by Calculated Risk on 2/11/2014 08:44:00 AM

Tuesday, February 11, 2014

NFIB: Small Business Optimism Index increases in January

From the National Federation of Independent Business (NFIB): Small Business Confidence Edges Up, Ever so Slightly

Small business optimism started the year slightly up from December at 94.1 but well below the pre-recession average of 100, according to the National Federation of Independent Business’ (NFIB’s) latest index. On the positive front, owners did find a reason to be more positive about their own sales (a huge 7 point jump in positive expectations) and plan more hiring, with the strongest job creation plans since 2007.

...

NFIB owners increased employment by an average of 0.12 workers per firm in January (seasonally adjusted), half the December reading, but a solid number.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 94.1 in January from 93.9 in December - and is just below the post-recession high.

Also this is the highest level for hiring plans since 2007. A small step in the right direction.

Monday, February 10, 2014

Tuesday: Yellen, JOLTS

by Calculated Risk on 2/10/2014 08:39:00 PM

An update on Congress paying the bills from the WSJ: GOP Leaders in New Push to Reach Debt Deal

House Republican leaders tried Monday to build support for raising the federal debt limit by linking it to a reversal of planned cuts in some military pensions ...Congress will pay the bills. Everything else is political theater (like the dumb questions for Fed Chair Yellen during her testimony tomorrow). Yawn.

"It's reasonable to attach that provision to the debt ceiling," Rep. Charlie Dent (R., Pa.) said of the military pension provision. "If the votes aren't there for that, then at some point we'll have to vote on a clean bill."

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for January.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for December from the BLS. Jobs openings increased in November to 4.001 million from 3.931 million in October. The number of job openings were up 5.6% year-over-year compared to November 2012 and this was the first time job openings had been above 4 million since 2008. Quits increased in November and were up about 13% year-over-year. These are voluntary separations, so this is a positive indicator.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for December. The consensus is for a 0.5% increase in inventories.

• Also at 10:00 AM, Testimony, Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

Weekly Update: Housing Tracker Existing Home Inventory up 4.7% year-over-year on Feb 10th

by Calculated Risk on 2/10/2014 06:05:00 PM

Here is another weekly update on housing inventory ... for the 17th consecutive week housing inventory is up year-over-year. This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for December). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 4.7% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

The California Budget Surplus: Stock and Flow

by Calculated Risk on 2/10/2014 05:03:00 PM

Over a year ago, I predicted that California would run an annual budget surplus soon. Several people wrote to me and said that can't be correct ... they heard California still had a significant amount of debt. That is also correct. This is a stock and flow issue. The cash deficit is the stock, and the annual budget surplus is the flow.

Even with a budget surplus, California still has $12.6 billion in debt. From California State Controller John Chiang:

The State ended the month with a General Fund cash deficit of $12.6 billion, which was covered with both internal and external borrowing. That figure was down from last year, when the State faced a cash deficit of $15.7 billion at the end of January 2013.It will take some time to pay down the cash deficit, but the state is running an annual budget surplus.

And on January cash update:

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in January 2014. Revenues for the month totaled $12.2 billion, surpassing estimates in the 2014-15 Governor's Budget by $387.7 million, or 3.3 percent.This is just one state, but I expect local and state governments (in the aggregate) to add to both GDP and employment in 2014.

"Strong revenues for the month of January confirm California is continuing its slow climb out of the wreckage of the Great Recession," said Chiang. "Better-than-expected income tax receipts -- particularly those straight from paychecks – could indicate Californians are working and earning more."

emphasis added

Las Vegas Real Estate in January: Year-over-year Non-contingent Inventory up 96.2%

by Calculated Risk on 2/10/2014 12:18:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports home prices started 2014 where they left off in 2013

GLVAR said the total number of existing local homes, condominiums and townhomes sold in the traditionally slow month of January was 2,527, down from 2,915 in December and down from 2,821 one year ago....There are several key trends that we've been following:

...

GLVAR has been reporting fewer foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. For instance, in January, 17 percent of all existing local home sales were short sales, down from 20.7 percent in December. Another 11 percent of all January sales were bank-owned properties, up from 8.5 percent in December.

GLVAR said 46.3 percent of all existing local homes sold in January were purchased with cash. That’s up from 44.4 percent in December, but down from a peak of 59.5 percent set in February 2013.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service in January was 13,537. That’s up 1.8 percent from 13,303 single-family homes listed for sale at the end of December, but down 6.2 percent from 14,433 homes one year ago. ...

GLVAR reported many more available homes listed for sale without any sort of pending or contingent offer. By the end of January, GLVAR reported 6,541 single-family homes listed without any sort of offer. That’s down 0.7 percent from 6,587 such homes listed in December, but still up 96.2 percent from one year ago.

emphasis added

1) Overall sales were down about 10.4% year-over-year.

2) Conventional sales are up solidly year-over-year. In January 2013, only 51.3% of all sales were conventional. This year, in January 2014, 72% were conventional. That is an increase in conventional sales of about 26% year-over-year.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 96.2% year-over-year!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow.

Home Sales Reports: What Matters

by Calculated Risk on 2/10/2014 10:40:00 AM

First here are some excepts from a post I wrote in June 2012 that is relevant today:

The key number in the existing home sales report is not sales, but inventory. ...A few key points:

When we look at sales for existing homes, the focus should be on the composition between conventional and distressed. Total sales are probably close to the normal level of turnover, but the composition of sales is far from normal - sales are still heavily distressed sales. Over time, existing home sales will probably settle around 5 million per year, but the percentage of distressed sales will eventually decline. Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. Look at inventory and the percent of conventional sales.

However, for the new home sales report, the key number is sales! An increase in sales adds to both GDP and employment (completed inventory is at record lows, so any increase in sales will translate to more single family starts).

...

Some people think housing will recover rapidly to the 1.2+ million rate we saw in 2004 and 2005. I think that is incorrect for two reasons. First, I think the recovery will be sluggish - 2012 will probably be the third worst year ever. Second, the 1.2 million in annual sales was due to an increasing homeownership rate and speculative buying. With a stable homeownerhip rate, and little speculative buying, sales will probably only rise to around 800 thousand at full recovery.

• If existing home sales are flat this year, or even decline - that doesn't mean the housing recovery is over. For existing home sales we need to look at the composition of sales (distressed vs. conventional), and the percent of conventional sales are increasing (and investor buying has slowed too). This is a positive sign.

• New Home sales were up 16.4% in 2013 (strong growth rate), but were only at 428 thousand. This was the sixth worst year since 1963. I don't expect sales to increase to 1.2+ million that we saw in 2004 and 2005, but I do expect sales to increase to close to 800 thousand - so I expect significant growth over the next few years.

• There was a slowdown in new home sales in the 2nd half of 2013, and I expect downward revisions to the Census Bureau reports - see Lawler: Expect Downward Revisions to Census Q4 New Home Sales, Broad-Based Builder Optimism for 2014 - but that was due to a combination of factors (builders increased prices rapidly, higher mortgage rates, constrained supply of entitled land) - but I expect a solid increase in sales in 2014.

Sunday, February 09, 2014

Sunday Night Futures

by Calculated Risk on 2/09/2014 08:41:00 PM

From Joe Weisenthal at Business Inside: Janet Yellen Will Be In The Spotlight This Week

Starting Tuesday, new Fed Chief Janet Yellen gives her first semiannual Humphrey-Hawkins testimony.The next FOMC meeting is March 18th and 19th (followed by Dr. Yellen's first press conference as Fed Chair). So there is just the February employment report in early March (one report, not two) between now and then.

Morgan Stanley's Vincent Reinhart writes:

Fed Chair Janet Yellen gives her first semiannual testimony on monetary policy on Tuesday, February 11. With two weak payroll prints in a row, she will feel no need to defend policy accommodation. ... With considerable confusion about the role of weather on the last two employment reports and two more to come before the next FOMC meeting, a modest show of empathy should be sufficient. Traditionally, these events are the peaks in the landscape of Fed communication.

Note: Personally I think the after meeting press conferences are more effective Fed communication than the testimony to Congress (the press mostly asks better questions, whereas the questions from Congress are mostly political posturing).

Weekend:

• Schedule for Week of Feb 9th

From MarketWatch: Asia Markets live blog: Stocks rolling higher

Tokyo equities are starting the week in the plus column, leading the Nikkei Average up 1.2% at 14,642.From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are unchanged (fair value).

Oil prices are up with WTI futures at $100.24 per barrel and Brent at $109.72 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.28 per gallon (moving up, but down significantly from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 2/09/2014 11:41:00 AM

Payroll employment is getting close to the pre-recession peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow), but reaching new highs in employment will be a significant milestone in the recovery.

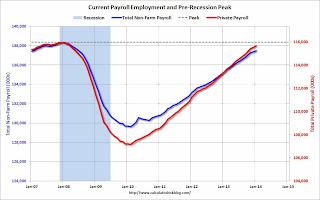

The graph below shows both total non-farm payroll (blue, left axis) and private payroll (red, right axis) since January 2007. Both total non-farm and private payroll employment peaked in January 2008.

The dashed line is the pre-recession peak.

Click on graph for larger image.

Click on graph for larger image.

The pre-recession peak for total non-farm payroll employment was 138.365 million. Currently there are 137.499 million total non-farm payroll jobs, or 866 thousand fewer than the pre-recession peak.

At the recent annual pace (about 2.2 million jobs added per year), total non-farm payroll will be at a new high in mid-2014.

The pre-recession peak for private payroll employment was 115.977 million. Currently there are 115.686 million total non-farm payroll jobs, or 291 thousand fewer than the pre-recession peak. It seems likely private sector employment that will be at a new high by March.

Saturday, February 08, 2014

Schedule for Week of Feb 9th

by Calculated Risk on 2/08/2014 10:57:00 AM

Th key reports this week are January retail sales on Thursday and industrial production on Friday.

New Fed Chair Janet Yellen will present the Semiannual Monetary Policy Report to the Congress this week.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for January.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in November to 4.001 million from 3.931 million in October. The number of job openings (yellow) is up 5.6% year-over-year compared to November 2012 and this was the first time job openings have been above 4 million since 2008.

Quits increased in November and are up about 13% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for December. The consensus is for a 0.5% increase in inventories.

10:00 AM: Testimony, Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM ET: the Monthly Treasury Budget Statement for January. The CBO estimates that the Treasury ran a deficit of $10 billion in January.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 331 thousand.

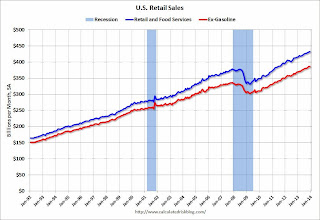

8:30 AM ET: Retail sales for January will be released.

8:30 AM ET: Retail sales for January will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.2% from November to December (seasonally adjusted), and sales were up 4.7% from December 2012.

The consensus is for retail sales to decrease 0.1% in December, and to increase 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.4% increase in inventories.

10:00 AM: Testimony, Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 80.0, down from 81.2 in January.

Unofficial Problem Bank list declines to 588 Institutions

by Calculated Risk on 2/08/2014 08:42:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 7, 2014.

Changes and comments from surferdude808:

Only two removals to report from the Unofficial Problem Bank List this week. The list includes 588 institutions with assets of $195.1 billion, which is down from 820 institutions with assets of $305.0 billion a year ago. Both banks -- GCF Bank, Sewell, NJ ($301 million) and First Community Bank of Crawford County, Van Buren, AR ($67 million) -- found merger partners in order to exit the list. So we did not have a fourth consecutive week with a bank failure.

This week, the Wall Street Journal published an article (Small Banks Face TARP Hit) stating that 27 small banks will have their quarterly TARP dividend doubled next week with another 32 by May 15th. Back on September 27, 2013 we provided the last semi-annual update on banks with outstanding TARP monies on the Unofficial Problem Bank List. A near doubling of the dividend rate will put additional financial pressure on these weak banks. As a result, many will likely need to find a merger partner.