by Calculated Risk on 1/10/2014 10:58:00 AM

Friday, January 10, 2014

Comments on the Disappointing Employment Report

This was a disappointing employment report, but 1) it was just one month, 2) November was revised up, 3) other data suggests stronger hiring, and 4) there was some weather related impact (as expected). This report doesn't change my outlook. On weather, the BLS reported:

Construction employment edged down in December (-16,000). However, in 2013, the industry added an average of 10,000 jobs per month. Employment in nonresidential specialty trade contractors declined by 13,000 in December, possibly reflecting unusually cold weather in parts of the country.There were probably other weather related impacts (unemployment claims spiked hire during the BLS reference week), but all the weakness can't be blamed on the weather (the report was still disappointing).

Overall job growth was about as expected in 2013 (see table below), and I expect employment growth to pick up in 2014.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,170 | 2,709 |

| 2000 | 1,944 | 1,680 |

| 2001 | -1,757 | -2,308 |

| 2002 | -532 | -765 |

| 2003 | 62 | 104 |

| 2004 | 2,019 | 1,872 |

| 2005 | 2,484 | 2,298 |

| 2006 | 2,071 | 1,862 |

| 2007 | 1,115 | 827 |

| 2008 | -3,617 | -3,797 |

| 2009 | -5,052 | -4,976 |

| 2010 | 1,022 | 1,235 |

| 2011 | 2,103 | 2,420 |

| 2012 | 2,193 | 2,269 |

| 2013 | 2,186 | 2,211 |

Although construction was weak (weather related), seasonal retail hiring remained solid. See the first graph below - this is a good sign for the holiday season ("Watch what they do, not what they say")

Seasonal Retail Hiring

Click on graph for larger image.

Click on graph for larger image.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to normal levels.

Retailers hired 176 thousand workers (NSA) net in December. This puts seasonal retail hiring at the highest level since 1999, and suggests holiday sales were decent. Note: this is NSA (Not Seasonally Adjusted).

Note: There is a decent correlation between seasonal retail hiring and holiday retail sales.

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The 25 to 54 participation rate declined in December to 80.7% from 80.9%, and the 25 to 54 employment population ratio increased to 76.1% from 76.0%. As the economy recoveries, I'd expect both to increase back towards pre-recession levels.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

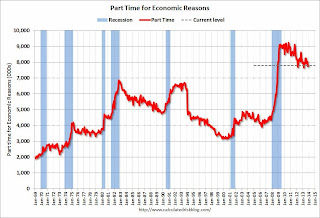

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 7.8 million in December. These individuals were working part time because their hours had been cut back or because they were unable to find full-time work.These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 13.1% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.878 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.044 million in November. This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In December 2013, state and local governments lost 11,000 jobs, however state and local employment was up 54 thousand in 2013.

It appears state and local employment employment has bottomed. Of course Federal government layoffs are ongoing.

Overall this was a disappointing employment report.