by Calculated Risk on 4/10/2015 10:30:00 AM

Friday, April 10, 2015

BofA: "Farewell winter blues"

We recently saw another spate of recession calls (my response was R-E-L-A-X). There are several reasons for the recent economic weakness including seasonal factors, poor weather, the West Cost port slowdown, the stronger dollar and lower oil prices (the negative impacts are more obvious, but overall lower prices will be a positive). It looks like consumer spending in March was solid.

Excerpts from a research note from BofA: "Farewell winter blues"

There is finally good news to report on the US consumer. Spending on BAC credit and debit cards was up sharply in March, following a string of weak reports. Our measure of core retail sales - ex-autos and gasoline sales - increased 0.9% mom on a seasonally adjusted basis in March. This is a notable improvement from the past three months of essentially no growth. If we include gasoline station sales, the swing is even more dramatic given the significant adjustment in gasoline prices. ...

As always when analyzing economic data, we have to be careful not to overreact to just one report. The gain in March follows several months of weak data, making the comparisons more favorable. Moreover, the early Easter holiday might have sent people shopping in late March. The weather is also an important factor; ... the regions with the harshest winter weather showed the largest declines in February and strongest gains in March.

We are hopeful that the gain in March is the beginning of a healthier trajectory for consumer spending. As we have been arguing, all signs point to a solid consumer backdrop. ... Households have repaired their balance sheets and animal spirits have improved with consumer confidence trending higher. We are therefore holding to our core view that consumer spending will accelerate into 2Q, providing much-need support to GDP tracking.

Thursday, April 09, 2015

Hotels near Record Occupancy Pace

by Calculated Risk on 4/09/2015 08:09:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 4 April

he U.S. hotel industry recorded mixed results in the three key performance measurements during the week of 29 March through 4 April 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy decreased 4.0 percent to 62.9 percent. Average daily rate increased 3.4 percent to finish the week at US$116.01. Revenue per available room for the week was down 0.7 percent to finish at US$72.93.

“The industrywide decline in RevPAR was driven by softness related to Passover and Easter,” said Brad Garner, STR’s senior VP for client relationships. “This was the first time in 49 weeks that U.S. RevPAR was negative for a week—the longest stretch of positive weekly RevPAR growth STR has ever tracked. The last time RevPAR went negative for a week (-0.3 percent) was the week heading into Passover and Easter in 2014. We would anticipate a quick RevPAR return to normalcy and another positive streak into the foreseeable future. STR is projecting an annual RevPAR increase of 6.4 percent in 2015.”

emphasis added

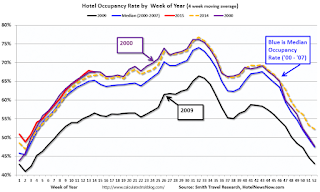

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the Spring travel period and business travel will be solid over the next couple of months (the decline was related to the timing of Easter and Passover).

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is close to 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Freddie Mac: 30 Year Mortgage Rates decrease to 3.66% in Latest Weekly Survey

by Calculated Risk on 4/09/2015 03:01:00 PM

From Freddie Mac today: Mortgage Rates Lower on Weak Jobs Report

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving lower following a weaker than expected jobs report for March. ...

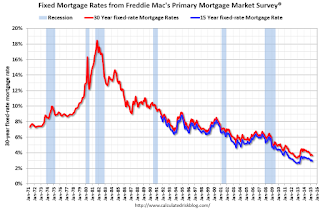

30-year fixed-rate mortgage (FRM) averaged 3.66 percent with an average 0.6 point for the week ending April 9, 2015, down from last week when it averaged 3.70 percent. A year ago at this time, the 30-year FRM averaged 4.34 percent.

15-year FRM this week averaged 2.93 percent with an average 0.6 point, down from last week when it averaged 2.98 percent. A year ago at this time, the 15-year FRM averaged 3.38 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (31 bps) from the all time low of 3.35% in late 2012, but down from 4.34% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Lawler: Good Start to Spring home-selling Season

by Calculated Risk on 4/09/2015 12:10:00 PM

From the WSJ: Housing Market Sees Hopeful Signs of Spring

The downturn was brutal for Jacksonville; home sales sank and foreclosures were running at high levels during the crisis. But in recent months, home sales have shot up, the percentage of distressed homes on the market has declined and traffic at model homes in new subdivisions has been brisk.Other cities with solid year-over-year performance are Phoenix and Las Vegas.

