by Calculated Risk on 2/14/2017 10:05:00 AM

Tuesday, February 14, 2017

NFIB: Small Business Optimism Index increased slightly in January

Earlier from the National Federation of Independent Business (NFIB): National Federation of Independent Business Monthly Survey Shows Another Gain in Small Business Optimism

Small business optimism rose again in January to its highest level since December 2004, suggesting that the post-election surge has staying power, according to the monthly National Federation of Independent Business (NFIB) Index of Small Business Optimism, released today.

...

The Index reached 105.9 in January, an increase of 0.1 points. The uptick follows the largest month-over-month increase in the survey’s history. Five of the Index components increased and five decreased, but many held near their record high.

...

[T]he seasonally adjusted average employment change per firm posting a gain of 0.15 workers per firm, the best reading since September 2015 and historically, a strong showing. ... Fifty-three percent reported hiring or trying to hire (up 2 points), but 47 percent reported few or no qualified applicants for the positions they were trying to fill. Fifteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 3 points).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 105.9 in January.

This is the highest level since 2004.

Monday, February 13, 2017

Tuesday: Yellen, PPI

by Calculated Risk on 2/13/2017 07:00:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 8:30 AM, The Producer Price Index for January from the BLS. The consensus is for 0.3% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

Lawler: Some Data on Institutional Holdings of Single-Family Properties

by Calculated Risk on 2/13/2017 03:10:00 PM

From housing economist Tom Lawler: Some Data on Institutional Holdings of Single-Family Properties

Invitation Homes, Blackstone Group’s single-family rental operator, recently went public, and its prospectus included some information on its portfolio of single-family rental properties. Other publicly-traded entities in the single-family rental business also provide such information, and I figured I’d compile some data.

Here is a table showing the number of single-family homes owned by selected publicly-traded companies (or subsidiaries of such companies). These totals include homes held for sale.

| Single-Family Homes Owned by Selected Institutions, 9/30/2016 | ||

|---|---|---|

| Number | Avg. Sq. Ft. | |

| Invitation Homes | 48,431 | 1,844 |

| American Homes 4 Rent | 48,158 | 1,959 |

| Colony Starwood Homes | 31,557 | 1,849 |

| Silver Bay Realty Trust Corp.* | 8,974 | 1,645 |

| Tricon American Homes | 8,006 | 1,521 |

| Total | 145,126 | 1,853 |

| *Silver Bay reported 8,837 SF homes, but the total excluded homes for sale, which I have estimated | ||

American Homes 4 Rent merged with American Residential Properties, Inc. in 2006, and that merger involved the “acquisition” of about 8,938 homes, bringing AH4R’s total property holdings to about the same as Invitation Homes.

Below is a table showing the geographic distribution of single-family homes held by these institutions. Note that reporting by “geographic market” in some cases varies by institution. E.g., one institution combines Charlotte and Raleigh, NC into one market, while another breaks those markets out separately. Also, two institutions have an “other” category – American Homes 4 Rent (a significant number of homes owned are in this category) and Colony Starwood Homes.

| Single Family Property Holdings of Certain Institions by Market, 9/30/2016 | ||||||

|---|---|---|---|---|---|---|

| Invitation Homes | American Homes 4 Rent | Colony Starwood Homes | Silver Bay Realty Trust | Tricom American Homes | Total | |

