by Calculated Risk on 11/09/2017 10:22:00 AM

Thursday, November 09, 2017

Is the stock market a bubble?

Update: Here are five questions that people ask me all the time.

1. Are house prices in a bubble?

2. Is a recession imminent (within the next 12 months)?

3. Is the stock market a bubble?

4. Can investors use macro analysis?

5. Will Mr. Trump have a negative impact on the economy?

Over a week ago I posted five economic questions I'm frequently asked.

Last week I discussed: Are house prices in a new bubble? and Is a recession imminent (within the next 12 months)?

Here are a few thoughts on "Is the stock market a bubble?"

First, as long term readers know, I rarely comment directly on the stock market (although I did post on the market in 2009 since that was a turning point). I'll be brief here.

Second, I write about the economy, and the stock market is not the economy. This is usually my first comment to people when they ask about the market. However - in general - the stock market does well when the economy is expanding, and poorly during economic downturns.

There are exceptions: in 1987, the economy was fine, but the stock market crashed in October 1987. However the crash followed a very strong rally of over 30% from the beginning of 1987, and the market actually finished up for the year (although well off the peak). There were reasons for the crash - like portfolio insurance - that exacerbated the sell-off. In addition, there weren't any trading curbs (aka circuit breakers) in 1987, so the market could fall over 20% in one day.

Note: Some people say the 1987 proposed changes in the tax law - and a new Fed Chair - contributed to the 1987 crash. Echoes of history?

Third, the general rule is don't invest based on your political views. Those who sold, or didn't buy, because they didn't like Obama missed an historical rally. And those who sold, or didn't buy, because they don't like Trump missed solid gains this year.

Since I don't think a recession is imminent, I'd generally expect further gains in the market over the next year. The PE ratio is high (around 25), and that is well above average. However it is typical for the PE ratio to expand during an economic expansion.

As I noted in the Are house prices in a new bubble?, a bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value (like the PE ratio), but the real key for detecting a bubble is speculation. Back in the late '90s, stock speculation was obvious. Not only was margin debt high, but everyone was talking about investing in stocks - especially tech stocks. I knew the bubble was over when my mom called me and asked what "QQQ" stood for (NASDAQ ETF)? All her friends were buying it! (My shoeshine boy story).

Another possible indicator of speculation is margin debt.

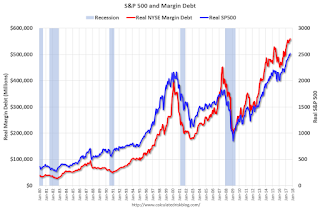

This graph shows the real S&P 500 (inflation adjusted, right axis), and real NYSE margin debt (left axis).

The high level of margin debt might suggest too much leverage.

The bottom line is the U.S. economy is doing well (the global economy is doing well too). There might be some speculation with margin debt, but everyone isn't talking stocks (like in 1999). So, in general, I don't think this is a bubble. Of course, as always, we could see a 10% to 20% correction starting at any time. I'll now go back to avoiding discussing the stock market.

Weekly Initial Unemployment Claims increase to 239,000

by Calculated Risk on 11/09/2017 08:34:00 AM

The DOL reported:

In the week ending November 4, the advance figure for seasonally adjusted initial claims was 239,000, an increase of 10,000 from the previous week's unrevised level of 229,000. The 4-week moving average was 231,250, a decrease of 1,250 from the previous week's unrevised average of 232,500. This is the lowest level for this average since March 31, 1973 when it was 227,750.The previous week was unrevised.

Claims taking procedures continue to be severely disrupted in the Virgin Islands. The ability to take claims has improved in Puerto Rico and they are now processing backlogged claims.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 231,250 - the lowest since 1973.

This was above the consensus forecast. The very low level of claims suggest relatively few layoffs.

Wednesday, November 08, 2017

The Future is still Bright!

by Calculated Risk on 11/08/2017 04:45:00 PM

I wrote this one year ago in November 2016. Not much has changed (no major policies have been enacted), and the economy remains on cruise control.

In January 2013 I wrote The Future's so Bright .... In that post I outlined why I was becoming more optimistic. I updated that post earlier this year (with a discussion of demographics).

For new readers: I was very bearish on the economy when I started this blog in 2005 - back then I wrote mostly about housing (see: LA Times article and more here for comments about the blog). I predicted a recession in 2007, and then I started looking for the sun in early 2009, and I've been fairly positive since then (although I expected a sluggish recovery).

I've also been optimistic about next year (2017), with most economic indicators improving - more jobs, lower unemployment rate, rising wages and much more - and with more room to run for the current expansion. Also the demographics in the U.S. are becoming more favorable (see here for more on improving demographics).

Now Mr. Trump has been elected President. How does that change the outlook?

In the long term, there is little or no change to the outlook. The future is still bright! Although I'm concerned about the impact of global warming.

In the short term, there is also no change (Mr Obama will be President until January, and it takes time for new policies to be implemented).

The intermediate term might be impacted. The general rule is don't invest based on your political views, however it is also important to look at the impact of specific policies.

I will probably disagree with most of Mr. Trump's proposals for both normative reasons (different values), and for positive reasons (because Mr. Trump rejects data that doesn't fit his view - and that is not good).

With Mr. Trump, no one knows what he will actually do. He has said he'd "build a wall" along the border with Mexico, renegotiate all trade deals, cut taxes on high income earners, repeal Obamacare and more. As an example, repealing the ACA - without a replacement - would lead to many millions of Americans without health insurance. And those with preexisting conditions would be uninsurable. This seems politically unlikely (without a replacement policy), but it is possible.

Since Trump is at war with the data (he rejects data that doesn't fit his views), I don't expect evidence based policy proposals - and that almost always means bad results. However bad results might mean higher deficits with little return - not an economic downturn. Until we see the actual policy proposals, it is hard to predict the impact. I will not predict a recession just because Trump is elected. In fact, additional infrastructure spending might give the economy a little boost over the next year or two. On the other hand, deporting 10+ million people would probably lead to a recession. We just have to wait and see what is enacted.

In conclusion: The future is still bright, but there might be a storm passing through.

Leading Index for Commercial Real Estate "Recovers" in October

by Calculated Risk on 11/08/2017 11:58:00 AM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Recovers in October

The Dodge Momentum Index rose in October, climbing 13.2% to 130.9 (2000=100) from the revised September reading of 115.6. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The move higher in October nearly reversed the erosion of the past four months (including September’s 7.9% decline), with October posting healthy gains in both sectors. From September to October the commercial portion of the Momentum Index advanced 16.8%, while the institutional portion grew 8.3%. On a year-over-year basis, the Momentum Index is now 6.1% higher, with the commercial portion up 5.5% and the institutional portion up 6.9%. October’s increase supports the belief that building activity has further room to grow during this cycle. While month-to-month activity could continue to be volatile, there are enough projects in the pipeline to sustain growth into 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 130.9 in October, up from 115.6 in September.

The index is up 6.1% year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further growth into 2018.

Las Vegas Real Estate in October: Sales up 13% YoY, Inventory down 32%

by Calculated Risk on 11/08/2017 09:20:00 AM

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local Home Prices Cool Down in October, Still Well Up from One Year Ago, GLVAR Housing Statistics for October 2017

The Greater Las Vegas Association of REALTORS® (GLVAR) reported today that local home prices cooled down a bit in October, though home prices and sales are still well up from one year ago.1) Overall sales were up about 13% year-over-year.

...

By the end of October, GLVAR reported 4,795 single-family homes listed for sale without any sort of offer. That’s down 32.3 percent from one year ago. For condos and townhomes, the 770 properties listed without offers in October represented a 32.0 percent drop from one year ago.