Local home builders and real-estate agents report the most vibrant period of home sales since 2006. Finalized sales of existing homes in the Jacksonville area were up 18% in March from a year earlier, and pending sales were up 30% in that span, according to the Northeast Florida Association of Realtors.

...

“The spring home-selling season is off to a very good start,” said Thomas Lawler, a housing economist in Leesburg, Va. “I think the rest of the season is going to be materially better than a year ago.”

Weekly Initial Unemployment Claims increased to 281,000, 4-Week Average Lowest Since 2000

by Calculated Risk on 4/09/2015 08:36:00 AM

The DOL reported:

In the week ending April 4, the advance figure for seasonally adjusted initial claims was 281,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 268,000 to 267,000. The 4-week moving average was 282,250, a decrease of 3,000 from the previous week's revised average. This is the lowest level for this average since June 3, 2000 when it was 281,500. The previous week's average was revised down by 250 from 285,500 to 285,250.The previous week was revised down to 267,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 282,250.

This was below the consensus forecast of 285,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, April 08, 2015

Thursday: Unemployment Claims

by Calculated Risk on 4/08/2015 08:48:00 PM

From the WSJ: After Foreclosures, Home Buyers Are Back

... For those who lost their homes in the early years of the crisis, credit scores are improving as the black marks drop away, improving their ability to borrow again. This could have widespread implications for the U.S. economy, including a boost in demand for mortgages in the coming years.Thursday:

Fair Isaac Corp. ... estimates that there were 910,000 consumers whose credit reports showed they had foreclosure proceedings begin on their homes between October 2007 and October 2008. Of those, some 264,400 had no evidence of the event on their credit reports by last October. That number will rise by up to 645,600 by the end of this year, according to FICO.

“The dark shadow of the foreclosure crisis is finally beginning to fade,” says Mark Zandi, chief economist at Moody’s Analytics, a unit of Moody’s Corp. “That should be a positive for single-family housing and, by extension, for the broader economy.”

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 268 thousand.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.2% increase in inventories.

Goldman: "The Effect of Slowing Energy Sector Activity on Non-Energy Payrolls"

by Calculated Risk on 4/08/2015 04:32:00 PM

An excerpt from a research piece by Goldman Sachs economist Alec Phillips: The Effect of Slowing Energy Sector Activity on Non-Energy Payrolls

Oil & gas-related employment has declined each of the last three months. We find that in previous oil-sector downturns, job growth in non-energy sectors that are closely related to the oil & gas industry--particularly certain segments of manufacturing and construction--has declined by three to four times as much as the decline in oil & gas employment itself. This means that in addition to the 10k or so monthly declines in energy-related jobs we expect over the next several months, we should begin to see more of an effect in these other areas as well.The overall impact of lower oil prices will be a positive on the US economy, however, as Professor Tim Duy noted early this year:

...

Taking a broader view, we continue to expect that lower energy prices should prove a net benefit for growth and we would expect the negative direct and indirect effects of slowing energy activity on the labor market to be offset by the positive effects on employment in industries that are more closely tied to consumption. Overall, we expect monthly payroll growth over the next several months to be roughly in line with the current 3-month average of 197k. If we are correct that weakness in oil-related employment will spill over into slower job growth in closely-related non-energy sectors, the burden will be on consumer-related sectors to produce a greater share of payroll growth than they have on average over the last several months. While this seems likely over the longer run, it does raise the possibility that the negative effects on job growth from slowing oil production, where the adjustment has been more immediate than expected, could be a bit more front-loaded than the employment boost from consumer spending.

