by Calculated Risk on 9/04/2018 08:00:00 AM

Tuesday, September 04, 2018

CoreLogic: House Prices up 6.2% Year-over-year in July

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: oreLogic Reports July Home Prices Increased by 6.2 Percent, Homeowners Waiting to Sell for Anticipated Increase Return on Investment

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for July 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 6.2 percent year over year from July 2017 to July 2018. On a month-over-month basis, prices increased by 0.3 percent in July 2018 compared with June 2018. (June 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)CR Note: The CoreLogic YoY increase has been in the 5% to 7% range for the last few years. This is near the middle of that range. The year-over-year comparison has been positive for over six consecutive years since turning positive year-over-year in February 2012.

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to continue to increase by 5.1 percent on a year-over-year basis from July 2018 to July 2019. On a month-over-month basis, homeprices are expected to decrease by 0.2 percent from July to August 2018. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“With increased interest rates and home prices, the CoreLogic Home Price Index is rising at a slower rate than it was a year ago,” said Dr. Frank Nothaft, chief economist for CoreLogic. “While markets in the western part of the country continue to experience rapid home-price growth, many of those metros are overvalued, and will likely experience a slowdown soon.”

emphasis added

Monday, September 03, 2018

Tuesday: ISM Mfg, Construction Spending, Auto Sales

by Calculated Risk on 9/03/2018 08:42:00 PM

Weekend:

• Schedule for Week of September 2, 2018

Tuesday:

• At 8:00 AM: Corelogic House Price index for July.

• At 10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 57.6, down from 58.1 in July. The PMI was at 58.1% in July, the employment index was at 56.5%, and the new orders index was at 60.2%.

• At 10:00 AM: Construction Spending for July. The consensus is for a 0.4% increase in construction spending.

• All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.7 million in July (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3 and DOW futures are up 10 (fair value).

Oil prices were up over the last week with WTI futures at $70.01 per barrel and Brent at $78.07 per barrel. A year ago, WTI was at $48, and Brent was at $53 - so oil prices are up 40% to 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.64 per gallon (jumped last year due to hurricane Harvey) - so gasoline prices are up 19 cents per gallon year-over-year.

Sunday, September 02, 2018

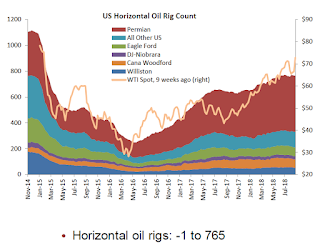

Oil Rigs: Increase Slightly

by Calculated Risk on 9/02/2018 07:48:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on August 31, 2018:"That's all, folks!"

• This week marks a psychological turning point in the oil cycle

• Total oil rigs rose, +2 to 862

• But horizontal oil rigs declined, -1 to 765

...

• Horizontal oil rigs have gone exactly nowhere in the last 11 weeks at WTI averaging above $68 / barrel.

• Under $68 WTI, the horizontal oil rig count is unlikely to rise further (although oil production will continue to increase at current rig numbers).

• Investors are beginning to appreciate that reviving rig count growth will involve moving to the next level of oil prices, and the back end of the futures curve is swinging up accordingly.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

August 2018: Unofficial Problem Bank list declines to 82 Institutions

by Calculated Risk on 9/02/2018 08:19:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for August 2018. During the month, the list had a decline of seven insured institutions to 82 banks. Aggregate assets were little changed staying at a rounded $57.3 billion after a deduction of $1.3 billion for the removals and an addition of $1.3 billion for asset growth during the second quarter. A year ago, the list held 123 institutions with assets of $28.3 billion.

Actions were terminated against Urban Partnership Bank, Chicago, IL ($442 million); Old Dominion National Bank, North Garden, VA ($222 million); and Providence Bank, Alpharetta, GA ($85 million). Finding their way off the list through merger were One Bank & Trust, National Association, Little Rock, AR ($266 million); Hometown Bank, National Association, Carthage, MO ($182 million); Liberty FSB, Enid, OK ($75 million); and High Desert Bank, Bend, OR ($20 million).

On August 23rd, the FDIC released industry results for the second quarter of 2018 and disclosed that the Official Problem Bank List held 82 banks with assets of $54.4 billion.

