by Calculated Risk on 4/07/2015 06:51:00 PM

Tuesday, April 07, 2015

Phoenix Real Estate in March: Sales Up 17.5%, Inventory DOWN 12% Year-over-year

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Minutes for Meeting of March 17-18, 2015

-------------------------------------

On Phoenix: For the fourth consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in March were up 17.5% year-over-year. Another significant change.

2) Cash Sales (frequently investors) were down to 27.5% of total sales. Non-cash sales were up 27.3% year-over-year.

3) Active inventory is now down 11.7% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline).

| March Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Mar-08 | 4,303 | --- | 822 | 19.1% | 57,0811 | --- |

| Mar-09 | 7,636 | 77.5% | 2,994 | 39.2% | 49,743 | -12.9% |

| Mar-10 | 8,969 | 17.5% | 3,745 | 41.8% | 42,755 | -14.0% |

| Mar-11 | 9,927 | 10.7% | 4,946 | 49.8% | 37,632 | -12.0% |

| Mar-12 | 8,868 | -10.7% | 4,222 | 47.6% | 21,863 | -41.9% |

| Mar-13 | 8,146 | -8.1% | 3,384 | 41.5% | 20,729 | -5.2% |

| Mar-14 | 6,708 | -17.7% | 2,222 | 33.1% | 30,167 | 45.5% |

| Mar-15 | 7,884 | 17.5% | 2,172 | 27.5% | 26,623 | -11.7% |

| 1 March 2008 probably included pending listings | ||||||

Q1 Review: Ten Economic Questions for 2015

by Calculated Risk on 4/07/2015 03:15:00 PM

At the end of last year, I posted Ten Economic Questions for 2015. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2015 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q1 review (it is very early in the year). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2015: How much will housing inventory increase in 2015?

Right now my guess is active inventory will increase further in 2015 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2015). I expect active inventory to move closer to 6 months supply this summer.According to the February NAR report on existing home sales, inventory was down slightly year-over-year in February, and the months-of-supply was at 4.6 months. I still expect inventory to increase in 2015, and for supply to be close to 6 months this summer.

9) Question #9 for 2015: What will happen with house prices in 2015?

In 2015, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. Low inventories, and a better economy (with more consumer confidence) suggests further price increases in 2015. I expect we will see prices up mid single digits (percentage) in 2015 as measured by these house price indexes.If is very early, but the CoreLogic data released today showed prices up 5.6% year-over-year in February. The CoreLogic year-over-year increase has been around 5% for the last seven months.

8) Question #8 for 2015: How much will Residential Investment increase?

My guess is growth of around 8% to 12% for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts might shift a little more towards single family in 2015.Through February, starts were up 8% year-over-year compared to the same period in 2014. New home sales were up 17% year-over-year (easy comparison).

7) Question #7 for 2015: What about oil prices in 2015?

It is impossible to predict an international supply disruption - if a significant disruption happens, then prices will obviously move higher. Continued weakness in Europe and China does seem likely - and I expect the frackers to slow down with exploration and drilling, but to continue to produce at most existing wells at current prices (WTI at $55 per barrel). This suggests in the short run (2015) that prices will stay well below $100 per barrel (perhaps in the $50 to $75 range) - and that is a positive for the US economy.As of this morning, WTI futures are just over $53 per barrel.

6) Question #6 for 2015: Will real wages increase in 2015?

As the labor market tightens, we should start seeing some wage pressure as companies have to compete more for employees. Whether real wages start to pickup in 2015 - or not until 2016 or later - is a key question. I expect to see some increase in both real and nominal wage increases this year. I doubt we will see a significant pickup, but maybe another 0.5 percentage points for both, year-over-year.Through March, nominal hourly wages were up 2.1% year-over-year. The is some evidence that wages will pick up, such as announcements by WalMart, Target and others of wage increases for minimum wage workers.

5) Question #5 for 2015: Will the Fed raise rates in 2015? If so, when?

The FOMC will not want to immediately reverse course, so the might wait a little longer than expected. Right now my guess is the first rate hike will happen at either the June, July or September meetings.So far right on schedule.

