by Calculated Risk on 9/12/2017 10:07:00 AM

Tuesday, September 12, 2017

BLS: Job Openings Increased Slightly in July

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.2 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.5 million and 5.3 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.2 million in July. The quits rate was 2.2 percent. The number of quits was little changed for total private and for government. Quits decreased in educational services (-16,000). The number of quits was little changed in all four regions.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in July to 6.170 million from 6.116 in June. This is the highest number of job openings since this series started in December 2000.

The number of job openings (yellow) are up 3% year-over-year.

Quits are up 4% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are mostly moving sideways at a high level, and quits are increasing. This is another strong report.

NFIB: Small Business Optimism Index increased slightly in August

by Calculated Risk on 9/12/2017 08:42:00 AM

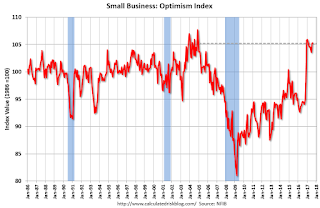

From the National Federation of Independent Business (NFIB): August 2017 Report:Small Business Optimism Holds its Altitude in August

The Index of Small Business Optimism rose 0.1 points to 105.3 in August, basically unchanged from July. Five of the 10 Index components posted a gain and five declined. The Index peaked for this recovery at 105.9 in January, just 0.6 points above the August reading.

...

Small business owners reported a seasonally adjusted average employment change per firm of 0.18 workers per firm over the past three months, virtually unchanged from July. Fourteen percent (up 1 point) reported increasing employment an average of 4.4 workers per firm and 12 percent (up 1 point) reported reducing employment an average of 2.4 workers per firm (seasonally adjusted). Fifty-nine percent reported hiring or trying to hire (down 1 point), but 52 percent (88 percent of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill. Nineteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (unchanged), second only to taxes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 105.3 in August.

Monday, September 11, 2017

Tuesday: Job Openings, Small Business Survey

by Calculated Risk on 9/11/2017 08:31:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jolted Higher, Relatively

Mortgage rates finally had a bad day, but everything's relative. This sort of bad day leaves the average lender quoting rates that would have been the best of 2017 any other time before last week. It's only when compared to last week that we'd consider them to be moderately higher.Tuesday:

How much higher are we talking about? Let's put it this way: most borrowers will still be quoted the same interest rates seen on Friday with the weakness being seen in the form of slightly higher upfront costs. [30YR FIXED - 3.875% Top Tier scenarios]

• At 6:00 AM ET, NFIB Small Business Optimism Index for August.

• At 10:00 AM, Job Openings and Labor Turnover Survey for July from the BLS. Jobs openings increased in June to 6.163 million from 5.702 in May. This was the highest number of job openings since this series started in December 2000. The number of job openings were up 11% year-over-year, and Quits were up 5% year-over-year.

Leading Index for Commercial Real Estate "Slips" in August

by Calculated Risk on 9/11/2017 03:00:00 PM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Slips in August

The Dodge Momentum Index moved lower in August, falling 2.4% to 129.1 (2000=100) from its revised July reading of 132.2. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The decline in August can be attributed to an 8.7% drop in the commercial component of the Momentum Index, while the institutional component rose 7.3%. The commercial component has seen a steep rise over the past year as large projects – particularly office buildings – entered the planning cycle. The August retreat for the commercial component brings planning activity back to a level more consistent with a sustainable pace of development.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 129.1 in August, down from 132.2 in July.

The index is only up 1.4% year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests some further increases in CRE spending over the next year.

Las Vegas: On Pace for Record Convention Attendance in 2017

by Calculated Risk on 9/11/2017 11:00:00 AM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered to new record highs.

As of July, visitor traffic is running slightly behind the record set in 2016 and on pace to be 10% above the pre-recession peak.

And convention attendance is now at record levels too. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

At this pace, convention attendance will set another new record in 2017, and be 5% above the pre-recession peak set in 2006.

There were many housing related conventions during the housing bubble, so it took some time for convention attendance to recover. But attendance has really picked up over the last three years.

Black Knight Mortgage Monitor: "Purchase Lending Hits Highest Level Since 2007"

by Calculated Risk on 9/11/2017 08:11:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for July today. According to BKFS, 3.90% of mortgages were delinquent in July, down from 4.51% in July 2016. BKFS also reported that 0.78% of mortgages were in the foreclosure process, down from 1.09% a year ago.

This gives a total of 4.68% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Purchase Lending Hits Highest Level Since 2007 Despite Continued Headwinds from Tight Lending; Refinance Share at 16-Year Low

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of July 2017. Reviewing second quarter mortgage origination volumes, Black Knight finds that while overall mortgage lending saw a 20 percent increase over Q1 2017, total volumes were down 16 percent from Q2 2016. Additionally, although purchase lending hit its highest level in 10 years, the total number of purchase mortgages being originated still falls far below pre-crisis (2000-2003) averages. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, more stringent credit requirements enacted in the wake of the Great Recession may be hampering purchase lending volumes.

“We saw positive growth in lending in the second quarter, with $467 billion in first lien mortgages originated,” said Graboske. “While down 16 percent from a year ago, that marks a 20 percent increase in mortgage lending over Q1. Drilling down into the make-up of those originations, we see that refinance lending made up just 31 percent of all Q2 originations – the lowest such share in over 16 years. Refinance volumes were down as well, falling 20 percent from Q1, but that drop was more than offset by a 57 percent seasonal rise in purchase lending. Purchase originations totaled $321 billion in Q2 2017; up six percent from last year, and the highest quarterly volume since 2007. As a result of growing average loan amounts for purchase originations, the total dollar amount of purchase originations is higher than averages seen from 2000-2003, prior to both the peak in home prices and the Great Recession that followed. This is partly due to rising home prices, but also comes as a result of an all-but-total absence of second lien usage for purchases, a shift toward high-dollar/low-risk loans among non-agency lenders and a higher share of cash purchases at the lower end of the market.

