by Calculated Risk on 3/01/2013 12:35:00 PM

Friday, March 01, 2013

Construction Spending declined in January

Catching up ...

A few key themes:

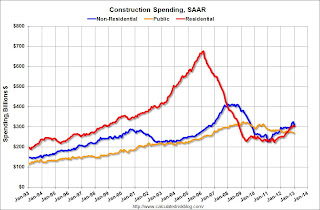

1) Private residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Private residential is now about even with private non-residential, and residential will probably be the largest category of construction spending in 2013. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time, mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels.

3) Public construction spending has declined to 2006 levels (not adjusted for inflation). This has been a drag on the economy for almost 4 years.

The Census Bureau reported that overall construction spending decreased in January:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during January 2013 was estimated at a seasonally adjusted annual rate of $883.3 billion, 2.1 percent below the revised December estimate of $902.6 billion. The January figure is 7.1 percent above the January 2012 estimate of $824.7 billion.Private construction spending decreased due to less spending on power and electric, and public construction spending declined too:

Spending on private construction was at a seasonally adjusted annual rate of $614.2 billion, 2.6 percent below the revised December estimate of $630.9 billion. Residential construction was at a seasonally adjusted annual rate of $304.6 billion in January, nearly the same as the revised December estimate of $304.7 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $269.0 billion, 1.0 percent below the revised December estimate of $271.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 55% below the peak in early 2006, and up 37% from the post-bubble low. Non-residential spending is 25% below the peak in January 2008, and up about 37% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 22%. Non-residential spending is up 4% year-over-year mostly due to energy spending (power and electric). Public spending is down 3% year-over-year.

ISM Manufacturing index increases in February to 54.2, Consumer Sentiment improves

by Calculated Risk on 3/01/2013 10:00:00 AM

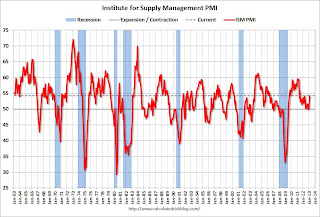

The ISM manufacturing index indicated expansion in February. PMI was at 54.2% in February, up from 53.1% in January. The employment index was at 52.6%, down from 54.0%, and the new orders index was at 57.8%, up from 53.3% in January.

From the Institute for Supply Management: February 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in February for the third consecutive month, and the overall economy grew for the 45th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 54.2 percent, an increase of 1.1 percentage points from January's reading of 53.1 percent, indicating expansion in manufacturing for the third consecutive month. This month's reading reflects the highest PMI™ since June 2011, when the index registered 55.8 percent. The New Orders Index registered 57.8 percent, an increase of 4.5 percent over January's reading of 53.3 percent, indicating growth in new orders for the second consecutive month. As was the case in January, all five of the PMI™'s component indexes — new orders, production, employment, supplier deliveries and inventories — registered in positive territory in February. In addition, the Backlog of Orders, Exports and Imports Indexes all grew in February relative to January."This was above expectations of 52.8% and suggests manufacturing expanded at a faster pace in February.

Final consumer sentiment for February:

The final Reuters / University of Michigan consumer sentiment index for February increased to 77.6. The preliminary reading was 76.3, and the January reading was 73.8.

The final Reuters / University of Michigan consumer sentiment index for February increased to 77.6. The preliminary reading was 76.3, and the January reading was 73.8. This was above the consensus forecast of 76.0, but still low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase, the default threat from Congress and the "sequester" spending cuts. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little ... but the sequester cuts might hurt sentiment in March.

Personal Income declined 3.6% in January, Spending increased 0.2%

by Calculated Risk on 3/01/2013 08:48:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income decreased $505.5 billion, or 3.6 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $18.2 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in January, the same increase as in December. ... PCE price index -- the price index for PCE increased less than 0.1 percent in January, in contrast to a decrease of less than 0.1 percent in December. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of less than 0.1 percent.

...

Personal saving -- DPI less personal outlays -- was $283.9 billion in January, compared with $797.4 billion in December. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 2.4 percent in January, compared with 6.4 percent in December.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE. Personal spending increased about as expected in January.

Ignore the sharp decline in income and decline in the saving rate - that decline was because some people took income in December to avoid higher taxes in 2013.

Thursday, February 28, 2013

Friday: Personal Income and Outlays, ISM Mfg Index, Construction Spending, Auto Sales, Consumer sentiment

by Calculated Risk on 2/28/2013 07:53:00 PM

There are several key economic releases on Friday. First, the Personal Income and Outlays report for January will be released. This will give some idea of how consumer spending is holding up following the payroll tax increase at the beginning of the year. Note that Personal Income will be off sharply in January since some people took income in December to avoid higher taxes in 2013. Don't be shocked by a large one month decline in income!

Another key release is light vehicles sales for February. The automakers will release results all day, and I'll post an estimate of the seasonally adjusted annual sales rate around 4 PM ET. Strong auto sales in February, combined with the ongoing housing recovery, would be a positive sign for the economy going forward.

