by Calculated Risk on 9/27/2015 07:52:00 PM

Sunday, September 27, 2015

Monday: Personal Income and Outlays, Pending Home Sales

From the NY Times: John Boehner Says There Won’t Be a Government Shutdown

Speaker John A. Boehner said Sunday that he expects the House of Representatives to pass the Senate’s government funding measure with Democratic support this week, averting a shutdown that has looked increasingly less likely since he announced on Friday that he would resign.Who votes for these crazies? I hope Boehner is correct about no shutdown, but I'd like to see a backlash at the voting booth.

...

Mr. Boehner delivered a clear message to conservative colleagues credited with forcing his hand: Holding the government hostage to achieve untenable policy goals was reckless and harmful to the institution itself.

“We have got groups here in town, members of the House and Senate here in town, who whip people into a frenzy believing they can accomplish things that they know, they know are never going to happen,” Mr. Boehner said in a live interview broadcast on CBS’s “Face the Nation.”

The speaker described these conservative members of his party as “false prophets,” who promise policy victories they cannot deliver. “The Bible says, beware of false prophets,” he said. “And there are people out there spreading noise about how much can get done.”

Weekend:

• Schedule for Week of September 27, 2015

Monday:

• At 8:30 AM ET, Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is for a 0.5% increase in the index.

• At 10:30 AM ET, Dallas Fed Manufacturing Survey for September.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 12 and DOW futures are down 85 (fair value).

Oil prices were up slightly over the last week with WTI futures at $45.43 per barrel and Brent at $48.60 per barrel. A year ago, WTI was at $94, and Brent was at $95 - so prices are down about 50% year-over-year (It was a year ago that prices started falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.29 per gallon (down over $1.00 per gallon from a year ago).

A few comments on Possible Government Shutdown

by Calculated Risk on 9/27/2015 12:43:00 PM

There are two possible imminent government shutdowns by Congress. The first is related to a budget for the next fiscal year (starts October 1st) and the second is related to the so-called "debt ceiling" (really a question of paying the bills).

It is possible there will be a shutdown Wednesday evening due to disagreements on the budget. This will not have serious economic consequences, but it will have a negative impact on the economy, including (there would be much more) ...

• Shutdowns cost money (there are no savings; shutdowns are fiscally irresponsible).

• A number of services will be shutdown (as example, there will be a negative impact on mortgage applications and the National Parks will close).

• Several economic releases will be delayed. First up will be the September employment report scheduled for Friday. Depending on how long the shutdown lasts, other reports that could be delayed include CPI, housing starts, new home sales, trade deficit and much more.

A more serious issue will be if Congress doesn't agree to "pay the bills". The so-called "debt ceiling" will probably be reached in November, and failure to pay the bills would have serious economic consequences (that would start slow and build over time). It would be absolutely irresponsible to not pay the bills.

Hopefully there will be no shutdowns this year.

Saturday, September 26, 2015

September 2015: Unofficial Problem Bank list declines to 276 Institutions, Q3 2015 Transition Matrix

by Calculated Risk on 9/26/2015 04:36:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 2015.

Changes and comments from surferdude808:

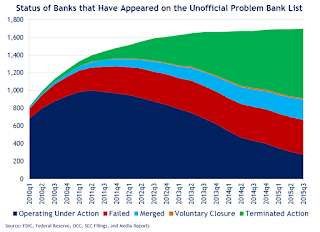

Update on the Unofficial Problem Bank List for September 2015. During the month, the list fell from 282 institutions to 276 after eight removals and two additions. Assets dropped by $683 million to an aggregate $82.0 billion. A year ago, the list held 432 institutions with assets of $136.8 billion.

Actions have been terminated against Virginia Community Bank, Louisa, VA ($215 million); US Metro Bank, Garden Grove, CA ($127 million); Freedom National Bank, Greenville, RI ($111 million); Amory Federal Savings and Loan Association, Amory, MS ($93 million Ticker: USMT); and Legacy Bank, Altoona, IA ($92 million).

Three banks found their way off the list by finding merger partners including Northwest Georgia Bank, Ringgold, GA ($286 million); The Patapsco Bank, Baltimore, MD ($219 million); and First Scottsdale Bank, National Association, Scottsdale, AZ ($96 million).

The additions this month were The National Capital Bank of Washington, Washington, DC ($420 million); and Anthem Bank & Trust, Plaquemine, LA ($136 million).

With it being the end of the third quarter, we bring an update on the transition matrix. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,698 institutions have appeared on a weekly or monthly list at some point. There have been 1,422 institutions have come on and gone off the list. Departure methods include 785 action terminations, 393 failures, 230 mergers, and 14 voluntary liquidations. The third quarter of 2015 started with 309 institutions on the list, so the 25 action terminations during the quarter reduced the list by 8.1 percent. Of the 389 institutions on the first published list, 34 or 8.7 percent still remain six years later. The 393 failures are 23.1 percent of the 1,698 institutions that have appeared on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 157 | (59,896,817) | |

| Unassisted Merger | 39 | (9,713,878) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 155 | (184,358,339) | |

| Asset Change | (3,015,680) | ||

| Still on List at 9/30/2015 | 34 | 8,744,601 | |

| Additions after 8/7/2009 | 242 | 81,999,685 | |

| End (9/30/2015) | 376 | 87,456,390 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 628 | 259,373,329 | |

| Unassisted Merger | 191 | 78,178,815 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 238 | 119,574,853 | |

| Total | 1,067 | 459,451,139 | |

| 1Institution not on 8/7/2009 or 9/30/2015 list but appeared on a weekly list. | |||

Schedule for Week of September 27, 2015

by Calculated Risk on 9/26/2015 09:13:00 AM

Special Note: If Congress shuts down the government on Wednesday, the employment report will not be released on Friday.

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM manufacturing index and September vehicle sales, both on Thursday.

There are several Federal Reserve speakers this week.

8:30 AM ET: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: Pending Home Sales Index for August. The consensus is for a 0.5% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for September.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the June 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.3% year-over-year increase in the Comp 20 index for July. The Zillow forecast is for the National Index to increase 4.6% year-over-year in July.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in September, the same as in August.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 53.6, down from 54.4 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 272 thousand initial claims, up from 267 thousand the previous week.

10:00 AM: ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.5, down from 51.1 in August.

10:00 AM: ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.5, down from 51.1 in August.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.1% in August. The employment index was at 51.2%, and the new orders index was at 51.6%.

10:00 AM: Construction Spending for August. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 17.5 million SAAR in September from 17.7 million in August (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 17.5 million SAAR in September from 17.7 million in August (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

8:30 AM: Employment Report for September. The consensus is for an increase of 203,000 non-farm payroll jobs added in September, up from the 173,000 non-farm payroll jobs added in August.

The consensus is for the unemployment rate to be unchanged at 5.1%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was over 2.9 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is a 1.3% decrease in orders.

Friday, September 25, 2015

Vehicle Sales Forecast for September: Over 17 Million Annual Rate Again

by Calculated Risk on 9/25/2015 08:19:00 PM

The automakers will report September vehicle sales on Thursday, Oct 1. Sales in August were at 17.7 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in September will be over 17 million SAAR again.

Note: There were 25 selling days in September, up from 24 in September 2014 (Also note: Labor Day was included in September this year). Here are several forecasts:

From WardsAuto: Forecast: U.S. Automakers to Record Best September in Ten Years

A WardsAuto forecast calls for U.S. automakers to deliver 1.42 million light vehicles in September, an 11-year high for the month. The report puts the seasonally adjusted annual rate of sales for the month at 17.8 million units, slightly above last month’s 17.7 million SAAR and well ahead of the year-to-date SAAR through August (17.1 million).From J.D. Power: Labor Day Propels New-Vehicle Retail Sales’ Strongest Growth So Far in 2015

Benefitting from an anomaly on the calendar, new-vehicle sales are headed to double-digit growth in September, with retail sales on pace for the strongest selling rate of any month in more than a decade, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive.From Kelley Blue Book: Double-Digit New-Car Sales Growth Expected In September 2015, According To Kelley Blue Book

For the first time since 2012, Labor Day weekend falls in the industry’s September sales month instead of August. Labor Day weekend is traditionally the biggest new-vehicle sales weekend of the year, as consumers take advantage of the holiday and model year-end sales promotions, as well as the availability of the new model-year vehicles arriving in showrooms. [17.7 million SAAR]

emphasis added

New-vehicle sales are expected to increase 12 percent year-over-year to a total of 1.39 million units in September 2015, resulting in an estimated 17.5 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...Another solid month for auto sales, however Volkswagen sales might have fallen off a cliff at the end of the month.

"While the Volkswagen scandal will have a negative impact on sales, the affected models represent less than a quarter of their portfolio, and some dealers have already depleted their stock of those units," said Alec Gutierrez, senior analyst for Kelley Blue Book. "The larger issue is the hit the automaker's brand image and perceived trustworthiness, which may affect sales of their other models. We think the effects on September sales won't be too bad for Volkswagen Group's combined sales, but October and beyond could be another story."

DOT: Vehicle Miles Driven increased 4.2% year-over-year in July, Rolling 12 Months at All Time High

by Calculated Risk on 9/25/2015 03:01:00 PM

The Department of Transportation (DOT) reported:

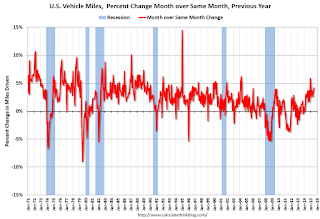

Travel on all roads and streets changed by 4.2% (11.4 billion vehicle miles) for July 2015 as compared with July 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 283.7 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for July 2015 is 264.4 billion miles, a 3.9% (9.9 billion vehicle miles) increase over July 2014. It also represents a 0.8% change (2.1 billion vehicle miles) compared with June 2015.

The rolling 12 month total is moving up - mostly due to lower gasoline prices - after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

The second graph shows the year-over-year change from the same month in the previous year.

In July 2015, gasoline averaged of $2.88 per gallon according to the EIA. That was down significantly from July 2014 when prices averaged $3.69 per gallon.

In July 2015, gasoline averaged of $2.88 per gallon according to the EIA. That was down significantly from July 2014 when prices averaged $3.69 per gallon. Gasoline prices aren't the only factor - demographics is also key. However, with lower gasoline prices, miles driven - on a rolling 12 month basis - is setting new highs each month.

Black Knight's First Look at August: Mortgage "Delinquency Rate Sees Largest 12-Month Decline in Four Years"

by Calculated Risk on 9/25/2015 11:59:00 AM

From Black Knight: Black Knight Financial Services' First Look at August Mortgage Data: Despite Monthly Rise, Delinquency Rate Sees Largest 12-Month Decline in Four Years

According to Black Knight's First Look report for August, the percent of loans delinquent increased 2.5% in August compared to July, and declined 18.2% year-over-year.

The percent of loans in the foreclosure process declined 2% in August and were down 24% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.83% in August, up from 4.71% in July.

The percent of loans in the foreclosure process declined in August to 1.37%. This was the lowest level of foreclosure inventory since 2007.

The number of delinquent properties, but not in foreclosure, is down 548,000 properties year-over-year, and the number of properties in the foreclosure process is down 217,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for August in early October.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2015 | July 2015 | Aug 2014 | Aug 2013 | |

| Delinquent | 4.83% | 4.71% | 5.90% | 6.20% |

| In Foreclosure | 1.37% | 1.40% | 1.80% | 2.66% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,582,000 | 1,503,000 | 1,852000 | 1,836,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 865,000 | 886,000 | 1,143,000 | 1,288,000 |

| Number of properties in foreclosure pre-sale inventory: | 696,000 | 711,000 | 913,000 | 1,341,000 |

| Total Properties | 3,142,000 | 3,100,000 | 3,908,000 | 4,465,000 |

Final September Consumer Sentiment at 87.2

by Calculated Risk on 9/25/2015 10:02:00 AM

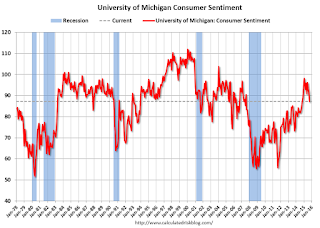

The final University of Michigan consumer sentiment index for September was at 87.2, up from the preliminary reading of 85.7, and down from 91.9 in August.

This was at the consensus forecast of 87.1.

Q2 GDP Revised Up to 3.9% Annual Rate

by Calculated Risk on 9/25/2015 08:35:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2015 (Third Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 3.9 percent in the second quarter of 2015, according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.6 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 3.1% to 3.6%. Residential investment was revised up from 7.8% to 9.3%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 3.7 percent. With the third estimate for the second quarter, the general picture of economic growth remains the same; personal consumption expenditures (PCE) and nonresidential fixed investment increased more than previously estimated ...

emphasis added

Thursday, September 24, 2015

Friday: Q2 GDP (3rd estimate), Consumer Sentiment

by Calculated Risk on 9/24/2015 07:21:00 PM

During her post FOMC press conference, Dr. Yellen declined to say whether she thought a rate hike was likely this year. However, in her speech today, Dr. Yellen included herself:

"Most FOMC participants, including myself, currently anticipate that achieving these conditions will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter."Barring a significant economic change, it seems likely there will be a rate hike in October, or more likely, December.

emphasis added

From Jon Hilsenrath and Ben Leubsdorf at the WSJ: Janet Yellen Says Fed Interest Rate Increase Still Likely This Year

Federal Reserve Chairwoman Janet Yellen laid out her most detailed case yet for the central bank to begin raising short-term interest rates later this year ...Friday:

Ms. Yellen made her case like a prosecutor making a courtroom closing argument. She presented it in a 40-page speech at the University of Massachusetts in Amherst, including 40 academic citations, 35 footnotes, nine graphs and an appendix.

Central to her argument was a belief that slack in the economy has diminished to a point where inflation pressures should start to gradually build in the coming years.

Those pressures aren’t asserting themselves yet, she argued, because a strong dollar and falling oil and import prices are placing temporary downward pressure on consumer prices. As those headwinds diminish, she predicted, inflation will gradually rise.

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2015 (third estimate). The consensus is that real GDP increased 3.7% annualized in Q2, the same as the second estimate.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 87.1, up from the preliminary reading of 85.7.