by Calculated Risk on 1/10/2014 02:46:00 PM

Friday, January 10, 2014

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

First, from Fed Chairman Ben Bernanke, Jan 3, 2014:

[A]t the current point in the recovery from the 2001 recession, employment at all levels of government had increased by nearly 600,000 workers; in contrast, in the current recovery, government employment has declined by more than 700,000 jobs, a net difference of more than 1.3 million jobs.By request, here is an update on an earlier post through the November employment report.

In April, I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush). Below are updates through the September report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the first year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton (light blue) and 14,688,000 under President Reagan (yellow).

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. Close to one year into Mr. Obama's second term, there are now 3,980,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010. The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 734,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level - but overall - maybe public employment has bottomed.

Comments on the Disappointing Employment Report

by Calculated Risk on 1/10/2014 10:58:00 AM

This was a disappointing employment report, but 1) it was just one month, 2) November was revised up, 3) other data suggests stronger hiring, and 4) there was some weather related impact (as expected). This report doesn't change my outlook. On weather, the BLS reported:

Construction employment edged down in December (-16,000). However, in 2013, the industry added an average of 10,000 jobs per month. Employment in nonresidential specialty trade contractors declined by 13,000 in December, possibly reflecting unusually cold weather in parts of the country.There were probably other weather related impacts (unemployment claims spiked hire during the BLS reference week), but all the weakness can't be blamed on the weather (the report was still disappointing).

Overall job growth was about as expected in 2013 (see table below), and I expect employment growth to pick up in 2014.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,170 | 2,709 |

| 2000 | 1,944 | 1,680 |

| 2001 | -1,757 | -2,308 |

| 2002 | -532 | -765 |

| 2003 | 62 | 104 |

| 2004 | 2,019 | 1,872 |

| 2005 | 2,484 | 2,298 |

| 2006 | 2,071 | 1,862 |

| 2007 | 1,115 | 827 |

| 2008 | -3,617 | -3,797 |

| 2009 | -5,052 | -4,976 |

| 2010 | 1,022 | 1,235 |

| 2011 | 2,103 | 2,420 |

| 2012 | 2,193 | 2,269 |

| 2013 | 2,186 | 2,211 |

Although construction was weak (weather related), seasonal retail hiring remained solid. See the first graph below - this is a good sign for the holiday season ("Watch what they do, not what they say")

Seasonal Retail Hiring

Click on graph for larger image.

Click on graph for larger image.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to normal levels.

Retailers hired 176 thousand workers (NSA) net in December. This puts seasonal retail hiring at the highest level since 1999, and suggests holiday sales were decent. Note: this is NSA (Not Seasonally Adjusted).

Note: There is a decent correlation between seasonal retail hiring and holiday retail sales.

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The 25 to 54 participation rate declined in December to 80.7% from 80.9%, and the 25 to 54 employment population ratio increased to 76.1% from 76.0%. As the economy recoveries, I'd expect both to increase back towards pre-recession levels.

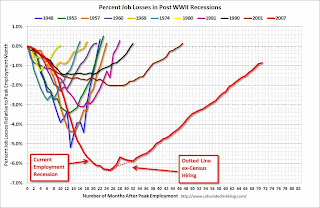

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

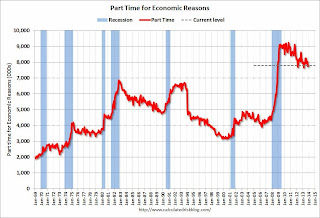

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 7.8 million in December. These individuals were working part time because their hours had been cut back or because they were unable to find full-time work.These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 13.1% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.878 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.044 million in November. This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In December 2013, state and local governments lost 11,000 jobs, however state and local employment was up 54 thousand in 2013.

It appears state and local employment employment has bottomed. Of course Federal government layoffs are ongoing.

Overall this was a disappointing employment report.

December Employment Report: 74,000 Jobs, 6.7% Unemployment Rate

by Calculated Risk on 1/10/2014 08:30:00 AM

From the BLS:

The unemployment rate declined from 7.0 percent to 6.7 percent in December, while total nonfarm payroll employment edged up (+74,000), the U.S. Bureau of Labor Statistics reported today.The headline number was well below expectations of 200,000 payroll jobs added.

...

The number of unemployed persons declined by 490,000 to 10.4 million in December, and the unemployment rate declined by 0.3 percentage point to 6.7 percent.

...

The change in total nonfarm payroll employment for October remained at +200,000, and the change for November was revised from +203,000 to +241,000. With these revisions, employment gains in October and November were 38,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Employment is less than 1% below the pre-recession peak.

NOTE: The second graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The third shows the unemployment rate.

