by Calculated Risk on 12/22/2014 08:38:00 AM

Monday, December 22, 2014

Chicago Fed: Index shows "Economic Growth Accelerated" in November

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth accelerated in November

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.73 in November from +0.31 in October. Two of the four broad categories of indicators that make up the index increased from October, and only one of the four categories made a negative contribution to the index in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, rose to +0.48 in November from +0.09 in October, reaching its highest level since May 2010. November’s CFNAI-MA3 suggests that growth in national economic activity was above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests modest inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in November (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, December 21, 2014

Monday: Existing Home Sales

by Calculated Risk on 12/21/2014 07:01:00 PM

From James Hamilton at Econbrowser: Do falling oil prices raise the threat of deflation?

If gasoline prices stay where they are and if we buy the same number of gallons of gasoline this year as last, that leaves us with an additional $160 billion to spend over the course of the year on other items. If we restate the total savings for U.S. consumers and businesses in terms of the 116 million U.S. households, that works out to almost $1400 per household.Monday:

It’s a particularly big deal for the lower-income households, who spend a much higher fraction of their income on energy.

Historically consumers have responded to windfalls like this by becoming more open to the big-ticket purchases that play a huge role in cyclical economic swings.

• At 8:30 AM ET, the Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 10:00 AM, the Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 5.20 million on seasonally adjusted annual rate (SAAR) basis. Sales in October were at a 5.26 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.90 million SAAR.

Weekend:

• Schedule for Week of December 21st

• Existing Home Sales: A Likely "Miss"

From CNBC: Pre-Market Data and Bloomberg futures.

Oil prices were up over the last week with WTI futures at $57.13 per barrel and Brent at $61.38 per barrel. A year ago, WTI was at $99, and Brent was at $111 - so prices are down 42% and 45% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.41 per gallon (down about 80 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Katie Couric and the Net Petroleum Exporter Myth

by Calculated Risk on 12/21/2014 09:59:00 AM

To understand what the general public is hearing about oil, I watched a Yahoo video yesterday with Katie Couric explaining the decline in oil prices.

In general the piece was very good. Couric started by explaining that the decline in oil prices could be explained in two words: Supply and Demand. She discussed reasons for more supply and softening demand.

Note: from Professor Hamilton "[In October] I discussed the three main factors in the recent fall in oil prices: (1) signs of a return of Libyan production to historical levels, (2) surging production from the U.S., and (3) growing indications of weakness in the world economy."

I'd add to the discussion that the short run supply and demand curves are both very steep for oil, so small changes in supply and / or demand can cause a large change in price (see A Comment on Oil Prices).

But then Couric mentioned a myth I've heard several times recently. She said:

In fact, [the U.S.] is now the world’s largest producer of petroleum, and for the last two years, it has been selling more to other countries than it’s been buying. Who knew?"Who knew?" No one, because it is not true. Yes, the U.S. is the largest producer this year (ahead of Saudi Arabia and Russia), but the U.S. is NOT "selling more to other countries than it's been buying".

The source of this error is that the U.S. is a net exporter of refined petroleum products, such as refined gasoline. Here is the EIA data on Weekly Imports & Exports of crude oil and petroleum products. The U.S. is importing around 9 million barrels per day of crude oil and products, and exporting around 4 million per day (mostly refined products). The U.S. is a large net importer!

Note: Here is some data on natural gas (the U.S. is net importer).

Another data source is the monthly trade balance report from the Department of Commerce that shows about a net petroleum trade deficit of about $15 to $20 billion per month this year. The good news is the petroleum contribution to the trade deficit has been declining, but it is still very large.

Couric was correct about supply and demand, but it is important to note the U.S. is still a large importer of oil.

Saturday, December 20, 2014

Existing Home Sales: A Likely "Miss"

by Calculated Risk on 12/20/2014 04:51:00 PM

The NAR will report November Existing Home Sales on Monday, December 22nd. The consensus is the NAR will report sales at 5.20 million seasonally adjusted annual rate (SAAR), however economist Tom Lawler estimates the NAR will report sales of 4.90 million on a SAAR basis.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 4 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Over the last four years, the consensus average miss was 150 thousand with a standard deviation of 160 thousand. Lawler's average miss was 70 thousand with a standard deviation of 45 thousand.

Note: Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has been doing a little better recently! Looking at the consensus for November, maybe some of the analysts took an early vacation this week.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | --- |

| 1NAR initially reported before revisions. | |||

Schedule for Week of December 21st

by Calculated Risk on 12/20/2014 12:19:00 PM

The key reports this week are November Existing Home Sales on Monday, November Personal Income and Outlays on Tuesday, November New Home Sales on Tuesday, and the third estimate of Q3 GDP also on Tuesday.

Merry Christmas and Happy Holidays to All!

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 5.20 million on seasonally adjusted annual rate (SAAR) basis. Sales in October were at a 5.26 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.90 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.9% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 3rd quarter 2014 (third estimate). The consensus is that real GDP increased 4.3% annualized in Q3, revised up from the second estimate of 3.9%.

9:00 AM: FHFA House Price Index for October 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.2% increase.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 93.0, down from the preliminary reading of 93.8, and up from the November reading of 88.8.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an increase in sales to 460 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 458 thousand in October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December.

10:00 AM: Personal Income and Outlays for November. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 289 thousand.

The NYSE and the NASDAQ will close at 1:00 PM ET.

All US markets will be closed in observance of the Christmas Holiday.

No economic releases scheduled.

Unofficial Problem Bank list declines to 401 Institutions

by Calculated Risk on 12/20/2014 08:07:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 19, 2014.

Changes and comments from surferdude808:

The OCC released an update on its latest enforcement action activity that contributed to many changes to the Unofficial Problem Bank List this week. Also, the FDIC closed a bank this Friday in what will likely will be the last closure of the year. In all, there were nine removals and four additions that leave the list with 401 institutions with assets of $125.1 billion. A year ago, the list held 633 institutions with assets of $216.7 billion. Assets on the list increased by $1.2 billion this week and one would have to go all the way back about two years to the week ending November 16, 2012 for a similar increase in assets.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 401.

Actions were terminated against The First National Bank of Layton, Layton, UT ($276 million); Stephens Federal Bank, Toccoa, GA ($147 million); First Federal Savings and Loan Association of Independence, Independence, KS ($137 million Ticker: FFSL); First Federal Bank, A FSB, Tuscaloosa, AL ($128 million); First National Community Bank, Chatsworth, GA ($124 million); Community Federal Savings Bank, Woodhaven, NY ($123 million); The Citizens National Bank of Meyersdale, Meyersdale, PA ($76 million); and Port Byron State Bank, Port Byron, IL ($75 million).

The FDIC shuttered Northern Star Bank, Mankato, MN ($19 million) today making it the 18th failure this year. A total of 23 institutions headquartered in Minnesota have failed since the on-set of the Great Recession, which ranks fifth after Georgia (88), Florida (71), Illinois (61), and California (40).

Additions this week were CertusBank, National Association, Easley, SC ($1.5 billion); Bank of Manhattan, N.A., El Segundo, CA ($496 million Ticker: MNHN); Solera National Bank, Lakewood, CO ($148 million Ticker: SLRK); and First Scottsdale Bank, National Association, Scottsdale, AZ ($95 million).

Next week we anticipate the FDIC will release an update on its enforcement action activity.

Friday, December 19, 2014

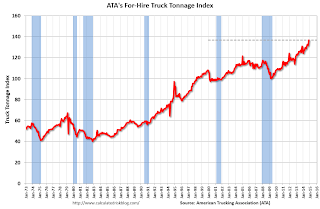

ATA Trucking Index increased 3.5% in November

by Calculated Risk on 12/19/2014 07:01:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Surged 3.5% in November

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index jumped 3.5% in November, following an increase of 0.5% during the previous month. In November, the index equaled 136.8 (2000=100), which was the highest level on record.

Compared with November 2013, the SA index increased 4.4%, down slightly from October’s 4.5% increase but still was the second highest year-over-year gain in 2014. Year-to-date, compared with the same period last year, tonnage is up 3.3%. ...

“With strong readings for both retail sales and factory output in November, I’m not surprised that tonnage increased as well,” said ATA Chief Economist Bob Costello. “However, the strength in tonnage did surprise to the upside.”

“The index has increased in four of the last five months for a total gain of 6.4%,” Costello said. “Clearly, the economy is doing well with tonnage on such a robust trend-line.”

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 4.4% year-over-year.

Lawler Update: Read on November Existing Home Sales, Distressed Sales and Cash buyers for Selected Cities

by Calculated Risk on 12/19/2014 02:54:00 PM

CR Note: The consensus is that on Monday, the NAR will report 5.20 million existing home sales for November, on a seasonally adjusted annual rate basis (SAAR). Housing economist Tom Lawler isn't always correct, but usually he is much closer than the consensus - so I expect a consensus miss on Monday.

From Tom Lawler: "Based on local realtor/MLS reports released through this morning, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.90 million in November, down 6.8% from October’s pace and up 1.4% from last November’s pace. Unadjusted sales last month should be down slightly from a year ago."

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for a selected cities in November.

On distressed: Total "distressed" share is down in these markets mostly due to a decline in short sales (the Mid-Atlantic and Orlando were unchanged).

Short sales are down significantly in these areas.

Foreclosures are up in several areas (working through the logjam).

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov-14 | Nov-13 | Nov-14 | Nov-13 | Nov-14 | Nov-13 | Nov-14 | Nov-13 | |

| Las Vegas | 9.5% | 21.0% | 8.7% | 7.0% | 18.2% | 28.0% | 32.8% | 43.7% |

| Reno** | 6.0% | 17.0% | 6.0% | 6.0% | 12.0% | 23.0% | ||

| Phoenix | 4.1% | 7.8% | 5.7% | 8.0% | 9.7% | 15.8% | 28.0% | 34.0% |

| Sacramento | 6.1% | 11.0% | 5.4% | 4.6% | 11.5% | 15.6% | 16.9% | 25.0% |

| Minneapolis | 3.1% | 5.0% | 10.2% | 16.9% | 13.4% | 21.9% | ||

| Mid-Atlantic | 4.7% | 7.5% | 11.0% | 8.1% | 15.7% | 15.7% | 19.1% | 19.6% |

| Orlando | 6.2% | 13.7% | 27.8% | 20.3% | 34.0% | 34.0% | 42.1% | 46.2% |

| California * | 6.2% | 10.2% | 5.8% | 6.8% | 12.0% | 17.0% | ||

| Bay Area CA* | 4.3% | 7.2% | 2.8% | 3.7% | 7.1% | 10.9% | 18.9% | 22.4% |

| So. California* | 6.2% | 10.5% | 5.3% | 6.3% | 11.5% | 16.8% | 23.9% | 28.1% |

| Miami MSA SF | 8.9% | 15.0% | 20.8% | 15.8% | 29.7% | 30.8% | 41.9% | 45.5% |

| Miami MSA C/TH | 5.0% | 9.2% | 22.4% | 18.3% | 27.4% | 27.5% | 67.8% | 74.6% |

| Chicago (City) | 20.2% | 32.8% | ||||||

| Hampton Roads | 20.4% | 26.9% | ||||||

| Northeast Florida | 29.7% | 38.1% | ||||||

| Tucson | 26.3% | 32.2% | ||||||

| Toledo | 35.4% | 37.2% | ||||||

| Wichita | 26.6% | 26.5% | ||||||

| Des Moines | 19.3% | 19.9% | ||||||

| Peoria | 19.7% | 21.8% | ||||||

| Georgia*** | 26.5% | N/A | ||||||

| Omaha | 21.1% | 21.6% | ||||||

| Pensacola | ||||||||

| Knoxville | ||||||||

| Memphis* | 15.1% | 20.5% | ||||||

| Birmingham AL | 14.9% | 21.0% | ||||||

| Springfield IL** | 11.8% | 17.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

DOT: Vehicle Miles Driven increased 2.6% year-over-year in October

by Calculated Risk on 12/19/2014 02:12:00 PM

With lower gasoline prices, vehicle miles driven might reach a new peak in 2015.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 2.6% (6.6 billion vehicle miles) for October 2014 as compared with October 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 264.2 billion vehicle miles.

Cumulative Travel for 2014 changed by 0.9% (23.2 billion vehicle miles).

The rolling 12 month total is slowly moving up, after moving sideways for a few years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 83 months - almost 7 years - and still counting. Currently miles driven (rolling 12 months) are about 1.6% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In October 2014, gasoline averaged of $3.26 per gallon according to the EIA. That was down from October 2013 when prices averaged $3.42 per gallon.

In October 2014, gasoline averaged of $3.26 per gallon according to the EIA. That was down from October 2013 when prices averaged $3.42 per gallon. Prices will really be down year-over-year in November and December too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years is probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a little more time before we see a new peak in miles driven - but it is possible that a new peak could happen in 2015.

Kansas City Fed: Regional Manufacturing "Activity Expanded at a Moderate Pace" in December

by Calculated Risk on 12/19/2014 11:05:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Moderate Pace

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to expand at a moderate pace in December, and producers’ expectations for future activity remained at solid levels.Two more regional Fed manufacturing surveys for December will be released this month (the Dallas and Richmond Fed surveys). So far the regional surveys have indicated decent growth in December and optimism about the future.

“This month’s results are similar to what we’ve seen most of the year, said Wilkerson. The main change in December, which we started to see in November, is that input price pressures have come down.”

The month-over-month composite index was 8 in December, up slightly from 7 in November and 4 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The employment index jumped from 10 to 18, its highest level in nearly two years. ...

Future factory indexes were mostly stable at solid levels. The future composite index was unchanged at 22, while the future shipments, new orders, and employment indexes increased further. The future capital spending index jumped from 15 to 23, its highest level in five months. In contrast, the future production index eased from 34 to 30, and the future order backlog index also inched lower.

emphasis added