by Calculated Risk on 11/10/2013 12:19:00 PM

Sunday, November 10, 2013

Q3 2013 GDP Details: Residential Investment increases, Commercial Investment very Low

The BEA released the underlying details for the Q3 advance GDP report Friday.

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

A few key points:

1) Usually the most important components are investment in single family structures followed by home improvement. However home improvement has been the top category for twenty consecutive quarters, but that is about to change. Investment in single family structures should be the top category again soon.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers’ commissions and other ownership transfer costs. This is the category mostly related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales are flat, or even decline due to fewer foreclosures, this will have little impact on total residential investment.

Click on graph for larger image.

Click on graph for larger image.

Investment in home improvement was at a $178 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (about 1.0% of GDP), still above the level of investment in single family structures of $172 billion (SAAR) (also 1.0% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment very soon.

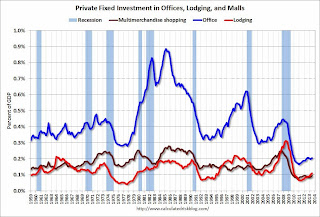

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

Investment in offices is down about 54% from the recent peak (as a percent of GDP). There has been some increase in the Architecture Billings Index lately, so office investment might start to increase. However the office vacancy rate is still very high, so any increase in investment will probably be small.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 62% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 62% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 65%. With the hotel occupancy rate close to normal, it is possible that hotel investment will probably continue to increase.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is increasing, but from a very low level.

State and local government austerity is over

by Calculated Risk on 11/10/2013 10:46:00 AM

On Friday, California State Controller John Chiang said

"[B]ecause higher-than-expected payroll withholdings and estimated payments are driving the good news [more state revenue], it signals that Californians are beginning to earn more, work more, and the Great Recession is becoming a faint image in the rear view mirror"This "good news" is happening in many state and local areas (not all). This is a significant change from state and local governments being a headwind for the economy to becoming a slight tailwind.

Here are two graphs that show the aggregate austerity is over.

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has been adding added to GDP growth.

The red bars are the contribution from state and local governments. Although not as big a drag as the housing bust, there was an unprecedented period of state and local austerity (not seen since the Depression).

Now state and local governments have added to GDP for two consecutive quarters, and I expect state and local governments to continue to make small positive contributions to GDP going forward.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

The second graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In 2013, state and local government employment is up 74 thousand through October.

Here is a table of the annual change in payrolls for state and local governments.

| Year | Annual Change State and Local Government Payrolls (000s) |

|---|---|

| 2002 | 204.0 |

| 2003 | -2.0 |

| 2004 | 159.0 |

| 2005 | 181.0 |

| 2006 | 212.0 |

| 2007 | 262.0 |

| 2008 | 158.0 |

| 2009 | -129.0 |

| 2010 | -262.0 |

| 2011 | -239.0 |

| 2012 | -34.0 |

| 20131 | 74.0 |

| 12013 through October | |

I think most of the recession related state and local government layoffs are over, and it appears state and local government employment has bottomed. Of course Federal government layoffs are ongoing, but it appears state and local government austerity is over (in the aggregate).

Saturday, November 09, 2013

Update: Four Charts to Track Timing for QE3 Tapering

by Calculated Risk on 11/09/2013 04:43:00 PM

Here is an update of the four charts I'm using to track when the Fed will start tapering the QE3 purchases.

In general the year-end data might be "broadly consistent" with the June (and September) FOMC projections.

However I suspect the FOMC is very concerned about the low level of inflation, and also the decline in the employment participation rate.

The December FOMC meeting is on the 17th and 18th.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for the unemployment rate.

The current forecast is for the unemployment rate to decline to 7.1% to 7.3% in Q4 2013.

We only have data through October - and that data was muddled by the government shutdown - however so far the unemployment rate is tracking the FOMC forecast (lower is better).

However, in July, Bernanke said that the unemployment rate "probably understates the weakness of the labor market." (He repeated this yesterday). He suggested he is watching other employment indicators too, and I suspect the FOMC will be looking closely at the participation rate in the November employment report.

