by Calculated Risk on 2/19/2014 08:30:00 AM

Wednesday, February 19, 2014

Housing Starts decline to 880 Thousand Annual Rate in January

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 880,000. This is 16.0 percent below the revised December estimate of 1,048,000 and is 2.0 percent below the January 2013 rate of 898,000.

Single-family housing starts in January were at a rate of 573,000; this is 15.9 percent below the revised December figure of 681,000. The January rate for units in buildings with five units or more was 300,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 937,000. This is 5.4 percent below the revised December rate of 991,000, but is 2.4 percent above the January 2013 estimate of 915,000.

Single-family authorizations in January were at a rate of 602,000; this is 1.3 percent below the revised December figure of 610,000. Authorizations of units in buildings with five units or more were at a rate of 309,000 in January.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in January (Multi-family is volatile month-to-month).

Single-family starts (blue) also decreased in January.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was below expectations of 950 thousand starts in January. Note: Starts for December were revised up to 1.048 million from 999 thousand. I'll have more later.

MBA: Mortgage Purchase Index lowest Since September 2011

by Calculated Risk on 2/19/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 14, 2014. ...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier and is at its lowest level since September of 2011. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.50 percent from 4.45 percent, with points decreasing to 0.26 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) increased to 4.45 percent from 4.40 percent, with points decreasing to 0.11 from 0.14 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 68% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 15% from a year ago - and the weekly purchase index is at the lowest level since September 2011.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Note: Interesting that Jumbo rates are still below conforming rates.

Tuesday, February 18, 2014

Wednesday: Housing Starts, PPI, Architecture Billings Index, FOMC Minutes

by Calculated Risk on 2/18/2014 07:07:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.Of course, with the terms of the bet, we could both "win" at some point during the year.

In January 2013, starts were at a 898 thousand seasonally adjusted annual rate (SAAR). For me to win, starts would have to be up 20% or at 1.078 million SAAR in January (very unlikely due to the weather). For NDD to win, starts would have to fall to 798 thousand SAAR. NDD could also "win" if permits fall to 815 thousand SAAR from 915 thousand SAAR in January 2013.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for January. Total housing starts were at 999 thousand (SAAR) in December. Single family starts were at 667 thousand SAAR in December. The consensus is for total housing starts to decrease to 950 thousand (SAAR) in January.

• Also at 8:30 AM, the Producer Price Index for January. The consensus is for a 0.2% decrease in producer prices (and 0.2% increase in core PPI).

• During the day, the AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Minutes for the Meeting of January 28-29, 2014.

Real Household Debt down 17% from Peak, Real Mortgage Debt down 21%

by Calculated Risk on 2/18/2014 02:14:00 PM

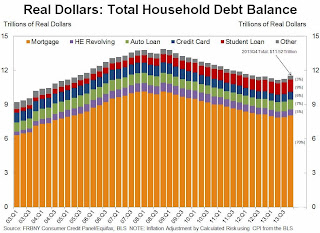

This morning, the NY Fed released their Q4 Household Debt and Credit Report. The report showed that total household debt is 9.1% below the Q3 2008 peak. Mortgage debt is down 13.4% from the peak, and Home Equity revolving debt is down 25.9%. This is nominal dollars.

If we look at real dollars (inflation adjusted using CPI from the BLS), then total debt is down 16.9% since 2008, mortgage debt down 20.7%, home equity debt down 32.6%, auto debt down 12.2%, and credit card debt down 27.9%. Only student debt is at a new high (up 77% since Q3 2008 in nominal terms).

The following graph (not from the NY Fed) shows household debt in real terms.

Click on graph for larger image.

Click on graph for larger image.

This household deleveraging was a key reason the recovery was slow, and now it appears the deleveraging is over.

This is a significant decline in total household debt, especially for mortgage, home equity, and credit card debt (student debt has increased).

NY Fed: Household Debt increased in Q4, Delinquency Rates Improve

by Calculated Risk on 2/18/2014 11:00:00 AM

Here is the Q4 report: Household Debt and Credit Report

Aggregate consumer debt increased in the fourth quarter by $241 billion, the largest quarter to quarter increase seen since the third quarter of 2007. As of December 31, 2013, total consumer indebtedness was $11.52 trillion, up by 2.1% from its level in the third quarter of 2013. The four quarters ending on December 31, 2013 were the first since late 2008 to register an increase ($180 billion or 1.6%) in total debt outstanding. Nonetheless, overall consumer debt remains 9.1% below its 2008Q3 peak of $12.68 trillion.

Mortgages, the largest component of household debt, increased 1.9% during the fourth quarter of 2013. Mortgage balances shown on consumer credit reports stand at $8.05 trillion, up by $152 billion from their level in the third quarter. Furthermore, calendar year 2013 saw a net increase of $16 billion in mortgage balances, ending the four year streak of year over year declines. Balances on home equity lines of credit (HELOC) dropped by $6 billion (1.1%) and now stand at $529 billion. Non-housing debt balances increased by 3.3%, with gains of $18 billion in auto loan balances, $53 billion in student loan balances, and $11 billion in credit card balances.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q4.

This suggests households (in the aggregate) may be near the end of deleveraging. If so, this is a significant change that started mid-2013.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Delinquency rates improved for most loan types in 2013Q4. As of December 31, 7.1% of outstanding debt was in some stage of delinquency, compared with 7.4% in 2013Q3. About $820 billion of debt is delinquent, with $580 billion seriously delinquent (at least 90 days late or “severely derogatory”).Here is the press release from the NY Fed: New York Fed Report Shows Households Adding Debt

Delinquency transition rates for current mortgage accounts are near pre-crisis levels, with 1.48% of current mortgage balances transitioning into delinquency.

There are a number of credit graphs at the NY Fed site.

NAHB: Builder Confidence declines sharply in February to 46

by Calculated Risk on 2/18/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 46 in February, down from 56 in January. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Poor Weather Puts a Damper on Builder Confidence in February

Unusually severe weather conditions across much of the nation along with continued concerns over the cost and availability of labor and lots resulted in builder confidence in the market for newly-built, single-family homes to post a 10-point drop to 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“Significant weather conditions across most of the country led to a decline in buyer traffic last month,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del. “Builders also have additional concerns about meeting ongoing and future demand due to a shortage of lots and labor.”

“Clearly, constraints on the supply chain for building materials, developed lots and skilled workers are making builders worry,” said NAHB Chief Economist David Crowe. “The weather also hurt retail and auto sales and this had a contributing effect on demand for new homes.”

...

All three of the major HMI components declined in February. The component gauging current sales conditions fell 11 points to 51, the component gauging sales expectations in the next six months declined six points to 54 and the component measuring buyer traffic dropped nine points to 31.

Looking at three-month moving averages for regional HMI scores, the West was unchanged at 63 in February while the Midwest registered a one-point decline to 57, the South registered a three-point decline to 53 and the Northeast posted a four-point decline to 38.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the first reading below 50 since May 2013.

NY Fed: Empire State Manufacturing Survey indicates slower expansion in February

by Calculated Risk on 2/18/2014 08:45:00 AM

From the NY Fed: Empire State Manufacturing Survey

The February 2014 Empire State Manufacturing Survey indicates that business conditions improved marginally for New York manufacturers. The general business conditions index fell eight points, but remained positive at 4.5. The new orders index fell to about zero, indicating that orders were flat, and the shipments index declined thirteen points to 2.1. ...This is the first of the regional surveys for February. The general business conditions index was below the consensus forecast of a reading of 9.0, and indicates slower expansion in February. The internals were mixed, with new orders flat after hitting a two year high in January, and the employment index indicated modest improvement.

Employment indexes were little changed from last month and pointed to a modest improvement in labor market conditions. The number of employees index was 11.3, indicating a modest increase in employment levels, and the average workweek index inched up to 3.8, suggesting slightly longer workweeks.

...

Indexes for the six-month outlook continued to convey fairly strong optimism about future business conditions. The index for expected general business conditions rose to 39.0, and the index for future new orders climbed six points to 45.3, its highest level in two years.

emphasis added

Monday, February 17, 2014

Tuesday: NY Fed Mfg Survey, Homebuilder Survey, Q4 Household Debt and Credit

by Calculated Risk on 2/17/2014 09:08:00 PM

First, Don Lee of the LA Times interviewed San Francisco Fed President John Williams: Fed district chief expects central bank's stimulus cuts to continue

Would another jobs report next month like January's payroll growth of 113,000 be enough for you or the committee to put a hold on the so-called tapering of the Fed's bond-buying stimulus?The Fed may not be on a "preset course" to taper QE3, but it sounds like it would take a significant change in the data for the Fed to slow down. There is much more in the interview.

If there was another employment report similar to what we saw in January, I personally would not see that as being inconsistent with my view of the economic recovery. I wouldn't call for a change in tapering.

Tuesday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for February. The consensus is for a reading of 9.8, down from 12.5 in January (above zero is expansion).

• At 10:00 AM, the February NAHB homebuilder survey. The consensus is for a reading of 56, unchanged from January. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 11:00 AM, the Q4 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

Weekly Update: Housing Tracker Existing Home Inventory up 6.6% year-over-year on Feb 17th

by Calculated Risk on 2/17/2014 06:44:00 PM

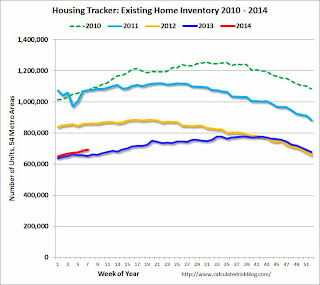

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for December). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 6.6% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Las Vegas: Visitor Traffic declines slightly in 2013, Convention Attendance still 18% below Pre-Recession Peak

by Calculated Risk on 2/17/2014 05:44:00 PM

Just an update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2012. However visitor traffic was down slightly in 2013.

Convention attendance is still about 18% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

There were 39,668,221 visitors to Las Vegas in 2013, just below the record 39,727,022 visitors in 2012. The pre-recession high was 39,196,761 in 2007.

Convention attendance was at 5,107,416 in 2013, still well below the record of 6,307,961 in 2006.

In general, the gamblers are back ... but the conventions are still lagging behind.