by Calculated Risk on 12/28/2016 06:05:00 PM

Wednesday, December 28, 2016

Duy: Is The Fed About To Experience A Repeat of 2016?

From Tim Duy at Fed Watch: Is The Fed About To Experience A Repeat of 2016?

In the most recent Summary of Economic Projections, Fed officials penciled in three 25bp rate hikes for 2017. The reality, however, could be very different. We all remember how “four” became “one” in 2016. The median dots are neither a promise nor an official forecast. As 2016 progressed, forecasts associated with a lower path of SEP “dots” evolved as the consensus view of policymakers. Will the same happen this year? I don’t think so; it is hard to see the Fed on pause for another twelve months.Three hikes may be more likely than one, but right now I think two hikes is the most likely - but it depends on the data and on fiscal policy (a great unknown).

...

Bottom Line: The economic situation on the ground is very different from December of last year. Whereas the decision to raise rates at that time looked ill-advised, this latest action appears more appropriate given the likely medium-term path of the US economy. Assuming the US economy is near full employment, that path likely contains enough upward pressure on activity to justify more than one more rate increase in 2017. Three I think is more likely than one. That said, the change in administrations and the path of fiscal policy creates uncertainties in both directions.

Question #8 for 2017: How much will Residential Investment increase?

by Calculated Risk on 12/28/2016 02:08:00 PM

Two days ago I posted some questions for next year: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

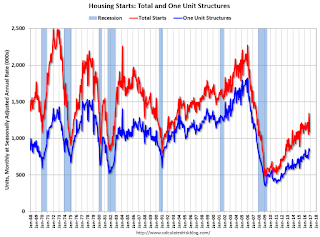

8) Residential Investment: Residential investment (RI) was sluggish in 2016, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2017? How about housing starts and new home sales in 2017?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2016.

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish. Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year since then.

RI as a percent of GDP is still very low - close to the lows of previous recessions - and was sluggish in 2016.

Housing starts are on pace to increase close to 5% in 2016. And even after the significant increase over the last four years, the approximately 1.16 million housing starts in 2016 will still be the 13th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the seven lowest years were 2008 through 2014). The other lower years were the bottoms of previous recessions.

New home sales in 2016 were up about 12% compared to 2015 at close to 560 thousand.

Here is a table showing housing starts and new home sales over the last decade. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That would suggest starts would increase close to 30% over the next few years from the 2016 level.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2068 | --- | 1,283 | --- |

| 2006 | 1801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1003 | 8.5% | 437 | 1.9% |

| 2015 | 1112 | 10.9% | 501 | 14.7% |

| 20161 | 1163 | 4.6% | 562 | 12.2% |

| 12016 estimated | ||||

Most analysts are looking for starts to increase to around 1.25 million in 2017, and for new home sales of around 600 to 650 thousand. This would be an increase of around 7% for starts and maybe 10% for new home sales.

I think there will be further growth in 2017, but I think a combination of higher mortgage rates, less multi-family starts, and not enough lots for low-to-mid range new homes will mean sluggish growth in 2017.

My guess is starts will increase to just over 1.2 million in 2017 and new home sales will be in the low 600 thousand range.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

NAR: Pending Home Sales Index decreased 2.5% in November, down 0.4% year-over-year

by Calculated Risk on 12/28/2016 10:06:00 AM

From the NAR: Pending Home Sales Backpedal in November

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 2.5 percent to 107.3 in November from 110.0 in October. After last month's decrease in activity, the index is now 0.4 percent below last November (107.7) and is at its lowest reading since January (105.4).This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

...

The PHSI in the Northeast nudged forward 0.6 percent to 97.5 in November, and is now 5.7 percent above a year ago. In the Midwest the index declined 2.5 percent to 103.5 in November, and is now 2.4 percent lower than November 2015.

Pending home sales in the South decreased 1.2 percent to an index of 118.7 in November and are now 1.3 percent lower than last November. The index in the West fell 6.7 percent in November to 101.0, and is now 1.0 percent below a year ago.

emphasis added

Tuesday, December 27, 2016

Zillow Forecast on Case-Shiller Index: "Expect a (Very) Modest Slowdown" in November

by Calculated Risk on 12/27/2016 05:55:00 PM

The Case-Shiller house price indexes for October were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: November Case-Shiller Forecast: Expect a (Very) Modest Slowdown

After several months in a row of accelerating growth in U.S. home prices, the pace of appreciation is expected to slow somewhat in November, according to Zillow’s November Case-Shiller forecast.The year-over-year change for the 10-city and 20-city indexes will probably be slightly lower in the November report compared to the October report. The change for the National index will probably be about the same.

The November Case-Shiller national index is expected to grow 5.6 percent year-over-year and 0.7 percent month-to-month (seasonally adjusted), on par with the pace of annual growth and down slightly from the 0.9 percent monthly appreciation recorded in October. We expect the 10-city index to grow 4.1 percent year-over-year and 0.4 percent (SA) from October, and the 20-city index is expected to grow 5 percent annually and 0.5 percent (SA) from October. Both annual and seasonally adjusted monthly appreciation forecasted for November for the 10- and 20-city indices would be slower than that recorded in October.

Zillow’s November Case-Shiller forecast is shown in the table below. These forecasts are based on today’s October Case-Shiller data release and the November 2016 Zillow Home Value Index. The November S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, January 31.

Question #9 for 2017: What will happen with house prices in 2017?

by Calculated Risk on 12/27/2016 02:54:00 PM

Yesterday I posted some questions for next year: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

7) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 6% or so in 2016. What will happen with house prices in 2017?

The following graph shows the year-over-year change through October 2016, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 4.3% compared to October 2015, the Composite 20 SA was up 5.1% and the National index SA was up 5.6% year-over-year. Other house price indexes have indicated similar gains (see table below).

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-16 | 5.1% |

| Case-Shiller National | Oct-16 | 5.6% |

| CoreLogic | Oct-16 | 6.7% |

| Zillow | Nov-16 | 6.5% |

| Black Knight | Oct-16 | 5.6% |

| FHFA Purchase Only | Oct-16 | 6.2% |

Most analysts are forecasting prices will increase in the 3% to 5% range in 2017.

Inventories will probably remain low in 2017, although I expect inventories to increase on a year-over-year basis by December of 2017. Low inventories, and a decent economy suggests further price increases in 2017.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2017, it seems likely that price appreciation will slow to the low-to-mid single digits.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Real Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/27/2016 11:55:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.6% year-over-year in October

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the National Index, not seasonally adjusted (NSA) was reported as being at a new nominal high. The seasonally adjusted (SA) index was reported as being at the previous the bubble peak. However, in real terms, the National index (SA) is still about 15.3% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 5%. In October, the index was up 5.6% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $277,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at the bubble peak, and the Case-Shiller Composite 20 Index (SA) is back to July 2005 levels, and the CoreLogic index (NSA) is back to August 2005.

Real House Prices

In real terms, the National index is back to March 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to September 2003 levels, the Composite 20 index is back to April 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.6% year-over-year in October

by Calculated Risk on 12/27/2016 09:10:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P CoreLogic Case-Shiller National Index Extends New High as Price Gains Continues

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.6% annual gain in October, up from 5.4% last month. The 10-City Composite posted a 4.3% annual increase, up from 4.2% the previous month. The 20-City Composite reported a year-over-year gain of 5.1%, up from 5.0% in September.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last nine months. In October, Seattle led the way with a 10.7% year-over-year price increase, followed by Portland with 10.3%, and Denver with an 8.3% increase. 10 cities reported greater price increases in the year ending October 2016 versus the year ending September 2016.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in October. The 10-City Composite remains unchanged and the 20-City Composite posted a 0.1% increase in October. After seasonal adjustment, the National Index recorded a 0.9% month-overmonth increase, while both the 10-City and 20-City Composites each reported a 0.6% month-overmonth increase. 13 of 20 cities reported increases in September before seasonal adjustment; after seasonal adjustment, all 20 cities saw prices rise.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.0% from the peak, and up 0.6% in October (SA).

The Composite 20 index is off 7.8% from the peak, and up 0.6% (SA) in October.

The National index is at the previous peak (SA), and up 0.85% (SA) in October. The National index is up 35.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to October 2015.

The Composite 20 SA is up 5.1% year-over-year.

The National index SA is up 5.6% year-over-year.

Note: According to the data, prices increased in all 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, December 26, 2016

Question #10 for 2017: Will housing inventory increase or decrease in 2017?

by Calculated Risk on 12/26/2016 07:27:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

10) Housing Inventory: Housing inventory declined in 2015 and 2016. Will inventory increase or decrease in 2017?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2016.

According to the NAR, inventory decreased to 1.85 million in November 2016 from 2.04 million in November 2015.

This was the lowest level for the month of November since 2000.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Inventory decreased 9.3% year-over-year in November compared to November 2015. (blue line). Note that the blue line (year-over-year change) turned slightly positive in 2013, but has been negative since mid-2015.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

I've heard reports of more inventory in some coastal areas of California, in New York city and for high rise condos in Miami. But we haven't seen a change in trend for inventory yet.