Saturday, September 01, 2018

Schedule for Week of September 2, 2018

by Calculated Risk on 9/01/2018 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the August ISM manufacturing and non-manufacturing indexes, August auto sales, and the July trade deficit.

All US markets will be closed in observance of the Labor Day holiday.

8:00 AM: Corelogic House Price index for July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 57.6, down from 58.1 in July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 57.6, down from 58.1 in July.Here is a long term graph of the ISM manufacturing index.

The PMI was at 58.1% in July, the employment index was at 56.5%, and the new orders index was at 60.2%.

10:00 AM: Construction Spending for July. The consensus is for a 0.4% increase in construction spending.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.7 million in July (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.7 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $50.2 billion in July from $46.3 billion in June.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 182,000 payroll jobs added in August, down from 219,000 added in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, unchanged from 213 thousand the previous week.

10:00 AM: the ISM non-Manufacturing Index for August. The consensus is for index to increase to 56.8 from 55.7 in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 198,000 non-farm payroll jobs in August, up from the 157,000 non-farm payroll jobs added in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 198,000 non-farm payroll jobs in August, up from the 157,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to decline to 3.8%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In July the year-over-year change was 2.400 million jobs.

A key will be the change in wages.

Friday, August 31, 2018

Fannie Mae: Mortgage Serious Delinquency rate decreased in July, Lowest since Oct 2007

by Calculated Risk on 8/31/2018 04:56:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 0.88% in July, down from 0.97% in June. The serious delinquency rate is down from 1.00% in July 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency for Fannie Mae since October 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.80% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 5.01% are seriously delinquent, For recent loans, originated in 2009 through 2018 (91% of portfolio), only 0.37% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q3 GDP Forecasts

by Calculated Risk on 8/31/2018 02:47:00 PM

From Goldman Sachs:

We boosted our tracking estimate of Q3 GDP growth by one tenth to +3.0% (qoq ar). [Aug 30 estimate].From Merrill Lynch:

emphasis added

Weak trade data sliced 0.2pp from 3Q GDP tracking, leaving our estimate at 3.3% qoq saar. [Aug 31 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.1 percent on August 30, down from 4.6 percent on August 24. [Aug 30 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q3 stands at 2.0%. [Aug 31 estimate]CR Note: The range has narrowed, but it is still early. It looks like GDP will be in the 3s in Q3.

Labor Slack and the Participation Rate (Spreadsheet included)

by Calculated Risk on 8/31/2018 12:16:00 PM

Back in June, Politico obtained some responses to questions from Senators by recently confirmed Richard Clarida:

Clarida, who has been nominated for Fed vice chairman, indicated that he believes there’s more slack in the labor market. He noted that the labor force participation rate for prime-age workers, particularly men, has not gone back to pre-recession levels. “I also think this group could represent an additional margin of slack in the sense that some of them could be enticed to reenter the labor force as the demand for labor continues to strengthen,” he said.This is an interesting question.

The decline in the overall Labor Force Participation Rate (LFPR) following the great recession can be divided into three parts: 1) economic weakness, 2) age related demographics, and 3) ongoing trends such as young people staying in school longer, more people working longer, more people taking time off mid-career to travel, and many other reasons.

What we'd like to know - as Clarida noted - is how much of the decline in the LFPR has been due to economic weakness. This would give an idea of how much slack is remaining in the labor market.

Removing the age related demographic changes is straightforward, but accounting for the ongoing trends is much more difficult (but important as the following graphs will show).

The first graph shows the overall participation rate (all civilians 16+ years old) and the employment population ratio.

Click on graph for larger image.

Click on graph for larger image.The Labor Force Participation Rate (Blue) was unchanged in July at 62.9%. This is the percentage of the 16+ year old population in the labor force.

The overall LFPR has declined significantly since the recession, and has been mostly moving sideways recently.

The second graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - just based on changes in age groups.

Important Note on Data: All BLS Population data is based on Census 2014 National Population Projections Tables. These projections probably overstate the current population, especially in the prime working age groups. This analysis did not include corrections to these projections (that Census will address soon).

To adjust by age groups, the participation rate for each age and sex group was held to the 2007 levels (all data NSA). The decline in the participation rate is due to age related demographics. As large groups move from high participation ages to lower participation ages, the overall participation rate declines.

