by Calculated Risk on 6/11/2018 09:22:00 AM

Monday, June 11, 2018

FOMC Preview

The consensus is that the Fed will increase the Fed Funds Rate 25bps at the meeting this week, and the tone will remain upbeat.

Assuming the expected happens, the focus will be on the wording of the statement, the projections, and Fed Chair Jerome Powell's press conference to try to determine how many rate hikes to expect in 2018 and in 2019.

Here are the March FOMC projections.

Current projections for Q2 GDP range from 3.1% to 4.5%. GDP increased at a 2.2% real annual rate in Q1. This puts first half GDP close to the top of the expected range, and GDP projections might be revised up.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Mar 2018 | 2.6 to 3.0 | 2.2 to 2.6 | 1.8 to 2.1 |

| Dec 2017 | 2.2 to 2.6 | 1.9 to 2.3 | 1.7 to 2.0 |

The unemployment rate was at 3.8% in May. So the unemployment rate projection for 2018 will probably be lowered.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Mar 2018 | 3.6 to 3.8 | 3.4 to 3.7 | 3.5 to 3.8 |

| Dec 2017 | 3.7 to 4.0 | 3.6 to 4.0 | 3.6 to 4.2 |

As of April, PCE inflation was up 2.0% from April 2017. Based on recent PCE readings, PCE inflation will likely be revised up for 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

| Dec 2017 | 1.7 to 1.9 | 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.8% in April year-over-year. Core PCE inflation might also be revised up for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

| Dec 2017 | 1.7 to 1.9 | 2.0 | 2.0 to 2.1 |

In general the data has been somewhat firmer than the FOMC's March projections, so it seems likely the FOMC will be on track for four rate hikes in 2018.

Sunday, June 10, 2018

Sunday Night Futures

by Calculated Risk on 6/10/2018 08:11:00 PM

Weekend:

• Schedule for Week of June 10, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 5, and DOW futures are down 30 (fair value).

Oil prices were down slightly over the last week with WTI futures at $65.55 per barrel and Brent at $76.32 per barrel. A year ago, WTI was at $46, and Brent was at $47 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.92 per gallon. A year ago prices were at $2.33 per gallon - so gasoline prices are up 59 cents per gallon year-over-year.

Oil Rigs: "Now, back to the Permian Show"

by Calculated Risk on 6/10/2018 10:30:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on June 8, 2018:

• Total US oil rigs were up 1 to 862

• Horizontal oil rigs added 5 to 763

...

• The Permian gained 7; the Cana Woodford gave back 3

• Since last July’s peak, 90 of the 105 horizontal oil rigs additions have been in the Permian; 12 in the Cana Woodford—and even the Cana Woodford is no higher than in November. All other plays have added a mere three rigs since last July

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Saturday, June 09, 2018

Schedule for Week of June 10, 2018

by Calculated Risk on 6/09/2018 08:11:00 AM

The key economic reports this week are the May Consumer Price Index (CPI) and Retail Sales.

For manufacturing, May industrial production, and the June New York survey, will be released this week.

The FOMC meets this week and is expected to raise the Fed Funds rate 25bps.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for May.

8:30 AM: The Consumer Price Index for May from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is a 0.3% increase in PPI, and a 0.2% increase in core PPI.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: Retail sales for May will be released. The consensus is for a 0.4% increase in retail sales.

8:30 AM ET: Retail sales for May will be released. The consensus is for a 0.4% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.0% on a YoY basis.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, up from 222 thousand the previous week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of 19.6, down from 20.1.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.0%.

10:00 AM: State Employment and Unemployment (Monthly) for May 2018

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

Friday, June 08, 2018

Bernanke Video: "What you are getting is a stimulus at the very wrong moment"

by Calculated Risk on 6/08/2018 04:42:00 PM

This discussion with Ben Bernanke is worth watching. He discusses monetary policy, QE, and the poor timing of the recent fiscal stimulus (something I've mentioned several times).

The Bernanke portion of the video ends around the 35 minute mark.

Q2 GDP Forecasts

by Calculated Risk on 6/08/2018 01:19:00 PM

From Merrill Lynch:

Better than expected trade data nudged up 2Q GDP tracking to 3.8% qoq saar [June 8 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.5 percent on June 6, down from 4.8 percent on June 1. [June 8 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.1% for 2018:Q2 and 2.9% for 2018:Q3. [June 8 estimate]CR Note: These estimates suggest real annualized GDP in the 3% to 4.5% range in Q2.

