while at year-end 2016 it was 16.3%.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.7% in the fourth quarter. At $33.43 per square foot (asking) and $27.13 per square foot (effective), the average rents have increased 2.6% and 2.7%, respectively, from the fourth quarter of 2017, barely above the rate of inflation: 2.5%.

Following three quarters of decelerating occupancy growth, net absorption rose to 7.3 million square feet. The fourth quarter tends to see the highest activity in both office completions and leasing; one year ago, net absorption was 7.6 million square feet, higher than the previous quarters of that year. For construction, office inventory expanded by 10.4 million square feet in the fourth quarter, above the previous quarter’s 8.9 million square feet but below the three prior quarters’ average of 11.9 million square feet.

...

Completions will be higher in 2019 – close to 50 million square feet including 6.7 million square feet in Hudson Yards alone – while office employment is expected to decelerate. This should push vacancy rates up a bit, but rent growth should remain positive and in line with recent growth rates.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.7% in Q4. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased slightly recently.

Office vacancy data courtesy of Reis.

ISM Manufacturing index Decreased Sharply to 54.1 in December

by Calculated Risk on 1/03/2019 10:05:00 AM

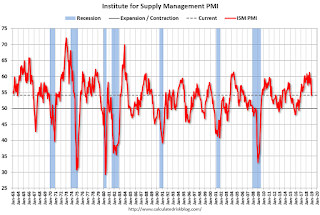

The ISM manufacturing index indicated expansion in December. The PMI was at 54.1% in December, down from 59.3% in November. The employment index was at 56.2%, down from 58.4% last month, and the new orders index was at 51.1%, down from 62.1%.

From the Institute for Supply Management: December 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in December, and the overall economy grew for the 116th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business® .

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The December PMI® registered 54.1 percent, a decrease of 5.2 percentage points from the November reading of 59.3 percent. The New Orders Index registered 51.1 percent, a decrease of 11 percentage points from the November reading of 62.1 percent. The Production Index registered 54.3 percent, 6.3-percentage point decrease compared to the November reading of 60.6 percent. The Employment Index registered 56.2 percent, a decrease of 2.2 percentage points from the November reading of 58.4 percent. The Supplier Deliveries Index registered 57.5 percent, a 5-percentage point decrease from the November reading of 62.5 percent. The Inventories Index registered 51.2 percent, a decrease of 1.7 percentage points from the November reading of 52.9 percent. The Prices Index registered 54.9 percent, a 5.8-percentage point decrease from the November reading of 60.7 percent, indicating higher raw materials prices for the 34th consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 58.0%, and suggests manufacturing expanded at a slower pace in December than in November.

Weekly Initial Unemployment Claims increased to 231,000

by Calculated Risk on 1/03/2019 08:33:00 AM

The DOL reported:

In the week ending December 29, the advance figure for seasonally adjusted initial claims was 231,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 216,000 to 221,000. The 4-week moving average was 218,750, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 1,250 from 218,000 to 219,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,750.

This was above the consensus forecast. Probably most of the increase in claims is related to the government shutdown.

ADP: Private Employment increased 271,000 in December

by Calculated Risk on 1/03/2019 08:19:00 AM

Private sector employment increased by 271,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 175,000 private sector jobs added in the ADP report.

...

“We wrapped up 2018 with another month of significant growth in the labor market,“ said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Although there were increases in most sectors, the busy holiday season greatly impacted both trade and leisure and hospitality. Small businesses also experienced their strongest month of job growth all year.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses continue to add aggressively to their payrolls despite the stock market slump and the trade war. Favorable December weather also helped lift the job market. At the current pace of job growth, low unemployment will get even lower.”

The BLS report for December will be released Friday, and the consensus is for 180,000 non-farm payroll jobs added in November.

MBA: "Mortgage Applications Decrease Over Two Week Period in Latest MBA Weekly Survey"

by Calculated Risk on 1/03/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 9.8 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 28, 2018. The results include adjustments to account for the Christmas holiday.

... The Refinance Index decreased 12 percent from two weeks ago. The seasonally adjusted Purchase Index decreased 8 percent from two weeks earlier. The unadjusted Purchase Index decreased 46 percent compared with two weeks ago and was 6 percent lower than the same week one year ago.

...

“Mortgage applications fell over the past two weeks – even as the 30-year fixed-rate mortgage decreased to 4.84 percent, its lowest since September 2018. Investors continued to show a preference for safer U.S. Treasuries, as concerns over U.S. and global economic growth, along with uncertainty over the current government shutdown, drove rates lower,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Even with lower borrowing costs, both purchase and refinance applications decreased over the two-week holiday period, as both conventional and government applications dropped. Part of the decline in mortgage applications was possibly because of the government shutdown, as concerns over delays in FHA application processing times likely contributed to the weakness in activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.84 percent from 4.86 percent, with points decreasing to 0.42 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is down 6% year-over-year.

Wednesday, January 02, 2019

Thursday: ADP Employment, Unemployment Claims, ISM Mfg Survey, Auto Sales, and More

by Calculated Risk on 1/02/2019 08:45:00 PM

Thursday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in December, down from 179,000 added in November.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, down from 216 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 59.3 in November. The PMI was at 59.3% in November, the employment index was at 58.4%, and the new orders index was at 62.1%.

• At 10:00 AM, POSTPONED Construction Spending for November. The consensus is for a 0.3% increase in construction spending.

• All day, Light vehicle sales for December. The consensus is for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).

• Early, Reis Q4 2018 Office Survey of rents and vacancy rates.