by Calculated Risk on 11/08/2013 02:54:00 PM

Friday, November 08, 2013

Las Vegas Real Estate in October: Year-over-year Non-contingent Inventory up 73%

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices rising again

GLVAR said the total number of existing local homes, condominiums and townhomes sold in October was 3,192. That’s down from 3,259 in September and down from 3,651 total sales in October 2012. Compared to September, single-family home sales during October decreased by 1.7 percent, while sales of condos and townhomes decreased by 3.6 percent. Compared to one year ago, single-family home sales were down 11.9 percent, while condo and townhome sales were down 15.4 percent. ...There are several key trends that we've been following:

...

GLVAR continued to report fewer foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. In October, 21 percent of all existing home sales were short sales, down from 23 percent in September. Another 6 percent of all October sales were bank-owned properties, down from 7.4 percent in September. The remaining 73 percent of all sales were the traditional type, up from 69.6 percent in September.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in October, with 15,011 single-family homes listed for sale at the end of the month. That’s up 6.2 percent from 14,659 single-family homes listed for sale at the end of September, but down 10.5 percent from one year ago....

GLVAR also reported more available homes listed for sale without any sort of pending or contingent offer. By the end of October, GLVAR reported 7,072 single-family homes listed without any sort of offer. That’s up 11.7 percent from 6,330 such homes listed in September and up 73.4 percent from one year ago.

emphasis added

1) Overall sales were down slightly from September, and down about 12% year-over-year.

2) Conventional sales are up sharply. In October 2012, only 43.7% of all sales were conventional. This year, in October 2013, 73.0% were conventional. That is an increase in conventional sales of about 46% year-over-year (of course there is heavy investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (over 3 to 1). Both foreclosures and short sales are declining.

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 73.4% year-over-year!

Inventory has clearly bottomed in Las Vegas (A major theme for housing in 2013). And fewer distressed sales and more inventory means price increases will slow.

Employment Report: Solid Report ex-Government Shutdown, Seasonal Retail Hiring highest since 1999

by Calculated Risk on 11/08/2013 11:26:00 AM

A few key points:

• The government shutdown impacted the unemployment rate and the participation rate. This impact from the shutdown should be reversed in the November report.

• Overall this was a solid employment report (except the impact of the government shutdown).

• Last weekend I noted four items that the Fed would probably be looking at to taper in December. Here were the two related to employment:

1) "If the unemployment rate declines back to 7.2% or so in November (the September rate), then the FOMC might taper." Since the unemployment rate only increased to 7.3% in October, it appears likely this will be met (the Fed will probably be looking for a bounce back in the participation rate in November too).

2) "If the year-over-year change in employment is still around 2.2 million for November, the FOMC might taper." Employment was up 2.329 million year-over-year in October. It appears very likely this level will be met in the November report.

• Seasonal retail hiring was solid. See the first graph below - this is a good sign for the holiday season ("Watch what they do, not what they say")

• And yes - several people have emailed me - I was thinking there would be an upside surprise for payrolls.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers in October at the highest level since 1999.

Click on graph for larger image.

Click on graph for larger image.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 159.5 thousand workers (NSA) net in October. This is about the same as in 2004, and the highest since 1999. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are somewhat optimistic about the holiday season. Note: There is a decent correlation between seasonal retail hiring and holiday retail sales.

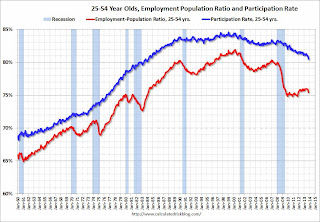

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

These numbers declined sharply in October due to the government shutdown, and should bounce back in the November report.

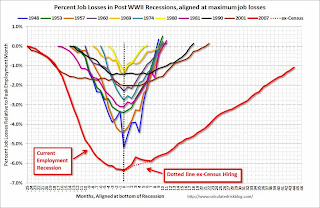

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 8.1 million in October. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in October to 8.05 million from 7.926 million in September. This increase was less than expected due to the government shutdown and should be reversed in the November report

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 13.8% in October from 13.6% in September.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.063 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.146 million in September. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In October 2013, state and local governments added 4,000 jobs, and state and local employment is up 74 thousand so far in 2013.

