by Calculated Risk on 10/02/2013 09:50:00 AM

Wednesday, October 02, 2013

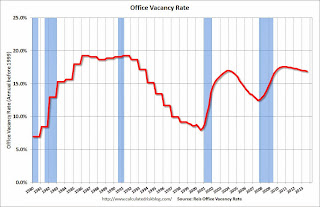

Reis: Office Vacancy Rate declines slightly in Q3 to 16.9%

Reis released their Q3 2013 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.9% in Q3 from 17.0% in Q2. This is down from 17.2% in Q3 2012, and down from the cycle peak of 17.6%.

From Reis Senior Economist Ryan Severino:

Vacancies declined by 10 basis points during the third quarter to 16.9%. This is a marginal improvement after last quarter when the vacancy rate did not change. However, since the market began to recover in mid‐2011, the vacancy rate has been unable to decline by more than 10 basis points in any given quarter. While this is technically an improvement versus last quarter, it is nonetheless a weak result. On a year‐over‐year basis, the vacancy rate fell by just 30 basis points, in line with last quarter's year‐over‐year decline.On new construction:

emphasis added

Occupied stock increased by 6.652 million SF in the third quarter. ... On the construction side, this quarter 4.099 million SF were completed, down from last quarter's mini‐spike of 8.049 million SF. While last quarter's bump in construction activity appears to be an aberration, construction activity for office has been slowly if inconsistently trending upward. Year‐to‐date, the market has developed 15.161 million SF. This is almost double the 8.820 million SF that were constructed through the third quarter of last year.On rents:

Asking and effective rents both grew by 0.3% during the third quarter. This marks the third consecutive quarter in a row with slowing asking and effective rent growth. Though in reality, rental growth rates are so low that the quarter‐to‐quarter differences are rather minor and could simply be idiosyncratic. Nonetheless, asking and effective rents have now risen for twelve consecutive quarters. Yet, the simple truth is that with vacancy remaining elevated at 16.9%, it is far too high to be conducive to much rent growth. At that level of vacancy, landlords have little leverage to either increase face level asking rents or to remove concessions from leases. A meaningful acceleration in rent growth will not be possible until vacancy falls to pre‐recessionary levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate declined to 16.9% in Q3 from 17.0% in Q2, and was down from 17.2% in Q3 2012. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

With the high vacancy rate, growth in construction activity for offices will be sluggish.

Office vacancy data courtesy of Reis.