by Calculated Risk on 12/13/2013 07:52:00 PM

Friday, December 13, 2013

Bank Failure #24 in 2013: Texas Community Bank, National Association, The Woodlands, Texas

As of September 30, 2013, Texas Community Bank, National Association had approximately $160.1 million in total assets and $142.6 million in total deposits.This might be the last failure this year, and that would make the number of failures this year the least since 2007 when only 3 banks failed (25 banks failed in 2008 - so this year will be close to 2008, and 51 banks failed last year).

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.8 million. ... Texas Community Bank, National Association is the 24th FDIC-insured institution to fail in the nation this year, and the second in Texas.

Lawler: Update Table of Distressed Sales and Cash buyers for Selected Cities in November

by Calculated Risk on 12/13/2013 04:48:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in November.

From CR: This is just a few markets, but total "distressed" share is down significantly, mostly because of a decline in short sales. Foreclosure are down in most areas too.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back in markets (like Vegas and Phoenix) the share of all cash buyers will probably decline.

Note: Several key areas have not reported for November yet. Existing home sales for November will be released next week on Thursday, and the consensus is for sales to decline to a 5.05 million seasonally adjusted annual rate (SAAR), down from 5.12 SAAR in October.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov-13 | Nov-12 | Nov-13 | Nov-12 | Nov-13 | Nov-12 | Nov-13 | Nov-12 | |

| Las Vegas | 21.0% | 41.2% | 7.0% | 10.7% | 28.0% | 51.9% | 43.7% | 52.7% |

| Reno | 17.0% | 41.0% | 6.0% | 9.0% | 23.0% | 50.0% | ||

| Phoenix | 7.8% | 23.2% | 8.0% | 12.9% | 15.8% | 36.1% | 34.0% | 43.2% |

| Minneapolis | 5.0% | 11.1% | 17.0% | 24.5% | 22.0% | 35.6% | ||

| Mid-Atlantic | 7.5% | 11.9% | 8.1% | 8.7% | 15.7% | 20.6% | 19.6% | 20.0% |

| Toledo | 37.2% | 40.9% | ||||||

| Tuscon | 32.6% | 33.8% | ||||||

| Des Moines | 19.9% | 22.1% | ||||||

| Peoria | 21.8% | 21.2% | ||||||

| Omaha | 21.6% | 19.8% | ||||||

| Hampton Roads | 26.9% | 28.3% | ||||||

| Northeast Florida | 36.4% | 41.8% | ||||||

| Spokane | 16.0% | 9.1% | ||||||

| Memphis* | 20.4% | 24.4% | ||||||

| Birmingham AL | 21.0% | 26.5% | ||||||

| Springfield IL | 17.0% | 15.8% | ||||||

| *share of existing home sales, based on property records | ||||||||

Hotel Occupancy Rate increases 0.2% year-over-year in latest Survey

by Calculated Risk on 12/13/2013 02:32:00 PM

From HotelNewsNow.com: STR: US results for week ending 7 December

The U.S. hotel industry reported increases in the three key performance metrics during the week of 1-7 December 2013, according to data from STR.The 4-week average of the occupancy rate is close to normal levels.

In year-over-year comparisons, occupancy rose 0.2 percent to 55.4 percent; average daily rate was up 1.9 percent to US$109.70; and revenue per available room increased 2.1 percent to US$60.82.

emphasis added

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average for the year 2000 through 2013.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013 and black is for 2009 - the worst year since the Great Depression for hotels.

Note: Although 2009 was the worst year since the Depression, there was a brief period in 2001 when the occupancy rate was even lower than in 2009 due to the attacks on 9/11. In 2005, the occupancy rate was very high at the end of the year due to Hurricanes Katrina and Rita.

Through December 7th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking at pre-recession levels.

This has been a solid year for the hotel industry and will be the best year for the hotel industry since 2007 (right before the recession).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

FHA Audit shows smaller projected shortfall in 2013

by Calculated Risk on 12/13/2013 10:53:00 AM

Update: FHA ISSUES ANNUAL FINANCIAL STATUS REPORT TO CONGRESS

Nick Timiraos at the WSJ has some details: Audit Shows FHA Faces $1.3 Billion Deficit

The Federal Housing Administration ran a projected shortfall of $1.3 billion at the end of September, down from a much larger projected deficit of $16.3 billion one year earlier, according to the agency's independent financial review, released Friday.

...

In September, the FHA received a $1.7 billion infusion from the U.S. Treasury, its first such injection in its 79-year history. The agency is required to maintain enough cash to pay for projected losses on the more than $1 trillion in loans that it guarantees. A separate report next year from White House budget officials will determine whether the FHA needs additional taxpayer money.

...

Most of the agency's losses stem from loans made between 2007 and 2009, when the housing bust deepened. Loans made since 2010 are profitable, the report found.

BLS: Producer Price Index declines 0.1 percent in November

by Calculated Risk on 12/13/2013 08:55:00 AM

The Producer Price Index for finished goods edged down 0.1 percent in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Prices for finished goods decreased 0.2 percent in October and 0.1 percent in September.This slight decline was expected, and was mostly due to a decline in energy products. However this is another indicator showing little inflation.

...

In November, the decrease in the finished goods index can be traced to a 0.4-percent decline in prices for finished energy goods. By contrast, prices for finished goods less foods and energy advanced 0.1 percent.

A key question for the Fed next week is if the below target "rate of inflation experienced so far this year has become ingrained in the economy" (using some of Bernanke's words from 2011 when he argued a small increase in inflation was transitory - and Bernanke was correct then).

To start to reduce asset purchases next week, the FOMC would probably have to argue that the current low inflation is transitory.

Thursday, December 12, 2013

Friday: PPI

by Calculated Risk on 12/12/2013 08:33:00 PM

As expected, the House passed the budget deal. From the WSJ: House Easily Passes Budget Agreement in 332-94 Vote

The bill passed by a wide bipartisan margin, 332-94. The bill drew a strong bipartisan majority: 169 Republicans and 163 Democrats voted for the measure. Voting in opposition were 62 Republicans and 32 Democrats.This isn't the end of "brinkmanship" or dumb political stunts, but those usually happen in odds years, as opposed to election years - so voters will forget.

...

There is no guarantee that this bipartisan budget deal signals the end of brinkmanship or that this episode of bipartisanship will reach into other areas.

Friday:

• 8:30 AM ET, the Producer Price Index for November. The consensus is for a 0.1% decrease in producer prices (and 0.1% increase in core PPI).

Lawler on Hovnanian: Net Home Orders Slowed Significantly in Summer; Rebounded Modestly as Year-End Approached

by Calculated Risk on 12/12/2013 06:46:00 PM

From housing economist Tom Lawler:

Hovnanian Enterprises reported that net orders (including jvs) in the quarter ended October 31, 2013 totaled 1,315, down 8.9% from the comparable quarter of 2012. The dip in orders came despite a YOY community-count increase of 6.9%. The company’s sales cancellation rate, expressed as a % of gross orders, was 23% last quarter, unchanged from a year ago. Home deliveries last quarter totaled 1,816, up 3.8% from the comparable quarter of 2012, at an average sales price of $371,401, up 13.8% from a year go. The company’s order backlog at the end of October was 2,392, up 11.5% from last October, at an average order price of $354,672, up 2.5% from a year ago.

Hovnanian said in its sales release that its “sales slowed from July through September due to the adverse impacts of higher mortgage rates, the sequester and the government shutdown,” but another factor was Hovnanian’s aggressive price increases (highlighted in last quarter’s presentation) in several markets, especially California. Hovnanian’s net orders in California last quarter were down 48.4% from a year ago, at an average contract price of $571,800, up 41.5% from a year ago.

Click on graph for larger image.

Click on graph for larger image.

In its quarter presentation Hovnanian provided monthly net orders figures, including an estimate for November. Combined net orders for October and November were virtually unchanged from the same two months of 2012 (847 vs. 849) While in its press release Hovnanian said that November net orders exceed last November’s levels, its quarterly presentation showed a small YOY decline (382 vs. 385).

Hovnanian joined the vast bulk of publicly-traded large home builders reporting a significant drop in net home orders last quarter – consistent with Census’s estimate of a substantial decline in new home sales during that period.

Update: When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 12/12/2013 03:06:00 PM

Two years ago I posted a graph with projections of when payroll employment would return to pre-recession levels (see: Sluggish Growth and Payroll Employment from November 2011).

In 2011, I argued we'd continue to see sluggish growth (back in 2011 many analysts were forecasting another US recession - those forecasts were wrong).

On the graph I posted two lines - one with payroll growth of 125,000 payroll jobs added per month (the pace in 2011), and another line with 200,000 payroll jobs per month. The following graph is an update with reported payroll growth through November 2013.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month. Both projections are from November 2011.

Click on graph for larger image.

Click on graph for larger image.

So far the economy has tracked just below the blue line (200,000 payroll jobs per month).

Right now it appears payrolls will exceed the pre-recession peak in mid-2014.

Currently there are about 1.3 million fewer payroll jobs than before the recession started, and at the recent pace of job growth it will take about 7 months to reach the previous peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

Note: There are 760 thousand fewer private sector payroll jobs than before the recession started. At the recent pace of private sector job growth, the private sector could be back at the pre-recession peak in March 2014.

CoStar: Commercial Real Estate prices increase in October, Distress Sales Lowest Level in Five Years

by Calculated Risk on 12/12/2013 11:56:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Prices Resume Upward Trend in October

The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—advanced by 1.1% and 1.4%, respectively, in October 2013. ... On an annual basis, the equal weighted CCRSI Composite Index has risen 7.4% while the value-weighted Composite CCRSI Index has advanced by 9.5%.

...

The percentage of commercial property selling at distressed prices dropped to 10.7% in October 2013 from nearly 20% one year earlier, the lowest level since December 2008. ... Distress levels vary widely by market, however. In housing bust markets including, Atlanta, Las Vegas and Orlando, distress deals still accounted for more than 20% of all sales activity in the third quarter of 2013, suggesting there is still significant room for price appreciation in those markets. Conversely, in healthier markets such as San Francisco, Boston, Los Angeles, Seattle and New York, the share of distressed sales fell into the single digits in the third quarter of 2013.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. CoStar reported that the Value-Weighted index is up 50.3% from the bottom (showing the earlier and stronger demand for higher end properties) and up 9.5% year-over-year. However the Equal-Weighted index is only up 17.0% from the bottom, and up 7.4% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

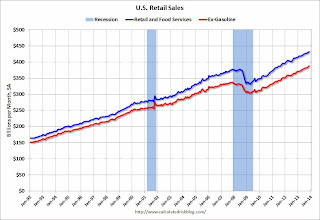

Retail Sales increased 0.7% in November

by Calculated Risk on 12/12/2013 08:49:00 AM

On a monthly basis, retail sales increased 0.7% from October to November (seasonally adjusted), and sales were up 4.7% from November 2012. Sales in October were revised up from a 0.4% increase to 0.6%. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $432.3 billion, an increase of 0.7 percent from the previous month, and 4.7 percent above November 2012. ... The September to October 2013 percent change was revised from +0.4 percent to +0.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos increased 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.5% on a YoY basis (4.7% for all retail sales).

Retail sales ex-gasoline increased by 5.5% on a YoY basis (4.7% for all retail sales).This was a solid report, and especially strong considering the upward revision to October sales.