by Calculated Risk on 4/30/2013 10:49:00 AM

Tuesday, April 30, 2013

Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation. This is why economist also look at real house prices (inflation adjusted).

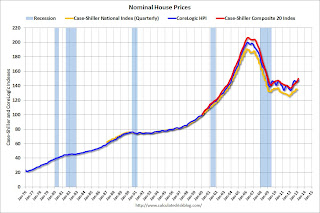

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through February) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through February) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q2 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to November 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to October 1999 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1999 levels, the Composite 20 index is back to January 2001 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 29% above January 2000 (I'll look at this in real terms later). Some cities - like Denver - are close to the peak level. Other cities, like Atlanta and Detroit, are below the January 2000 level.

Case-Shiller: Comp 20 House Prices increased 9.3% year-over-year in February

by Calculated Risk on 4/30/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Rise in February 2013 According to the S&P/Case-Shiller Home Price Indices

Data through February 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed average home prices increased 8.6% and 9.3% for the 10- and 20-City Composites in the 12 months ending in February 2013. The 10- and 20-City Composites rose 0.4% and 0.3% from January to February.

“Home prices continue to show solid increases across all 20 cities,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The 10- and 20-City Composites recorded their highest annual growth rates since May 2006; seasonally adjusted monthly data show all 20 cities saw higher prices for two months in a row – the last time that happened was in early 2005.

“Phoenix, San Francisco, Las Vegas and Atlanta were the four cities with the highest year-over-year price increases. Atlanta recovered from a wave of foreclosures in 2012 while the other three were among the hardest hit in the housing collapse. At the other end of the rankings, three older cities – New York, Boston and Chicago – saw the smallest year-over-year price improvements.

Click on graph for larger image.

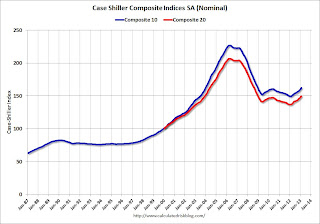

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 28.4% from the peak, and up 1.2% in February (SA). The Composite 10 is up 8.6% from the post bubble low set in Feb 2012 (SA).

The Composite 20 index is off 27.5% from the peak, and up 1.2% (SA) in February. The Composite 20 is up 9.4% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 8.6% compared to February 2012.

The Composite 20 SA is up 9.3% compared to February 2012. This was the ninth consecutive month with a year-over-year gain and this was the largest year-over-year gain for the Composite 20 index since 2006.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in February seasonally adjusted (prices increased in 12 of 20 cities NSA). Prices in Las Vegas are off 55.0% from the peak, and prices in Denver only off 1.0% from the peak.

This was just above the consensus forecast for a 9.0% YoY increase. I'll have more on prices later.

Monday, April 29, 2013

Tuesday: Case-Shiller House Prices, Chicago PMI, Consumer Confidence

by Calculated Risk on 4/29/2013 08:35:00 PM

Earlier today from LPS: U.S. Home Prices Up 1.0 Percent for the Month; Up 7.3 Percent Year-Over-Year. LPS reported their House Price Index increased to $210,000 in February, up from $208,000 or 1.0% from January - and up from $196,000 or 7.3% from February 2012. The LPS index is 20.6% below the peak in 2006.

Tuesday economic releases:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for February will be released. Although this is the February report, it is really a 3 month average of December, January and February. The consensus is for a 9.0% year-over-year increase in the Composite 20 index (NSA) for February. The Zillow forecast is for the Composite 20 to increase 8.9% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

• At 9:45 AM, the Chicago Purchasing Managers Index for April. The consensus is for the index to be unchanged at 52.4.

• At 10:00 AM, the Conference Board's consumer confidence index for April. The consensus is for the index to increase to 62.0 from 59.7.

• Also at 10:00 AM, the Census Bureau will release the Q1 Housing Vacancies and Homeownership report. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track other measures (like the decennial Census and the ACS) and this survey probably shouldn't be used to estimate the excess vacant housing supply.

Q1 2013 GDP Details: Single Family investment increases, Commercial Investment very Low

by Calculated Risk on 4/29/2013 04:56:00 PM

The BEA released the underlying details for the Q1 advance GDP report today.

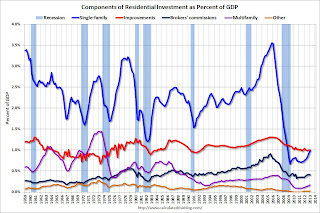

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

A few key points:

1) Usually the most important components are investment in single family structures followed by home improvement. However home improvement has been the top category for eighteen consecutive quarters, but that is about to change. Investment in single family structures should be the top category again by Q2 or Q3.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers' commissions. This is the category related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales are flat, or even decline due to fewer foreclosures, this will have little impact on residential investment.

Click on graph for larger image.

Click on graph for larger image.

Investment in home improvement was at a $161 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.0% of GDP), still above the level of investment in single family structures of (corrected) $157 billion (SAAR) (or 0.98% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment next quarter.

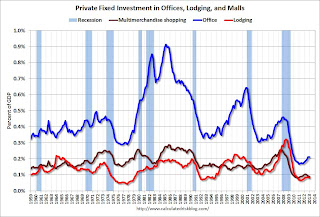

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased slightly, but from a very low level.

Investment in offices is down about 54% from the recent peak (as a percent of GDP). With the high office vacancy rate, investment will probably not increase significantly (as a percent of GDP) for several years - even though there has been some increase in the Architecture Billings Index lately.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.32% of GDP in Q2 2008 and is down about 75%. With the hotel occupancy rate close to normal, it is possible that hotel investment will increase this year.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.

Existing Home Inventory is up 12.1% year-to-date on April 29th

by Calculated Risk on 4/29/2013 01:05:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory mostly followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 12.1%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It is possible that inventory could bottom this year - especially if inventory is up 15% to 18% from the seasonal lows by mid-to-late summer.

It will probably be close. Inventory might have already bottomed in early 2013, or might bottom in early 2014. This will be important for price increases ... once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases will slow.

Dallas Fed: Regional Manufacturing Activity "stalls" in April

by Calculated Risk on 4/29/2013 10:38:00 AM

This is the last of the regional manufacturing surveys for April. From the Dallas Fed: Growth in Texas Manufacturing Activity Stalls

Texas factory activity was flat in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 9.9 to -0.5. The near-zero reading indicates output was little changed from March levels.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Ebbing growth in manufacturing activity was reflected in other survey measures as well. The capacity utilization index came in at 2.7, down from 5.5, and the shipments index fell to zero after rising to 10.6 in March. The new orders index fell nearly 14 points to -4.9, posting its first negative reading this year.

Perceptions of broader business conditions worsened in April. The general business activity index plummeted from 7.4 to -15.6, reaching its lowest level since July 2012.

Labor market indicators remained mixed. The employment index has been in positive territory so far in 2013 and moved up to 6.3 in April. ... The hours worked index pushed further negative, from -2.4 to -6.5.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

The ISM index for April will be released Wednesday, May 1st, and these surveys suggest a lower reading, possibly even at or below 50 (contraction).

Pending Home Sales index increases in March

by Calculated Risk on 4/29/2013 10:00:00 AM

From the NAR: March Pending Home Sales Improve but Overall Pace Leveling

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 1.5 percent to 105.7 in March from a downwardly revised 104.1 in February, and is 7.0 percent above March 2012 when it was 98.8. Pending sales have been above year-ago levels for the past 23 months; the data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May.

...

The PHSI in the Northeast was unchanged at 82.8 in March and is 6.3 percent higher than March 2012. In the Midwest the index increased 0.3 percent to 103.8 in March and is 13.7 percent above a year ago. Pending home sales in the South rose 2.7 percent to an index of 120.0 in March and are 10.4 percent higher than March 2012. In the West the index increased 1.5 percent in March to 102.9 but is 4.3 percent below a year ago.

As I've noted several times, with limited inventory at the low end and fewer foreclosures, we might see flat or even declining existing home sales. The key is that the number of conventional sales is increasing while foreclosures and short sales decline - and that is a sign of an improving market, even if total sales decline.

Personal Income increased 0.2% in March, Core PCE prices up 1.1% year-over-year

by Calculated Risk on 4/29/2013 08:30:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $30.9 billion, or 0.2 percent ... in March, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $21.0 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in March, the same increase as in February. ... PCE price index -- The price index for PCE decreased 0.1 percent in March, in contrast to an increase of 0.4 percent in February. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared with an increase of 0.1 percent.

...

Personal saving -- DPI less personal outlays -- was $329.1 billion in March, compared with $330.9 billion in February. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 2.7 percent in March, the same as in February.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. PCE for both January and February were revised down slightly.

As reported on Friday in the advance GDP report, PCE increased at a 3.2% annual rate in Q1.

A key point is that the PCE price index was only up 1.0% year-over-year (1.1% for core PCE). Core PCE increased at a 0.4% annualized rate in March. This will put pressure on the Fed to do more.

Sunday, April 28, 2013

Monday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 4/28/2013 08:54:00 PM

First a couple of articles ...

From Jon Hilsenrath at the WSJ: Tame Inflation to Keep Fed on Course

With inflation now lower than the Fed wants, officials are likely to conclude their policies show no sign of overheating the economy. That allows them to maintain their $85 billion-a-month bond-buying program ...Too little inflation is a growing concern at the Fed.

Several Fed officials have changed the way they are talking about inflation. In a late March speech, New York Fed President William Dudley described inflation as "below" the Fed target. In mid-April, after new inflation data emerged, he described it as "well below" target, the kind of subtle change central-bank officials often deploy after careful deliberation.

"If inflation is lower and continues to go lower than our target, that would be another reason potentially for not pulling back on our program," said Eric Rosengren, president of the Boston Fed, in an interview this month. [James Bullard, president of the Federal Reserve Bank of St. Louis] said he would consider supporting an increase in bond purchases if inflation fell much further.

And from Ben Casselman at the WSJ: Demographics Behind Smaller Workforce. I've discussed the participation rate a number of times - see: Labor Force Participation Rate Update, Understanding the Decline in the Participation Rate and Update: Further Discussion on Labor Force Participation Rate - the key point is that most of the recent decline in the participation rate was expected because of demographics.

Monday economic releases:

• At 8:30 AM ET, The BEA will release the Personal Income and Outlays report for March. The consensus is for a 0.4% increase in personal income in March, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, the NAR will release their Pending Home Sales Index for March. The consensus is for a 0.7% increase in this index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for April will be released. The consensus is a decrease to 5.0 from 7.4 in March (above zero is expansion).

Weekend:

• Summary for Week ending April 26th

• Schedule for Week of April 28th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 6 and Dow futures are down 19 (fair value).

Oil prices were up over the last week with WTI futures at $92.56 per barrel and Brent at $102.70 per barrel.

According to Gasbuddy.com, gasoline prices are down about 25 cents over the last 2 months to $3.48 per gallon. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.41 per gallon. That is about 7 cents below the current level according to Gasbuddy.com, so I expect gasoline prices to fall some more.

FOMC Preview: Inflation Watch

by Calculated Risk on 4/28/2013 03:09:00 PM

The Federal Open Market Committee (FOMC) is meeting on Tuesday and Wednesday, with the FOMC statement expected to be released at 2:00 PM ET on Wednesday.

Expectations are the FOMC will take no action at this meeting (the FOMC will probably not adjust the size of their purchases of agency mortgage-backed securities and Treasury securities).

Since the most recent meeting in March, the incoming data has been a little weaker, so the FOMC will probably adjust the wording of the statement. For growth, there will probably be some slight changes to the first sentence in the March statement:

Information received since the Federal Open Market Committee met in January suggests a return to moderate economic growth following a pause late last year. Labor market conditions have shown signs of improvement in recent months but the unemployment rate remains elevated.Perhaps something like (from the April 2011 statement):

Information received since the Federal Open Market Committee met in March indicates that the economic recovery is proceeding at a moderate pace and overall conditions in the labor market are improving gradually.A key will be to watch the comments on inflation. From the March meeting:

Inflation has been running somewhat below the Committee's longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices.Since then, it appears inflation has fallen even more, even excluding energy prices. Core PCE inflation is probably running close to 1.2% year-over-year, and other key measures of inflation are trending down. This decline in inflation is probably becoming a concern for some FOMC participants.

As a reminder, here are the quarterly projections from the March meeting. For GDP, the Q1 advance report released last week probably wouldn't change the outlook.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 |

The unemployment rate was at 7.6% in March, and the outlook for Q4 unemployment probably hasn't changed.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 |

For inflation, PCE inflation was up 1.2% year-over-year in Q1, and only increased at a 0.9% annualized rate in Q1. This is below the FOMC projected range and is probably a growing concern.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 |

The BEA will release core PCE for March tomorrow, and core inflation is also expected to be below the FOMC projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |