by Calculated Risk on 12/14/2016 09:25:00 AM

Wednesday, December 14, 2016

Industrial Production declined 0.4% in November

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.4 percent in November after edging up 0.1 percent in October. In November, manufacturing output moved down 0.1 percent, and mining posted a gain of 1.1 percent. The index for utilities dropped 4.4 percent, as warmer-than-normal temperatures reduced the demand for heating. At 103.9 percent of its 2012 average, total industrial production in November was 0.6 percent lower than its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in November to 75.0 percent, a rate that is 5.0 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.0% is 5.0% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production declined in November to 104.2. This is 18.9% above the recession low, and is close to the pre-recession peak.

This was below expectations of a 0.2% decrease.

Retail Sales increased 0.1% in November

by Calculated Risk on 12/14/2016 08:36:00 AM

On a monthly basis, retail sales increased 0.1 percent from October to November (seasonally adjusted), and sales were up 3.8 percent from November 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $465.5 billion, an increase of 0.1 percent from the previous month, and 3.8 percent above November 2015. ... The September 2016 to October 2016 percent change was revised from up 0.8 percent to up 0.6 percent.

Click on graph for larger image.

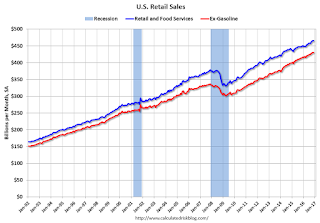

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.8% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.8% on a YoY basis.The increase in November was below expectations and October sales were revised down, however September sales were revised up.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 12/14/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 9, 2016.

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 5 percent compared with the previous week. The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since October 2014, 4.28 percent, from 4.27 percent, with points decreasing to 0.36 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "2 percent higher than the same week one year ago".

In general, the purchase index has held up over the last month (up and down week to week). However, refinance activity - as would be expected with higher rates - has declined sharply.

Tuesday, December 13, 2016

Wednesday: FOMC Announcement Retail Sales, PPI, Industrial Production

by Calculated Risk on 12/13/2016 06:24:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady-to-Lower Ahead of Fed Day

Mortgage rates started stronger out of the gate, but morning weakness in bond markets prompted many lenders to adjust rates higher by early afternoon. On balance, the average lender ended the day just a hair better than yesterday's latest levels. To be clear, we're talking about microscopic differences. Note rates are the same as yesterday. The most prevalent conventional 30yr fixed quote is 4.25%, followed closely by 4.125%. The microscopic improvement refers to changes in upfront costs/credits.Wednesday:

In the bigger picture, rates remain very close to the highest levels in more than 2 years.

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for November will be released. The consensus is for 0.4% increase in retail sales in November.

• At 8:30 AM, The Producer Price Index for November from the BLS. The consensus is for a 0..2% increase in prices, and a 0.2% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.0%.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for no change in inventories.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Las Vegas: On Pace for Record Visitor Traffic and Convention Attendance in 2016

by Calculated Risk on 12/13/2016 02:42:00 PM

Another update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered to new record highs.

As of October, visitor traffic is running 2.9% above the record set in 2015 and on pace to be 10% above the pre-recession peak.

And convention attendance has returned too. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention attendance is up 14.0% from the same period in 2015, after being up 14.0% in 2015 compared to 2014.

At this pace, convention attendance will set a new record in 2016, and be close to 2% above the pre-recession peak set in 2006.

There were many housing related conventions during the housing bubble, so it has taken some time for convention attendance to recover. But attendance has really picked up over the last two years.

Mortgage Equity Withdrawal Positive in Q3

by Calculated Risk on 12/13/2016 10:53:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q3 2016, the Net Equity Extraction was a positive $39 billion, or a positive 1.1% of Disposable Personal Income (DPI) . This is only the second positive MEW since Q1 2008.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $86 billion in Q3.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.2 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With a slower rate of debt cancellation, MEW will likely stay positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

NFIB: Small Business Optimism Index increases in November

by Calculated Risk on 12/13/2016 08:32:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Soars Post Election

The full November index, calculated as it is every month, improved 3.5 points to 98.4, which is just above the 42-year average and only the third time since 2007 that it has broken into above average territory.

Plans to hire jumped five points from the previous month. Expected higher sales rose from a net one percent in October to net 11 percent in November. But the blockbuster was expected better business conditions, which shot from a net -7 percent to 12.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.4 in November.

This is the highest level since 2014.

Monday, December 12, 2016

Duy: December FOMC Preview

by Calculated Risk on 12/12/2016 07:30:00 PM

A few excerpts from long post by Tim Duy at Fed Watch: December FOMC Preview

The Federal Reserve will nudge rates 25bp higher this week. This will not end the policy tension among FOMC members. How will that unfold in 2017? My expectation is that whereas 2016 began with excessively high expectations for rate hikes, 2017 will be the opposite. My tendency is think that the risks to the Fed’s median forecast of 50bp of rate hikes in 2017 are more weighted to the upside than the downside. Beware then of a more aggressive than expected Fed.Other FOMC previews from Goldman Sachs, Merrill Lynch, Nomura, and a review of projections.

...

Bottom Line: The Fed will hike rates this week; the unemployment drop will give added weight to case for a preemptive rate hike. They will play it close to the vest regarding future policy; although the stars are beginning to align for stronger growth next year, this represents more of a risk than a reality. Expect Federal Reserve Chair Yellen to emphasize that policy is data dependent.

The consensus is the Fed will hike rates this week. Currently expectations are the Fed will hike twice next year ...

Update: Prime Working-Age Population Growing Again, Near Previous Peak

by Calculated Risk on 12/12/2016 01:39:00 PM

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of November 2016, there are still fewer people in the 25 to 54 age group than in 2007.

However the prime working age (25 to 54) will probably hit a new peak in December!

An update: in 2014, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through November 2016.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity. And it appears the prime working age group will exceed the previous peak later this year.

Note: If we expand the prime working age to 25 to 64, the story is a little different. The 55 to 64 age group is still expanding, but that will change in a few years - and that will slow growth in the 25 to 64 total age group.

Demographics are now improving in the U.S., and this is a reason for optimism.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 12/12/2016 11:55:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2016 are now up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early October 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 5% from a year ago, and CME futures are up about 30% year-over-year.