To adjust by age groups, the participation rate for each age and sex group was held to the 2007 levels (all data NSA). The decline in the participation rate is due to age related demographics. As large groups move from high participation ages to lower participation ages, the overall participation rate declines.Some analysts just looked at age related demographics to estimate the remaining slack in the labor force participation rate. However, as I've noted many times, there are long term trends that are important too.

The third graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - based on both changes in age AND long term trends. Note: Trends are hard, but most of the trend projections were close (some were not).

The third graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - based on both changes in age AND long term trends. Note: Trends are hard, but most of the trend projections were close (some were not).Using this graph, a couple of years ago when others were arguing that "most of the decline in the labor force participation rate" was due to economic weakness, I argued that most (approximately two-thirds) was related to a combination of demographics and long term trends.

The difference between using just age related demographics, and a combination of Age and Trend, is especially important for prime age workers.

The fourth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.

The fourth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.Using just age adjusted demographics, it appears there is significant labor slack remaining and someone using this graph would expect the prime LFPR to increase to from the current 82.1% to around 83% over the next few years.

However, if we look at the long trends, we wouldn't expect the prime LFPR to increase significantly.

The fifth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.

The fifth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.My estimates of the trends could be off (most groups seem close, although estimates from some groups were way off - like 55 to 59 year old women).

But this analysis suggests the Prime LFPR is close to the expected level and might only increase a few tenths of a percent from here.

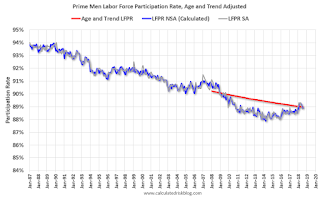

And finally, here is a look at Prime Age Men as Richard Clarida suggested.

The sixth graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.

The sixth graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.Using just age adjusted demographics, we'd expect the LFPR for prime age men to be increasing slightly. This is because of the older prime workers leaving the labor force and being replaced by younger workers. This suggests significant slack in the labor market for prime age men (as Clarida suggested).

However, if we account for long term trends, there might be little slack remaining for prime age men.

The seventh graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.

The seventh graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.Looking at this graph (and my trend estimates could be off) there is little slack for prime age men.

Of course long term trends can change. For example, the LFPR for women was increasing for decades, and peaked in the year 2000 at just over 60%, but has declined since then. If we used the period from 1950 to 2000 to predict the LFPR for women today, we would expect something close to 70%. However the LFPR for women in July was only 57.3%.

With the caveat that trends may change and are difficult to forecast, I'd conclude: 1) that long term trends are important for forecasting the LFPR, and 2) there is little slack remaining in the labor market.

Here is my spreadsheet. Please feel free to put in your own estimate of the long term trends.

Hotels: Occupancy Rate Unchanged Year-over-Year

by Calculated Risk on 8/31/2018 08:46:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 25 August

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 19-25 August 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 20-26 August 2017, the industry recorded the following:

• Occupancy: flat at 69.5%

• Average daily rate (ADR): +1.8% to US$127.55

• Revenue per available room (RevPAR): +1.8% to US$88.69

...

STR analysts note that percentage changes in several markets were negatively affected by a comparison with the week of the Great American Eclipse in 2017. emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is close to the record year in 2017. Note: 2017 finished strong due to the impact of the hurricanes.

On a seasonal basis, the 4-week average of the occupancy rate will decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, August 30, 2018

Friday: Chicago PMI

by Calculated Risk on 8/30/2018 06:45:00 PM

From Merrill Lynch on August NFP:

We forecast that nonfarm payrolls increased by 205k in August ... We take signal from our payrolls tracker based on internal BAC data which increased by 245k in August, though we are fading our official forecast as nonfarm payrolls has tended to grow below trend in August in the first estimate by 40k since 2012.Friday:

...

We expect average hourly earnings to increase by 0.3% mom ... wages should grow by 2.8% yoy ... We look for the unemployment rate to tick down by 0.1pp to 3.8% ... owing to strong job gains and little change in the labor force participation rate at 62.9%.

• At 9:45 AM ET, Chicago Purchasing Managers Index for August. The consensus is for a reading of 63.5, down from 65.5 in July.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 95.3.