by Calculated Risk on 1/29/2018 12:36:00 PM

Monday, January 29, 2018

Black Knight: House Price Index up 0.3% in November, Up 6.4% year-over-year

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight HPI: Appreciation Remains Steady as U.S. Home Prices Gain 0.27 Percent in November, Up 6.44 Percent Year-Over-Year

• After 67 consecutive months of annual appreciation, U.S. home prices reached another new peak at $283KOnce again, this index is Not seasonally adjusted, and seasonally declines in some states is expected (so don't read too much into any regional declines). The year-over-year increase in this index has been about the same for the last year (close to 6% range).

• At the national level, home prices have now gained 6.49 percent growth since the start of 2017

• New York led all states in monthly appreciation with home prices there rising 1.36 percent from October

...

• Home prices fell in six of the nation’s 20 largest states; Wisconsin saw the largest decline at -0.37 percent

• Ten of the 20 largest states and 12 of the 40 largest metros hit new home price peaks in November

Note also that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for November will be released tomorrow.

Dallas Fed: Manufacturing Expansion Solid in January

by Calculated Risk on 1/29/2018 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity continued to expand in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained elevated but retreated to 16.8 after surging to an 11-year high in December.This was the last of the regional Fed surveys for January.

Most other measures of manufacturing activity also pointed to somewhat slower growth in January after the rapid expansion seen in December. The new orders index moved down from 30.1 to 25.5, and the growth rate of orders index fell six points to 15.5. The capacity utilization index also stayed positive but declined, dropping 12 points to 14.5. Meanwhile, the shipments index rose six points to 27.1, indicating a pickup in growth.

Perceptions of broader business conditions remained highly positive in January. The general business activity index pushed up further to 33.4, its highest reading in more than 12 years. The company outlook index remained elevated but edged down to 27.8.

Labor market measures suggested a slight deceleration in employment growth and longer workweeks this month. The employment index came in at 15.2, down five points from December.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be strong again in January (to be released Thursday, Feb 1st).

Personal Income increased 0.4% in December, Spending increased 0.4%

by Calculated Risk on 1/29/2018 08:47:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $58.7 billion (0.4 percent) in December according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $48.0 billion (0.3 percent) and personal consumption expenditures (PCE) increased $54.2 billion (0.4 percent).The December PCE price index increased 1.7 percent year-over-year and the December PCE price index, excluding food and energy, increased 1.5 percent year-over-year.

...

Real PCE increased 0.3 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through December 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly above expectations, and the increase in PCE was slightly below expectations.

Sunday, January 28, 2018

Sunday Night Futures

by Calculated Risk on 1/28/2018 07:14:00 PM

Weekend:

• Schedule for Week of Jan 28, 2018

Monday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional surveys for January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 2, and DOW futures are up 50 (fair value).

Oil prices were up over the last week with WTI futures at $66.24 per barrel and Brent at $60.47 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.57 per gallon. A year ago prices were at $2.27 per gallon - so gasoline prices are up 30 cents per gallon year-over-year.

Vehicle Forecast: Sales Expected to Exceed 17 million SAAR Again in January

by Calculated Risk on 1/28/2018 11:06:00 AM

The automakers will report January vehicle sales on Thursday, Feb 1st.

Note: There are 25 selling days in January 2018, there were 24 selling days in January 2017.

From WardsAuto: U.S. Forecast: January Sets Stage for Anticipated Year-Over-Year Decline

The Wards Intelligence January forecast calls for 1.16 million LVs to be delivered over 25 selling days, resulting in a 46,430-unit daily sales rate compared with 47,442 in prior-year (24 days). The DSR is down 2.1% from like-2017.Sales had been below 17 million SAAR (Seasonally Adjusted Annual Rate) for six consecutive months last year, until September, when sales increased due to buying following Hurricane Harvey. If sales exceed 17 million SAAR in January, this will be the fifth consecutive month over 17 million SAAR. However, overall, it appears sales will be down again in 2018.

...

The resulting seasonally adjusted annual rate is 17.24 million units, below the 17.75 million in the previous month and 17.34 million year-ago.

emphasis added

Here is a table of light vehicle sales since 2000. The record year for sales was 2016, followed by 2015, both breaking the previous record set in 2000. Last year, 2017, was the fourth best year ever, just ahead of 2001.

| Light Vehicle Sales (000s) | ||

|---|---|---|

| Year | Sales | Change |

| 2000 | 17,350 | |

| 2001 | 17,122 | -1.3% |

| 2002 | 16,816 | -1.8% |

| 2003 | 16,639 | -1.1% |

| 2004 | 16,867 | 1.4% |

| 2005 | 16,948 | 0.5% |

| 2006 | 16,504 | -2.6% |

| 2007 | 16,089 | -2.5% |

| 2008 | 13,195 | -18.0% |

| 2009 | 10,402 | -21.2% |

| 2010 | 11,555 | 11.1% |

| 2011 | 12,742 | 10.3% |

| 2012 | 14,433 | 13.3% |

| 2013 | 15,530 | 7.6% |

| 2014 | 16,452 | 5.9% |

| 2015 | 17,396 | 5.7% |

| 2016 | 17,465 | 0.4% |

| 2017 | 17,135 | -1.9% |

Saturday, January 27, 2018

January 2018: Unofficial Problem Bank list declines to 101 Institutions

by Calculated Risk on 1/27/2018 06:12:00 PM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for January 2018. The list had a net decline of two insured institutions to 101 banks. Likewise, aggregate assets had a small decline of $200 million to $20.7 billion. A year ago, the list held 163 institutions with assets of $43.5 billion.

