by Calculated Risk on 11/06/2013 07:03:00 AM

Wednesday, November 06, 2013

MBA: Mortgage Applications decrease 7% in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 1, 2013. ...

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier and is at its lowest level since the end of December 2012. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.32 percent from 4.33 percent, with points increasing to 0.42 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up slightly over the last two months as rates have declined from the August levels.

However the index is still down 61% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is now down about 3% from a year ago.

Tuesday, November 05, 2013

Lawler: Household Estimate, If True, Disturbing; Fortunately, Probably Isn’t

by Calculated Risk on 11/05/2013 07:51:00 PM

CR Note: CNBC had an article today: The housing stat you need to watch

Household formation—when a person who lives with someone else (parents, roommates, etc.) moves into another housing unit on his or her own, creating a new household—has averaged around 1 million per year historically as the U.S. population grows. In the early part of this century, when housing was just beginning its boom, it jumped by nearly 2 million. In the third quarter of this year, just 380,000 new households were formed, according to the U.S. Census.This household formation data is from the Housing Vacancies and Homeownership report and is probably not accurate.

From economist Tom Lawler: Census Residential Vacancies and Homeownership Report for Q3: Household Estimate, If True, Disturbing; Fortunately, Probably Isn’t

The Census released the Third Quarter 2013 “Residential Vacancies and Homeownership” Report this morning, which is based on the Housing Vacancy Survey supplement to the Current Population Survey. Here are some summary stats from the report, which is commonly called the Housing Vacancy Survey (HVS) report.

| Select Stats, Housing Vacancy Survey (Housing Units in thousands) | ||||

|---|---|---|---|---|

| Q3/2013 | Q2/2013 | Q3/2012 | YOY Change | |

| Rental Vacancy Rate | 8.3% | 8.2% | 8.6% | -0.3% |

| Homeowner Vacancy Rate | 1.9% | 1.9% | 1.9% | 0.0% |

| Gross Vacancy Rate | 13.61% | 13.62% | 13.66% | -0.05% |

| Homeownership Rate: NSA | 65.3% | 65.0% | 65.5% | -0.2% |

| Homeownership Rate: SA | 65.1% | 65.1% | 65.3% | -0.2% |

| Total Housing Units | 132,845 | 132,754 | 132,482 | 363 |

| Occupied Housing Units | 114,767 | 114,677 | 114,387 | 380 |

| Owner Occupied | 74,901 | 74,563 | 74,878 | 23 |

| Renter Occupied | 39,866 | 40,134 | 39,507 | 359 |

| Vacant Housing Units | 18,077 | 18,077 | 18,095 | -18 |

| Totals may not add up due to rounding | ||||

The surprising – and if true, disturbing – stat from the report is the estimate for occupied homes, which for last quarter was up just 380,000 from a year ago. That YOY increase is the lowest since the second quarter of 2010, and such anemic growth, if accurate, would be “most disturbing” from a “housing recovery” perspective. However, other estimates from a CPS-based survey earlier this year show significantly faster household growth from early 2012 to early 2013 than does the HVS, making it difficult to determine what, if anything, this latest report might mean.

Click on graph for larger image.

Click on graph for larger image.The CPS/HVS estimate for occupied housing units, or households, is “controlled” to separate estimates of the number of housing units from the Population Division, and assumes that (1) these housing units estimates are correct; and (2) the HVS estimates for the % of the housing stock that is occupied are correct. Historical estimates are “consistent” with historical estimates of the housing stock from the Population Division, but only back to 2000.

Alternative CPS estimates for the number of households are available from the CPS Annual Social and Economic Supplement for March of each year. These household estimates are “controlled” to estimates of the civilian non-institutionalized population from the Population Division, and assume that (1) the population estimates (both total and by age, sex, etc.) are correct; and (2) that the “headship” rates from the CPS/ASEC are correct. Historical estimates from the CPS/ASEC consistent with revised population estimates for last decade (based on Census 2010 results) are only available back to 2011.

The CPS/ASEC estimate for the number of US households for March, 2013 was 122.459 million, up 1.375 million from March, 2012. The HVS estimate for the number of households for March, 2013 was 114.061 million, up 373 thousand from March 2012, and the HVS estimate for the average number of households in the first half of 2013 was 114.480 million, up 575 thousand from the first half of 2012. The CPS/ASEC estimate of the number of US households increased by 2.532 million from March 2011 to March 2013, while the CPS/HVS estimate increased by only 1.306 million over that period.

| Different CPS-Based Estimates of US Households (000's) | ||||

|---|---|---|---|---|

| Mar-13 | Mar-12 | Mar-11 | Mar-13 vs. Mar-11 | |

| CPS/HVS | 114,061 | 113,688 | 112,755 | 1,306 |

| CPS/ASEC | 122,459 | 121,084 | 119,927 | 2,532 |

These shockingly different estimates both for the number of households and for recent changes in the number of households have understandably confused, baffled, and annoyed analysts and policymakers.

While both the CPS/HVS and the CPS/ASEC estimates are “controlled” to select Census 2010 results – one for the number of housing units, and the other to the number of people -- neither survey’s results are “controlled” to critical Census 2010 estimates such as the number of households (or headship rates), homeownership rates, vacancy rates, etc. -- making both of limited value to housing analysts and policymakers. Comparisons to Census 2010 results indicate that both CPS-based surveys considerably overstate homeownership rates, especially for “younger” adults, and that the CPS/HVS considerably overstates housing vacancy rates. While it is not clear whether the “bad” CPS results are based on sampling or non-sampling error – no real research has been done on this – the “sampling frame” for the CPS is incredibly outdated, and Id guess that “sampling error” is a “big deal.”

For analysts focused on the housing outlook, which is heavily dependent on the growth in households, the latest HVS estimates are “disturbing,” but the massive disparity between CPS-based household growth estimates based on “people” counts and household growth estimates based on “house” counts earlier this year makes one, I guess, “less disturbed,” though kinda pissed off.

HVS: Q3 2013 Homeownership and Vacancy Rates

by Calculated Risk on 11/05/2013 04:01:00 PM

The Census Bureau released the Housing Vacancies and Homeownership report for Q3 2013 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate,except as a guide to the trend.

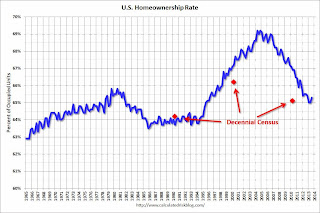

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate was increased to 65.3% in Q3, from 65.0% in Q2.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range - and given changing demographics, the homeownership rate is probably close to a bottom.

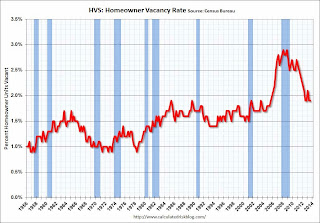

The HVS homeowner vacancy was unchanged at 1.9% in Q3.

The HVS homeowner vacancy was unchanged at 1.9% in Q3.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

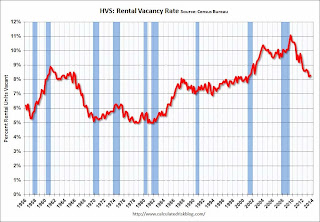

The rental vacancy rate increased slightly in Q3 to 8.3% from 8.2% in Q2.

The rental vacancy rate increased slightly in Q3 to 8.3% from 8.2% in Q2.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that most of the bubble excess is behind us.

Employment Preview: Upside Payroll Surprise?

by Calculated Risk on 11/05/2013 01:09:00 PM

There will be some ugly numbers in the October employment report to be released on Friday. The unemployment rate will probably increase sharply, and the number of part time workers for economic reasons will also increase. Excerpts from the BLS on the impact of the government shutdown:

For October 2013, the household survey reference week was Sunday, October 6, through Saturday, October 12. During this period, some federal government agencies were closed or were operating at reduced staffing levels because of the lapse in their funding. The federal employees and contractors who work for those agencies may have been off work for all or part of the week. ... Workers who indicate that they were not working during the entire survey reference week and expected to be recalled to their jobs should be classified in the household survey as unemployed, on temporary layoff.These shutdown related ugly numbers should be reversed in the November report (due early December).

Workers who usually work full time but indicate that they had worked fewer than 35 hours in the reference week because of the shutdown should be classified as employed part time for economic reasons.

However the impact on the October establishment survey is less certain. The consensus forecast is for an increase of 120,000 non-farm payroll jobs in October, down from the 148,000 non-farm payroll jobs added in September.

Here is a summary of recent data:

• The ADP employment report showed an increase of 130,000 private sector payroll jobs in October. This was below expectations of 138,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index decreased in October to 53.2% from 55.4% in September. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs were mostly unchanged in October. The ADP report indicated a 5,000 increase for manufacturing jobs in October.

The ISM non-manufacturing employment index increased in October to 56.2% from 52.7% in September. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 235,000 in October.

Taken together, these surveys suggest around 235,000 jobs added in October - well above the consensus forecast.

• Initial weekly unemployment claims averaged close to 356,000 in October. This was up sharply from an average of 305,000 in September. However there were some computer problems in California, and claims in September were probably too low - and claims in October too high. So this might not be useful this month.

• The final October Reuters / University of Michigan consumer sentiment index decreased to 73.2 from the September reading of 77.5. This is frequently coincident with changes in the labor market, but in this case the decline was probably related to the government shutdown.

• The small business index from Intuit showed a small decrease in small business employment in October.

• Conclusion: As usual the data was mixed. The ADP report was a little lower in October than in September, however the ISM surveys suggest an increase in hiring. Weekly claims for the reference week were higher (probably mostly due to computer issues), and consumer sentiment decreased (due to the government shutdown).

There is always some randomness to the employment report - and there are reasons for pessimism (ADP, unemployment claims, consumer sentiment), however with so many questions about the data, I'll lean towards the ISM surveys and my guess is the BLS will report more than the 120,000 consensus jobs added in October.

There are many questions about this employment report because of the government shutdown, and the November report will be much more important.

Trulia: Asking House Price Increases "Slowing Down"

by Calculated Risk on 11/05/2013 11:38:00 AM

From Trulia this morning: Trulia Reports Asking Home Prices Still Slowing Down Despite Rising 11.7 Percent Year-over-year in October

In October, asking home prices increased 0.6 percent month-over-month (M-o-M), the second-slowest monthly gain in seven months. This continued slowdown in asking prices is largely due to expanding inventory, rising mortgage rates, and declining investor activity. Asking prices could potentially slow further if consumer confidence suffers from the ongoing budget uncertainty and future shutdown and debt-default worries. Nevertheless, the monthly, quarterly, and yearly gains are all still high compared with historical norms. In fact, asking prices rose 11.7 percent year-over-year (Y-o-Y) – the highest increase since the housing bubble burst.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis (but the year-over-year increases will probably slow).

...

Nationally, rents rose 2.7 percent Y-o-Y. Among the 25 largest rental markets, rents rose most in San Francisco, Portland, and Seattle, while falling slightly in Washington D.C. and Philadelphia. Unfortunately for Bay Area renters, San Francisco now has the steepest Y-o-Y increase in rents and the highest median rent: $3,250 for a two-bedroom unit, edging out the New York metro area where the current median rent for a similarly-sized unit is $3,150 per month. At the other extreme, median rent for a two-bedroom unit is less than $1,000 in Phoenix, St. Louis, and Las Vegas.

“Although October’s asking home prices rose at the second-slowest pace in seven months, prices are still rising unsustainably fast,” said Jed Kolko, Trulia’s Chief Economist. “Even though the market is far from bubble territory, we still see the effects of fast-rising prices, including investors flipping homes and would-be sellers waiting longer to put their homes on the market.”

emphasis added

More from Kolko: Though Slowing, Asking Home Prices Still Climbing Fast

ISM Non-Manufacturing Index at 55.4 indicates faster expansion in October

by Calculated Risk on 11/05/2013 10:00:00 AM

The October ISM Non-manufacturing index was at 55.4%, up from 54.4% in September. The employment index increased in October to 56.2%, down from 52.7% in September. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: October 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 46th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI® registered 55.4 percent in October, 1 percentage point higher than September's reading of 54.4 percent. This indicates continued growth at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased to 59.7 percent, which is 4.6 percentage points higher than the 55.1 percent reported in September, reflecting growth for the 51st consecutive month. The New Orders Index decreased by 2.8 percentage points to 56.8 percent, and the Employment Index increased 3.5 percentage points to 56.2 percent, indicating growth in employment for the 15th consecutive month. The Prices Index decreased 1.1 percentage points to 56.1 percent, indicating prices increased at a slower rate in October when compared to September. According to the NMI®, 10 non-manufacturing industries reported growth in October. Respondents' comments are mixed with the majority reflecting an uptick in business. A number of respondents indicate that they are negatively impacted by the government shutdown."