The recent increase in interest rates might impact inventory. Looking back at the "taper tantrum" in May and June 2013 suggests we might see more inventory in the coming months. In May 2013, inventory was down 13% year-over-year, but by September 2013, inventory was unchanged year-over-year. However that change in year-over-year inventory was part of an ongoing trend (look at 2013 in the second graph above), and the "taper tantrum" might not have been the cause.

I was wrong on inventory last year, but right now my guess is active inventory will increase in 2017 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2017). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent increase in interest rates.

If correct, this will keep house price increases down in 2017 (probably lower than the 5% or so gains in 2014, 2015 and 2016).

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Ten Economic Questions for 2017

by Calculated Risk on 12/26/2016 11:56:00 AM

Here is a review of the Ten Economic Questions for 2016.

Here are my ten questions for 2017. I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2017, and - when there are surprises - to adjust my thinking.

1) US Policy: There is significant uncertainty as to fiscal and regulatory policy in 2017. This is probably the biggest risk for the US economy this coming year. I assume some sort of tax cuts will be passed, possibly some additional infrastructure spending, and possibly some deregulation.

These is the potential for significant policy mistakes - like defaulting on the debt (seems unlikely) - or the start of a trade war. Usually at this point in the transition process, there is a pretty clear understanding of the new administration's policy proposals, but not this time. I'll write much more about this issue.

2) Economic growth: Heading into 2017, most analysts are pretty sanguine and expecting some pickup in growth due to tax cuts and infrastructure spending. How much will the economy grow in 2017?

3) Employment: Through November, the economy has added almost 2,000,000 jobs this year, or 180,000 per month. As expected, this was down from the 230 thousand per month in 2015. Will job creation in 2017 be as strong as in 2016? Or will job creation be even stronger, like in 2014 or 2015? Or will job creation slow further in 2017?

4) Unemployment Rate: The unemployment rate was at 4.6% in November, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 4.5% to 4.6% range in Q4 2017. What will the unemployment rate be in December 2017?

5) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

6) Monetary Policy: The Fed raised rates this month, and now the question is how much will the Fed raise rates in 2017? The market is pricing in three 25 bps rate hikes in 2017, and most analysts expect two to three hikes in 2017. Will the Fed raise rates in 2017, and if so, by how much?

7) Real Wage Growth: Wage growth picked up in 2016. How much will wages increase in 2017?

8) Residential Investment: Residential investment (RI) was sluggish in 2016, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2017? How about housing starts and new home sales in 2017?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% to 6% or so in 2016. What will happen with house prices in 2017?

10) Housing Inventory: Housing inventory declined in 2015 and 2016. Will inventory increase or decrease in 2017?

There are other important questions, but these are the ones I'm focused on right now. I'll write on each of these questions over the next couple of weeks.

Vehicle Sales Forecast: Sales Over 17 Million SAAR Again in December, On Track for Record Year in 2016

by Calculated Risk on 12/26/2016 09:53:00 AM

The automakers will report December vehicle sales on Wednesday, January 4th.

Note: There were 27 selling days in December 2016, down from 28 in December 2015.

From WardsAuto: December Light-Vehicle Sales to Push U.S. Market to New Record

December U.S. light-vehicle sales are forecast to finish strong enough for 2016 to top 2015’s record 17.396 million units. However, actual volume largely will be determined by results in the final third of the month, because a major portion of December’s deliveries typically occur after Christmas.Here is a table (source: BEA) showing the 5 top years for light vehicle sales through November, and the top 5 full years. 2016 will probably finish in the top 3, and could be the best year ever - just beating last year.

The forecast 17.7 million-unit seasonally adjusted annual rate is below November’s 17.8 million, but above December 2015’s 17.4 million.

...

Despite the drop in December’s volume, total 2016 sales will end at 17.41 million units, barely edging out the all-time high set last year.

emphasis added

| Light Vehicle Sales, Top 5 Years and Through November | ||||

|---|---|---|---|---|

| Through November | Full Year | |||

| Year | Sales (000s) | Year | Sales (000s) | |

| 1 | 2000 | 16,109 | 2015 | 17,396 |

| 2 | 2001 | 15,812 | 2000 | 17,350 |

| 3 | 2016 | 15,783 | 2001 | 17,122 |

| 4 | 2015 | 15,766 | 2005 | 16,948 |

| 5 | 1999 | 15,498 | 1999 | 16,894 |