| West | ||||||

| Southern CA | 4,633 | 2,794 | 280 | 7,707 | ||

| Northern CA | 2,892 | 972 | 382 | 631 | 4,877 | |

| Seattle WA | 3,177 | 3,177 | ||||

| Phoenix AZ | 5,636 | 2,776 | 1,375 | 1,424 | 409 | 11,620 |

| Tucson AZ | 0 | 209 | 209 | |||

| Las Vegas NV | 940 | 1,023 | 1,713 | 290 | 295 | 4,261 |

| Reno NV | 0 | 251 | 251 | |||

| Salt Lake City UT | 0 | 1,048 | 1,048 | |||

| Denver CO | 0 | 1,981 | 1,981 | |||

| Midwest | ||||||

| Gr. Chicago ILIN | 2,973 | 2,047 | 5,020 | |||

| Minneapolis MN | 1,183 | 1,183 | ||||

| Indianapolis IN | 0 | 2,901 | 353 | 3,254 | ||

| Cincinnati OH | 0 | 1,952 | 1,952 | |||

| Columbus OH | 0 | 1,500 | 284 | 1,784 | ||

| South | ||||||

| Southeast FL | 5,588 | 3,693 | 308 | 604 | 10,193 | |

| Tampa FL | 4,997 | 1,729 | 3,717 | 1,111 | 500 | 12,054 |

| Orlando FL | 3,734 | 1,557 | 1,941 | 491 | 7,723 | |

| Jacksonville FL | 2,018 | 1,659 | 451 | 4,128 | ||

| Atlanta GA | 7,537 | 3,950 | 5,557 | 2,694 | 1,207 | 20,945 |

| Charlotte NC | 3,123 | 2,800 | 892 | 689 | 1,412 | 8,916 |

| Raleigh NC | 0 | 1,828 | 1,828 | |||

| Winston-Salem NC | 0 | 761 | 761 | |||

| Charleston SC | 0 | 725 | 725 | |||

| Columbia SC | 0 | 426 | 426 | |||

| Dallas TX | 0 | 4,340 | 2,043 | 504 | 614 | 7,501 |

| Houston TX | 0 | 3,153 | 2,726 | 820 | 6,699 | |

| San Antonio TX | 0 | 1,003 | 204 | 1,207 | ||

| Austin TX | 0 | 695 | 695 | |||

| Nashville TN | 0 | 2,381 | 240 | 2,621 | ||

| Not Specified | 0 | 7,087 | 967 | 8,054 | ||

| TOTAL | 48,431 | 46,915 | 30,611 | 8,837 | 8,006 | 142,800 |

| Note: AH4R, Colony, and Starwood totals exclude homes available for sale | ||||||

There are a few striking things to note. First, none of the properties held by these companies are in either the Northeast of the Mid-Atlantic regions of the country. Second, the different entities have decidedly different geographic concentrations, though none would be classified as “geographically diverse” relative to the US as a whole. And finally, the entities’ single-family rental property holdings are especially large relative to the size of the overall housing market in Atlanta, Charlotte, Orlando, Tampa, and (to a lesser extent) Phoenix.

Lawler: Selected Operating Statistics, Large Publicly-Traded Home Builders

by Calculated Risk on 2/13/2017 02:03:00 PM

From housing economist Tom Lawler.

Below is a table from Tom Lawler showing selected operating results of large publicly-traded builders for the quarter ended December 31, 2016.

| Net Orders | Settlements | Average Closing Price (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/16 | 12/15 | % Chg | 12/16 | 12/15 | % Chg | 12/16 | 12/15 | % Chg |

| D.R. Horton | 9,241 | 8,064 | 14.6% | 9,404 | 8,061 | 16.7% | 298 | 290 | 2.4% |

| Pulte Group | 4,202 | 3,659 | 14.8% | 6,197 | 5,662 | 9.4% | 396 | 353 | 12.3% |

| NVR | 3,645 | 3,100 | 17.6% | 4,419 | 4,010 | 10.2% | 389 | 382 | 1.9% |

| Cal Atlantic | 2,848 | 2,699 | 5.5% | 4,338 | 3,795 | 14.3% | 450 | 437 | 3.0% |

| Beazer Homes | 1,005 | 923 | 8.9% | 995 | 1,049 | -5.1% | 338 | 321 | 5.3% |

| Meritage Homes | 1,493 | 1,568 | -4.8% | 2,117 | 1,919 | 10.3% | 414 | 397 | 4.3% |

| MDC Holdings | 1,018 | 1,020 | -0.2% | 1,582 | 1,275 | 24.1% | 453 | 435 | 4.1% |

| M/I Homes | 999 | 897 | 11.4% | 1,416 | 1,253 | 13.0% | 356 | 360 | -1.1% |

| Total | 24,451 | 21,930 | 11.5% | 30,468 | 27,024 | 12.7% | 373 | 356 | 4.6% |

Gary Cohn and the Participation Rate

by Calculated Risk on 2/13/2017 12:05:00 PM

A Bloomberg article from December had some comments from Gary Cohn, the White House National Economic Council Director: Cohn in His Own Words