AAR: Rail Carloads Up 3.2% YoY, Intermodal Up 6.6% YoY

by Calculated Risk on 6/08/2018 11:19:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

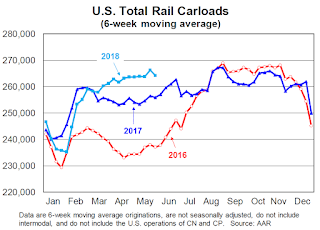

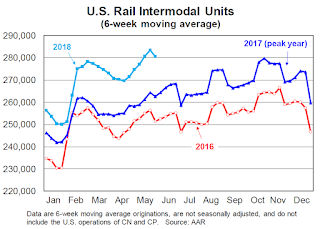

The U.S. economy is clicking right now, and freight railroads are both beneficiaries and enablers of that. In May 2018, originated carloads on U.S. railroads were up 3.2% over May 2017, the third straight month with year-over-year growth greater than 3%. In May 2018, 15 of the 20 commodity categories the AAR tracks saw higher carloads, including nearly all the major categories. Total carloads averaged 263,884 in May 2018, the most for May since 2015. … May was a good month for intermodal too: U.S. intermodal originations in May 2018 were up 6.6% over last year.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,319,420 carloads in May 2018, up 3.2% (41,078 carloads) over May 2017. Year-over-year carloads have risen by more than 3% for three straight months. Carloads averaged 263,884 in May 2018, the most for May since 2015. Year-to-date carloads through May (5.67 million) were up 1.2%, or 66,071 carloads, over the first five months of last year and were up 8.1% (422,829 carloads) over the first five months of 2016.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,398,203 intermodal containers and trailers in May 2018, up 6.6%, or 86,010 units, over May 2017. Average weekly intermodal volume in May 2018 was 279,641 units — that’s the second most in history. (Only February 2018, at 279,853, had more.)

Year-to-date intermodal volume through May was a record 5,993,584, up 6.0%, or 336,944 units, over the same period in 2017. Barring a catastrophe, this year will be another record year for U.S. intermodal.

Hotels: Occupancy Rate increased Year-over-Year, On Record Annual Pace

by Calculated Risk on 6/08/2018 08:58:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 2 June

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 27 May through 2 June 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 28 May through 3 June 2017, the industry recorded the following:

• Occupancy: +0.1% to 64.1%

• Average daily rate (ADR): +2.1% to US$122.58

• Revenue per available room (RevPAR): +2.3% to US$78.61

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

On a seasonal basis, the occupancy rate will now increase as the summer travel season starts.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, June 07, 2018

Leading Index for Commercial Real Estate Increases in May

by Calculated Risk on 6/07/2018 04:01:00 PM

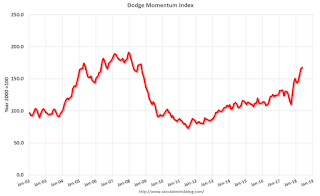

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Inches Up in May

The Dodge Momentum Index eked out a small gain in May, moving 1.8% higher to 167.8 (2000=100) from the revised April reading of 164.9. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. May’s gain was the result of a 4.7% increase by the commercial component of the Momentum Index, while the institutional component fell 2.4%. The Momentum Index has posted solid gains through the first five months of 2018, rising 19% from the same period of 2017 and reaching a level not seen since mid-2008. However, the upturn to this point shows that the current expansion has been more drawn out than what occurred during the previous cyclical expansion. It has been nearly seven years since the Momentum Index hit bottom in July 2011, but it has yet to eclipse its previous peak set in December 2007. At the same time, the recent gains for the Momentum Index suggest that construction spending for nonresidential buildings should remain healthy through the rest of 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 167.8 in May, up from 164.9 in April.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further growth in 2018 and into 2019.

Fed's Flow of Funds: Household Net Worth increased in Q1

by Calculated Risk on 6/07/2018 01:25:00 PM

The Federal Reserve released the Q1 2018 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q1 2018 compared to Q4 2017:

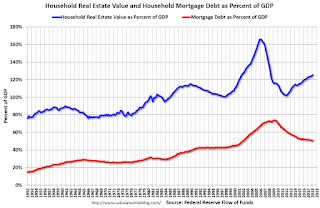

The net worth of households and nonprofits rose to $100.8 trillion during the first quarter of 2018. The value of directly and indirectly held corporate equities decreased $0.4 trillion and the value of real estate increased $0.5 trillionThe Fed estimated that the value of household real estate increased to $25.1 trillion in Q1. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and this also includes new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2018, household percent equity (of household real estate) was at 58.7% - up from Q4, and the highest since Q4 2005. This was because of an increase in house prices in Q1 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 58.7% equity - and about 2.5 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $34 billion in Q1.

Mortgage debt has declined by $0.6 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q1, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.