4) Question #4 for 2015: Will too much inflation be a concern in 2015?

Due to the slack in the labor market (elevated unemployment rate, part time workers for economic reasons), and even with some real wage growth in 2015, I expect these measures of inflation will stay mostly at or below the Fed's target in 2015. If the unemployment rate continues to decline - and wage growth picks up - maybe inflation will be an issue in 2016.It is early, but inflation was still low through February.

So currently I think core inflation (year-over-year) will increase in 2015, but too much inflation will not be a serious concern this year.

3) Question #3 for 2015: What will the unemployment rate be in December 2015?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to close to 5% by December 2015. My guess is based on the participation rate staying relatively steady in 2015 - before declining again over the next decade. If the participation rate increases a little, then I'd expect unemployment in the low-to-mid 5% range.The participatin rate was unchanged from December to March, and the unemployment rate was 5.5% in March, down slightly from 5.6% in December.

2) Question #2 for 2015: How many payroll jobs will be added in 2015?

Energy related construction hiring will decline in 2015, but I expect other areas of construction to be solid.Through March 2015, the economy has added 591,000 thousand jobs; 197,000 per month. I still expect employment gains to average 200,000 to 225,000 per month in 2015 (lower than 2014, but still solid).

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - and more companies will have difficulty finding qualified candidates. Even with the overall boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2015 than in 2014.

So my forecast is for gains of about 200,000 to 225,000 payroll jobs per month in 2015. Lower than 2014, but another solid year for employment gains given current demographics.

1) Question #1 for 2015: How much will the economy grow in 2015?

Lower gasoline prices suggest an increase in personal consumption expenditures (PCE) excluding gasoline. And it seems likely PCE growth will be above 3% in 2015. Add in some more business investment, the ongoing housing recovery, some further increase in state and local government spending, and 2015 should be the best year of the recovery with GDP growth at or above 3%.Once again the first quarter will be disappointing due to the weather, cutbacks in the oil sector, the West Coast port slowdown and the strong dollar (most early estimates are GDP below 1% growth in Q1), but I expect economic activity to pick up in the last three quarters of the year.

Although there was some weakness in Q1, overall 2015 is unfolding about as expected.

Mortgage Equity Withdrawal Still Negative in Q4 2014

by Calculated Risk on 4/07/2015 12:13:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released this morning) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is still little (but increasing) MEW right now - and normal principal payments and debt cancellation.

For Q4 2014, the Net Equity Extraction was minus $35 billion, or a negative 1.1% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $5 billion in Q3. This was only the third quarterly increase in mortgage debt since Q1 2008.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again soon.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

BLS: Jobs Openings at 5.1 million in February, Up 23% Year-over-year

by Calculated Risk on 4/07/2015 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 5.1 million job openings on the last business day of February, little changed from 5.0 million in January, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in February, about the same as in January.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in February to 5.133 million from 4.965 million in January. This is the highest level for job openings since January 2001.

The number of job openings (yellow) are up 23% year-over-year compared to February 2014.

Quits are up 10% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another very positive report. It is a good sign that job openings are over 5 million, and that quits are increasing solidly year-over-year.

CoreLogic: House Prices up 5.6% Year-over-year in February

by Calculated Risk on 4/07/2015 09:11:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports National Homes Prices Rose by 5.6 Percent Year Over Year in February 2015

CoreLogic® ... today released its February 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 5.6 percent in February 2015 compared to February 2014. This change represents three years of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 1.1 percent in February 2015 compared to January 2015.

Including distressed sales, 26 states and the District of Columbia were at or within 10 percent of their peak prices. Six states, including Colorado (+9.8 percent), New York (+8.2 percent), North Dakota (+7.7 percent), Texas (+8.5 percent), Wyoming (+8.4 percent) and Oklahoma (+5.2 percent), reached new home price highs since January 1976 when the CoreLogic HPI started.