The total number of existing local homes, condos and townhomes sold during October was 3,633, up from 3,225 in October 2016. Compared to one year ago, sales were up 13.3 percent for homes and up 16.1 percent for condos and townhomes.

According to GLVAR, home sales so far in 2017 continue to run about 10 percent ahead of the pace from 2016, when 41,720 total properties were sold in Southern Nevada. At this rate, GLVAR statistics show that 2017 is on pace to be the best year for local home sales since at least 2012.

...

In recent years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in October, when 2.9 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 5.1 percent of all sales in October 2016. Another 2.3 percent of all October sales were bank-owned, down from 5.6 percent one year ago.

As these declining percentages indicate, [GLVAR President David] Tina said “distressed sales now make up such a small share of the local housing market that they’ve really become a non-issue.”

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago.

3) Fewer distressed sales.

MBA: Mortgage Applications "Flat" in Latest Weekly Survey

by Calculated Risk on 11/08/2017 07:00:00 AM

From the MBA: Mortgage Applications Flat in Latest MBA Weekly Survey

Mortgage applications remained unchanged from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 3, 2017.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.18 percent from 4.22 percent, with points decreasing to 0.38 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.

Tuesday, November 07, 2017

First Look: 2018 Housing Forecasts

by Calculated Risk on 11/07/2017 04:30:00 PM

Towards the end of each year I collect some housing forecasts for the following year. This is just a beginning (I'll gather many more).

First a review of the previous five years ...

Here is a summary of forecasts for 2017. It is early (just nine months), but in 2017, new home sales will probably be around 600 to 610 thousand, and total housing starts will be around 1.200 to 1.210 million. Wells Fargo and Brad Hunter (HomeAdvisor) appear very close on New Home sales, and Merrill Lynch and NAR appear close on starts.

Here is a summary of forecasts for 2016. In 2016, new home sales will probably be around 565 thousand, and total housing starts will be around 1.175 million. Fannie Mae and Merrill Lynch were very close on New Home sales, and MetroStudy was close on starts.

Here is a summary of forecasts for 2015. In 2015, new home sales were 501 thousand, and total housing starts were 1.112 million. Zillow, CoreLogic, and the MBA were right on with New Home sales, and CoreLogic, MetroStudy, MBA and Zillow were all correct on starts.

Here is a summary of forecasts for 2014. In 2014, new home sales were 437 thousand, and total housing starts were 1.003 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high). In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays was the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2017:

From Fannie Mae: Housing Forecast: October 2017

From Freddie Mac: Freddie Mac September 2017 Outlook

From NAHB: NAHB’s housing and economic forecast

Note: For comparison, new home sales in 2017 will probably be around 605 thousand, and total housing starts around 1.205 million.

| Housing Forecasts for 2018 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 651 | 945 | 1,300 | 5.1%2 |

| Freddie Mac | 1,330 | 4.9%2 | ||

| NAHB | 628 | 903 | 1,253 | |

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Prices 4Zillow Home Prices 5Brad Hunter, chief economist, formerly of MetroStudy |

||||

CoreLogic: House Prices up 7.0% Year-over-year in September

by Calculated Risk on 11/07/2017 11:58:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Reveals Nearly Half of the Nation’s Largest 50 Markets are Overvalued

CoreLogic® ... today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for September 2017, which shows home prices are up strongly both year over year and month over month. Home prices nationally increased year over year by 7 percent from September 2016 to September 2017, and on a month-over-month basis, home prices increased by 0.9 percent in September 2017 compared with August 2017, according to the CoreLogic HPI.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is the top end of that range.

Looking ahead, the CoreLogic HPI Forecast indicates that home prices will increase by 4.7 percent on a year-over-year basis from September 2017 to September 2018, and on a month-over-month basis home prices are expected to decrease by 0.1 percent from September 2017 to October 2017. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Heading into the fall, home price growth continues to grow at a brisk pace,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This appreciation reflects the low for-sale inventory that is holding back sales and pushing up prices. The CoreLogic Single-Family Rent Index rose about 3 percent over the last year, less than half the rise in the national Home Price Index.”

emphasis added

The year-over-year comparison has been positive for over five consecutive years since turning positive year-over-year in February 2012.

BLS: Job Openings Unchanged in September

by Calculated Risk on 11/07/2017 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.1 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.3 million and 5.2 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.2 million in September. The quits rate was 2.2 percent. The number of quits was little changed for total private and for government. Quits rose in professional and business services (+82,000) and state and local government, excluding education (+10,000). Quits fell in other services (-45,000) and real estate and rental and leasing (-16,000).

...

Hurricane Irma made landfall in Florida during September, the reference month for the preliminary estimates in this release. All possible efforts were made to contact and collect data from survey respondents in the hurricane-affected areas. A review of the data indicated that Hurricane Irma had no discernible effect on the JOLTS estimates for September.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased slightly in September to 6.093 million from 6.090 in August.

The number of job openings (yellow) are up 7.5% year-over-year.

Quits are up 3.5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are mostly moving sideways at a high level, and quits are increasing year-over-year. This is another strong report.

Black Knight Mortgage Monitor: 2017 Hurricane Impact on Mortgage Performance Worse than Katrina

by Calculated Risk on 11/07/2017 08:01:00 AM

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 4.40% of mortgages were delinquent in September, up from 4.27% in September 2016. Black Knight also reported that 0.7o% of mortgages were in the foreclosure process, down from 1.00% a year ago.

This gives a total of 5.10% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Despite Continued Home Price Acceleration, Housing Remains More Affordable Than Long-Term Benchmarks

Today, the Data & Analytics division of Black Knight, Inc. (NYSE: BKI) released its latest Mortgage Monitor Report, based on data as of the end of September 2017. Given continued acceleration in the rate of home price appreciation observed across most of the country, Black Knight thought it pertinent to examine both the current state of home affordability as well as potential impacts of future home price and interest rate increases on the home affordability landscape.

“Rising home prices continue to offset the majority of would-be savings from recent interest rate declines, which has kept home affordability near a post-recession low,” said Ben Graboske, Executive Vice President - Data & Analytics, Black Knight. “That being said, when viewing the market through a longer-term lens, affordability across most of the country still remains favorable to long-term benchmarks.”

...

In looking at the affordability landscape across the country, we certainly see varying levels of affordability in each market compared to their own long-term benchmarks,” Graboske explained. “But, by and large, the overall theme is that affordability in most areas, while tightening, remains favorable to long-term norms.” When looking at state-level data, payment-to-income ratios in 47 of 50 states remain below their 1995-2003 averages. Only Hawaii, California, Oregon, and Washington, D.C., have higher payment-to-income ratios today than their longer-term benchmarks.

...

In addition to affordability, Black Knight also took an in-depth look at the effect of recent hurricanes on mortgage performance and determined that Hurricanes Harvey and Irma have likely accounted for an increase of 135,800 past-due mortgages nationwide. The combined impacts of these two storms, which are being credited with a 27 bps rise in the national non-current rate – has already surpassed that of Hurricane Katrina in 2005 and is expected to increase further in October results, where the heaviest impact from Hurricane Irma is expected to be seen.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graphic from Black Knight looks at the delinquency roll count over time.

From Black Knight:

• Over 621,000 borrowers that were current on mortgage payments as of August became 30 days delinquent in September. This marks the highest single month inflow of delinquent loans in nearly 3 yearsThere is much more in the mortgage monitor.

• Increases in delinquent loan volumes are common for the month of September, but this month’s inflow was also impacted by the effects of hurricanes Harvey and Irma

• Later-stage delinquency rolls also increased with 30day to 60-day delinquency rolls hitting a 21-month high and 60-day to 90-day delinquency rolls hitting a 10-month high