by Calculated Risk on 11/21/2017 12:43:00 PM

Tuesday, November 21, 2017

A Few Comments on October Existing Home Sales

Earlier: NAR: "Existing-Home Sales Grow 2.0 Percent in October"

My view is a sales rate of 5.48 million is solid. In fact, I'd consider any existing home sales rate in the 5 to 5.5 million range solid based on the normal historical turnover of the existing stock. As always, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

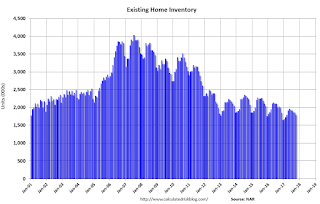

Inventory is still very low and falling year-over-year (down 10.4% year-over-year in October). Inventory has declined year-over-year for 29 consecutive months. I started the year expecting inventory would be increasing year-over-year by the end of 2017. However it looks like 2017 will be another year of declining inventory.

Inventory is a key metric to watch. More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in October (458,000, red column) were above sales in October 2016 (445,000, NSA) and at the highest level for October since 2006.

Sales NSA are now slowing seasonally, and sales NSA will be lower through February.

NAR: "Existing-Home Sales Grow 2.0 Percent in October"

by Calculated Risk on 11/21/2017 10:00:00 AM

From the NAR: Existing-Home Sales Grow 2.0 Percent in October

Existing-home sales increased in October to their strongest pace since earlier this summer, but continual supply shortages led to fewer closings on an annual basis for the second straight month, according to the National Association of Realtors®.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 2.0 percent to a seasonally adjusted annual rate of 5.48 million in October from a downwardly revised 5.37 million in September. After last month's increase, sales are at their strongest pace since June (5.51 million), but still remain 0.9 percent below a year ago.

...

Total housing inventory at the end of October decreased 3.2 percent to 1.80 million existing homes available for sale, and is now 10.4 percent lower than a year ago (2.01 million) and has fallen year-over-year for 29 consecutive months. Unsold inventory is at a 3.9-month supply at the current sales pace, which is down from 4.4 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (5.48 million SAAR) were 2.0% higher than last month, and were 0.9% below the October 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.80 million in October from 1.86 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.80 million in October from 1.86 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 10.4% year-over-year in October compared to October 2016.

Inventory decreased 10.4% year-over-year in October compared to October 2016. Months of supply was at 3.9 months in October.

As expected by CR readers, sales were above the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Chicago Fed "Index Points to a Pickup in Economic Growth in October"

by Calculated Risk on 11/21/2017 08:39:00 AM

From the Chicago Fed: Index Points to a Pickup in Economic Growth in October

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.65 in October from +0.36 in September. One of the four broad categories of indicators that make up the index increased from September, but three of the four categories made positive contributions to the index in October. The index’s three-month moving average, CFNAI-MA3, increased to +0.28 in October from +0.01 in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in October (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Black Knight: National Mortgage Delinquency Rate increased in October due to Hurricanes

by Calculated Risk on 11/21/2017 08:01:00 AM

From Black Knight: Black Knight’s First Look at October 2017 Mortgage Data: National Delinquency Rate Sees Second Consecutive Annual Rise as Impact from Hurricanes Continues

• October’s 4BPS increase in the national delinquency rate can be directly linked to continued hurricane impact, while delinquencies fell 14BPS in non-affected areasAccording to Black Knight's First Look report for October, the percent of loans delinquent increased 0.9% in October compared to September, and increased 2.0% year-over-year.

• Though delinquencies were down in all states except Texas and Florida, in FEMA-declared Hurricanes Harvey and Irma disaster areas, they rose another 24 percent (186BPS) in October

• The most notable increase was in Florida, where delinquencies spiked 36 percent from September in hurricane-affected areas

• Over 229,000 past-due mortgages can now be attributed to Hurricanes Irma (163,000) and Harvey (66,000)

• Total non-current inventories in Florida and Texas (all loans 30 or more days past due or in foreclosure) have risen 79 and 30 percent, respectively, over the past six months

...

• The inventory of loans in active foreclosure continues to improve, falling below 350,000 for the first time since 2006

The percent of loans in the foreclosure process declined 2.8% in October and were down 31.4% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.44% in October, up from 4.40% in September.

The percent of loans in the foreclosure process declined in October to 0.68%.

The number of delinquent properties, but not in foreclosure, is up 60,000 properties year-over-year, and the number of properties in the foreclosure process is down 156,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2017 | Sept 2017 | Oct 2016 | Oct 2015 | |

| Delinquent | 4.44% | 4.40% | 4.35% | 4.77% |

| In Foreclosure | 0.68% | 0.70% | 0.99% | 1.43% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,262,000 | 2,245,000 | 2,202,000 | 2,415,000 |

| Number of properties in foreclosure pre-sale inventory: | 348,000 | 358,000 | 504,000 | 721,000 |

| Total Properties | 2,610,000 | 2,603,000 | 2,706,000 | 3,136,000 |

Monday, November 20, 2017

Tuesday: Existing Home Sales, Fed Chair Yellen

by Calculated Risk on 11/20/2017 06:38:00 PM

From the Federal Reserve: Janet L. Yellen will step down as a Member of the Board of Governors of the Federal Reserve System, effective upon the swearing in of her successor as Chair

Janet L. Yellen submitted her resignation Monday as a Member of the Board of Governors of the Federal Reserve System, effective upon the swearing in of her successor as Chair.Tuesday:

Dr. Yellen, 71, was appointed to the Board by President Obama for an unexpired term ending January 31, 2024. Her term as Chair expires on February 3, 2018. She also serves as Chair of the Federal Open Market Committee, the System's principal monetary policymaking body.

Prior to her appointment as Chair, Dr. Yellen served as Vice Chair of the Board of Governors, from October 2010 to February 2014, and as President of the Federal Reserve Bank of San Francisco, from June 2004 to October 2010. She was initially appointed to the Board by President Clinton in August 1994 and served until February 1997, when she resigned to serve as Chair of the President's Council of Economic Advisers, until August 1999.

Dr. Yellen is Professor Emerita at the University of California at Berkeley, where she has been a member of the faculty since 1980. She was born in Brooklyn, New York, in August 1946 and received her undergraduate degree in economics from Brown University in 1967 and her Ph.D. in economics from Yale University in 1971. Dr. Yellen is married and has an adult son.

A copy of her resignation letter is attached.

• At 8:30 AM ET, Chicago Fed National Activity Index for October. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.40 million SAAR, up from 5.39 million in August. Housing economist Tom Lawler expects the NAR to report sales of 5.60 million SAAR for October. Take the Over.

• At 6:00 PM, Panel Discussion with Fed Chair Janet Yellen, Moderated discussion with Mervyn King, At the New York University Stern School of Business, New York, New York

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 11/20/2017 05:16:00 PM

Note: This is a repeat of a June post with updated statistics and graph.

There are a number of observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 13.5% under Mr. Trump compared to up 37.9% under Mr. Obama for the same number of market days.

Will Mr. Trump have a negative impact on the economy?

by Calculated Risk on 11/20/2017 03:03:00 PM

Update: Here are five questions that people ask me all the time.

1. Are house prices in a bubble?

2. Is a recession imminent (within the next 12 months)?

3. Is the stock market a bubble?

4. Can investors use macro analysis?

5. Will Mr. Trump have a negative impact on the economy?

Three weeks ago I posted five economic questions I'm frequently asked.

Since then I've discussed:

1) Are house prices in a new bubble?

2) Is a recession imminent (within the next 12 months)?

3) Is the stock market a bubble?

4) Can investors use macro analysis?

The final question I'm frequently asked: Will Mr. Trump have a negative impact on the economy?

First some good news. When Mr. Trump was elected, the cupboard was full. In November 2016, employment had been increasing solidly for several years (and the unemployment low and falling), wages had finally started picking up in 2015 and 2016, demographics were improving (the prime working age population was growing again), and the World economy was starting to pick up.

Luckily for Americans, and for Mr. Trump, there have been limited policy changes this year - and the economy has stayed the positive course. For example, despite the campaign rhetoric, there has been no significant trade wars and no mass deportations.

Some infrastructure spending would be a positive, but the proposals from the Trump administration would have had minimal impact (and luckily they haven't gone anywhere). As an aside, the best time for more infrastructure spending would have been in the years immediately following the financial crisis when the unemployment rate was still elevated - but unfortunately those efforts were blocked by Congress.

"Repeal and replace" would have had a negative impact on the economy, but luckily it failed.

The current tax proposals - mostly to cut taxes on high income earners and inherited wealth - might have some short term positive impact on the economy, but these proposals would be neutral or negative in the medium to long term.

There is a push to loosen financial regulations, and that would be a medium to long term negative, but not a concern for a few years.

The biggest concern is what Mr. Trump will do if something needs to be done (a crisis of some sort). Mr. Trump is reckless, ignorant and irresponsible - and his response in a crisis is unpredictable. But right now the best course for Americans would be if the Trump administration did nothing, and hopefully the expansion will stay on course.

Lawler: Selected Operating Statistics, Large Publicly-Traded Home Builders

by Calculated Risk on 11/20/2017 10:22:00 AM

Below is a table showing selected operating statistics for eight large, publicly-traded builders for the quarter ended September 30, 2017.

From housing economist Tom Lawler:

| Net Orders | Settlements | Average Closing Price $ (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/17 | 9/16 | % Chg | 9/17 | 9/16 | % Chg | 9/17 | 9/16 | % Chg |

| D.R. Horton | 10,333 | 8,744 | 18.2% | 13,165 | 12,247 | 7.5% | 307 | 297 | 3.2% |

| Pulte Group | 5,300 | 4,775 | 11.0% | 5,151 | 5,037 | 2.3% | 399 | 374 | 6.7% |

| NVR | 4,200 | 3,477 | 20.8% | 4,158 | 3,922 | 6.0% | 393 | 384 | 2.3% |

| Cal Atlantic | 3,416 | 3,531 | -3.3% | 3,380 | 3,680 | -8.2% | 448 | 452 | -0.9% |

| Beazer Homes | 1,315 | 1,346 | -2.3% | 1,904 | 1,856 | 2.6% | 350 | 334 | 4.6% |

| Meritage Homes | 1,874 | 1,737 | 7.9% | 1,969 | 1,800 | 9.4% | 409 | 409 | 0.0% |

| MDC Holdings | 1,270 | 1,296 | -2.0% | 1,317 | 1,293 | 1.9% | 444 | 445 | -0.2% |

| M/I Homes | 1,225 | 1,008 | 21.5% | 1,256 | 1,148 | 9.4% | 366 | 365 | 0.3% |

| SubTotal | 28,933 | 25,914 | 11.7% | 32,300 | 30,983 | 4.3% | 364 | 356 | 2.1% |

Comments on October Housing Starts

by Calculated Risk on 11/20/2017 08:11:00 AM

Last Friday: Housing Starts increased to 1.290 Million Annual Rate in October

The housing starts report released Friday showed starts were up 13.7% in October compared to September, however starts were down 2.9% year-over-year compared to October 2016.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were down 2.9% in October 2017 compared to October 2016 (a difficult comparison), and starts are up only 5.8% year-to-date.

Note that single family starts are up 10.2% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess was starts would increase around 3% to 7% in 2017. Looks about right.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have just passed starts (more deliveries).

Completions lag starts by about 12 months, so completions will probably turn down in about a year.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

Sunday, November 19, 2017

Sunday Night Futures

by Calculated Risk on 11/19/2017 06:39:00 PM

Weekend:

• Schedule for Week of Nov 19, 2017

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 3, and DOW futures are down 23 (fair value).

Oil prices were down over the last week with WTI futures at $56.55 per barrel and Brent at $62.54 per barrel. A year ago, WTI was at $46, and Brent was at $46 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.15 per gallon - so gasoline prices are up 39 cents per gallon year-over-year.