emphasis added

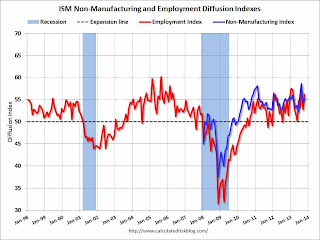

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.5% and indicates faster expansion in October than in September.

CoreLogic: House Prices up 12.0% Year-over-year in September

by Calculated Risk on 11/05/2013 08:59:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 12 Percent Year Over Year in September

Home prices nationwide, including distressed sales, increased 12 percent on a year-over-year basis in September 2013 compared to September 2012. This change represents the 19th consecutive monthly year-over-year increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.2 percent in September 2013 compared to August 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 10.8 percent in September 2013 compared to September 2012. On a month-over-month basis, excluding distressed sales, home prices increased 0.3 percent in September 2013 compared to August 2013. Distressed sales include short sales and real estate owned (REO) transactions.

Click on graph for larger image.

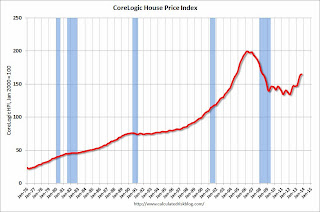

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.2% in September, and is up 12.0% over the last year. This index is not seasonally adjusted, and the month-to-month changes will be smaller for next several months.

The index is off 17.5% from the peak - and is up 22.8% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for nineteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for nineteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

I expect the year-over-year price increases to slow in the coming months.

Monday, November 04, 2013

Tuesday: ISM Service Index

by Calculated Risk on 11/04/2013 10:01:00 PM

Tuesday:

• At 10:0 AM ET, the ISM non-Manufacturing Index for October. The consensus is for a reading of 54.5, up slightly from 54.4 in September. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Trulia Price Rent Monitors for October. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• Also at 10:00 AM, the Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

Weekly Update: Housing Tracker Existing Home Inventory up 2.1% year-over-year on Nov 4th

by Calculated Risk on 11/04/2013 06:49:00 PM

Here is another weekly update on housing inventory ... for the third consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early this year.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for September). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now above the same week in 2012 (red is 2013, blue is 2012).

We can be pretty confident that inventory bottomed early this year, and I expect the seasonal decline to be less than usual at the end of the year - so the year-over-year change will continue to increase.

Inventory is still very low, but this increase in inventory should slow house price increases.

Fed Survey: Banks eased lending standards, "little change in loan demand"

by Calculated Risk on 11/04/2013 02:00:00 PM

From the Federal Reserve: The October 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices

The October 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months. Domestic banks, on balance, reported having eased their lending standards and having experienced little change in loan demand, on average, over the past three months. The survey contained two sets of special questions. Motivated by the increase in long-term interest rates since the spring, the first set of questions asked banks to describe whether they had experienced changes in the volume of applications for residential mortgages and whether they had changed lending policies for new home-purchase loans. The second set of questions examined the standards and terms on subprime auto loans over the past 12 months. This summary is based on the responses from 73 domestic banks and 22 U.S. branches and agencies of foreign banks.

Regarding loans to businesses, the October survey results generally indicated that banks eased their lending policies for commercial and industrial (C&I) loans and experienced little change in demand for such loans over the past three months.2 All domestic banks that eased their C&I lending policies cited increased competition for such loans as an important reason for having done so. ...

The survey results also indicated that banks, on average, did not substantially change standards or terms on lending to households. Modest net fractions of respondents reported having eased standards on prime residential mortgage loans, with a few large banks indicating they had eased standards on those loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE.

Banks are seeing a pickup in demand for all categories of CRE.This suggests (along with the Architecture Billing Index) that we will see an increase in commercial real estate development in the near future.