I tend agree that the net impact [from the decline in oil prices] will be positive, but note that the negative impacts will be fairly concentrated and easy for the media to sensationalize, while the positive impacts will be fairly dispersed. We all know what is going to happen to rig counts, high-yield energy debt, and the economies of North Dakota and at least parts of Texas. "Kablooey," I think, is the technical term. Easy media fodder. Much more difficult to see the positive impact spread across the real incomes of millions of households, with particularly solid gains at the lower ends of the income distribution. This will be most likely revealed in the aggregate data and be much less newsworthy.To add to Duy, the negative impacts will happen quicker than the positive impacts, but lower oil prices are still a positive for 2015.

emphasis added

FOMC Minutes: Different Views on Timing

by Calculated Risk on 4/08/2015 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, March 17-18, 2015 . Excerpts:

Participants expressed a range of views about how they would assess the outlook for inflation and when they might deem it appropriate to begin removing policy accommodation. It was noted that there were no simple criteria for such a judgment, and, in particular, that, in a context of progress toward maximum employment and reasonable confidence that inflation will move back to 2 percent over the medium term, the normalization process could be initiated prior to seeing increases in core price inflation or wage inflation. Further improvement in the labor market, a stabilization of energy prices, and a leveling out of the foreign exchange value of the dollar were all seen as helpful in establishing confidence that inflation would turn up. Several participants judged that the economic data and outlook were likely to warrant beginning normalization at the June meeting. However, others anticipated that the effects of energy price declines and the dollar's appreciation would continue to weigh on inflation in the near term, suggesting that conditions likely would not be appropriate to begin raising rates until later in the year, and a couple of participants suggested that the economic outlook likely would not call for liftoff until 2016. With regard to communications about the timing of the first increase in the target range for the federal funds rate, two participants thought that the Committee should seek to signal its policy intentions at the meeting before liftoff appeared likely, but two others judged that doing so would be inconsistent with a meeting-by-meeting approach. Finally, many participants commented that it would be desirable to provide additional information to the public about the Committee's strategy for policy after the beginning of normalization. Some participants emphasized that the stance of policy would remain highly accommodative even after the first increase in the target range for the federal funds rate, and several noted that they expected economic developments would call for a fairly gradual pace of normalization or that a data-dependent approach would not necessarily dictate increases in the target range at every meeting.

emphasis added

Las Vegas Real Estate in March: Sales Increased 8.5% YoY

by Calculated Risk on 4/08/2015 10:17:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home sales spring forward

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in March was 3,358, up from 2,452 in February and up from 3,094 one year ago. Compared to the previous month, GLVAR reported that sales were up 37.8 percent for single-family homes and up 33.7 percent for condos and townhomes. Compared to March 2014, sales were 6.7 percent higher for homes and 17.1 percent higher for all types of condos and townhomes.There are several key trends that we've been following:

...

GLVAR continued to track fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In March, 8.3 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 9.3 percent in February and from 12.9 percent one year ago. Another 9.3 percent of March sales were bank-owned, down from 9.7 percent in February and down from 11.7 percent last year.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in March was 13,532, up 2.6 percent from 13,188 in February, but down 3.0 percent from one year ago. GLVAR tracked a total of 3,613 condos, high-rise condos and townhomes listed for sale on its MLS in March, up 1.5 percent from 3,558 in February, but down 2.4 percent from one year ago.

By the end of March, GLVAR reported 7,257 single-family homes listed without any sort of offer. That’s down 0.8 percent from February, but up 12.2 percent from one year ago. For condos and townhomes, the 2,445 properties listed without offers in March represented a 0.8 percent increase from February and a 6.5 percent increase from one year ago.

emphasis added

1) Overall sales were up 8.5% year-over-year.

2) Conventional(equity, not distressed) sales were up 18.6% year-over-year. In March 2014, only 75.4% of all sales were conventional equity. In March 2015, 82.4% were standard equity sales. Note: In March 2013 (two years ago), only 55.5% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 43.1% in March 2014 to 32.4% in March 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 12.2% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

MBA: Purchase Mortgage Applications Increased, Highest level since July 2013

by Calculated Risk on 4/08/2015 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 3, 2015. ...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 7 percent from one week earlier, reaching its highest level since July 2013. ... The unadjusted Purchase Index ... was 12 percent higher than the same week one year ago

...

“Purchase mortgage application volume last week increased to its highest level since July 2013, spurred on by still low mortgage rates and strengthening housing markets,” said Mike Fratantoni, MBA’s Chief Economist. “Purchase volume has increased for three straight weeks now on a seasonally adjusted basis.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.86 percent from 3.89 percent, with points decreasing to 0.27 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 12% higher than a year ago.