Actions were terminated against First South Bank, Spartanburg, SC ($238 million) and Blue Grass Federal Savings and Loan Association, Paris, KY ($33 million). Heartland Bank, Little Rock, AR ($182 million) found their way off the list through a merger partner. Added this month was Jackson County Bank, Black River Falls, WI ($253 million).

Schedule for Week of Jan 28, 2018

by Calculated Risk on 1/27/2018 08:09:00 AM

The key report this week is the January employment report on Friday.

Other key indicators include the January ISM manufacturing index, January auto sales, and the Case-Shiller house price index.

Also the FOMC meets this week, and no change to policy is expected.

8:30 AM: Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional surveys for January.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the October 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.4% year-over-year increase in the Comp 20 index for November.

10:00 AM: the Q4 Housing Vacancies and Homeownership from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 195,000 payroll jobs added in January, down from 250,000 added in December.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 64.0, down from 67.6 in December.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 0.4% increase in the index.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce no change to policy at this meeting.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 233 thousand the previous week.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 58.7, down from 59.7 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 58.7, down from 59.7 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in December. The PMI was at 59.7% in December, the employment index was at 57.0%, and the new orders index was at 69.4%.

10:00 AM: Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.3 million SAAR in January, down from 17.8 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.3 million SAAR in January, down from 17.8 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

8:30 AM: Employment Report for January. The consensus is for an increase of 176,000 non-farm payroll jobs added in January, up from the 148,000 non-farm payroll jobs added in December.

The consensus is for the unemployment rate to be unchanged at 4.1%.

The consensus is for the unemployment rate to be unchanged at 4.1%.This graph shows the year-over-year change in total non-farm employment since 1968.

In December the year-over-year change was 2.055 million jobs.

A key will be the change in wages.

Note from the BLS: "Effective with the release of The Employment Situation for January 2018 on February 2, 2018, the establishment survey will introduce revisions to nonfarm payroll employment, hours, and earnings data to reflect the annual benchmark adjustment for March 2017 and updated seasonal adjustment factors. Not seasonally adjusted data beginning with April 2016 and seasonally adjusted data beginning with January 2013 are subject to revision. Consistent with standard practice, some historical data may be subject to revisions resulting from issues identified during the benchmark process." The preliminary benchmark revision showed an increase of 95,000 jobs.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 95.0, up from 94.4 in January.

Friday, January 26, 2018

Oil Rigs "US oil rigs were up sharply"

by Calculated Risk on 1/26/2018 07:02:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Jan 26, 2017:

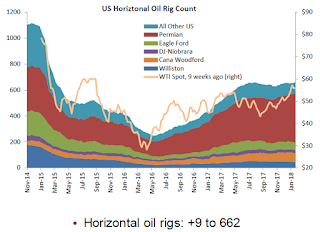

• Total US oil rigs were up sharply, +12 to 759

• Horizontal oil rigs were similarly up, +9 to 662

• All of the gain comes from the Permian, up 18 rigs in total

...

• The oil price continues to rise, with WTI above $66, even as the Brent spread has fallen below $5.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Philly Fed: State Coincident Indexes increased in 37 states in December

by Calculated Risk on 1/26/2018 01:25:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for December 2017. Over the past three months, the indexes increased in 42 states and decreased in eight, for a three-month diffusion index of 68. In the past month, the indexes increased in 37 states, decreased in 10, and remained stable in three, for a one-month diffusion index of 54.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Recently several states have turned red.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In December, 38 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

The reason for the mid-to-late 2017 sharp decrease in the number of states with increasing activity is unclear.

Q4 GDP: Investment

by Calculated Risk on 1/26/2018 11:11:00 AM

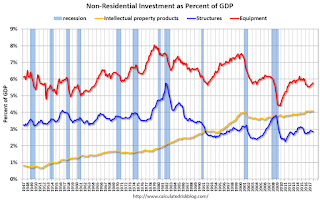

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased at a 11.6% annual rate in Q3. Equipment investment increased at a 11.4% annual rate, and investment in non-residential structures increased at a 1.4% annual rate.

On a 3 quarter trailing average basis, RI (red) is unchanged, equipment (green) is positive, and nonresidential structures (blue) is unchanged.

Recently RI has been soft, but picked up in Q4.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP increased in Q4, and has generally been increasing. RI as a percent of GDP is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next couple of years.

The increase is primarily coming from single family investment and the boom in home remodeling.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.