by Calculated Risk on 5/30/2014 02:37:00 PM

Friday, May 30, 2014

Lawler on Toll Brothers: Net Signed Contracts “Flat” vs. Year Ago; Prices Up But Gains Slow; Demand over Past Year “Relatively Flat”

From economist Tom Lawler:

Toll Brothers, the self-described “nation’s leading builder of luxury homes” which was recently honored as BUILDER Magazine’s “builder of the year,” reported that net signed contracts on homes in the quarter ended April 30, 2014 totaled 1,749, down 0.2% from the comparable quarter of 2013. Net signed contracts per community last quarter were down 8.3% from the comparable quarter of 2013. The average price on net signed contracts last quarter was $729,000, up 7.5% from a year ago. Home deliveries totaled 1,218 last quarter, up 36.2% from the comparable quarter of 2013, at an average sales price of $706,000, up 22.4% from the comparable quarter of 2013. The outsized gain in the average sales price for closed homes partly reflected big increases in contract prices last year, but also reflected product “mix” changes, including a sharp increase in the share of homes closed in the expensive West region. The company’s order backlog as of the end of April was 4,324, up 18.3% from last April, at an average order price of $742,000, up 7.1% from a year ago.

The company said that it owned or controlled 50,358 lots at the end of April, up 11.5% from last April, and up 40.1% from April 2011.

In Toll’s press release, the company’s CEO said that “(d)emand over the past year has been solid, although relatively flat, compared to the strong growth we initially experienced beginning in 2011, coming off the bottom of this housing cycle.” He also expressed optimism going forward. Here is another quote from the press release.

“We note that last cycle's recovery, in the early 1990's, began with a period of rapid acceleration, followed by leveling, before further upward momentum. We believe that we are in a similar leveling period in the early stages of the housing recovery with significant pent-up demand building."

Toll does give limited (and not very useful) guidance in its press release, and Toll said that it expects to deliver between 5,100 and 5,850 in the fiscal year ending 10/31/2014. Given deliveries in the first half of the fiscal year, that guidance implies a range of deliveries from May 1 through October 31 of between 2,954 and 3,704. Toll’s guidance on the average sales price on deliveries for the year was between $690,000 and $720,000. Using the midpoint of these ranges as the “best guidance,” that would imply deliveries from May 1, 2014 through October 2014 of 3,329, up 30.8% from the comparable period of 2013, at an average sales price of 705,000, up 3.5% from the comparable period of 2013, and little changed from the average sales price in the first half of FY 2014.

Toll’s earnings beat consensus, but net orders per community were disappointing.

Headline for Next Friday: "U.S. Employment at All Time High"

by Calculated Risk on 5/30/2014 12:22:00 PM

Just a quick note, total nonfarm U.S. employment is currently 113 thousand below the pre-recession peak. With the release of the May employment report next Friday, total employment will probably be at an all time high.

Note: The consensus is for an increase of 217 thousand non-farm payroll jobs added in May.

I guess I'm going to have to retire the following graph until the next recession ... (once call the "THE SCARIEST JOBS CHART EVER").

Click on graph for larger image.

The graph shows the percentage of payroll jobs lost during post WWII recessions through April.

Of course this doesn't include growth of the labor force, but this will be a significant milestone as the economy recovers from the housing bust and severe financial crisis.

Final May Consumer Sentiment at 81.9, Chicago PMI increases to 65.5

by Calculated Risk on 5/30/2014 09:55:00 AM

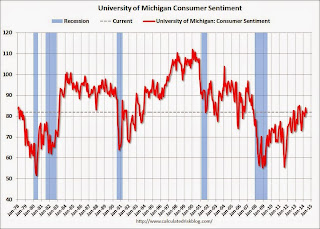

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for May decreased to 81.9 from the April reading of 84.1, and was up slightly from the preliminary May reading of 81.8.

This was below the consensus forecast of 82.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

Still waiting for sentiment to back at post-recession highs!

Chicago PMI May 2014: Chicago Business Barometer Up 2.5 to 65.5 in May

The Chicago Business Barometer increased to 65.5 in May from 63.0 in April, the highest since October, as demand strengthened and the economy continued to recover from a weather related slowdown in Q1. ...This was above the consensus estimate of 61.0.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist at MNI Indicators said, “It looks pretty clear now that the slowdown in Q1 was due to the poor weather, with activity now back to or exceeding the level seen in Q4. The rise in the Barometer to a seven month high in May suggests we’ll see a significant bounceback in GDP growth this quarter following the contraction in Q1.”

emphasis added

Personal Income increased 0.3% in April, Spending decreased 0.1%

by Calculated Risk on 5/30/2014 08:30:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $43.7 billion, or 0.3 percent ... in April, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $8.1 billion, or 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April 2013 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.3 percent in April, in contrast to an increase of 0.8 percent in March. ... The price index for PCE increased 0.2 percent in April, the same increase as in March. The PCE price index, excluding food and energy, increased 0.2 percent in April, the same increase as in March. ... The April price index for PCE increased 1.6 percent from April a year ago. The April PCE price index, excluding food and energy, increased 1.4 percent from April a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

This is just one month for Q2 - and the month-to-month decline in PCE was due to the surge in spending in March (following the severe winter).

Thursday, May 29, 2014

Friday: Personal Income and Outlays, Chicago PMI, Consumer Sentiment

by Calculated Risk on 5/29/2014 08:59:00 PM

From the WSJ: Borrowers Tap Their Homes at a Hot Clip

A rebound in house prices and near-record-low interest rates are prompting homeowners to borrow against their properties, marking the return of a practice that was all the rage before the financial crisis.This is still a low level (not really a "hot clip"), but this is an increase from last year. I've been expecting Mortgage Equity Withdrawal (MEW) to turn positive soon, and maybe the Q1 Flow of Funds report will suggest positive MEW (to be released by the Fed on June 5th).

Home-equity lines of credit, or Helocs, and home-equity loans jumped 8% in the first quarter from a year earlier, industry newsletter Inside Mortgage Finance said Thursday. The $13 billion extended was the most for the start of a year since 2009. Inside Mortgage Finance noted the bulk of the home-equity originations were Helocs.

While that is still far below the peak of $113 billion during the third quarter of 2006, this year's gains are the latest evidence that the tight credit conditions that have defined mortgage lending in recent years are starting to loosen.

Friday:

• At 8:30 AM, Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a decrease to 61.0, down from 63.0 in April.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 82.5, up from the preliminary reading of 81.8, but down from the April reading of 84.1.

A comment on GDP Revisions: No Worries

by Calculated Risk on 5/29/2014 02:22:00 PM

The BEA reported this morning that GDP declined at a 1.0% annual rate in Q1. This is disappointing, but not concerning looking forward.

The key driver of the downward revision was a much larger negative change in private inventories (see table below that shows the contribution to GDP from each major category). In the advance release, change in private inventories subtracted 0.57 percentage points from GDP. With the 2nd release - based on more data - change in private inventories subtracted 1.61 percentage point. This was payback from the positive contribution in Q3 last year (change in private inventories tends to bounce around quarter-to-quarter).

There were also downward revisions to investment in nonresidential structure, trade, and state and local government.

PCE was revised up from 3.0% to 3.1% in Q1 (annualized growth rate), and the contribution from PCE to GDP increased slightly.

This weakness will not continue - growth has already picked up in Q2. And I expect both residential investment and state and local governments to add to growth soon. And even investment in nonresidential structures should turn positive.

The growth story is intact. No worries.

| Revision: Contributions to Percent Change in Real Gross Domestic Product | |||

|---|---|---|---|

| Advance | 2nd Release | Revision | |

| GDP, Percent change at annual rate: | 0.1 | -1.0 | -1.1 |

| PCE, Percentage points at annual rates: | |||

| Personal consumption expenditures | 2.04 | 2.09 | 0.05 |

| Investment, Percentage points at annual rates: | |||

| Nonresidential Structures | 0.00 | -0.21 | -0.21 |

| Equipment | -0.32 | -0.18 | 0.14 |

| Intellectual property products | 0.06 | 0.19 | 0.13 |

| Residential | -0.18 | -0.16 | 0.02 |

| Change in private inventories | -0.57 | -1.62 | -1.05 |

| Trade, Percentage points at annual rates: | |||

| Net exports of goods and services | -0.83 | -0.95 | -0.12 |

| Government, Percentage points at annual rates: | |||

| Federal Government | 0.05 | 0.05 | 0.00 |

| State and Local | -0.14 | -0.20 | -0.06 |

NAR: Pending Home Sales Index increases 0.4% in April, down 9.2% year-over-year

by Calculated Risk on 5/29/2014 10:00:00 AM

From the NAR: Pending Home Sales Edge Up in April

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 0.4 percent to 97.8 in April from 97.4 in March, but is 9.2 percent below April 2013 when it was 107.7.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

...

The PHSI in the Northeast increased 0.6 percent to 79.3 in April, but is 12.0 percent below a year ago. In the Midwest the index rose 5.0 percent to 99.2 in April, but is 6.9 percent below April 2013. Pending home sales in the South slipped 0.6 percent to an index of 111.9 in April, and are 6.4 percent below a year ago. The index in the West declined 2.9 percent in April to 88.4, and is 15.0 percent below April 2013.

Q1 GDP Revised Down to -1.0% Annual Rate, Weekly Initial Unemployment Claims decrease to 300,000

by Calculated Risk on 5/29/2014 08:41:00 AM

From the BEA: Gross Domestic Product: First Quarter 2014 (Second Estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 1.0 percent in the first quarter according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.6 percent. ...Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 3.0% to 3.1%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, real GDP was estimated to have increased 0.1 percent. ...

The second estimate of the first-quarter percent change in real GDP was revised down 1.1 percentage points, or $43.7 billion, from the advance estimate issued last month, primarily reflecting a downward revision to private inventory investment and an upward revision to imports that were partly offset by an upward revision to exports.

The DOL reports:

In the week ending May 24, the advance figure for seasonally adjusted initial claims was 300,000, a decrease of 27,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 326,000 to 327,000. The 4-week moving average was 311,500, a decrease of 11,250 from the previous week 's revised average. This is the lowest level for this average since August 11, 2007 when it was 311,250. The previous week's average was revised up by 250 from 322,500 to 322,750.The previous week was revised up from 326,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 311,500.

This was below the consensus forecast of 317,000. The 4-week average is at the lowest level since 2007 and at normal levels for an expansion.

Wednesday, May 28, 2014

Thursday: Q1 GDP Revision, Unemployment Claims, Pending Home Sales

by Calculated Risk on 5/28/2014 06:54:00 PM

From the WSJ: Contracting Economy? What to Watch in Thursday’s Report on U.S. GDP

Economists surveyed by The Wall Street Journal forecast it will show GDP contracted at a 0.6% annual rate in the first three months of the year. ...Economists frequently blame weakness on the weather ... but sometimes it really is the weather!

Since the recession ended in June 2009, U.S. GDP growth has dipped into the red only once: the first quarter of 2011, when economic output contracted at a 1.3% rate.

It appears likely to happen again. But economists aren’t worried about a prolonged downturn. Most have chalked up the weak first quarter to transitory factors like the brutal winter weather, and expect to see a significant rebound this spring.

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 317 thousand from 326 thousand.

• Also at 8:30 AM, Q1 GDP (second estimate). This is the second estimate of Q1 GDP from the BEA. The consensus is that real GDP decreased 0.6% annualized in Q1, revised down from the advance estimate of a 0.1% increase.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 1% increase in the index.

Average 30 Year Fixed Mortgage Rates decline to 4.08%

by Calculated Risk on 5/28/2014 01:46:00 PM

I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates declined today to 4.08% from 4.16% yesterday.

One year ago rates were at 3.81% and rising. If the current rate holds, mortgage rates will be down year-over-year in about 3 weeks. As MND told me "Many borrowers would be getting quoted the same rates a year ago today".

Here is a table from Mortgage News Daily: