by Calculated Risk on 11/11/2016 10:50:00 AM

Friday, November 11, 2016

Preliminary November Consumer Sentiment increases to 91.6

The preliminary University of Michigan consumer sentiment index for November was at 91.6, up from 87.2 in October.

The Sentiment Index in early November erased the small October decline to climb to its highest level since mid 2016 and rise slightly above the 2016 average of 91.1. The recent gain in sentiment was driven by an improved outlook for the economy. The most striking finding in early November was that both near and long-term inflation expectations jumped to 2.7% from last month's record matching lows of 2.4%. These increases must be replicated before they can be taken to indicate a troublesome development; thus far, the data has simply repeated the March 2016 peaks. Nonetheless, it may be viewed as added justification for next month's expected interest rate hike. The expected small increase in interest rates had little impact on favorable buying attitudes, and still supports a 2.5% increase in real consumer spending during 2017. Unfortunately, the November data must be accompanied by the proviso that it was collected before the result of the Presidential election was known late Tuesday.

emphasis added

Click on graph for larger image.

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 11/11/2016 09:08:00 AM

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of October 2016, there are still fewer people in the 25 to 54 age group than in 2007!

However the prime working age (25 to 54) will probably hit a new peak very soon.

An update: in 2014, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2016.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity. And it appears the prime working age group will exceed the previous peak later this year.

Note: If we expand the prime working age to 25 to 64, the story is a little different. The 55 to 64 age group is still expanding, but that will change in a few years - and that will slow growth in the 25 to 64 total age group.

Demographics are now improving in the U.S., and this is a reason for optimism.

Thursday, November 10, 2016

Off-topic: Acceptance and Response

by Calculated Risk on 11/10/2016 05:29:00 PM

I've spoken to several young adults today, and they are in shock and experiencing overwhelming grief about the election. How could this happen in America? And what can we do?

I've also spoken to older adults, and they are terrified by the echoes of history. We need to be on guard, but not borrow trouble (I doubt the worst fears will come to pass).

First, we have to accept that Mr. Trump will be the next President.

Second, we must make our voices heard and start preparing for the elections in two and four years. I expect to disagree with many of Trump's policy proposals, but I will keep an open mind. Maybe he will surprise us (I doubt it). I will write about the economic policies on this blog, but I care deeply about the non-economic issues too.

Third, we must make it clear what is not acceptable in a civil society.

No good person should EVER accept as normal the racism, bigotry, misogyny and xenophobia Mr. Trump and some of his supporters exhibited during the election. All good people must speak out every time we hear a disgusting comment. I'd hope Mr. Trump would speak out against the rash of verbal attacks we've seen over the last day on immigrants and non-white Americans. This must stop.

We should NEVER accept any attack on the 1st amendment. Being able to speak out is the people's check on abuse.

We should NEVER accept Mr. Trump abusing his power to silence or intimidate his critics, political opponents and accusers.

We should NEVER accept policies that disregard science and evidence.

Make your voice heard. And get ready for 2018.

Merrill on October Retail Sales

by Calculated Risk on 11/10/2016 03:41:00 PM

Retail sales for October will be released next Tuesday. The consensus forecast is for sales to increase 0.6% month-over-month.

From Merrill Lynch:

Consumer spending accelerated in October, according to internal aggregated BAC credit and debit card data. Using the BAC card data, retail sales ex-autos climbed by 0.8% mom seasonally adjusted in October. This follows the 0.5% mom gain in September, leaving an improving trend. ... This is indicative of a solid pace of consumer spending. Indeed ... the consumer has strong support from wealth gains and income creation, but has restrained spending somewhat, given the propensity for greater savings and deleveraging.It looks like Q4 is off to a solid start.

MBA: Mortgage Delinquencies and Foreclosures Decrease in Q3

by Calculated Risk on 11/10/2016 11:42:00 AM

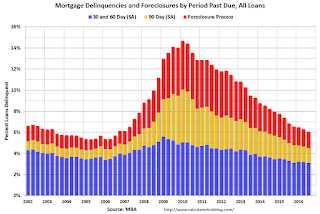

From the MBA: Delinquencies and Foreclosures Decrease in Latest Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased 14 basis points to a seasonally adjusted rate of 4.52 percent of all loans outstanding at the end of the third quarter of 2016. This was the lowest level since the second quarter of 2006 when the delinquency rate was 4.39 percent. The delinquency rate was 47 basis points lower than one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.30 percent, a decrease of two basis points from the previous quarter, and down eight basis points from one year ago. This foreclosure starts rate was at its lowest level since the second quarter of 2000.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 1.55 percent, down nine basis points from the previous quarter and 33 basis points lower than one year ago. The foreclosure inventory rate was at its lowest level since the second quarter of 2007.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.96 percent, a decrease of 15 basis points from previous quarter, and a decrease of 61 basis points from last year. The serious delinquency rate was at its lowest level since the third quarter of 2007.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Note that the total percent delinquencies and foreclosures is below the 2002 level.

The percent of loans 30 and 60 days delinquent ticked down in Q3, and is below the normal historical level.

The 90 day bucket declined further in Q3, but remains a little elevated.

The percent of loans in the foreclosure process continues to decline, and is still above the historical average.

The 90 day bucket and foreclosure inventory are still elevated, but should be close to normal in 2017. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

Weekly Initial Unemployment Claims decrease to 254,000

by Calculated Risk on 11/10/2016 08:34:00 AM

The DOL reported:

In the week ending November 5, the advance figure for seasonally adjusted initial claims was 254,000, a decrease of 11,000 from the previous week's unrevised level of 265,000. The 4-week moving average was 259,750, an increase of 1,750 from the previous week's revised average. The previous week's average was revised up by 250 from 257,750 to 258,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 88 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 259,750.

This was lower than the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, November 09, 2016

Thursday: Unemployment Claims

by Calculated Risk on 11/09/2016 07:16:00 PM

From Matthew Graham at Mortgage News Daily: Worst Day For Mortgage Rates in Over 3 Years

Mortgage Rates skyrocketed today, relative to their average range of movement. It was the single biggest move higher since the days of the taper tantrum in mid-2013. Virtually all lenders are quoting conventional 30yr fixed rates that are at least an eighth of a point higher versus yesterday. Over the past decade, you can count single-day eighth-point moves without using any toes. Some lenders were a quarter point higher, which has only happened a few times, ever.Thursday:

emphasis added

• 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 263 thousand initial claims, down from 265 thousand the previous week.

The Future is still Bright!

by Calculated Risk on 11/09/2016 02:53:00 PM

In January 2013 I wrote The Future's so Bright .... In that post I outlined why I was becoming more optimistic. I updated that post earlier this year (with a discussion of demographics).

For new readers: I was very bearish on the economy when I started this blog in 2005 - back then I wrote mostly about housing (see: LA Times article and more here for comments about the blog). I predicted a recession in 2007, and then I started looking for the sun in early 2009, and I've been fairly positive since then (although I expected a sluggish recovery).

I've also been optimistic about next year (2017), with most economic indicators improving - more jobs, lower unemployment rate, rising wages and much more - and with more room to run for the current expansion. Also the demographics in the U.S. are becoming more favorable (see here for more on improving demographics).

Now Mr. Trump has been elected President. How does that change the outlook?

In the long term, there is little or no change to the outlook. The future is still bright! Although I'm concerned about the impact of global warming.

In the short term, there is also no change (Mr Obama will be President until January, and it takes time for new policies to be implemented).

The intermediate term might be impacted. The general rule is don't invest based on your political views, however it is also important to look at the impact of specific policies.

I will probably disagree with most of Mr. Trump's proposals for both normative reasons (different values), and for positive reasons (because Mr. Trump rejects data that doesn't fit his view - and that is not good).

With Mr. Trump, no one knows what he will actually do. He has said he'd "build a wall" along the border with Mexico, renegotiate all trade deals, cut taxes on high income earners, repeal Obamacare and more. As an example, repealing the ACA - without a replacement - would lead to many millions of Americans without health insurance. And those with preexisting conditions would be uninsurable. This seems politically unlikely (without a replacement policy), but it is possible.

Since Trump is at war with the data (he rejects data that doesn't fit his views), I don't expect evidence based policy proposals - and that almost always means bad results. However bad results might mean higher deficits with little return - not an economic downturn. Until we see the actual policy proposals, it is hard to predict the impact. I will not predict a recession just because Trump is elected. In fact, additional infrastructure spending might give the economy a little boost over the next year or two. On the other hand, deporting 10+ million people would probably lead to a recession. We just have to wait and see what is enacted.

In conclusion: The future is still bright, but there might be a storm passing through.

Leading Index for Commercial Real Estate "moves higher" in October

by Calculated Risk on 11/09/2016 12:21:00 PM

Note: This index is a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data & Analytics: Dodge Momentum Index Moves Higher in October

The Dodge Momentum Index grew 4.1% in October to 133.6 from its revised September reading of 128.3 (2000=100). The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. October’s gain nearly reversed the loss in September, and returns the Momentum Index to the rising trend that began earlier in the year. The commercial component of the Momentum Index rose 6.1% in October, and is 20% above last year. This suggests that despite being in a more mature phase of the building cycle, commercial construction has room for further growth in the coming months. The institutional component of the Momentum Index increased 1.4% in the month, and is now 10% higher than one year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 133.6 in October, up from 128.3 in September.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". In general, this suggests further increases in CRE spending over the next year.

Phoenix Real Estate in October: Sales up 13%, Inventory up 1% YoY

by Calculated Risk on 11/09/2016 10:11:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up 1.0% year-over-year in October. This was the eighth consecutive month with a YoY increase in inventory, following fifteen consecutive months of YoY declines in Phoenix.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in October were up 12.6% year-over-year.

2) Cash Sales (frequently investors) were down to 21.0% of total sales.

3) Active inventory is now up 1.0% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

Now inventory is increasing a little again, and - if this trend continues in Phoenix - price increases will probably slow in Phoenix. According to Case-Shiller, prices in Phoenix are up 2.7% through August (about a 4.0% annual rate) - slower than in 2015.

| October Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Oct-08 | 5,384 | --- | 1,348 | 25.0% | 55,7031 | --- |

| Oct-09 | 8,121 | 50.8% | 2,688 | 33.1% | 39,312 | -29.4% |

| Oct-10 | 6,591 | -18.8% | 2,800 | 42.5% | 45,252 | 15.1% |

| Oct-11 | 7,561 | 14.7% | 3,336 | 44.1% | 27,266 | -39.7% |

| Oct-12 | 7,020 | -7.2% | 3,081 | 43.9% | 22,702 | -16.7% |

| Oct-13 | 6,038 | -14.0% | 1,910 | 31.6% | 26,267 | 15.7% |

| Oct-14 | 6,186 | 2.5% | 1,712 | 27.7% | 27,760 | 5.7% |

| Oct-15 | 6,308 | 2.0% | 1,570 | 24.9% | 24,702 | -11.0% |

| Oct-16 | 7,102 | 12.6% | 1,494 | 21.0% | 24,950 | 1.0% |

| 1 October 2008 probably includes pending listings | ||||||