The unemployment rate decreased in December to 6.7% from 7.0% in November.

The fourth graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased in December to 62.8% from 63.0% in November. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was unchanged in December at 58.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

This was a disappointing employment report. However this is just one month and other recent employment data was positive. As I noted yesterday, unemployment claims spiked higher during the BLS reference period in December (the reason I took the "under"), and that might have been weather related. I'll have much more later ...

Thursday, January 09, 2014

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 1/09/2014 09:25:00 PM

The forecasts for the employment report have been moving up all week, although there is some concern about adverse weather in December, especially during the BLS reference week. We will know soon ...

Jon Hilsenrath has an interesting Q&A at the WSJ: Q&A: Fed’s Williams on Upbeat 2014 Outlook and What Keeps Him up at NightSome excerpts:

WSJ: WHAT WOULD IT TAKE FOR YOU TO START MOVING YOUR FORECASTS UP FOR THIS YEAR?Friday:

WILLIAMS: Investment spending is an interesting question. One of the things that still is surprisingly weak is business investment spending. Normally our macro models tell us that business investment tracks the economy pretty well. Yet right now business investment spending still seems pretty weak. I could see some upside surprises occurring. I’m not predicting them obviously. But a potential development would be seeing more business investment or a faster return on housing construction. I think the risks to our forecast are pretty balanced. I could easily think of scenarios where growth picked up to be well above 3%, as well as downside surprises.

...

WSJ: DO YOU WORRY ABOUT THE RISK OF REPEATING WHAT MIGHT OR MIGHT NOT HAVE BEEN A MISTAKE IN 2004 AND 2005, OF KEEPING RATES TOO LOW FOR TOO LONG? IF WE DON’T KNOW THE ANSWER TO WHAT CAUSES BUBBLES, HOW DOES IT AFFECT YOUR THINKING AS A POLICY MAKER NOW?

WILLIAMS: It is something that keeps me up at night and probably others too. Think about the asymmetry of risks. For the last few years I think we’ve been correctly focused on tail risks to the downside, like deflation or the economy getting stuck in a low growth or stagnating situation. My view now is there are some potential risks to the upside, growth picking up much faster than we expect. We have a lot of accommodation in place. We should always keep that in mind. The funds rate is zero. We have a balance sheet of trillions and trillions in dollars. That’s all in place. Whether we cut purchases by 10 billion a month or not, we still have a very accommodative stance of policy and that is going to stay with us for quite some time. That is where I worry. If the economy really picks up or inflation or risks to financial stability really do start to emerge in a serious way, we need to be able to move policy back to normal, or adjust policy appropriately, in a timely manner. It’s always a difficult issue. This time it is just a much greater risk because we’re in a much more accommodative stance of policy.

• At 8:30 AM ET, the Employment Report for December. The consensus is for an increase of 200,000 non-farm payroll jobs in December, down from the 203,000 non-farm payroll jobs added in November. The consensus is for the unemployment rate to be unchanged at 7.0% in December.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.5% increase in inventories.

Employment Report: Some Positive Outlooks

by Calculated Risk on 1/09/2014 03:54:00 PM

Yesterday I posted an employment preview. Even though the ISM indexes suggest around 245,000 payroll jobs added in December, and the ADP employment report was above expectations at 238,000 private sector jobs added - I still took the "under" (under the consensus forecast of 200,000). My key reason for a little pessimism was that unemployment claims spiked higher during the BLS reference week, possibly due to weather factors.

Here are a couple more positive outlooks:

From Tim Duy at Economist's View: Next Up: Employment Report

Since it worked well last time, my quick-and-dirty estimate is a 245k gain for nonfarm payrolls in December ... Use with caution, usual caveats apply. Forecasting the preliminary nonfarm payroll gain is akin to throwing darts. And my prior is that something that worked well last month probably will not work well this month. That said, while this technique might not predict the exact number, I think it tells us that:From Kris Dawsey at Goldman Sachs (revised up from 175,000):

1. The labor market is improving modestly.

2. Any large deviation from a gain of 245k - either positive or negative - is likely not indicative of the underlying trend in labor markets.

For comparison, this is a decidedly above consensus forecast. Consensus is for 200k with a range of 120k to 225k. 245k would be a large upward surprise.

We forecast a gain of 200,000 nonfarm payroll jobs in December. Factors arguing for a solid print include the recent trend, an improvement in most employment indicators already released for the month, the compressed holiday hiring period, and a potential "couriers and messengers effect." On the negative side, cold weather is a downside risk.From Deutsche Bank economist Carl Riccadonna (via Business Insider):

We now look for +250K on nonfarm payrolls and 6.8% on the unemployment rate. It is worth noting that in our employment scorecard, there was really only one component which materially weakened last month — Chicago PMI employment. We are dismissing the signals from both initial and continuing jobless claims, because both series displayed erratic behavior throughout December. ...Overall the trend is positive, but it is difficult to predict any one month.