Excluding distressed sales, home prices increased by 5.8 percent in February 2015 compared to February 2014 and increased by 1.5 percent month over month compared to January 2015. ...

“Since the second half of 2014, the dwindling supply of affordable inventory has led to stabilization in home price growth with a particular uptick in low-end home price growth over the last few months,” said Dr. Frank Nothaft, chief economist for CoreLogic. “From February 2014 to February 2015, low-end home prices increased by 9.3 percent compared to 4.8 percent for high-end home prices, a gap that is three times the average historical difference.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in February, and is up 5.6% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty six consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty six consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase has mostly moved sideways over the last seven months.

Monday, April 06, 2015

Tuesday: Job Openings

by Calculated Risk on 4/06/2015 08:31:00 PM

A depressing quote from Paul Krugman: Economics and Elections

[A] large body of political science research [on elections shows] ... What mainly matters is income growth immediately before the election. And I mean immediately: We’re talking about something less than a year, maybe less than half a year.This is why we see political stunts in odd years (threats to not pay the bills, government shutdowns). People forget quickly.

This is, if you think about it, a distressing result, because it says that there is little or no political reward for good policy. A nation’s leaders may do an excellent job of economic stewardship for four or five years yet get booted out because of weakness in the last two quarters before the election.

Monday:

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS. Job openings increased in January to 4.998 million from 4.877 million in December. The number of job openings were up 28% year-over-year, and Quits were up 17% year-over-year.

• At 3:00 PM, Consumer Credit for March from the Federal Reserve. The consensus is for a $14 billion increase in credit.

Update: U.S. Heavy Truck Sales

by Calculated Risk on 4/06/2015 04:08:00 PM

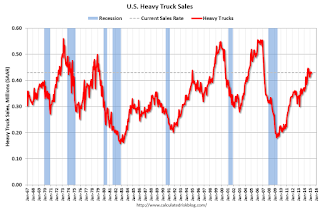

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the March 2015 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate basis (SAAR). Since then sales have more than doubled and hit 446 thousand SAAR in August 2014. Sales have declined a little since August (possibly due to the oil sector), and were at 430 thousand SAAR in March.

The level in August 2014 was the highest level since February 2007 (over 7 years ago). Sales have been above 400 thousand SAAR for nine consecutive months, are now above the average (and median) of the last 20 years.

Zillow: February Case-Shiller House Price Index year-over-year change expected to be about the same as in January

by Calculated Risk on 4/06/2015 12:40:00 PM

The Case-Shiller house price indexes for January were released last week. Zillow forecasts Case-Shiller a month early - now including the National Index - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Expect More of the Same From Case-Shiller in Feb.

The January S&P/Case-Shiller (SPCS) data published yesterday showed healthy home price appreciation largely in line with prior months, with 4.5 percent annual growth in the U.S. National Index in January, down slightly from 4.6 percent annual growth in December.So the year-over-year change in for February Case-Shiller index will probably be about the same as in the January report.

Annual appreciation in home values as measured by SPCS has been less than 5 percent for the past five months. We anticipate this trend to continue, with next month’s (February) national index expected to rise 4.4 percent, in line with historically normal levels between 3 percent and 5 percent.

The 10- and 20-City Composite Indices both experienced modest bumps in annual growth rates in January; the 10-City index rose 4.4 percent and the 20-City Index rose to 4.6 percent–up from rates of 4.3 percent and 4.5 percent, respectively, in December. The non-seasonally adjusted (NSA) 10- and 20-City indices were flat from December to January, and we expect both to remain flat in February (NSA).

All forecasts are shown in the table below. These forecasts are based on the January SPCS data release and the February 2014 Zillow Home Value Index (ZHVI), released March 27. Officially, the SPCS Composite Home Price Indices for January will not be released until Tuesday, April 28.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| January Actual YoY | 4.4% | 4.4% | 4.6% | 4.6% | 4.5% | 4.5% |

| February Forecast YoY | 4.4% | 4.4% | 4.6% | 4.6% | 4.4% | 4.4% |

| February Forecast MoM | 0.0% | 0.6% | 0.0% | 0.6% | 0.3% | 0.5% |

From Zillow:

The Zillow Home Value Index rose 4.9 percent year-over-year in February, the first month of sub-5 percent annual appreciation since May 2013. Zillow data shows the annual home value appreciation rate has fallen every month since April, and we expect this slowdown to continue throughout 2015. The January Zillow Home Value Forecast calls for a 2.6 percent rise in home values through February 2016. Further details on our forecast of home values can be found here, and more on Zillow’s full January 2014 report can be found here.

ISM Non-Manufacturing Index decreased to 56.5% in March

by Calculated Risk on 4/06/2015 10:05:00 AM

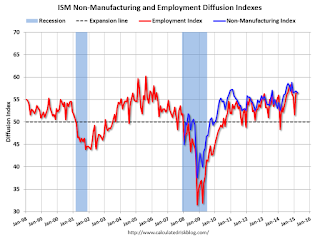

The March ISM Non-manufacturing index was at 56.5%, down from 56.9% in February. The employment index increased in March to 56.6%, up slightly from 56.4% in February. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 62nd consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.5 percent in March, 0.4 percentage point lower than the February reading of 56.9 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased to 57.5 percent, which is 1.9 percentage points lower than the February reading of 59.4 percent, reflecting growth for the 68th consecutive month at a slower rate. The New Orders Index registered 57.8 percent, 1.1 percentage points higher than the reading of 56.7 percent registered in February. The Employment Index increased 0.2 percentage point to 56.6 percent from the February reading of 56.4 percent and indicates growth for the 13th consecutive month. The Prices Index increased 2.7 percentage points from the February reading of 49.7 percent to 52.4 percent, indicating prices increased in March after three consecutive months of decreasing. According to the NMI®, 14 non-manufacturing industries reported growth in March. The majority of respondents’ comments reflect stability and are mostly positive about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was close to the consensus forecast of 56.7% and suggests slightly slower expansion in March than in February. Overall this was a solid report.

Black Knight February Mortgage Monitor: Foreclosure Rate still "175 percent above pre-crisis norms"

by Calculated Risk on 4/06/2015 07:07:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for February today. According to BKFS, 5.36% of mortgages were delinquent in February, down from 5.56% in January. BKFS reported that 1.58% of mortgages were in the foreclosure process, down from 2.22% in February 2014.

This gives a total of 6.94% delinquent or in foreclosure. It breaks down as:

• 1,646,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,067,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 800,000 loans in foreclosure process.

For a total of 3,512,000 loans delinquent or in foreclosure in February. This is down from 4,106,000 in February 2014.

From Black Knight:

Delinquency and foreclosure inventories continue to trend towards pre-crisis normsAlso from Black Knight:

February’s delinquency rate, while still 17 percent above the pre-crisis norm of 4.6 percent, was down 49 percent from its January 2010 peak of 10.6 percent

At 1.58 percent, the foreclosure rate remained 175 percent above precrisis norms, but was still down 63 percent from its October 2011 peak

Today, the Data and Analytics division of Black Knight Financial Services released its latest Mortgage Monitor Report, based on data as of the end of February 2015. Black Knight revisited its periodic review of potential refinance candidates, looking at broad-based eligibility criteria, and found that in light of recent mortgage interest rate decreases, the population of potential refinance candidates currently sits at 7.1 million. However, according to Trey Barnes, Black Knight’s senior vice president of Loan Data Products, this number has the potential to decline should rates climb, even marginally.There is much more in the mortgage monitor.

“Black Knight looked at the population of borrowers whose current interest rates – as well as credit scores and loan-to-value ratios – mark them as good candidates for refinancing,” said Barnes. “In February 2014, there were approximately 4.1 million borrowers who could both benefit from and potentially qualify for refinancing their mortgages. Through a combination of declining interest rates and increased equity among borrowers driven by home price increases, an additional three million borrowers now meet the same broad-based eligibility criteria as compared to one year prior. As of the end of February 2015, there were a total of 7.1 million potential refinance candidates.