by Calculated Risk on 4/06/2013 06:56:00 PM

Saturday, April 06, 2013

Unofficial Problem Bank list declines to 790 Institutions, Q1 Transition Matrix

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 5, 2013.

Changes and comments from surferdude808:

The failure last night is the only change to the Unofficial Problem Bank List this week. The removal leaves the list at 790 institutions with assets of $290.0 billion. A year ago the list held 946 institutions with assets of $376.5 billion. Gold Canyon Bank, Gold Canyon, AZ ($45 million Ticker: GCYO) is the fifth failure this year and the 13th bank to fail in Arizona since the on-set of the financial crisis.

With the first quarter of 2013 ending this past week, it is time for an update of the transition matrix. As seen in the table, there have been a total of 1,624 institutions with assets of $811.2 billion that have appeared on the list. For the first time since publication of the list, more than half of the institutions that have appeared on the list have been removed. Specifically, 833 institutions or 51.3 percent of the total are no longer on the list. Failure is still the primary removal reason as 351 institutions with assets of $290.8 billion have failed since appearing on the list. However, action terminations are rapidly approaching the number of failures. A total of 343 institutions with assets of $153.2 billion have improved enough for their enforcement action to be terminated. Other forms of exit include 129 institutions with assets of $55.9 billion finding a merger partner and 10 institutions with assets of $6.7 billion voluntarily surrendering their banking charters. The slowdown in action terminations noted last quarter reversed as 51 terminations occurred during the first quarter of 2013 compared to 40 in the fourth quarter of 2012. Next quarter, terminations will finally exceed failures.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 104 | (31,414,531) | |

| Unassisted Merger | 26 | (4,191,282) | |

| Voluntary Liquidation | 3 | (4,896,324) | |

| Failures | 148 | (182,228,947) | |

| Asset Change | (14,534,468) | ||

| Still on List at 12/28/2012 | 108 | 39,047,877 | |

| Additions | 683 | 250,947,679 | |

| End (12/28/2012) | 791 | 289,995,556 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 239 | 121,805,500 | |

| Unassisted Merger | 103 | 51,745,000 | |

| Voluntary Liquidation | 7 | 1,760,816 | |

| Failures | 203 | 108,650,455 | |

| Total | 552 | 283,961,771 | |

| 1Institution not on 8/7/2009 or 3/31/2013 list but appeared on a weekly list. | |||

Earlier:

• Summary for Week Ending April 5th

• Schedule for Week of April 7th

Summary for Week ending April 5th

by Calculated Risk on 4/06/2013 02:12:00 PM

"Disappointing" and "below expectations" were the most used phrases to describe the economic releases last week. Even though growth in Q1 was better than in Q4 2012, it appears the first quarter ended sluggishly.

The employment report was well below expectations with only 88,000 payroll jobs added, the ISM manufacturing and service indexes indicated slower growth in March, initial weekly unemployment claims increased sharply, and even auto sales were a little disappointing.

On the positive side, construction spending increased, and it appears the layoffs at the state and local government level are ending (two of the key reasons I'm more optimistic this year).

But overall it was a disappointing week. I expect some slowdown over the next couple of quarters related to policy (sequestration), but I think the key drivers for growth are still positive.

Here is a summary of last week in graphs:

• March Employment Report: 88,000 Jobs, 7.6% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

From the BLS: "Nonfarm payroll employment edged up in March (+88,000), and the unemployment rate was little changed at 7.6 percent, the U.S. Bureau of Labor Statistics reported today. ... The change in total nonfarm payroll employment for January was revised from +119,000 to +148,000, and the change for February was revised from +236,000 to +268,000."

The headline number was well below expectations of 193,000 payroll jobs added. However employment for January and February were revised higher.

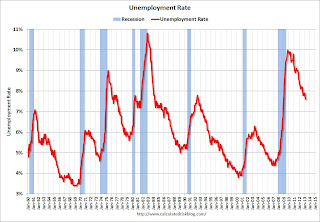

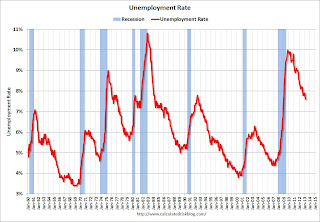

The second graph shows the unemployment rate.

The second graph shows the unemployment rate.

The unemployment rate decreased to 7.6% from 7.7% in February.

The unemployment rate is from the household report and the household report showed a sharp decline in the labor force - and that meant a lower unemployment rate.

The labor force (household survey) declined from 155.524 million to 155.028 million - a decline of 496 thousand.

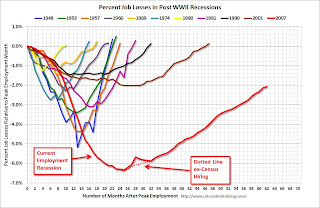

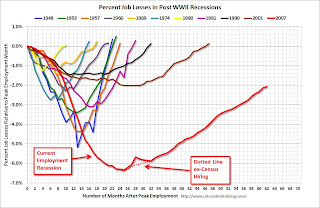

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was a disappointing employment report and worse than expectations.

• ISM Manufacturing index declines in March to 51.3

The ISM manufacturing index indicated expansion in March. The PMI was at 51.3% in March, down from 54.2% in February. The employment index was at 54.2%, up from 52.6%, and the new orders index was at 51.4%, down from 57.8% in February.

The ISM manufacturing index indicated expansion in March. The PMI was at 51.3% in March, down from 54.2% in February. The employment index was at 54.2%, up from 52.6%, and the new orders index was at 51.4%, down from 57.8% in February.

Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.0% and suggests manufacturing expanded at a slower pace in March.

• ISM Non-Manufacturing Index indicates slower expansion in March

The March ISM Non-manufacturing index was at 54.4%, down from 56.0% in February. The employment index decreased in March to 53.3%, down from 57.2% in February. Note: Above 50 indicates expansion, below 50 contraction.

The March ISM Non-manufacturing index was at 54.4%, down from 56.0% in February. The employment index decreased in March to 53.3%, down from 57.2% in February. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.0% and indicates slower expansion in March than in February.

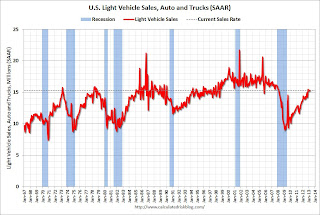

• U.S. Light Vehicle Sales decreased to 15.3 million annual rate in March

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.27 million SAAR in March. That is up 8% from March 2012, and down slightly from the sales rate last month.

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.27 million SAAR in March. That is up 8% from March 2012, and down slightly from the sales rate last month.

This was below the consensus forecast of 15.4 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This is a solid start to the new year. After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another positive year for the auto industry.

Even if sales average the Q1 rate all year, Total sales would be up about 6% from 2012.

• Construction Spending increased in February

From Census Bureau: "The U.S. Census Bureau of the Department of Commerce announced today that construction spending during February 2013 was estimated at a seasonally adjusted annual rate of $885.1 billion, 1.2 percent above the revised January estimate of $874.8 billion. The February figure is 7.9 percent above the February 2012 estimate of $820.7 billion."

From Census Bureau: "The U.S. Census Bureau of the Department of Commerce announced today that construction spending during February 2013 was estimated at a seasonally adjusted annual rate of $885.1 billion, 1.2 percent above the revised January estimate of $874.8 billion. The February figure is 7.9 percent above the February 2012 estimate of $820.7 billion."

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 55% below the peak in early 2006, and up 36% from the post-bubble low. Non-residential spending is 25% below the peak in January 2008, and up about 37% from the recent low.

Private residential spending is 55% below the peak in early 2006, and up 36% from the post-bubble low. Non-residential spending is 25% below the peak in January 2008, and up about 37% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and just above the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

On a year-over-year basis, private residential construction spending is now up 20%. Non-residential spending is up 6% year-over-year mostly due to energy spending (power and electric). Public spending is down 1.5% year-over-year.

• Trade Deficit declined in February to $43 Billion

The Department of Commerce reported: "[T]otal February exports of $186.0 billion and imports of $228.9 billion resulted in a goods and services deficit of $43.0 billion, down from $44.5 billion in January, revised. February exports were $1.6 billion more than January exports of $184.4 billion. February imports were $0.1 billion more than January imports of $228.9 billion."

The Department of Commerce reported: "[T]otal February exports of $186.0 billion and imports of $228.9 billion resulted in a goods and services deficit of $43.0 billion, down from $44.5 billion in January, revised. February exports were $1.6 billion more than January exports of $184.4 billion. February imports were $0.1 billion more than January imports of $228.9 billion."

The trade deficit was below the consensus forecast of $44.8 billion.

Exports are 12% above the pre-recession peak and up 3.2% compared to February 2012; imports are slightly below the pre-recession peak, and up 2% compared to February 2012.

This graph shows the U.S. trade deficit, with and without petroleum, through February.

This graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The decrease in the trade deficit in February was mostly due to a decrease in the volume of petroleum imports.

Oil averaged $95.96 per barrel in February, up from $94.08 in January, but down from $103.63 in February 2012.

• Weekly Initial Unemployment Claims increase to 385,000

From the DOL: "In the week ending March 30, the advance figure for seasonally adjusted initial claims was 385,000, an increase of 28,000 from the previous week's unrevised figure of 357,000."

From the DOL: "In the week ending March 30, the advance figure for seasonally adjusted initial claims was 385,000, an increase of 28,000 from the previous week's unrevised figure of 357,000."

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 354,250 - the highest level since February.

Weekly claims were above the 350,000 consensus forecast. Note: This appears to be the beginning of the impact of the "sequestration" budget cuts.

Schedule for Week of April 7th

by Calculated Risk on 4/06/2013 10:23:00 AM

Note: I'll post a summary of last week soon.

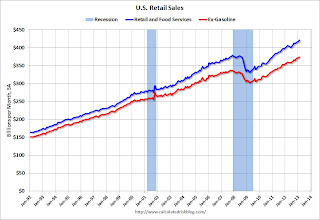

The key report this week is the March retail sales report on Friday.

The FOMC minutes for the March meeting will be released on Wednesday.

Fed Chairman Ben Bernanke will speak on Monday and Friday (several regional Fed presidents will also speak this week).

7:15 PM ET, Speech by Fed Chairman Ben Bernanke, Stress-Testing Banks: What Have We Learned? , At the 2013 Financial Markets Conference, Atlanta, Georgia

7:30 AM ET: NFIB Small Business Optimism Index for March. The consensus is for a decrease to 90.6 from 90.8 in February.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 3.693 million, up from 3.612 million in December. number of job openings (yellow) has generally been trending up, and openings are up 8% year-over-year compared to January 2012.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.5% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes for Meeting of March 19-20, 2013

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 385 thousand last week. The "sequester" budget cuts appear to be impacting weekly claims.

8:30 AM: Producer Price Index for March. The consensus is for a 0.2% decrease in producer prices (0.2% increase in core).

8:30 AM ET: Retail sales for March will be released.

8:30 AM ET: Retail sales for March will be released.This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline) through February. Retail sales are up 27.2% from the bottom, and now 11.2% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be unchanged in March (following the large increases in January and February), and to increase 0.1% ex-autos.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for April). The consensus is for a reading of 79.0, up from 78.6.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.4% increase in inventories.

12:30 PM: Speech by Fed Chairman Ben Bernanke, Creating Resilient Communities, At the 2013 Federal Reserve System Community Development Research Conference, Washington, D.C.

Friday, April 05, 2013

Bank Failure #5 in 2013: Gold Canyon Bank, Gold Canyon, Arizona

by Calculated Risk on 4/05/2013 08:35:00 PM

From the FDIC: First Scottsdale Bank, National Association, Scottsdale, Arizona, Assumes All of the Deposits of Gold Canyon Bank, Gold Canyon, Arizona

As of December 31, 2012, Gold Canyon Bank had approximately $45.2 million in total assets and $44.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.2 million. ... Gold Canyon Bank is the fifth FDIC-insured institution to fail in the nation this year, and the first in Arizona.Hmmm ... someone make a joke about Gold ...

Earlier on the employment report:

• March Employment Report: 88,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs

AAR: Rail Traffic "mixed" in March

by Calculated Risk on 4/05/2013 04:30:00 PM

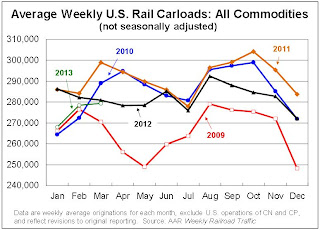

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for March, Declines for Week Ending March 30

Intermodal traffic in March 2013 totaled 933,208 containers and trailers, up 0.5 percent (4,859 units) compared with March 2012. That percentage increase represents the smallest year-over-year monthly gain for intermodal since August 2011.

Carloads originated in March 2013 totaled 1,117,427, down 0.5 percent (5,969 carloads) compared with the same month last year. While it was a decline, March had the lowest year-over-year monthly dip in carloads since January of 2012. Carloads excluding coal and grain were up 3.4 percent (19,965 carloads) in March 2013 over March 2012.

“U.S. rail traffic continues to mirror the overall economy: not great, not terrible, anticipating a better future,” said AAR Senior Vice President John T. Gray. “Petroleum and petroleum products continues to lead traffic gains, while coal and grain have seen better days. Intermodal volume in March was up just 0.5 percent over last year, but it was still the highest-volume March in history and built on even stronger gains earlier in the quarter.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

Commodities with the biggest carload increases in March included petroleum and petroleum products, up 54.3 percent or 19,295 carloads; crushed stone, gravel and sand, up 11.9 percent or 8,380 carloads; motor vehicles and parts, up 6.1 percent or 4,127 carloads; and coke, up 11.4 percent or 1,550 carloads. Commodities with carload declines last month included grain, down 20.1 percent or 16,971 carloads; coal, down 2 percent or 8,963 carloads; metallic ores, down 13.2 percent or 2,908 carloads; and chemicals, down 1.3 percent or 1,581 carloads.Note that building related commodities were up.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.Intermodal traffic was weaker in March, but still on track for a record year in 2013:

After a stellar February, U.S. intermodal traffic came back to earth in March. U.S. railroads originated 933,208 containers and trailers in March 2013, up just 0.5% (4,859 units) over March 2012. (The comparable numbers were 10.5% and 93,231 units in February.) That’s the smallest year-over-year monthly increase since August 2011. On the other hand, March 2013’s weekly average of 233,302 containers and trailers is the highest average for any March in history.Earlier on the employment report:

• March Employment Report: 88,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs

Employment Report Comments and more Graphs

by Calculated Risk on 4/05/2013 01:57:00 PM

The 88 thousand payroll jobs added in March is from the establishment survey (a survey of businesses for payroll jobs), but the unemployment rate is from the household survey. To help understand the decline in the unemployment rate, here is some data from the household survey.

The "Population" is the Civilian Noninstitutional Population, or the number of people 16 and over who are "not inmates of institutions (for example, penal and mental facilities and homes for the aged) and who are not on active duty in the Armed Forces". This is increasing every month, and increased 167 thousand in March.

The Civilian Labor Force is based on the percentage of people who say they are either employed or unemployed. This yields the participation rate (the percentage of the civilian noninstitutional population that is in the labor force). The participation rate has declined recently due to both demographic reasons and the weak recovery from the financial crisis. Separating out the two reasons is difficult, see: Understanding the Decline in the Participation Rate and Further Discussion on Labor Force Participation Rate and Labor Force Participation Rate Update.

If the participation rate increases, then it would take more jobs to reduce the unemployment rate. If the participation rate continues to decline (or just flat lines for a couple of years), then it takes fewer jobs to reduce the unemployment rate.

According to the household survey, the economy lost 206 thousand jobs (the establishment survey is MUCH better for payroll jobs added), and there were 290 thousand fewer people unemployed - so the unemployment rate declined to the lowest level since December 2008. We'd prefer to see the unemployment rate decline because of more jobs, as opposed to less participation.

| Employment Status, Household Data (000s) | |||

|---|---|---|---|

| Feb | Mar | Change | |

| Population | 244,828 | 244,995 | 167 |

| Civilian Labor Force | 155,524 | 155,028 | -496 |

| Participation Rate | 63.52% | 63.28% | -0.24% |

| Employed | 143,492 | 143,286 | -206 |

| Unemployed | 12,032 | 11,742 | -290 |

| Unemployment Rate | 7.74% | 7.57% | -0.17% |

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio was unchanged at 75.9% in March. The participation rate for this group declined slightly to 81.1%. The decline in the participation rate for this age group is probably mostly due to economic weakness, whereas most of the decline in the overall participation rate is probably due to demographics.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 350,000 over the month to 7.6 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decline in March to 7.64 million from 7.99 million in February. This is the few part time for economic reasons since November 2008.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 13.8% in March. This is the lowest level for U-6 since December 2008.

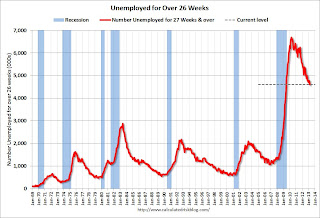

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.61 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.8 million in February. This is trending down, but is still very high. This is the fewest long term unemployed since June 2009. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In March 2013, state and local governments added 7,000 jobs and state and local employment has increased 8,000 so far in 2013.

I think most of the state and local government layoffs are over. Of course the Federal government layoffs are ongoing with many more layoffs expected due to the sequestration spending cuts.

Overall this was a weak report, but there were a few positives including the upward revisions to the January and February reports, the decline in the long term unemployed, and the decline in part time workers to list a few.

Trade Deficit declined in February to $43 Billion

by Calculated Risk on 4/05/2013 10:55:00 AM

Note: I'll have more on the employment report soon.

The Department of Commerce reported:

[T]otal February exports of $186.0 billion and imports of $228.9 billion resulted in a goods and services deficit of $43.0 billion, down from $44.5 billion in January, revised. February exports were $1.6 billion more than January exports of $184.4 billion. February imports were $0.1 billion more than January imports of $228.9 billion.The trade deficit was below the consensus forecast of $44.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2013.

Click on graph for larger image.

Click on graph for larger image.Exports increased in February, and imports were essentially flat, so the deficit declined.

Exports are 12% above the pre-recession peak and up 3.2% compared to February 2012; imports are slightly below the pre-recession peak, and up 2% compared to February 2012.

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The decrease in the trade deficit in February was mostly due to a decrease in the volume of petroleum imports.

Oil averaged $95.96 per barrel in February, up from $94.08 in January, but down from $103.63 in February 2012.

The trade deficit with China increased to $23.4 billion in February, up from $19.4 billion in February 2012. Most of the trade deficit is still due to oil and China.

The trade deficit with the euro area was $8.1 billion in January, up from $5.8 billion in February 2012. This is another sign of weakness in the euro area.

March Employment Report: 88,000 Jobs, 7.6% Unemployment Rate

by Calculated Risk on 4/05/2013 08:30:00 AM

From the BLS:

Nonfarm payroll employment edged up in March (+88,000), and the unemployment rate was little changed at 7.6 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was well below expectations of 193,000 payroll jobs added. However employment for January and February were revised higher.

...

The change in total nonfarm payroll employment for January was revised from +119,000 to +148,000, and the change for February was revised from +236,000 to +268,000.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The second graph shows the unemployment rate.

The unemployment rate decreased to 7.6% from 7.7% in February.

The unemployment rate is from the household report and the household report showed a sharp decline in the labor force - and that meant a lower unemployment rate.

The unemployment rate is from the household report and the household report showed a sharp decline in the labor force - and that meant a lower unemployment rate.The labor force (household survey) declined from 155.524 million to 155.028 million - a decline of 496 thousand.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 63.3% in March (blue line). This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was also declined to 58.5% in March (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was a disappointing employment report and worse than expectations. I'll have much more later ...

Thursday, April 04, 2013

Friday: Employment Report, Trade Deficit

by Calculated Risk on 4/04/2013 09:06:00 PM

First, from CNBC: Nikkei Surges Past 13,000 on BOJ Surprise

Japan's benchmark Nikkei index traded nearly 4 percent higher on Friday while the yen plunged to a three-and-a-half-year low against the greenback ... The BOJ's shock therapy program to meet its 2 percent inflation target includes doubling the monetary base and purchasing long-dated government bonds. It plans to inject $1.4 trillion into the economy in less than two years.And from the WSJ: Money Spigot Opens Wider

The Bank of Japan's new leaders delivered on their pledge to radically overhaul its strategy to revive Japan's economy, unveiling a package of easy-money policies Thursday so aggressive in scale and tactics that it surprised investors.Friday economic releases:

... "This is an entirely new dimension of monetary easing, both in terms of quantity and quality,'' the Bank of Japan's new governor, Haruhiko Kuroda, said Thursday. The BOJ said the programs would continue at least two years.

The strategy seeks to broadly change Japanese behavior and attitudes that have contributed to depressed spending, wages and prices over the past two decades.

"I will not use my fighting power in an incremental manner," Mr. Kuroda said at a news conference following the central bank's two-day meeting. "Our stance is to take all the policy measures imaginable at this point to achieve the 2% target in two years."

• 8:30 AM ET, the Employment Report for March will be released. The consensus is for an increase of 193,000 non-farm payroll jobs in March; the economy added 236,000 non-farm payroll jobs in February. The consensus is for the unemployment rate to be unchanged at 7.7% in March.

• Also at 8:30 AM, Trade Balance report for February from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $44.8 billion in February from $44.4 billion in January.

• At 3:00 PM, Consumer Credit for February from the Federal Reserve. The consensus is for credit to increase $16.0 billion in February.

Fed's Yellen: Communication in Monetary Policy

by Calculated Risk on 4/04/2013 05:55:00 PM

Fed Vice Chair Janet Yellen gave an overview about the importance of communication in monetary policy today: Communication in Monetary Policy. Here are a few excerpts related to the eventual exit plan:

The Federal Reserve's ongoing asset purchases continually add to the accommodation that the Federal Reserve is providing to help strengthen the economy. An end to those purchases means that the FOMC has ceased augmenting that support, not that it is withdrawing accommodation. When and how to begin actually removing the significant accommodation provided by the Federal Reserve's large holdings of longer-term securities is a separate matter. In its March statement, the FOMC reaffirmed its expectation that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the current asset purchase program ends and the economic recovery has strengthened. Accordingly, there will likely be a substantial period after asset purchases conclude but before the FOMC starts removing accommodation by reducing asset holdings or raising the federal funds rate.Here are the "exit principles" that Yellen discussed from the June 2011 minutes: Exit Strategy Principles.

To guide expectations concerning the process of normalizing the size and composition of the Federal Reserve's balance sheet, at its June 2011 meeting, the FOMC laid out what it called "exit principles." [Note: see below for "exit principles"] In these principles, the FOMC indicated that asset sales would likely follow liftoff of the federal funds rate. It also noted that, in order to minimize the risk of market disruption, the pace of asset sales during this process could be adjusted up or down in response to changes in either the economic outlook or financial conditions. For example, changes in the pace or timing of asset sales might be warranted by concerns over market functioning or excessive volatility in bond markets. While normalization of the Federal Reserve's portfolio is still well in the future, the FOMC is committed to clear communication about the likely path of the balance sheet.

There will come a time when the FOMC begins the process of returning the federal funds rate to a more normal level. In their individual projections submitted for the March FOMC meeting, 13 of the 19 FOMC participants saw the first increase in the target for the federal funds rate as most likely to occur in 2015, and another expected it to occur in 2016. But the course of the economy is uncertain, and the Committee added the thresholds for unemployment and inflation, in part, to help guide the public if economic developments warrant liftoff sooner or later than expected. As the time of the first increase in the federal funds rate moves closer, in my view it will be increasingly important for the Committee to clearly communicate about how the federal funds rate target will be adjusted.

emphasis added