As always during the winter months, we will pay close attention to workers who could not work or worked reduced hours due to inclement weather. We do not anticipate a significant weather distortion in December, based on utility statistics, but if the payroll print is unusual this series could provide clues.

AAR: Record Intermodal Rail Traffic in 2013, Carloads down slightly

by Calculated Risk on 1/09/2014 01:27:00 PM

From the Association of American Railroads (AAR): Freight Rail Traffic for 2013 Saw Record Intermodal Growth, Slight Dip in Carloads

The Association of American Railroads (AAR) today reported that U.S. rail traffic for 2013 saw record intermodal growth with a slight full year decrease in carloadings. U.S. rail intermodal volume totaled a record 12.8 million containers and trailers in 2013, up 4.6 percent or 564,276 units, over 2012. Carloads totaled 14.6 million in 2013, down 0.5 percent or 76,784 carloads, from 2012. Intermodal volume in 2013 was the highest on record, surpassing the record high totals of 2006 by 549,471 units.

In 2013, 11 of the 20 carload commodity categories tracked annually by AAR saw increases on U.S. railroads compared with 2012. The categories with sizable gains were: petroleum and petroleum products, up 167,868 carloads or 31.1 percent; crushed stone, gravel and sand, up 81,023 carloads or 8.3 percent; motor vehicles and parts, up 41,166 carloads or 5.1 percent, and waste and nonferrous scrap, up 14,472 carloads or 9.1 percent.

The commodities with the largest carload declines in 2013 compared with 2012 were: coal, down 256,751 carloads or 4.3 percent; grain, down 81,309 carloads or 8 percent, and metallic ores, down 37,068 carloads or 9.9 percent. However, excluding coal and grain, those U.S. rail carloads which are reflective of the economy were up 261,276 carloads or 3.4 percent in 2013 over 2012.

“2013 ended the way it began — strong intermodal, weak coal, and mixed performance for other commodities, resulting in a year for rail traffic that could have been much better but also could have been much worse,” said AAR Senior Vice President John T. Gray. “A variety of indicators seem to be saying that the economy is slowly strengthening; a trend we expect to continue in 2014.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

In December 2013, U.S. railroads originated a total of 1,078,903 carloads, down 0.9% (9,978 carloads) from December 2012 and an average of 269,726 per week. That’s the lowest weekly average for a December since 2009 and the third lowest (behind 2008 and 2009) since 1988. ...

Blame coal. U.S. railroads originated 423,218 carloads of coal in December 2013, down 5.2% (23,159 carloads) from December 2012. For more on coal, see page 15. Excluding coal, U.S. carloads were up 2.1% (13,181 carloads) in December 2013

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.The second graph is for intermodal traffic (using intermodal or shipping containers):

Intermodal traffic set a record in 2013 and finished strong in December:

U.S. railroads originated 958,778 intermodal containers and trailers in December 2013, up 70,742 units (8.0%) over December 2012 and an average of 239,695 per week. That’s by far the highest weekly average for any December in history and is a fitting end to a great year for intermodal.Rail traffic and the economy usually grow together, so this is a good sign for the overall economy.

For all of 2013, U.S. rail intermodal volume totaled a record 12,831,692 containers and trailers, up 4.6% (564,276 units) over 2012 and 549,471 units more than the previous record set in 2006.

Trulia: Asking House Prices up 11.9% year-over-year in December, Price "Rebound effect fading"

by Calculated Risk on 1/09/2014 09:47:00 AM

From Trulia chief economist Jed Kolko: The Post-Crash Rebound, Not Job Growth, Drove 2013 Price Gains

In 2013, the housing markets with the biggest increases in asking prices were all rebounding from severe price drops in the housing bust. Home prices are still in rebound mode, but this effect will weaken in 2014. Job growth, in contrast, mattered little for price gains in 2013 but helped drive rent increases.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases, but at a slower rate, over the next few months on a seasonally adjusted basis.

In December, the year-over-year increase in asking home prices slowed for the first time since the price recovery began in early 2012: prices rose 11.9% year-over-year in December, compared with November’s 12.2% year-over-year increase. Asking prices rose 0.4% month-over-month, seasonally adjusted, the third straight month of gains less than 1%.

...

Overall, regression analysis shows that recent price gains are most strongly associated with the severity of the local housing bust. Markets where prices fell most during the bust (roughly 2006 to 2011, but varies by metro) offered bargains for investors and other buyers who have helped bid prices back up over the past two years. A second important factor is foreclosures: adjusting for other factors, metros with a higher foreclosure inventory today – including many in Florida – have slower price growth. Job growth, however, had little impact on local home price gains in 2013: the relationship between job growth and price gains was positive but not statistically significant.

Therefore, year-over-year price gains in December 2013 are still primarily a reaction to the housing bust, but this rebound effect is fading as we enter 2014. Looking at the quarter-over-quarter price changes throughout 2013, the relationship between the severity of the housing bust and the recent price recovery was stronger earlier in the year than later in the year. More specifically, the correlation between peak-to-trough price change (FHFA) and the Trulia Price Monitor quarter-over-quarter change was -.59 in March; -.45 in June; -.43 in September; and -.33 in December. This correlation is moving closer to zero, which signifies that the rebound effect is fading.

As the housing market continues to recover, factors other than the rebound effect – like job growth – will matter more for price gains. That means slower but more sustainable price increases. emphasis added

Weekly Initial Unemployment Claims decline to 330,000

by Calculated Risk on 1/09/2014 08:34:00 AM

The DOL reports:

In the week ending January 4, the advance figure for seasonally adjusted initial claims was 330,000, a decrease of 15,000 from the previous week's revised figure of 345,000. The 4-week moving average was 349,000, a decrease of 9,750 from the previous week's revised average of 358,750.The previous week was revised up from 339,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 349,000.

Weekly claims are frequently volatile during the holidays because of the seasonal adjustment. The four-week should decline further next week.

Wednesday, January 08, 2014

Thursday: Unemployment Claims

by Calculated Risk on 1/08/2014 09:00:00 PM

From Jeffry Bartash at MarketWatch: What happens when jobless benefits are cut? North Carolina may offer clues

Last summer, North Carolina slashed the amount of cash it gave to people after they lost their jobs and the state also reduced the number of weeks they could receive benefits. Within several months, the unemployment rate fell a few ticks and by November it fell to a five-year low.If Congress fails to take action, I expect the national unemployment rate to fall as many people leave the labor force (the wrong reason for a decline in the unemployment rate). Hopefully Congress will extend the benefits as has happened every time before when this many people are suffering from long term unemployment (it is good policy and good economics) ...

...

Government data also shows that more than 22,000 North Carolinians found work since the cutoff and the number of unemployed sank by nearly 73,000 to 344,000.

What the data doesn’t tell us, however, is what happened to all the people no longer classified as unemployed. While some found a job, others may have retired, ended up on welfare, moved in with family members, sought disability payments or fled to a nearby state with better benefits. We just don’t know.

Thursday:

• Early: Trulia Price Rent Monitors for December. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decline to 331 thousand from 339 thousand.

Las Vegas Real Estate in December: Year-over-year Non-contingent Inventory up 78.6%

by Calculated Risk on 1/08/2014 05:26:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports home prices rose in December, up 24 percent in 2013

GLVAR said the total number of existing local homes, condominiums and townhomes sold in December was 2,915, up from 2,694 in November, but down from 3,624 in December 2012....There are several key trends that we've been following:

...

GLVAR has been tracking fewer foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. In December, 20.7 percent of all existing local home sales were short sales, down from 21 percent in November. Another 8.5 percent of all December sales were bank-owned properties, up from 7 percent in November.

Of the 40,242 existing residential properties sold in Southern Nevada during 2013, GLVAR reported that 62 percent were traditional sales. That’s a big jump from 2012, when only 37 percent of all 44,902 sales that year were traditional.

In December, GLVAR reported that 44.4 percent of all existing local homes sold were purchased with cash. That’s up from 43.7 in November but down from a peak of 59.5 percent set in February 2013. ...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service decreased in December, with 13,303 single-family homes listed for sale at the end of the month. That’s down 6.6 percent from 14,240 single-family homes listed for sale at the end of November and down 8.9 percent from one year ago. GLVAR reported a total of 2,903 condos and townhomes listed for sale on its MLS in December, down 19.9 percent from 3,624 listed in November and down 16.5 percent from one year ago.

GLVAR also reported fewer available homes listed for sale without any sort of pending or contingent offer. By the end of December, GLVAR reported 6,587 single-family homes listed without any sort of offer. That’s down 3.6 percent from 6,830 such homes listed in November, but still up 78.6 percent from one year ago.

emphasis added

1) Sales were up in December, but down about 19.6% year-over-year.

2) Conventional sales are up solidly year-over-year. In December 2012, only 44.7% of all sales were conventional. This year, in December 2013, 70.8% were conventional. That is an increase in conventional sales of about 27% year-over-year.

3) The percent of cash sales is declining (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 78.6% year-over-year!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow.