by Calculated Risk on 2/11/2017 08:01:00 AM

Saturday, February 11, 2017

Schedule for Week of Feb 12, 2017

The key economic reports this week are Retail Sales, Housing Starts, and the Consumer Price Index (CPI).

For manufacturing, January industrial production, and the February New York, and Philly Fed manufacturing surveys, will be released this week.

Fed Chair Janet Yellen is scheduled to deliver the Semiannual Monetary Policy Report to the Congress.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for January.

8:30 AM: The Producer Price Index for January from the BLS. The consensus is for 0.3% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for January will be released. The consensus is for 0.1% increase in retail sales in January.

8:30 AM ET: Retail sales for January will be released. The consensus is for 0.1% increase in retail sales in January.This graph shows retail sales since 1992 through December 2016.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 7.5, up from 6.5.

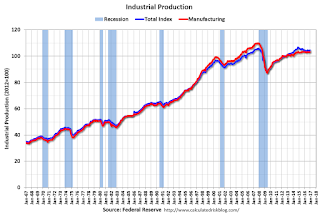

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for no change in Industrial Production, and for Capacity Utilization to be unchanged at 75.5%.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 68, up from 67 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.4% increase in inventories.

10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C.

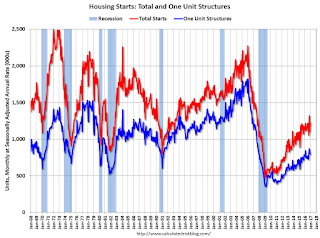

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. The consensus is for 1.232 million, up from the December rate of 1.226 million.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 246 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 23.6, up from 19.3.

11:00 AM: The New York Fed will release their Q4 2016 Household Debt and Credit Report

No major economic releases scheduled.