by Calculated Risk on 9/15/2015 03:23:00 PM

Tuesday, September 15, 2015

WSJ: "For the Fed, Markets May Be Flashing a Wait Sign"

First a quote that is probably correct ...

"I suspect way more economists than traders think the Fed will go this week. While way more traders than economists think the Fed should." Joseph Weisenthal

This is an important point from Greg Ip at the WSJ: For the Fed, Markets May Be Flashing a Wait Sign

The Federal Reserve owes no allegiance to the stock market. Its responsibility is to the actual economy—employment, output, inflation.The Fed isn't directly concerned about market volatility. However they would be concerned if the volatility signals economic weakness.

But sometimes, markets send the Fed important signals about the actual economy, and this may be one of those times.

As Fed policy makers ponder Wednesday and Thursday whether and when to raise rates, an important factor in their decision will be whether to wait to see if the recent turmoil in stocks, bonds and currencies points to unanticipated troubles in the global economy.

CoreLogic: "CoreLogic Reports 759,000 US Properties Regained Equity in the Second Quarter of 2015"

by Calculated Risk on 9/15/2015 10:58:00 AM

From CoreLogic: CoreLogic Reports 759,000 US Properties Regained Equity in the Second Quarter of 2015

CoreLogic ... today released a new analysis showing 759,000 properties regained equity in the second quarter of 2015, bringing the total number of mortgaged residential properties with equity at the end of Q2 2015 to approximately 45.9 million, or 91 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by $691 billion in Q2 2015. The total number of mortgaged residential properties with negative equity is now at 4.4 million, or 8.7 percent of all mortgaged properties. This compares to 5.1 million homes, or 10.2 percent, that had negative equity in Q1 2015, a quarter-over-quarter decrease of 1.5 percentage points. Compared with 5.4 million homes, or 10.9 percent, reported for Q2 2014, the number of underwater homes has decreased year over year by 1.1 million, or 19.4 percent.

... Of the more than 50 million residential properties with a mortgage, approximately 9 million, or 17.8 percent, have less than 20 percent equity (referred to as “under-equitied”), and 1.1 million, or 2.3 percent, have less than 5 percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near-negative equity are considered at risk of moving into negative equity if home prices fall. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged residential properties in negative equity at 20.6 percent, followed by Florida (18.5 percent), Arizona (15.4 percent), Rhode Island (13.8 percent) and Illinois (13.1 percent). Combined, these five states accounted for 31.7 percent of negative equity in the U.S."

Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago.

The second graph shows the distribution of home equity in Q2 2015 compared to Q1 2015. In Q2, 3.3% of residential properties have 25% or more negative equity, down from 3.8% in Q1 2015.

The second graph shows the distribution of home equity in Q2 2015 compared to Q1 2015. In Q2, 3.3% of residential properties have 25% or more negative equity, down from 3.8% in Q1 2015.In Q2 2014, there were 5.4 million properties with negative equity - now there are 4.4 million. A significant change.

Fed: Industrial Production decreased 0.4% in August

by Calculated Risk on 9/15/2015 09:31:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.4 percent in August after increasing 0.9 percent in July. The increase in July is now estimated to be greater than originally reported last month, largely as a result of upward revisions for mining and utilities. Manufacturing output fell 0.5 percent in August primarily because of a large drop in motor vehicles and parts that reversed a substantial portion of its jump in July; production elsewhere in manufacturing was unchanged. The index for mining fell 0.6 percent in August, while the index for utilities rose 0.6 percent. At 107.1 percent of its 2012 average, total industrial production in August was 0.9 percent above its year-earlier level. Capacity utilization for the industrial sector fell 0.4 percentage point in August to 77.6 percent, a rate that is 2.5 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

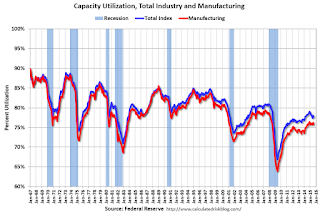

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.6% is 2.5% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.4% in August to 107.1. This is 22.8% above the recession low, and 1.8% above the pre-recession peak.

This was below expectations of a 0.2% decrease. Much of the recent weakness has been due to lower oil prices - a weak report.

Retail Sales increased 0.2% in August

by Calculated Risk on 9/15/2015 08:38:00 AM

On a monthly basis, retail sales were up 0.2% from July to August (seasonally adjusted), and sales were up 2.2% from August 2014.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $447.7 billion, an increase of 0.2 percent from the previous month, and 2.2 percent above August 2014. ... The June 2015 to July 2015 percent change was revised from +0.6 percent to +0.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increased 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.2% on a YoY basis (2.2% for all retail sales including gasoline).

Retail and Food service sales ex-gasoline increased by 4.2% on a YoY basis (2.2% for all retail sales including gasoline).The increase in August was below the consensus expectations of a 0.3% increase, however sales in July were revised up. An OK report.

Monday, September 14, 2015

Tuesday: Retail Sales, Industrial Production, NY Fed Mfg

by Calculated Risk on 9/14/2015 06:17:00 PM

From Reuters: Credibility, 'gradual' approach at stake as Fed weighs rate rise

A broad group of economists polled by Reuters last week bet on a September move by a slim margin; economists at banks that deal directly with the Fed, known as primary dealers, picked December as more likely; and traders of short term interest rate futures were giving a rate rise this week only a one-in-four chance.This will be an interesting announcement!

...

As recently as July, Yellen, who took over the Fed's reins in early 2014, appeared to make the case for a September move, telling a congressional hearing that waiting longer could mean the need to hike more rapidly later. "An advantage to beginning a little bit earlier is that we might have a more gradual path," she said.

emphasis added

Tuesday:

• At 8:30 AM ET, Retail sales for August will be released. The consensus is for retail sales to increase 0.3% in August, and to increase 0.2% ex-autos.

• Also at 8:30 AM, NY Fed Empire State Manufacturing Survey for September. The consensus is for a reading of -0.5, up from -14.9.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.8%.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.1% increase in inventories

The Consensus is No Rate Hike this Week

by Calculated Risk on 9/14/2015 04:31:00 PM

Some random thoughts ... Based on the data, I noted that a rate hike this week is possible, even likely. However the consensus of economists is no rate hike at the FOMC meeting this week.

Economists at Goldman Sachs, Deutsche Bank, J.P. Morgan, Nomura, and many others see December as more likely than September (some see the Fed waiting until 2016). Economics professor Tim Duy also thinks a September rate hike is unlikely. Duy and Goldman Sachs chief economist Jan Hatzius have probably been as accurate as anyone in forecasting Fed actions - and neither expects a rate hike this week.

The arguments against a rate hike are low inflation, low inflation expectations, market based financial tightening (stronger dollar, wider credit spreads), global economic weaknesses, recent stock market volatility, slack in the labor market, and asymmetrical risks (hiking too soon poses much larger risks than waiting too long).

Those arguing the FOMC will probably raise rates this week point to "some further improvement" in the labor market since June, and that the forces holding down inflation are dissipating. The revisions to the FOMC projections will be mostly supportive of a rate hike - and it wasn't long ago that FOMC members were hinting they'd hike rates in September if the economy evolved as expected.

In a WSJ article yesterday, Harriet Torry and Jon Hilsenrath pointed out that every central bank that has raised rates over the last seven years had had to reverse course. See: Lesson for Fed: Higher Interest Rates Haven’t Been Sticking. Of course that will be true for the FOMC meetings in October and December too!

A rate hike this week still seems possible to me (just focusing on the data), but it seems every research piece I read says "no".

Las Vegas: On Pace for Record Visitor Traffic in 2015

by Calculated Risk on 9/14/2015 02:18:00 PM

Another update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2014.

We only have data through July 2015, but visitor traffic is 2% above the record 2014 pace so far.

However convention attendance is only returning slowly. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Through July, visitor traffic in 2015 is running 2.0% above 2014.

Convention traffic is up 0.6% from last year, and is still way below the pre-recession peak. In general, the gamblers are back - and the conventions are slowly returning.

It seemed like there were many housing related conventions during the housing bubble, so it may be some time before convention attendance hits a new high.

LA area Port Traffic: Record Inbound Traffic in August

by Calculated Risk on 9/14/2015 10:14:00 AM

Note: There were some large swings in LA area port traffic earlier this year due to labor issues that were settled on February 21st. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 1.1% compared to the rolling 12 months ending in July. Outbound traffic was down 0.4% compared to 12 months ending in July.

The recent downturn in exports might be due to the strong dollar and weakness in China.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 12% year-over-year in August; exports were down 4% year-over-year.

On a monthly basis, imports were at an all time high.

This data suggests a larger trade deficit with Asia in August, and that U.S. retailers are optimistic about the holiday shopping season.

Sunday, September 13, 2015

Sunday Night Futures

by Calculated Risk on 9/13/2015 08:33:00 PM

From Harriet Torry and Jon Hilsenrath at the WSJ: Lesson for Fed: Higher Interest Rates Haven’t Been Sticking

In the seven years since the world’s central banks responded to the financial crisis by slashing interest rates, more than a dozen banks in the advanced world have tried to raise them again. All have been forced to retreat.My guess is Fed Chair Yellen would say she is aware of the actions of the other central banks, and this one of the reasons the Fed has been so patient in waiting to raise rates.

...

Central banks in the eurozone, Sweden, Israel, Canada, South Korea, Australia, Chile and beyond have tried to raise rates in recent years, only to reduce them again as their economies stumbled.