“However, the number of purchase loans being originated still lags the pre-crisis average by almost 30 percent; while overall purchase origination volumes are strong from a total dollar amount perspective, the market still does not appear to be performing at peak capacity. One key cause is the more stringent purchase lending credit requirements enacted in response to the financial crisis. Consider that borrowers with credit scores of 720 or higher accounted for 74 percent of all Q2 2017 purchase loans as compared to a pre-crisis average of 47 percent. Today, there are 65 percent fewer purchase loans being originated to borrowers with credit scores below 720 than in those years. The lack of credit availability for those borrowers is causing a strong headwind for the purchase market. Using 2000-2003 averages as a measure, as many as 645,000 purchase loans were not originated in Q2 due to tighter lending standards. To put it another way, the purchase market is operating at less than two-thirds of peak capacity because of these factors.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graphic from Black Knight compares the number, and balance, of mortgages impacted by hurricane Katrina in 2005, and hurricane Harvey in 2017.

From Black Knight:

• Though the situation around Hurricane Harvey continues to evolve, millions of Americans’ lives have been impacted by the storm and immense floodingThere is much more in the mortgage monitor.

• The effects on mortgage performance may actually exceed those of Hurricane Katrina in 2005, both due to the magnitude of the rainfall as well as the population of the impacted area

• FEMA-designated disaster areas in southeast Texas associated with Hurricane Harvey have over twice as many mortgaged properties as Katrina’s FEMA-designated disaster areas, carrying nearly 4x the unpaid principal balance

Sunday, September 10, 2017

Sunday Night Futures

by Calculated Risk on 9/10/2017 08:09:00 PM

Weekend:

• Schedule for Week of Sept 10, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 6, and DOW futures are up 120 (fair value).

Oil prices were up over the last week with WTI futures at $47.65 per barrel and Brent at $53.94 per barrel. A year ago, WTI was at $46, and Brent was at $48 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.66 per gallon - up sharply due the Hurricane Harvey - a year ago prices were at $2.19 per gallon - so gasoline prices are up 47 cents per gallon year-over-year.

The increase in gasoline prices will push up inflation in September, but prices will probably decline back to pre-hurricane levels fairly quickly.

Goldman: Hurricane and Economic Data

by Calculated Risk on 9/10/2017 09:32:00 AM

A few excerpts from a research note by Goldman Sachs economist Spencer Hill: Hurricane Handbook: Natural Disasters and Economic Data

• We find that major natural disasters are associated with a temporary slowdown in most major growth indicators. ... Modeling these effects, we estimate that hurricane-related disruptions could reduce 3Q GDP growth by as much as 1 percentage point. We believe the main channels for these GDP effects are consumption, inventories, housing, and the energy sector.CR Note: We've already seen a sharp increase in unemployment claims (as expected), and a drop in auto sales. Harvey and Irma will probably negatively impact other indicators for August and September. As Hill notes, we should see a sharp rebound later this year in many indicators.

• We expect a meaningful drag on key growth indicators over the next two months, including a temporary drag on September payrolls growth of 20k—or as much as 100k if severe storm effects persist into next week (the payrolls reference period). We also expect a near-term boost to headline inflation (around 0.2pp on the yoy rate) due to higher gasoline prices ...

• Given potentially sizeable growth effects from Harvey—and with Irma risks now moving to center stage—we are lowering our Q3 GDP tracking estimate by 0.8pp to +2.0%. However, we expect this weakness to reverse over the subsequent three quarters, more than recouping the lost output.

emphasis added

Saturday, September 09, 2017

Schedule for Week of Sept 10, 2017

by Calculated Risk on 9/09/2017 08:11:00 AM

The key economic reports this week are August retail sales and the Consumer Price Index (CPI).

For manufacturing, August industrial production, and the September New York Fed manufacturing survey, will be released this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for August.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 6.163 million from 5.702 in May. This was the highest number of job openings since this series started in December 2000.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up 5% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is a 0.13% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 300 thousand initial claims, up from 298 thousand the previous week.

8:30 AM: The Consumer Price Index for August from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: Retail sales for August be released. The consensus is for a 0.1% increase in retail sales.

8:30 AM ET: Retail sales for August be released. The consensus is for a 0.1% increase in retail sales.This graph shows retail sales since 1992 through July 2017.

8:30 AM: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 19.0, down from 25.2.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.2% increase in inventories.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 96.0, down from 96.8 in August.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2017

Friday, September 08, 2017

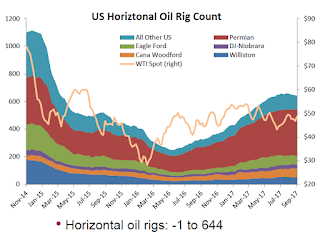

Oil Rigs "Rig counts continue to ease back"

by Calculated Risk on 9/08/2017 06:09:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Sept 8, 2017:

• Rig counts were off modestly this week

• Total US oil rigs were down 3 at 756

• Horizontal oil rigs were down 1 at 643

...

• Drilling Info rig counts are plateauing, still higher than Baker Hughes

• Texas – and Baker Hughes’ headquarters – faced challenging conditions this past week; numbers may be a bit more unreliable than usual.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.