The published U.S. unemployment rate “is a very, very fictitious rate. It’s only that low because the participation rate has gone downward...”This is not a "fun fact", it is complete nonsense.

“The participation rate really measures people out in the U.S. population that are looking for jobs. There are so many people who are frustrated looking for jobs that they’ve just stopped. If the participation rate normalized -- this is a fun fact -- if it normalized to Day 1 of the Obama administration, we’d still be at an 11 percent plus unemployment rate.” -- July 2015

First, Cohn obviously ignored his own economic research at Goldman Sachs. In March 2016, Goldman Sachs economist David Mericle wrote: "At this point, we see the cyclical “participation gap” as nearly closed." If most of the cyclical gap is closed, then the remaining decline was due to demographics and long term trends.

Second, as I've been discussing for years, the reason the recent decline in the overall participation rate (for those 16+ years old) is mostly due to demographics and long term trends. The two main drivers of the lower participation rate have been aging baby boomers, and younger people staying in school. There are also other long term trends that have pushed down the participation rate.

Lets look at the participation rate trend for two young male cohorts, those 16 to 19 years old, and those 20 to 24 years old.

Click on graph for larger image.

Click on graph for larger image.Note: For simplification, I used men only for this graph. It is more complicated for women because there was a significant increase in women participating in the labor force in the '60s, '70s, and '80s due to changing societal norms.

There has been a down trend that for both the "16 to 19" and "20 to 24" year old male cohorts that preexisted the recent recession. This is because more people are staying in school (a long term positive for the economy). This pushed down the overall participation rate - especially since there were large cohorts recently in these age groups.

Another key trend has been the aging of the baby boomers. This is a little more complicated because we have to look at two factors - the participation rate for older workers, and the number of people in each cohort.

The following table tracks two cohorts over the last decade. Those people in the 50 to 54 year old cohort in January 2007, are now in the 60 to 64 year old cohort.

And those people in the 55 to 59 year old cohort in 2007, are now in the 65 to 69 year old cohort.

If we track these people over time, we see the large cohort in the 50 to 54 in January 2007 has seen their participation rate decline from 80.5% to 55.6%.

And the cohort in the 55 to 59 age group in 2007 has seen their participation rate decline from 71.9% to 31.8%. These people are retiring (being able to retire is a positive for an individual).

| Demographics and Participation, Selected Cohorts | ||||

|---|---|---|---|---|

| Population | 50 to 54 | 55 to 59 | 60 to 64 | 65 to 69 |

| Jan-07 | 20,667 | 18,194 | ||

| Jan-17 | 19,786 | 16,607 | ||

| Participation Rate | 50 to 54 | 55 to 59 | 60 to 64 | 65 to 69 |

| Jan-07 | 80.5% | 71.9% | ||

| Jan-17 | 55.6% | 31.8% | ||

These are large population cohorts, and the decline in their participation has pushed down the overall participation rate.

A careful analysis suggests that almost all of the decline in the overall participation rate over the last decade is related to demographics and long term trends.

Perhaps Mr. Cohn doesn't know how to normalize using demographics, but his assertions are nonsense.

Hotels: Solid Start to 2017

by Calculated Risk on 2/13/2017 10:11:00 AM

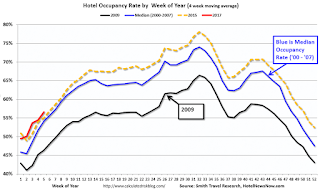

From HotelNewsNow.com: STR: US hotel results for week ending 4 February

he U.S. hotel industry reported mostly negative results in the three key performance metrics during the week of 29 January through 4 February 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In a year-over-year comparison with the week of 31 January through 6 February 2016:

• Occupancy: -1.5% to 55.6%

• Average daily rate (ADR): +0.2% to US$119.58

• Revenue per available room (RevPAR): -1.3% to US$66.51

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far occupancy in 2017 is slightly ahead of 2015, and well ahead of the median rate.

For hotels, this is the slow season of the year, and occupancy will pick up into the Spring.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, February 12, 2017

Sunday Night Futures

by Calculated Risk on 2/12/2017 07:42:00 PM

Weekend:

• Schedule for Week of Feb 12, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 2, and DOW futures are up 23 (fair value).

Oil prices were down over the last week with WTI futures at $53.74 per barrel and Brent at $56.56 per barrel. A year ago, WTI was at $29, and Brent was at $32 - so oil prices are up sharply year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.28 per gallon - a year ago prices were at $1.70 per gallon - so gasoline prices are up almost 60 cents a gallon year-over-year.

Update: "Scariest jobs chart ever"

by Calculated Risk on 2/12/2017 12:51:00 PM

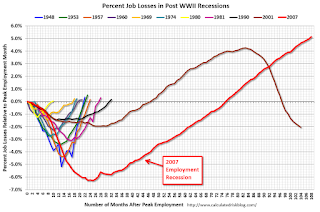

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I keep getting asked if I could post an update to the graph, and here it is through the January 2017 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 5.2% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Saturday, February 11, 2017

Schedule for Week of Feb 12, 2017

by Calculated Risk on 2/11/2017 08:01:00 AM

The key economic reports this week are Retail Sales, Housing Starts, and the Consumer Price Index (CPI).

For manufacturing, January industrial production, and the February New York, and Philly Fed manufacturing surveys, will be released this week.

Fed Chair Janet Yellen is scheduled to deliver the Semiannual Monetary Policy Report to the Congress.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for January.

8:30 AM: The Producer Price Index for January from the BLS. The consensus is for 0.3% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for January will be released. The consensus is for 0.1% increase in retail sales in January.

8:30 AM ET: Retail sales for January will be released. The consensus is for 0.1% increase in retail sales in January.This graph shows retail sales since 1992 through December 2016.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 7.5, up from 6.5.

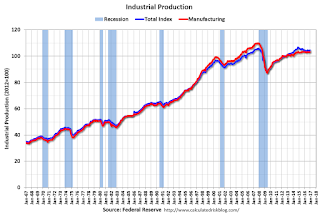

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for no change in Industrial Production, and for Capacity Utilization to be unchanged at 75.5%.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 68, up from 67 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.4% increase in inventories.

10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C.

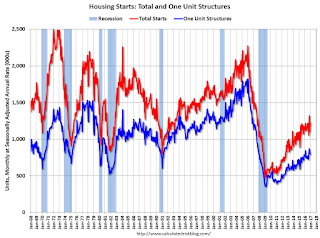

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. The consensus is for 1.232 million, up from the December rate of 1.226 million.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 246 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 23.6, up from 19.3.

11:00 AM: The New York Fed will release their Q4 2016 Household Debt and Credit Report

No major economic releases scheduled.

Friday, February 10, 2017

Sacramento Housing in January: Sales up 14%, Active Inventory down 20% YoY

by Calculated Risk on 2/10/2017 06:55:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In January, total sales were up 14.3% from January 2016, and conventional equity sales were up 18.6% compared to the same month last year.

In January, 5.7% of all resales were distressed sales. This was up from 4.8% last month, and down from 9.1% in January 2016.

The percentage of REOs was at 3.2%, and the percentage of short sales was 2.5%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 19.7% year-over-year (YoY) in January. This was the 21st consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 15.3% of all sales - this has been generally declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.