The second graph is for GDP.

The second graph is for GDP.

The current forecast is for GDP to increase between 2.0% and 2.3% (the FOMC revised down their forecast from 2.3% and 2.6% in June). This is the increase in GDP from Q4 2012 to Q4 2013.

Currently GDP is tracking the FOMC forecasts, and real GDP only has to increase 1.5% annualized in Q4 to reach the lower forecast (Edit: Corrected required Q4 growth rate, ht Michael)

The third graph is for PCE prices.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

So far PCE prices are close just below this projection - however this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The fourth graph is for core PCE prices

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

So far core PCE prices are just below this projection - and, once again, this projection is significantly below the FOMC target of 2%.

Schedule for Week of November 10th

by Calculated Risk on 11/09/2013 08:51:00 AM

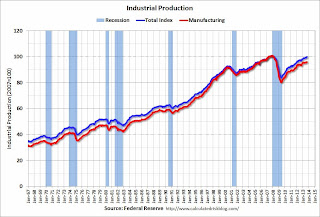

The key reports this week are the October Industrial Production and Capacity Utilization report and the September Trade Balance report.

On Thursday, there will be a confirmation hearing for Janet Yellen as the new Fed Chair. Yellen is qualified, has an excellent track record (she has been "hawkish" when appropriate, and "dovish" when appropriate), and I expect she will be confirmed by a large majority.

Government offices, banks and the bond market will be closed in observance of the Veteran's Day holiday. Stock markets will be open.

7:30 AM ET: NFIB Small Business Optimism Index for October.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 336 thousand last week.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. Imports and export were mostly unchanged in August.

The consensus is for the U.S. trade deficit to increase to $39.1 billion in September from $38.8 billion in August.

10:00 AM: Confirmation Hearing, Nominee for Fed Chair Janet Yellen

11:00 AM: The Q3 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

8:30 AM: NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of 5.5, up from 1.5 in October (above zero is expansion).

9:15 AM: The Fed is scheduled to release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed is scheduled to release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.3%.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.4% increase in inventories.

Friday, November 08, 2013

Unofficial Problem Bank list declines to 661 Institutions

by Calculated Risk on 11/08/2013 10:38:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 8, 2013.

Changes and comments from surferdude808:

Very quiet week for the Unofficial Problem Ban List with only one removal that pushes the institutions list count to 661 with assets of $228.8 billion. It has been since the middle of July 2013 when there was such few changes to the list.

A year ago, the list held 860 institutions with assets of $328.2 billion. Acacia Federal Savings Bank, Falls Church, VA ($631 million) found a merger partner in order to find a way off the list. Next week, we anticipate the OCC will release its enforcement action activity through mid-September 2013.

State and Local Finances Improving, California Controller says: "Great Recession is becoming a faint image in the rear view mirror"

by Calculated Risk on 11/08/2013 05:11:00 PM

Earlier today I posted a graph showing that after 4 years of layoffs, state and local governments have started increasing employment again. Yesterday I noted that state and local governments are now adding to GDP growth.

Today from the California State Controller: Controller Releases October Cash Update

State Controller John Chiang today released his monthly report covering California’s cash balance, receipts and disbursements in October 2013. Revenues for the month totaled $5.3 billion, surpassing estimates in the state budget by $510.5 million, or 10.7 percent. Total revenue from the first four months of the fiscal year totaled $25.5 billion, beating year-to-date estimates by $603.7 million.From Joshua Dennerlein at Merrill Lynch today:

"State revenues are more than $600 million ahead of projections following a second straight month of strong collections," said Chiang. "Importantly, because higher-than-expected payroll withholdings and estimated payments are driving the good news, it signals that Californians are beginning to earn more, work more, and the Great Recession is becoming a faint image in the rear view mirror."

emphasis added

After three years of being a headwind to economic growth, state and local (S&L) governments are beginning to show signs of life. While it is early in the story, S&L spending may be a slight tailwind to the economy in 2014. ... The recovery in the state and local sector presents an upside risk to our 2014 forecasts.

Bernanke: The Crisis as a Classic Financial Panic

by Calculated Risk on 11/08/2013 04:17:00 PM

From Fed Chairman Ben Bernanke: The Crisis as a Classic Financial Panic. A few excerpts:

The recent crisis echoed many aspects of the 1907 panic. Like most crises, the recent episode had an identifiable trigger--in this case, the growing realization by market participants that subprime mortgages and certain other credits were seriously deficient in their underwriting and disclosures. As the economy slowed and housing prices declined, diverse financial institutions, including many of the largest and most internationally active firms, suffered credit losses that were clearly large but also hard for outsiders to assess. Pervasive uncertainty about the size and incidence of losses in turn led to sharp withdrawals of short-term funding from a wide range of institutions; these funding pressures precipitated fire sales, which contributed to sharp declines in asset prices and further losses. Institutional changes over the past century were reflected in differences in the types of funding that ran: In 1907, in the absence of deposit insurance, retail deposits were much more prone to run, whereas in 2008, most withdrawals were of uninsured wholesale funding, in the form of commercial paper, repurchase agreements, and securities lending. Interestingly, a steep decline in interbank lending, a form of wholesale funding, was important in both episodes. Also interesting is that the 1907 panic involved institutions--the trust companies--that faced relatively less regulation, which probably contributed to their rapid growth in the years leading up to the panic. In analogous fashion, in the recent crisis, much of the panic occurred outside the perimeter of traditional bank regulation, in the so-called shadow banking sector.Bernanke places too much blame on "subprime" (Alt-A mortgages were a real disaster too), but this is an interesting comparison to 1907.

The responses to the panics of 1907 and 2008 also provide instructive comparisons. In both cases, the provision of liquidity in the early stages was crucial. In 1907 the United States had no central bank, so the availability of liquidity depended on the discretion of firms and private individuals, like Morgan. In the more recent crisis, the Federal Reserve fulfilled the role of liquidity provider, consistent with the classic prescriptions of Walter Bagehot.6 The Fed lent not only to banks, but, seeking to stem the panic in wholesale funding markets, it also extended its lender-of-last-resort facilities to support nonbank institutions, such as investment banks and money market funds, and key financial markets, such as those for commercial paper and asset-backed securities.

In both episodes, though, liquidity provision was only the first step. Full stabilization requires the restoration of public confidence. Three basic tools for restoring confidence are temporary public or private guarantees, measures to strengthen financial institutions' balance sheets, and public disclosure of the conditions of financial firms. At least to some extent, Morgan and the New York Clearinghouse used these tools in 1907, giving assistance to troubled firms and providing assurances to the public about the conditions of individual banks. All three tools were used extensively in the recent crisis: In the United States, guarantees included the Federal Deposit Insurance Corporation's (FDIC) guarantees of bank debt, the Treasury Department's guarantee of money market funds, and the private guarantees offered by stronger firms that acquired weaker ones. Public and private capital injections strengthened bank balance sheets. Finally, the bank stress tests that the Federal Reserve led in the spring of 2009 and the publication of the stress-test findings helped restore confidence in the U.S. banking system. Collectively, these measures helped end the acute phase of the financial crisis, although, five years later, the economic consequences are still with us.

Las Vegas Real Estate in October: Year-over-year Non-contingent Inventory up 73%

by Calculated Risk on 11/08/2013 02:54:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices rising again

GLVAR said the total number of existing local homes, condominiums and townhomes sold in October was 3,192. That’s down from 3,259 in September and down from 3,651 total sales in October 2012. Compared to September, single-family home sales during October decreased by 1.7 percent, while sales of condos and townhomes decreased by 3.6 percent. Compared to one year ago, single-family home sales were down 11.9 percent, while condo and townhome sales were down 15.4 percent. ...There are several key trends that we've been following:

...

GLVAR continued to report fewer foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. In October, 21 percent of all existing home sales were short sales, down from 23 percent in September. Another 6 percent of all October sales were bank-owned properties, down from 7.4 percent in September. The remaining 73 percent of all sales were the traditional type, up from 69.6 percent in September.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in October, with 15,011 single-family homes listed for sale at the end of the month. That’s up 6.2 percent from 14,659 single-family homes listed for sale at the end of September, but down 10.5 percent from one year ago....

GLVAR also reported more available homes listed for sale without any sort of pending or contingent offer. By the end of October, GLVAR reported 7,072 single-family homes listed without any sort of offer. That’s up 11.7 percent from 6,330 such homes listed in September and up 73.4 percent from one year ago.

emphasis added

1) Overall sales were down slightly from September, and down about 12% year-over-year.

2) Conventional sales are up sharply. In October 2012, only 43.7% of all sales were conventional. This year, in October 2013, 73.0% were conventional. That is an increase in conventional sales of about 46% year-over-year (of course there is heavy investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (over 3 to 1). Both foreclosures and short sales are declining.

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 73.4% year-over-year!

Inventory has clearly bottomed in Las Vegas (A major theme for housing in 2013). And fewer distressed sales and more inventory means price increases will slow.

Employment Report: Solid Report ex-Government Shutdown, Seasonal Retail Hiring highest since 1999

by Calculated Risk on 11/08/2013 11:26:00 AM

A few key points:

• The government shutdown impacted the unemployment rate and the participation rate. This impact from the shutdown should be reversed in the November report.

• Overall this was a solid employment report (except the impact of the government shutdown).

• Last weekend I noted four items that the Fed would probably be looking at to taper in December. Here were the two related to employment:

1) "If the unemployment rate declines back to 7.2% or so in November (the September rate), then the FOMC might taper." Since the unemployment rate only increased to 7.3% in October, it appears likely this will be met (the Fed will probably be looking for a bounce back in the participation rate in November too).

2) "If the year-over-year change in employment is still around 2.2 million for November, the FOMC might taper." Employment was up 2.329 million year-over-year in October. It appears very likely this level will be met in the November report.

• Seasonal retail hiring was solid. See the first graph below - this is a good sign for the holiday season ("Watch what they do, not what they say")

• And yes - several people have emailed me - I was thinking there would be an upside surprise for payrolls.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers in October at the highest level since 1999.

Click on graph for larger image.

Click on graph for larger image.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 159.5 thousand workers (NSA) net in October. This is about the same as in 2004, and the highest since 1999. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are somewhat optimistic about the holiday season. Note: There is a decent correlation between seasonal retail hiring and holiday retail sales.

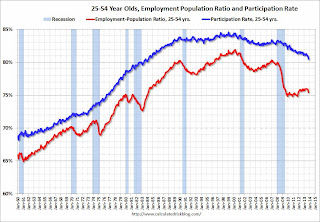

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

These numbers declined sharply in October due to the government shutdown, and should bounce back in the November report.

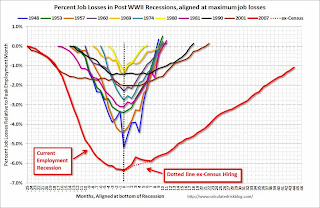

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 8.1 million in October. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in October to 8.05 million from 7.926 million in September. This increase was less than expected due to the government shutdown and should be reversed in the November report

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 13.8% in October from 13.6% in September.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.063 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.146 million in September. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In October 2013, state and local governments added 4,000 jobs, and state and local employment is up 74 thousand so far in 2013.

I think most of the state and local government layoffs are over, and state and local employment has probably bottomed. Of course Federal government layoffs are ongoing.

Overall this was a solid report.

Preliminary November Consumer Sentiment declines to 72.0

by Calculated Risk on 11/08/2013 09:55:00 AM

Note: I'll have much more on the employment report soon.

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for November was at 72.0, down from the October reading of 73.2.

This was below the consensus forecast of 75.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

The decline in October and early November was probably due to the government shutdown and another threat to "not pay the bills", but usually sentiment rebounds fairly quickly following event driven declines - and I expect the upward trend to continue soon.