by Calculated Risk on 11/15/2017 07:00:00 AM

Wednesday, November 15, 2017

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Surve

Mortgage applications increased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 10, 2017. This week’s results do not include an adjustment for the Veterans’ Day holiday.

... The Refinance Index increased 6 percent from the previous week to its highest level since October 2017. The seasonally adjusted Purchase Index increased 0.4 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 17 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.18 percent, with points increasing to 0.40 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 17% year-over-year.

Tuesday, November 14, 2017

NY Fed Q3 Report: "Total Household Debt Increases, Delinquency Rates of Several Debt Types Continue Rising"

by Calculated Risk on 11/14/2017 07:18:00 PM

From the NY Fed: Total Household Debt Increases, Delinquency Rates of Several Debt Types Continue Rising

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt increased by $116 billion (0.9%) to $12.96 trillion in the third quarter of 2017. There were increases in mortgage, student, auto and credit card debt (increasing by 0.6%, 1.0%, 1.9% and 3.1% respectively) and a modest decline in home equity lines of credit (HELOC) balances (decreasing by 0.9%).

...

Credit card and auto loan flows into delinquency increased. Specifically, credit card flows into delinquency have increased over the past year, while auto loan flows into delinquency have been steadily increasing for several years.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Mortgage balances, the largest component of household debt, increased again during the third quarter. Mortgage balances shown on consumer credit reports on September 30 stood at $8.74 trillion, an increase of $52 billion from the second quarter of 2017. Balances on home equity lines of credit (HELOC) have been slowly declining; they dropped by $4 billion and now stand at $448 billion. Non-housing balances, which have been increasing steadily for nearly 6 years overall, saw a $68 billion increase in the third quarter. Auto loans grew by $23 billion and credit card balances increased by $24 billion, while student loans saw a $13 billion increase.

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate increased in Q3. From the NY Fed:

Aggregate delinquency rates ticked up slightly in the third quarter of 2017. As of September 30, 4.9% of outstanding debt was in some stage of delinquency. Of the $630 billion of debt that is delinquent, $408 billion is seriously delinquent (at least 90 days late or “severely derogatory”). Flows into delinquency deteriorated for some types of debt. The flow into 90+ delinquent for credit card balances has been increasing notably for one year, and that measure for auto loans has increased, and the flow into 90+ delinquency for auto loan balances has been slowly increasing since 2012.There is much more in the report.

Wednesday: Retail Sales, CPI, NY Fed Mfg Survey

by Calculated Risk on 11/14/2017 06:18:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for October be released. The consensus is for a 0.1% increase in retail sales.

• Also at 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 26.0, down from 30.2.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.1% increase in inventories.

• During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate)

LA area Port Traffic: Imports increased YoY, Exports decreased YoY in October

by Calculated Risk on 11/14/2017 02:18:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

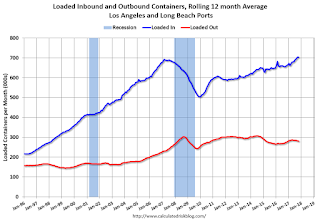

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.1% compared to the rolling 12 months ending in September. Outbound traffic was down 0.7% compared to the rolling 12 months ending in September.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

This was the 2nd highest level of imports ever for the month of October - following record imports in July, August and September - suggesting the retailers are optimistic about the Christmas Holiday shopping season.

In general imports have been increasing, and exports are mostly moving sideways to down recently.

A few random thoughts on Taxes

by Calculated Risk on 11/14/2017 12:54:00 PM

A few random thoughts ...

Income and corporate taxes are just part of the tax system. Americans pay a wide variety of taxes. These include sales, property, payroll, state and Federal income and corporate taxes, and more. Many of these taxes are regressive, meaning that lower income families pay a higher percentage of their income for these taxes. Sales taxes and payroll taxes are example of regressive taxes.

There are some "hidden" taxes, such as resource extraction taxes (severance tax "imposed on the removal of non-renewable natural resources") and state lotteries. The severance tax is borne primarily by consumers, and is therefore regressive - and lotteries are also regressive.

The main non-regressive taxes are income and corporate taxes. Higher income families generally pay a higher percentage of their income for these taxes. So when there is a discussion of reducing corporate and income taxes - and "broadening the base" for income taxes - this makes the entire tax system more regressive.

To make the system more progressive (where higher income families pay a higher percentage of their income in taxes), the discussion would be about decreasing regressive taxes (like the payroll tax), or increasing income and corporate taxes.

Why change the tax code? There could be many reasons to change the code: to make it simpler, to encourage certain activities (homeownership, investment, education, etc.), or to remove existing tax preferences, to spur growth, to reduce the deficit, to change the balance of who pays taxes.

As an example, to spur growth we could look for ways to lower income and wealth inequality (this is slowing growth in the US), and also ways to put more money in the hands of low to middle income families (people who tend to spend additional money). Examples of policies to spur growth in the short term would be reducing the payroll tax, and for growth in the longer term, increase the estate tax (and make it unavoidable).

What about the business cycle? If we look at the business cycle and the deficit, economic theory suggests that the government should increase the deficit during economic downturns, and work down the deficit during expansions. The economy is currently in the mid-to-late stage of a recovery, so decreasing the deficit makes sense now.

Conclusion: Right now it might make sense to reduce the payroll tax, increase income taxes - especially the estate tax (and make it unavoidable) - and reduce the deficit. Basically the opposite of the current proposal that reduces the burden on high income earners, offset by more debt and increasing the burden on low-to-middle income families.

NFIB: Small Business Optimism Index "inches up" in October

by Calculated Risk on 11/14/2017 09:22:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Index inches up in October in October

The October Index rose to 103.8, up from 103 the previous month. The historically strong performance extends the streak of positive months dating back to last November, when it shot up immediately following the election.

Four of the Index components rose last month. Five declined slightly, while one remained unchanged. Outlook for expansion and sales expectations each jumped six points, while job openings increased by five points.

The tight labor market got tighter for small business owners last month, continuing a year-long trend. Fifty-nine percent of owners said they tried to hire in October, with 88 percent of them reporting no or few qualified applicants. Hiring activity was particularly high in Florida and Georgia, as construction firms are still trying to meet higher demand caused by the recent hurricane.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased slightly to 103.8 in October.

Monday, November 13, 2017

"Mortgage Rates Sideways to Slightly Higher"

by Calculated Risk on 11/13/2017 05:21:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Higher

Mortgage rates were unchanged to slightly higher today, keeping them in line with their highest levels in more than 2 weeks, depending on the lender [30YR FIXED - 4.0%]. Bond markets (which underlie mortgage rates) were in slightly better shape this morning, but that failed to translate to rate sheet improvements due to bond market weakness on Friday afternoon.Tuesday:

There were no significant economic reports or market moving headlines for bonds/rates today, but that will quickly change as the week progresses. Wednesday brings a key inflation report--the Consumer Price Index (CPI). Markets are also interested in any meaningful tax bill headlines, including the vote scheduled for the House version of the bill on Thursday.

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for October.

• At 8:30 AM, The Producer Price Index for October from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/13/2017 01:20:00 PM

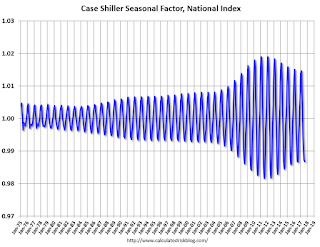

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through August 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

U.S. Heavy Truck Sales up Year-over-year in October

by Calculated Risk on 11/13/2017 09:27:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2017 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 364 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 411 thousand SAAR in October 2017, down from 440 thousand in September, and up from 364 thousand in October 2016.

Sunday, November 12, 2017

Sunday Night Futures

by Calculated Risk on 11/12/2017 07:19:00 PM

Weekend:

• Schedule for Week of Nov 12, 2017

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 4, and DOW futures are up 44 (fair value).

Oil prices were up over the last week with WTI futures at $56.88 per barrel and Brent at $64.65 per barrel. A year ago, WTI was at $43, and Brent was at $42 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.56 per gallon. A year ago prices were at $2.17 per gallon - so gasoline prices are up 39 cents per gallon year-over-year.