As always, the ISM manufacturing index could move the markets. The regional surveys have been mixed, although the Markit Flash PMI was fairly strong, and the Chicago PMI increased in February.

Friday economic releases:

• At 8:30 AM ET, Personal Income and Outlays for January. The consensus is for a 2.1% decrease in personal income in January, and for 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 76.0.

• At 10:00 AM, ISM Manufacturing Index for February. The consensus is for PMI to decline to 52.8%. (above 50 is expansion).

• Also at 10:00 AM, Construction Spending for January. The consensus is for a 0.6% increase in construction spending.

• All day: Light vehicle sales for February. The consensus is for light vehicle sales to be at 15.2 million SAAR in February (Seasonally Adjusted Annual Rate) down from 15.3 SAAR in January.

Freddie Mac: $4.5 Billion Net Income, No Treasury Draw, REO Declines

by Calculated Risk on 2/28/2013 05:51:00 PM

From Freddie Mac: Freddie Mac Fourth Quarter 2012 Financial Results

Net income for the fourth quarter of 2012 was $4.5 billion, compared to $2.9 billion for the third quarter of 2012. The increase primarily reflects a shift from a provision for credit losses in the third quarter to a benefit for credit losses in the fourth quarter due to a decrease in the volume of newly delinquent single-family loans and continued improvement in national home prices, as well as a higher income tax benefit primarily driven by the favorable resolution of tax matters with the Internal Revenue Service (IRS). These favorable impacts were partially offset by higher net security impairments.On Real Estate Owned (REO), Freddie acquired 82,818 properties in 2012, and disposed of 94,296, and the total REO fell to 49,077 at the end of the year.

...

Freddie Mac does not require a draw from Treasury for the fourth quarter of 2012 because the company had positive net worth at December 31, 2012. The company’s $8.8 billion net worth at December 31, 2012 reflects $4.9 billion in net worth at September 30, 2012 and fourth quarter comprehensive income of $5.7 billion, partially offset by the $1.8 billion quarterly dividend payment to Treasury on the company’s senior preferred stock.

From Freddie:

In 2012, REO dispositions continued to exceed the volume of REO acquisitions. We believe our single-family REO acquisition volume in 2012 and 2011 was less than it otherwise would have been due in part to the length of the single-family foreclosure timeline, particularly in states where judicial foreclosures (those conducted under the supervision of the court) are required.

During 2012, our REO property inventory declined most in the West region primarily due to increased disposition activity and strengthening home prices in California.

The North Central region comprised 42 percent of our REO property inventory at December 31, 2012. We continue to have a significant number of properties in our REO inventory that we are unable to list because they are occupied or in states with a redemption period, particularly in Michigan, Minnesota and Illinois. States with redemption periods require a period of time after foreclosure during which the borrower may reclaim the property.

Click on graph for larger image.

Click on graph for larger image.This graph shows REO inventory for Freddie.

For FDIC insured institutions, the FDIC reports the dollar value of REOs, and the dollar value declined again in Q4. After Fannie announces results I'll post a graph of REO for the F's (Fannie, Freddie, and the FHA).

Restaurant Performance Index: Expansion in January

by Calculated Risk on 2/28/2013 03:15:00 PM

From the National Restaurant Association: Restaurant Performance Index Hit Five-Month High in January as Operators’ Optimism Grew

Driven by a more optimistic outlook among restaurant operators, the National Restaurant Association's Restaurant Performance Index (RPI) rose to its highest level in five months. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.6 in January, up 1.0 percent from December and its highest level since August 2012. In addition, January represented the first time in four months that the RPI rose above 100, which signifies expansion in the index of key industry indicators.

“Although the current situation indicators were mixed in January, restaurant operators were decidedly more optimistic about sales growth and the economy in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Operators’ outlook for same-store sales, capital spending and the overall economy all improved, which propelled the Expectations Index to its highest level in eight months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 99.7 in January – up 0.6 percent from December’s level. Although restaurant operators reported net positive same-store sales results in January, softness in the customer traffic and labor indicators outweighed the performance, which resulted in a Current Situation Index reading below 100 for the fifth consecutive month.

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.6 in January, up from 99.7 in December (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Kansas City Fed: Regional Manufacturing contracted in February

by Calculated Risk on 2/28/2013 01:30:00 PM

This is the last of the regional manufacturing surveys for February, and the results have been mixed. From the Kansas City Fed: Tenth District Manufacturing Survey Contracted Further

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity contracted further in February, and factories’ expectations weakened somewhat.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factory activity fell more sharply in February than in previous months. Some contacts cited disruptions due to bad weather, and many firms noted that possible federal spending cuts were hurting business,” said Wilkerson. However, capital spending plans for later in the year improved considerably.”

The month-over-month composite index was -10 in February, down from -2 in January and -1 in December ...

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

The average of the five regional surveys was slightly negative again, but improved from January.

The ISM index for February will be released tomorrow, Friday, March 1st, and these surveys suggest another weak reading. However the Chicago PMI (released this morning) indicated stronger expansion, and the Markit Flash PMI for February was solid too. So the ISM PMI will probably show sluggish expansion.

Fed: Consumer Debt increased slightly in Q4, "Deleveraging Process Decelerates"

by Calculated Risk on 2/28/2013 11:00:00 AM

From the NY Fed: Total Consumer Debt Up Slightly as Deleveraging Process Decelerates

In its latest Household Debt and Credit Report, the Federal Reserve Bank of New York announced that in the fourth quarter of 2012 outstanding consumer debt increased slightly ($31 billion), breaking the downward trend observed since the fourth quarter of 2008. The increase was primarily due to a rise in non-housing debt and the stabilization of mortgage debt.Here is the Q4 report: Quarterly Report on Household Debt and Credit

Total consumer indebtedness was $11.34 trillion, 0.3% higher than the previous quarter but considerably lower than its peak of $12.68 trillion in the third quarter of 2008. While outstanding mortgage debt remained roughly flat, originations of new mortgages rose to $553 billion, a fifth consecutive quarterly increase.

Non-housing debt balances increased for the third straight quarter and now stand at $2.75 trillion, up 1.4% in the fourth quarter. All non-housing components increased; auto loans up $15 billion, student loans up $10 billion and credit cards up $5 billion.

“The data provides early evidence that consumers may be reaching the end of the four year deleveraging cycle, though we’ll need to see if this is sustained in upcoming quarters,” said Andrew Haughwout, vice president and economist at the New York Fed. “At the same time, we observed mixed developments, mortgage originations increased and fewer accounts entered the foreclosure pipeline but delinquency rates remain considerably higher than pre-crisis levels.”

emphasis added

Mortgages, the largest component of household debt, were roughly flat. Mortgage balances shown on consumer credit reports stand at $8.03 trillion, roughly unchanged from the level in 2012Q3. Home equity lines of credit (HELOC) were the only product to see a substantive decline in the fourth quarter; balances dropped by $10 billion (1.7%) and now stand at $563 billion. Non-housing household debt balances increased for the third consecutive quarter and now stand at 2.75 trillion, up by 1.3% in the fourth quarter. All non-housing components increased, with auto loans up by $15 billion; student loans up by $10 billion, and credit card balances up by $5 billion.Here are two graphs:

...

About 336,000 consumers had a bankruptcy notation added to their credit reports in 2012Q4, a 21% drop from the same quarter last year, and the eighth consecutive drop in bankruptcies on a year-over-year basis.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt increased slightly in Q4.

Student debt is still increasing. From the NY Fed:

Outstanding student loan balances increased by $10 billion during the fourth quarter, to a total of $966 billion as of December 31, 2012.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Overall, delinquency rates continued to improve in 2012Q4. As of December 31, 8.6% of outstanding debt was in some stage of delinquency, compared with 8.9% in 2012Q3. About $978 billion of debt is delinquent, with $712 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

LPS: Mortgage delinquencies decreased in January

by Calculated Risk on 2/28/2013 09:56:00 AM

Note: From the Chicago ISM for February: "The Chicago Purchasing Managers reported the Chicago Business Barometer rose for a second month, up 1.2 points to 56.8, its highest level since last March." PMI: Increased to 56.8 from 55.6. (Above 50 is expansion). Employment: at 55.7, down from 58.0. New orders increased to 60.2 from 58.2. This was above expectations of a reading of 55.0.

LPS released their First Look report for January today. LPS reported that the percent of loans delinquent decreased in January compared to December, and declined about 8% year-over-year. Also the percent of loans in the foreclosure process declined further in January and were down significantly over the last year.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 7.03% from 7.17% in December. Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.41% in January from 3.44% in December.

The number of delinquent properties, but not in foreclosure, is down about 11% year-over-year (413,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 21% or 461,000 properties year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but the number of loans in the foreclosure process is now steadily declining.

LPS will release the complete mortgage monitor for January in early March.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Jan 2013 | Dec 2012 | Jan 2012 | |

| Delinquent | 7.03% | 7.17% | 7.67% |

| In Foreclosure | 3.41% | 3.44% | 4.23% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,974,000 | 2,031,000 | 2,159,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,531,000 | 1,545,000 | 1,759,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,703,000 | 1,716,000 | 2,164,000 |

| Total Properties | 5,208,000 | 5,292,000 | 6,082,000 |

Weekly Initial Unemployment Claims decrease to 344,000

by Calculated Risk on 2/28/2013 08:30:00 AM

Note: Q4 GDP growth was revised up from slightly negative to slightly positive. From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 0.1 percent in the fourth quarter of 2012 ... In the advance estimate, real GDP declined 0.1 percent.I'll have more on GDP later.

The DOL reports:

In the week ending February 23, the advance figure for seasonally adjusted initial claims was 344,000, a decrease of 22,000 from the previous week's revised figure of 366,000. The 4-week moving average was 355,000, a decrease of 6,750 from the previous week's revised average of 361,750.The previous week was revised up from 362,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 355,000 - just above the lowest 4-week average since the recession.

Weekly claims were below the 360,000 consensus forecast.