I think most of the state and local government layoffs are over, and state and local employment has probably bottomed. Of course Federal government layoffs are ongoing.

Overall this was a solid report.

Preliminary November Consumer Sentiment declines to 72.0

by Calculated Risk on 11/08/2013 09:55:00 AM

Note: I'll have much more on the employment report soon.

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for November was at 72.0, down from the October reading of 73.2.

This was below the consensus forecast of 75.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

The decline in October and early November was probably due to the government shutdown and another threat to "not pay the bills", but usually sentiment rebounds fairly quickly following event driven declines - and I expect the upward trend to continue soon.

October Employment Report: 204,000 Jobs, 7.3% Unemployment Rate

by Calculated Risk on 11/08/2013 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 204,000 in October, and the unemployment rate was little changed at 7.3 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was well above expectations of 120,000 payroll jobs added.

...

Among the unemployed, however, the number who reported being on temporary layoff increased by 448,000. This figure includes furloughed federal employees who were classified as unemployed on temporary layoff under the definitions used in the household survey.

...

The civilian labor force was down by 720,000 in October. The labor force participation rate fell by 0.4 percentage point to 62.8 percent over the month. Total employment as measured by the household survey fell by 735,000 over the month and the employment-population ratio declined by 0.3 percentage point to 58.3 percent. This employment decline partly reflected a decline in federal government employment.

...

The change in total nonfarm payroll employment for August was revised from +193,000 to +238,000, and the change for September was revised from +148,000 to +163,000. With these revisions, employment gains in August and September combined were 60,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Employment is still about 1% below the pre-recession peak.

NOTE: The second graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The third shows the unemployment rate.

The unemployment rate increased in October to 7.3% from 7.2% in September.

This increase in the unemployment rate is probably related to the government shutdown - and should be reversed in the November employment report.

This increase in the unemployment rate is probably related to the government shutdown - and should be reversed in the November employment report.The fourth graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was declined sharply in October to 62.8% from 63.2% in September (related to shutdown). This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was declined in October to 58.3% from 58.6% in September (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

This was a solid employment report - especially with the upward revisions to prior months. Many of the negatives were related to the government shutdown and should be reversed in the November report. I'll have much more later ...

Thursday, November 07, 2013

Friday: Employment Report, Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 11/07/2013 08:43:00 PM

Last year I spoke to some builders who were concerned about a shortage of lots in prime areas. Here are two deals from Carolyn Said at the San Francisco Chronicle: Toll Brothers buys Shapell's homebuilding business

[H]ome builder Toll Brothers agreed to pay Shapell Industries $1.6 billion for its homebuilding business, primarily consisting of 5,200 sites in affluent coastal California markets, including the Bay Area, Los Angeles, Orange County and Carlsbad."Entitlements" are valuable! I expect these builders will ramp up production fairly quickly.

...

More than 97 percent of the Shapell sites are entitled, meaning they have received local permits for construction to proceed. ... "The key word there is 'entitlement,' " said Christopher Thornberg, principal of Beacon Economics.

...

In the Bay Area, the deal includes 1,500 lots at Shapell's Gale Ranch master-planned community in San Ramon, 350 lots at Alamo Creek in Danville, and a few dozen lots in Gilroy, San Jose and Orinda. In Southern California, Porter Ranch in Los Angeles with more than 1,700 lots is the largest community included.

..

In another major deal this week, Tri Pointe Homes Inc. of Irvine (Orange County) bought Weyerhaeuser Corp.'s homebuilding division for $2.7 billion. That purchase included 27,000 lots, about 16,000 of them in California, primarily southern California.

Friday:

• At 8:30 AM ET, the Employment Report for October. The consensus is for an increase of 120,000 non-farm payroll jobs in October, down from the 148,000 non-farm payroll jobs added in September. The consensus is for the unemployment rate to increase to 7.3% in October, although the rate could spike higher to 7.4% or 7.5% due to the government shutdown based on the BLS method.

There will probably also be a significant increase in the number of people working part time for economic reasons. Any sharp increase in the unemployment rate - and part time for economic reasons - due to the shutdown should be reversed in the November report.

• Also at 8:30 AM, the Personal Income and Outlays report for October. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for a reading of 75.0, up from 73.2 in October.

MBA National Delinquency Survey: Judicial vs. Non-Judicial Foreclosure States in Q3 2013

by Calculated Risk on 11/07/2013 06:24:00 PM

Earlier I posted the MBA National Delinquency Survey press release and a graph that showed mortgage delinquencies and foreclosures by period past due. There is a clear downward trend for mortgage delinquencies, however some states are further along than others. From the press release:

“The degree to which the mortgage delinquency and foreclosure problem has changed over the last five years is perhaps best illustrated by the fact that last quarter New Jersey led the nation in the increase in the percentage of foreclosure actions filed, followed by Delaware, Maryland and Indiana. While Florida still leads the nation in the percentage of loans in foreclosure, that percentage is falling. In contrast, New York and New Jersey were the only two states that saw an increase in the percentages of loans in foreclosure,” said Jay Brinkmann, MBA’s Chief Economist and SVP of Research and Education. ... States with judicial foreclosure systems still account for most of the loans in foreclosure.

Click on graph for larger image.

Click on graph for larger image.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission. Blue is for judicial foreclosure states, and red for non-judicial foreclosure states.

The top states are Florida (9.48% in foreclosure down from 10.58% in Q2), New Jersey (8.28% UP from 8.01%), New York (6.34% UP from 6.09%), and Maine (5.44% down from 5.62%). Nevada is the only non-judicial state in the top 10, and this is partially due to state laws that slow foreclosures.

California (1.42% down from 1.64%) and Arizona (1.26% down from 1.51%) are now far below the national average by every measure.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for five consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for five consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.It looks like the judicial states will have a significant number of distressed sales for a few more years - however the non-judicial states are closer to normal levels.

Lawler on Fannie and Freddie Results, REO Inventory Increases in Q3

by Calculated Risk on 11/07/2013 04:33:00 PM

From economist Tom Lawler:

Fannie Q3 Highlights: GAAP Net Income $8.7 Billion; Dividend Payment to Treasury in December $8.6 Billion, Bringing Cumulative Payments to $113.9 Billion; SF REO Inventory Up on Slower Dispositions Due to “Overall Market Conditions”

Fannie Mae reported that its GAAP net income in the quarter ended September 30, 2013 was $8.7 billion, and that its “GAAP” net worth at the end of September was $11.6 billion, which under the term of the “revised” senior preferred dividend agreement means that Fannie will make a $8.6 billion dividend payment to the Treasury in December. That payment will make cumulative dividend payments to the Treasury of bout $113.9 billion. The Treasury’s senior preferred stock amount will remain at $117.1 billion. Fannie’s cumulative cash Treasury draws totaled $116.1 billion.

On the SF REO front, here are some summary stats on Fannie’s activity.

| Fannie SF REO Activity | |||

|---|---|---|---|

| Acquisitions | Dispositions | Inventory | |

| Q3/09 | 40,959 | 31,299 | 72,275 |

| Q4/09 | 47,189 | 33,309 | 86,155 |

| Q1/10 | 61,929 | 38,095 | 109,989 |

| Q2/10 | 68,838 | 49,517 | 129,310 |

| Q3/10 | 85,349 | 47,872 | 166,787 |

| Q4/10 | 45,962 | 50,260 | 162,489 |

| Q1/11 | 53,549 | 62,814 | 153,224 |

| Q2/11 | 53,697 | 71,202 | 135,719 |

| Q3/11 | 45,194 | 58,297 | 122,616 |

| Q4/11 | 47,256 | 51,344 | 118,528 |

| Q1/12 | 47,700 | 52,071 | 114,157 |

| Q2/12 | 43,783 | 48,674 | 109,266 |

| Q3/12 | 41,884 | 43,925 | 107,225 |

| Q4/12 | 41,112 | 42,671 | 105,666 |

| Q1/13 | 38,717 | 42,934 | 101,449 |

| Q2/13 | 36,106 | 40,635 | 96,920 |

| Q3/13 | 37,353 | 33,332 | 100,941 |

Fannie’s SF REO inventory increased from the end of June to the end of September, mainly as a result of a “surprisingly” large slowdown in REO dispositions. Fannie attributed the sharp drop in the sale of REO properties to “overall market conditions.”

Fannie Mae also reported that its internal “national” home price index, which is a repeat-sales index that (1) includes both Fannie-Freddie acquisitions and available public deed data; (2) excludes foreclosure transactions; and (3) in housing-unit weighted, was up by 9.4% over the 12 months ending in September.

Click on graph for larger image.

Click on graph for larger image.CR Note: Here is a graph of Fannie and Freddie REO. This was the first quarterly increase since 2010.

From Lawler: Freddie Q3 Highlights: GAAP Net Income $30.5 Billion, $23.9 Billion of Which Reflects Release of Valuation Allowance Against Net Deferred Tax Asset; Dividend Payment To Treasury in December $30.4 Billion

Freddie Mac reported that its GAAP net income in the quarter ended September 30, 2013 was $30.5 billion, $23.9 billion of which was related to a release of the company’s valuation allowing against its net deferred tax asset. This release, in turn, reflected the company’s massively improved earnings outlook. Freddie’s GAAP net worth at the end of September was $33.4 billion, which under the term of the “revised” senior preferred dividend agreement means that Freddie will make a $30.4 billion dividend payment to the Treasury in December. That payment will make cumulative dividend payments to the Treasury of about $71.345 billion, versus cumulative previous cash draws from Treasury of $71.336 billion. The Treasury’s senior preferred stock amount will remain at $72.3 billion.

On the SF REO front, here are some summary stats on Freddie’s activity.

| Freddie SF REO Activity | |||

|---|---|---|---|

| Acquisitions | Dispositions | Inventory | |

| Q3/09 | 24,373 | 17,939 | 41,133 |

| Q4/09 | 24,749 | 20,835 | 45,047 |

| Q1/10 | 29,412 | 20,628 | 53,831 |

| Q2/10 | 34,662 | 26,315 | 62,178 |

| Q3/10 | 39,053 | 26,334 | 74,897 |

| Q4/10 | 23,771 | 26,589 | 72,079 |

| Q1/11 | 24,707 | 31,627 | 65,159 |

| Q2/11 | 24,788 | 29,348 | 60,599 |

| Q3/11 | 24,378 | 25,381 | 59,596 |

| Q4/11 | 24,758 | 23,819 | 60,535 |

| Q1/12 | 23,805 | 25,033 | 59,307 |

| Q2/12 | 20,033 | 26,069 | 53,271 |

| Q3/12 | 20,302 | 22,660 | 50,913 |

| Q4/12 | 18,672 | 20,514 | 49,071 |

| Q1/13 | 17,881 | 18,984 | 47,968 |

| Q2/13 | 16,418 | 19,763 | 44,623 |

| Q3/13 | 19,441 | 16,945 | 47,119 |

Freddie’s SF REO inventory increased last quarter, “as foreclosure activity increased in judicial foreclosure states and disposition activity moderated.”

Freddie also showed that its “national” home-price index, a repeat-transactions index that (1) uses only Fannie/Freddie transactions; (2) uses repeat purchase transactions and some refinance transactions; and (3) is value weighted with state weights based on the share of Freddie’s SF mortgage portfolio, increased by 10.8% over the 12 months ending in September.

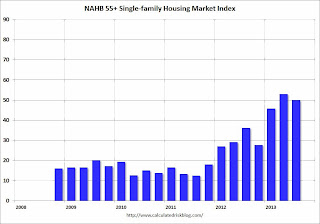

NAHB: Builder Confidence improves year-over-year in the 55+ Housing Market in Q3

by Calculated Risk on 11/07/2013 12:48:00 PM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so the readings have been very low.

From the NAHB: Builder Confidence in the 55+ Housing Market Continues to Improve in Third Quarter

Builder confidence in the 55+ housing market showed continued improvement in the third quarter of 2013 compared to the same period a year ago, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. All segments of the market—single-family homes, condominiums and multifamily rental—registered strong increases. The single-family index increased 14 points to a level of 50, which is the highest third-quarter number since the inception of the index in 2008 and the eighth consecutive quarter of year over year improvements. [CR Note: NAHB is reporting the year-over-year increase]

...

All of the components of the 55+ single-family HMI showed considerable growth from a year ago: present sales climbed 16 points to 52, expected sales for the next six months rose 11 points to 53 and traffic of prospective buyers increased 10 points to 43.

...

“Right now the positive year over year increase in confidence by builders for the 55+ market is tracking right along with other segments of the home building industry,” said NAHB Chief Economist David Crowe. “And like other segments of the industry, the 55+ market is improving in part because consumers are more likely to be able to sell their current homes, which allows them to buy a new home or move into an apartment that suits their specific needs.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q3 2013. The index declined in Q3 to 50 from 53 in Q2 - however the index is up solidly year-over-year. This indicates that about the same numbers builders view conditions as good than as poor.

This is going to be a key demographic for household formation over the next couple of decades, but only if the baby boomers can sell their current homes.

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

MBA: Mortgage "Delinquency and Foreclosure Rates Continue to Plummet" in Q3

by Calculated Risk on 11/07/2013 10:00:00 AM

From the MBA: Delinquency and Foreclosure Rates Continue to Plummet, Improve to Best in More than Five Years

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.41 percent of all loans outstanding at the end of the third quarter of 2013, the lowest level since the second quarter of 2008. The delinquency rate dropped 55 basis points from the previous quarter, and 99 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 3.08 percent down 25 basis points from the second quarter and 99 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since 2008.

“The degree to which the mortgage delinquency and foreclosure problem has changed over the last five years is perhaps best illustrated by the fact that last quarter New Jersey led the nation in the increase in the percentage of foreclosure actions filed, followed by Delaware, Maryland and Indiana. While Florida still leads the nation in the percentage of loans in foreclosure, that percentage is falling. In contrast, New York and New Jersey were the only two states that saw an increase in the percentages of loans in foreclosure,” said Jay Brinkmann, MBA’s Chief Economist and SVP of Research and Education.

“States with judicial foreclosure systems still account for most of the loans in foreclosure. While the percentages of loans in foreclosure dropped in both judicial and nonjudicial states, the average rate for judicial states was 5.28 percent, more than triple the average rate of 1.66 percent for nonjudicial states.

...

“[M]any mortgage servicers are already reducing their staffs that handled delinquent loans and foreclosures and we expect that trend to continue as the numbers continue to fall."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 2.79% from 3.19% in Q2. This is close to the long term average.

Delinquent loans in the 60 day bucket decreased to 1.07% in Q3, from 1.12% in Q2. This is still slightly elevated.

The 90 day bucket decreased to 2.56% from 2.65%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.08% from 3.33% and is now at the lowest level since 2008.

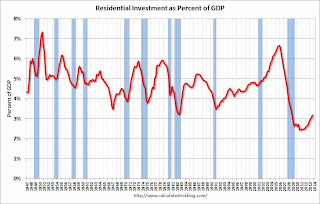

Q3 GDP: Growth slightly above Expectations, but Weak Personal consumption expenditures

by Calculated Risk on 11/07/2013 09:18:00 AM

The advance Q3 GDP report, with 2.8% annualized growth, was above expectations. However some of the details were weak. Personal consumption expenditures (PCE) increased at a 1.5% annualized rate - the slowest rate since Q2 2011.

"Change in private inventories" added 0.83 percentage points to GDP in Q3. This was above expectations of a 2.0% growth rate, but mostly because of inventories.

It appears that the drag from state and local governments has ended, although the drag from Federal government spending is ongoing. The Federal government subtracted 0.13 percentage points in Q3, whereas state and local governments added 0.17 percentage points.

Residential investment (RI) remains a bright spot (increasing at a 14.6% annualized rate), and RI as a percent of GDP is still very low - and I expect RI to continue to increase over the next few years.

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 12 quarters (through Q3 2013).

And the drag from state and local governments appears to have ended after an unprecedented period of state and local austerity (not seen since the Depression). State and local governments have added to GDP for two quarters now.

I expect state and local governments to continue to make small positive contributions to GDP going forward.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession in the near future (with the usual caveats about Congress).

Finally, real GDP has increased only 1.6% over the last year (Q3 2012 to Q3 2013). Because GDP growth was very weak in Q4 2012, it will only take 1.5% annualized growth in Q4 to reach the lower end of the Fed's GDP target.