Weekend:

• Schedule for Week of September 13, 2015

Monday:

• No economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 10 and DOW futures are up 180 (fair value).

Oil prices were down slightly over the last week with WTI futures at $44.84 per barrel and Brent at $48.22 per barrel. A year ago, WTI was at $93, and Brent was at $99 - so prices are down over 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.33 per gallon (down over $1.00 per gallon from a year ago).

FOMC Preview and Review of Projections

by Calculated Risk on 9/13/2015 12:14:00 PM

Analysts are split on whether the FOMC will raise the Fed Funds rate this week. It could go either way.

Those arguing the FOMC will probably wait until December (or until 2016) point to inflation below target, market based financial tightening (stronger dollar, wider credit spreads), global economic weaknesses, and recent stock market volatility.

Those arguing the FOMC will probably raise rates this week point to "some further improvement" in the labor market, and that the forces holding down inflation are dissipating.

Note: It is a different question if the Fed "should" raise rates in September, as opposed to "will" the Fed raise rates. Clearly the risks are asymmetrical (hiking too soon poses much larger risks than waiting too long), and that argues for waiting a little longer.

For review, here is the key sentence in the July FOMC statement:

"The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term."Since that statement, the economy added 245 thousand jobs in July and 173 thousand jobs in August (and frequently August is revised up). The unemployment rate declined from 5.3% in June to 5.1% in August. This is probably the "some further improvement" in the labor market that the FOMC mentioned in the July statement.

So the focus at the FOMC meeting will probably be on inflation. Is the FOMC "reasonably confident that inflation will move back to its 2 percent objective over the medium term" (emphasis added).

Fed Vice Chairman Stanley Fischer said two weeks ago:

As I have discussed, given the apparent stability of inflation expectations, there is good reason to believe that inflation will move higher as the forces holding down inflation dissipate further. While some effects of the rise in the dollar may be spread over time, some of the effects on inflation are likely already starting to fade. The same is true for last year's sharp fall in oil prices, though the further declines we have seen this summer have yet to fully show through to the consumer level. And slack in the labor market has continued to diminish, so the downward pressure on inflation from that channel should be diminishing as well.Although inflation may be low over the next few months (lower oil prices), it sounds like Fischer is "reasonably confident" that inflation will move higher in the "medium term".

emphasis added

What about the revisions to the FOMC projections? (See below) Projections for 2015 GDP will probably be revised up, the unemployment rate revised lower, and core inflation revised up slightly.

My view: Based on the FOMC's previous statement, and the likely revisions to the FOMC projections, and Fischer's views on inflation, it seems likely the FOMC will raise rates this week.

Here are the June projections. Since the release of those projections, Q1 GDP was revised up from -0.7% annualized to +0.6% annualized. And Q2 GDP was reported at 3.7% (and will probably be revised up a little more).

So it seems likely projections for 2015 GDP will be revised up.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2015 | 2016 | 2017 | |

| Jun 2015 | 1.8 to 2.0 | 2.4 to 2.7 | 2.1 to 2.5 | |

| Mar 2015 | 2.3 to 2.7 | 2.3 to 2.7 | 2.0 to 2.5 | |

The unemployment rate was at 5.1% in August, so the unemployment rate projection for Q4 2015 will be revised lower.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2015 | 2016 | 2017 | |

| Jun 2015 | 5.2 to 5.3 | 4.9 to 5.1 | 4.9 to 5.1 | |

| Mar 2015 | 5.0 to 5.2 | 4.9 to 5.1 | 4.8 to 5.1 | |

As of July, PCE inflation was up only 0.3% from July 2014. However, PCE inflation has been running at a 2.2% annualized rate over the last 6 months. At that rate, PCE inflation will be up to 0.9% year-over-year in Q4.

On the other hand, oil prices have declined a little since July, and, as a result, PCE inflation could move down some more in August. Overall PCE inflation projections will probably be mostly unrevised for 2015, and will be well below the FOMC's 2% target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2015 | 2016 | 2017 | |

| Jun 2015 | 0.6 to 0.8 | 1.6 to 1.9 | 1.9 to 2.0 | |

| Mar 2015 | 0.6 to 0.8 | 1.7 to 1.9 | 1.9 to 2.0 | |

PCE core inflation was up only 1.2% in July year-over-year. However core PCE inflation has been running at a 1.7% annualized rate over the last 6 months. Based on the last 6 months, it appears 2015 projections for core PCE will be revised up slightly.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2015 | 2016 | 2017 | |

| Jun 2015 | 1.3 to 1.4 | 1.6 to 1.9 | 1.9 to 2.0 | |

| Mar 2015 | 1.3 to 1.4 | 1.5 to 1.9 | 1.8 to 2.0 | |