by Calculated Risk on 1/20/2013 09:56:00 AM

Sunday, January 20, 2013

"The case for deficit optimism"

From Ezra Klein: The case for deficit optimism Here’s a secret:

For all the sound and fury, Washington’s actually making real progress on debt.

... Start the clock — and the deficit projections — on Jan. 1, 2011. Congress cut expected spending by $585 billion during the 2011 appropriations process. It cut another $860 billion as part of the resolution to the 2011 debt-ceiling standoff. And it added another $1 trillion in spending cuts as part of the sequester. Then it raised $600 billion in taxes in the fiscal cliff deal.

Together, that’s slightly more than $3 trillion in deficit reduction. ... In fact, that’s about enough to stabilize the nation’s debt-to-GDP ratio over the next decade.

... Obama said ... we have “a health-care problem,” not a spending problem. This is, in general, a fairly uncontroversial point on the right ...

Back in December 2011, I asked Rep. Paul Ryan, budget guru to the House Republicans, for his favorite chart of the year ... He sent me one from the Bipartisan Policy Center showing four lines. One, labeled “discretionary spending,” was drifting down. Another, “mandatory spending,” was also falling. A third, denoting Social Security expenses, was rising a bit, but not by enough to worry anyone. The fourth, health-care spending, was shooting skyward. “Government spending drives the debt, and the growth of government health-care programs drives the spending,” Ryan explained.A few key points:

So here’s the good news: The growth of health-care costs has slowed in recent years. Big time. From 2009 to 2011, which is the most recent data available, health-care costs have grown by less than four percentage points. That’s compared to typical growth of six or seven percentage points through most of the Aughts. ... The $64,000 question — actually, it’s worth trillions of dollars more — is whether this slowdown is a recession-induced blip or the product, at least in part, of cost controls that will persist long after the economy has returned to health. At the moment, there’s evidence to support both views. ...

... the truth is that deficit reduction is going better than you’d think from listening to the sniping in Washington.

1) the deficit as a percent of GDP has been declining and will probably continue to decline over the next several years even without further deficit reduction measures (see the third chart here),

2) the debt to GDP ratio will probably stabilize and may even decline over the next decade,

3) the key long term budget issue is health care costs.

Saturday, January 19, 2013

"Financial Collapse: A 10-Step Recovery Plan"

by Calculated Risk on 1/19/2013 09:34:00 PM

Alan Blinder lists 10 financial commandments to remember - and starts by reminding us that "people do learn. The problem is that they forget — sometimes amazingly quickly."

The old Wall Street saying is "there is no institutional memory". Each new generation of Wall Street wizards figures out a new way to turn lead into gold, and to become wealthy while damaging the financial system. Some of these wizards are probably perfecting their financial alchemy right now.

Maybe next time people will remember Blinder's 10 step plan, but I doubt it: Financial Collapse: A 10-Step Recovery Plan

1. Remember That People ForgetBlinder concludes:

...

2. Do Not Rely on Self-Regulation

...

3. Honor Thy Shareholders

...

4. Elevate Risk Management

...

5. Use Less Leverage

...

6. Keep It Simple, Stupid

...

7. Standardize Derivatives and Trade Them on Exchanges

...

8. Keep Things on the Balance Sheet

...

9. Fix Perverse Compensation

...

10. Watch Out for Consumers

Mark Twain is said to have quipped that while history doesn’t repeat itself, it does rhyme. There will be financial crises in the future, and the next one won’t be a carbon copy of the last. Neither, however, will it be so different that these commandments won’t apply. Financial history does rhyme, but we’re already forgetting the meter.All of these items are important, but I think the key is to watch for excessive speculation using leverage. One thing is certain, there will be another bubble ...

Earlier:

• Schedule for Week of Jan 20th

• Summary for Week Ending Jan 18th

Unofficial Problem Bank list declines to 826 Institutions

by Calculated Risk on 1/19/2013 05:44:00 PM

Here is the unofficial problem bank list for Jan 18, 2012.

Changes and comments from surferdude808:

With the FDIC having a closing for the second consecutive week and the OCC releasing its actions through mid-December 2012, it was a busy week for the Unofficial Problem Bank List. In all, there were 10 removals and four additions, which leave the list holding 826 institutions with assets of $308.7 billion. A year ago the list held 963 institutions with assets of $389.2 billion.Earlier:

First Federal Bank Texas, Tyler, TX ($192 million Ticker: FFBT) merged on an unassisted basis and Evergreen International Bank, Long Beach, CA ($28 million) closed via a voluntary liquidation. The involuntary liquidation or FDIC closing was 1st Regents Bank, Andover, MN ($50 million).

Actions were terminated against Southwest Securities, FSB, Dallas, TX ($1.3 billion Ticker: SWS); Bank of Blue Valley, Overland Park, KS ($662 million Ticker: BVBC); Mountain West Bank, National Association, Helena, MT ($633 million Ticker: MTWF); First Federal Bank, Harrison, AR ($544 million Ticker: FFBH); Tulsa National Bank, Tulsa, OK ($165 million); and RiverWood Bank, Baxter, MN ($157 million). Also, Triumph Savings Bank, SSB, Dallas, TX ($286 million) was removed based on media report provided by a reader. However, the FDIC has not recognized the action termination by press release or in its enforcement action database.

The following four banks joined the list this week -- Citizens Financial Bank, Munster, IN ($1.1 billion Ticker: CITZ); Fieldpoint Private Bank & Trust, Greenwich, CT ($682 million); Delanco Federal Savings Bank, Delanco, NJ ($133 million); and Ben Franklin Bank of Illinois, Arlington Heights, IL ($100 million Ticker: BFFI).

Next week, we anticipate the FDIC will release its actions for December 2012.

• Schedule for Week of Jan 20th

• Summary for Week Ending Jan 18th

Summary for Week ending January 18th

by Calculated Risk on 1/19/2013 11:21:00 AM

Most of the data released last week was encouraging. Housing starts were up 28% annually in 2012 - a strong increase, and starts are still very low - and that suggests further increases for starts over the next few years and is good news for the economy. Note: There is a strong seasonal adjustment for housing starts in December (typically a slow month), so I'd use the monthly sales rate with caution - but the annual increase was solid.

There were other positive reports: retail sales in December were stronger than expected, industrial production increased, and weekly unemployment claims fell sharply (although there are strong seasonal adjustments in January). Still, the 4-week average of initial weekly unemployment claims is near the post-recession low.

On the negative side, both the NY Fed (Empire State) and Philly Fed manufacturing indexes indicated contraction in January. Even though housing is picking up, manufacturing remains weak. Another negative was consumer sentiment - probably being impacted by Congress (maybe by the payroll tax increase too) - but it now appears that Congress will pay the bills, so sentiment will probably improve.

It appears that economic growth is picking up, although the fiscal agreement will mean a drag of 1.5 to 2.0 percentage points on GDP growth in 2013 - so we should expect another year of sluggish growth.

Finally, I heard one analyst on CNBC ask why the Fed is staying so accommodative even with a pickup in growth. The answer is simple: the unemployment rate is 7.8% (very high), and inflation is below the Fed's target (see graph below).

And here is a summary of last week in graphs:

• Housing Starts increase sharply to 954 thousand SAAR in December

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 954 thousand (SAAR) in December, up 12.1% from the revised November rate of 851 thousand (SAAR). This was well above expectations of 887 thousand starts in December.

Housing starts increased 28.1% in 2012 and even after the sharp increase, the 780 thousand housing starts last year were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011). This was also the fourth lowest year for single family starts since 1959.

Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 annual level.

Since residential investment and housing starts are usually the best leading indicator for economy, this suggests the economy will continue to grow over the next couple of years.

• Retail Sales increased 0.5% in December

On a monthly basis, retail sales increased 0.5% from November to December (seasonally adjusted), and sales were up 4.7% from December 2011.

On a monthly basis, retail sales increased 0.5% from November to December (seasonally adjusted), and sales were up 4.7% from December 2011.Sales for November were revised up to a 0.4% gain.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 25.4% from the bottom, and now 9.7% above the pre-recession peak (not inflation adjusted)

This was above the consensus forecast of a 0.3% increase, and suggests the initial "soft" reports for December were too pessimistic.

• Fed: Industrial Production increased 0.3% in December

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.From the Fed: Industrial production and Capacity Utilization "Industrial production increased 0.3 percent in December after having risen 1.0 percent in November when production rebounded in the industries that had been negatively affected by Hurricane Sandy in late October. ... Capacity utilization for total industry moved up 0.1 percentage point to 78.8 percent, a rate 1.5 percentage points below its long-run (1972--2011) average."

This graph shows Capacity Utilization. This series is up 12 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 12 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 78.8% is still 1.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Both Industrial Production and Capacity Utilization were slightly above expectations.

• Philly Fed and NY Fed Manufacturing Surveys show contraction in January

From the Philly Fed: January Manufacturing Survey "Manufacturing activity declined moderately this month, according to firms responding to the January Business Outlook Survey. ... The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from

a revised reading of 4.6 in December to ‐5.8 this month". Earlier this week, the Empire State manufacturing survey also indicated contraction in January.

From the Philly Fed: January Manufacturing Survey "Manufacturing activity declined moderately this month, according to firms responding to the January Business Outlook Survey. ... The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from

a revised reading of 4.6 in December to ‐5.8 this month". Earlier this week, the Empire State manufacturing survey also indicated contraction in January.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

The average of the Empire State and Philly Fed surveys decreased in January, and is back below zero. This suggests another weak reading for the ISM manufacturing index.

• Weekly Initial Unemployment Claims decline to 335,000

The DOL reported: "In the week ending January 12, the advance figure for seasonally adjusted initial claims was 335,000, a decrease of 37,000 from the previous week's revised figure of 372,000. The 4-week moving average was 359,250, a decrease of 6,750 from the previous week's revised average of 366,000."

The DOL reported: "In the week ending January 12, the advance figure for seasonally adjusted initial claims was 335,000, a decrease of 37,000 from the previous week's revised figure of 372,000. The 4-week moving average was 359,250, a decrease of 6,750 from the previous week's revised average of 366,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 359,250.

This was the lowest level for weekly claims since January 2008, and the 4-week average is near the low since early 2008. Note: Data for January has large seasonal adjustments - and can be very volatile, but this is still good news.

• Key Measures show low inflation in December

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for November and increased 1.5% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for November and increased 1.5% year-over-year.On a monthly basis, median CPI was at 1.9% annualized, trimmed-mean CPI was at 1.1% annualized, and core CPI increased 1.2% annualized. Also core PCE for November increased 1.6% annualized. These measures suggest inflation is below the Fed's target of 2% on a year-over-year basis.

With this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

• CoreLogic: House Prices up 7.4% Year-over-year in November, Largest increase since 2006

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index was up 0.3% in November, and is up 7.4% over the last year.

The index is off 26.8% from the peak - and is up 9.6% from the post-bubble low set in February 2012 (the index is NSA, so some of the increase is seasonal).

The next graph is from CoreLogic.

The year-over-year comparison has been positive for nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The year-over-year comparison has been positive for nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in November - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

• Preliminary January Consumer Sentiment declines to 71.3

The preliminary Reuters / University of Michigan consumer sentiment index for January declined to 71.3 from the December reading of 72.9.

The preliminary Reuters / University of Michigan consumer sentiment index for January declined to 71.3 from the December reading of 72.9.This was below the consensus forecast of 75.0. There are a number of factors that can impact sentiment including unemployment, gasoline prices and other concerns - and, for January, the payroll tax increase and Congress' threat to not pay the bills.

Back in August 2011, sentiment declined sharply due to the threat of default and the debt ceiling debate. Unfortunately it appears Congress is negatively impacting sentiment once again.

Schedule for Week of Jan 20th

by Calculated Risk on 1/19/2013 08:02:00 AM

Note: I'll post a summary for last week soon.

There are two key December housing reports that will be released this week, Existing home sales on Tuesday, and New Home sales on Friday.

For manufacturing, the January Richmond Fed and Kansas City Fed surveys will be released this week.

All US markets will be closed in observance of the Martin Luther King, Jr. Day holiday.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for sales of 5.10 million on seasonally adjusted annual rate (SAAR) basis. Sales in November 2012 were 5.04 million SAAR.

Economist Tom Lawler estimates the NAR will report sales at 4.97 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January. The consensus is for a a reading of 5 for this survey, unchanged from December (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: FHFA House Price Index for November 2012. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 360 thousand from 335 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This release might provide hints about the ISM PMI for January. This consensus is for a decrease to 54.0 from 54.2 in December.

10:00 AM: Conference Board Leading Indicators for December. The consensus is for a 0.4% increase in this index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for January. The consensus is for a reading of 2, up from -2 in December (below zero is contraction).

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the November sales rate.

The consensus is for an increase in sales to 388 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 377 thousand in November.

Friday, January 18, 2013

Bank Failure #2 in 2013: 1st Regents Bank, Andover, Minnesota

by Calculated Risk on 1/18/2013 09:20:00 PM

Nor all of First Regent’s men

Can save it again

by Soylent Green is People

From the FDIC: First Minnesota Bank, Minnetonka, Minnesota, Assumes All of the Deposits of 1st Regents Bank, Andover, Minnesota

As of September 30, 2012, 1st Regents Bank had approximately $50.2 million in total assets and $49.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.5 million. ... 1st Regents Bank is the second FDIC-insured institution to fail in the nation this year, and the first in Minnesota.A Friday tradition continues ...

Lawler: Early Look At Existing Home Sales in December

by Calculated Risk on 1/18/2013 06:49:00 PM

From economist Tom Lawler:

Based on reports from various realtor associations/MLS across the country, I expect that existing home sales in December as measured by the National Association of Realtors will come in at a seasonally adjusted annual rate of 4.97 million in December, down 1.4% from November’s pace (which I think should be revised upward a bit), but up 13.5% from last December’s seasonally adjusted pace. Folks who track unadjusted data from local realtor reports but don’t take into account “calendar” effects would probably expect a lower number; after all, most (though not all) local realtor reports showed substantially lower YOY growth in December compared to November, and the number of local areas showing YOY sales declines was up in December compared to November. Indeed, national existing homes sales on an unadjusted basis, which showed YOY growth of 15.5% in November, are likely to show a YOY growth rate of less than half that amount in December. However, not only was there one fewer “business” day this December compared to last December, but both Christmas and New Years (this year) came on a Tuesday --- reducing the “effective” number of business days even further. As a result, this December’s seasonal factor will “gross up” the unadjusted sales figures by more than last Decembers.

On the inventory front, both local realtor reports and entities that track local real estate listings showed that in most (though not all) areas of the country the number of homes listed for sale at the end of December was down sharply from the end of the November – which is typical for most (though not quite all) parts of the country. Based on looking at various sources of data, my “best guess” is that the NAR’s estimate of the inventory of existing homes for sale at the end of December will be 1.87 million, down 7.9% from November and down 19.4% from last December.

Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price in December will show another double-digit YOY increase, probably of around 11.0%. This gain does not, of course, reflect the increase in “typical” home prices, but does reflect in part the sharply lower foreclosure sales share of home resales this December compared to last December.

CR Note: The NAR will report December existing home sales on Tuesday, Jan 22nd. The consensus is the NAR will report sales of 5.10 million.

Based on Lawler's estimates, the NAR will report inventory around 1.87 million units for December, and months-of-supply around 4.5 months (down from 4.8 months in November). This would be the lowest level of inventory in over 10 years, and the lowest months-of-supply since early 2005.

The Future's so Bright ...

by Calculated Risk on 1/18/2013 03:19:00 PM

It looks like economic growth will pickup over the next few years. I've written about this before - a combination of growth in the key housing sector, a significant amount of household deleveraging behind us, the end of the drag from state and local government layoffs (four years of austerity nearing the end), some loosening of household credit, and the Fed staying accommodative (with a 7.8% unemployment rate and inflation below the Fed's target, the Fed will remain accommodative).

The key short term risk is too much additional deficit reduction too quickly. There is a strong argument that the "fiscal agreement" might be a little too much with the current unemployment rate - my initial estimate was that Federal government austerity would subtract about 1.5 percentage points from growth in 2013 (Merrill Lynch estimate up to 2.0 percentage points including an estimate for the coming sequester agreement). This means another year of sluggish growth, even with an improved private sector (retail will be impacted by the payroll tax increase). But ex-austerity, we'd probably be looking at a decent year.

Here are a few graphs:

Click on graph for larger image.

Click on graph for larger image.

This graph shows total and single family housing starts. Even after the 28.1% in 2012, the 780 thousand housing starts in 2012 were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959. Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

Residential investment and housing starts are usually the best leading indicator for economy, so this suggests the economy will continue to grow over the next couple of years.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.

Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over. Some states like California are close to running a surplus, and, as the BLS reported this morning, even Nevada is seeing a sharp improvement in the unemployment rate.

And another key graph on the US deficit. As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to around 3% in fiscal 2015.

And another key graph on the US deficit. As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to around 3% in fiscal 2015.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next three years based on current policy (Jan Hatzius at Goldman Sachs estimates the deficit will 3% of GDP in 2015). Note: With 7.8% unemployment, there is a strong argument for less deficit reduction in the short term, but that doesn't seem to be getting any traction.

This graph from the the NY Fed shows aggregate consumer debt decreased in Q3. This was mostly due to a decline in mortgage debt.

Household debt peaked in Q2 2008 and has been declining for over four years. There is probably more deleveraging ahead (mostly from foreclosures and distressed sales), but this suggests some improvement in household balance sheets.

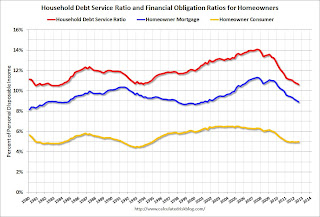

The second graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The second graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages and consumer debt. The overall Debt Service Ratio has declined back to early 1980s levels, and is near the record low - thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt is at 1994 levels.

The blue line is the homeowner's financial obligation ratio for mortgages (blue). This ratio increased rapidly during the housing bubble, and continued to increase until 2008. Now, with falling interest rates, and less mortgage debt (mostly due to foreclosures), the ratio is back to 2001 levels. This will probably decline further, but for many homeowners, the obligation ratio is low.

There are several tailwinds for the economy, and the headwinds (like household deleveraging) are mostly subsiding. Deficit reduction is on a reasonable path - we don't want to reduce the deficit much faster than this projection for the next few years, because that will be too much of a drag on the economy.

Overall it appears the economy is poised for more growth over the next few years.

What about the longer term?

There are a number of longer term challenges from rising health care expenditures, climate change, income and wealth inequality and more, but I remain very optimistic about the longer term too. There is a constant focus on the aging population, but by 2020, eight of the top ten largest cohorts (five year age groups) will be under 40, and by 2030 the top 11 cohorts are the youngest 11 cohorts. The renewing of America! And these young people are smart (less exposure to lead is a significant story), and well educated too. I'll write more on the long term soon.

Last year, I said that looking forward I was the most optimistic since the '90s. And things are only getting better. The future's so bright, I gotta wear shades.

Yes, the song was about nuclear holocaust ... but it was originally intended the way I'm using it.

2007 Fed Transcripts

by Calculated Risk on 1/18/2013 01:48:00 PM

Here are the Fed transcripts for 2007.

From the WSJ: Fed's 2007 Transcripts Show Shift to Alarm

The Fed entered 2007 with interest-rate policies on hold and many officials comfortable about the economic outlook. By year-end, the U.S. was in recession ...One of my ongoing criticisms of Bernanke was that he was "behind the curve".

Fed Chairman Ben Bernanke ... was often behind the curve in his economic outlook. In January, for example, he projected that the "worst outcomes" for housing had become less likely. In May, he said he saw "good fundamental reasons to think that growth will be moderate."

He began to see after midyear that strains in financial markets threatened to move beyond housing to the broader economy and financial system. Mr. Bernanke himself slowly took on a more interventionist stance, but appears to have embraced that position reluctantly.

...

Meanwhile, Janet Yellen, then president of the Federal Reserve Bank of San Francisco and now the central bank's vice chairman, became increasingly alarmed about the growing risks to the economy as the year progressed.

"I still feel the presence of a 600-pound gorilla in the room, and that is the housing sector," she said in June 2007. "The risk for further significant deterioration in the housing market, with house prices falling and mortgage delinquencies rising further, causes me appreciable angst."

By December, she was pushing the Fed for aggressive responses to the crisis. "At the time of our last meeting, I held out hope that the financial turmoil would gradually ebb and the economy might escape without serious damage. Subsequent developments have severely shaken that belief," she said in December.

And some excerpts from FT Alphaville: From subprime to crisis: the Fed’s 2007 transcripts and 2007 FOMC transcripts: a few more excerpts. Janet Yellen in September 2007:

"We see a large drop in house prices as quite likely to adversely affect consumption spending over time through a number of different channels, including wealth effects, collateral effects, and negative effects on spending through the interest rate resets. A big worry is that a significant drop in house prices might occur in the context of job losses, and this could lead to a vicious spiral of foreclosures, further weakness in housing markets, and further reductions in consumer spending. ... at this point I am concerned that the potential effects of the developing credit crunch could be substantial. I recognize that there’s a tremendous amount of uncertainty around any estimate. But I see the skew in the distribution to be primarily to the downside, reflecting possible adverse spillovers from housing to consumption and business investment."And from the WaPo Wonkblog: The Fed’s 2007 crisis response: Twinkies, pessimism pills, and missed warnings.

State Unemployment Rates "little changed" in December

by Calculated Risk on 1/18/2013 10:59:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in December. Twenty-two states recorded unemployment rate decreases, 16 states and the District of Columbia posted increases, and 12 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-two states and the District of Columbia registered unemployment rate decreases from a year earlier, six states experienced increases, and two states had no change.

...

Nevada and Rhode Island recorded the highest unemployment rates among the states in December, 10.2 percent each. North Dakota again registered the lowest jobless rate, 3.2 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan, Ohio and Nevada have seen the largest declines - New Jersey is the laggard.

The states are ranked by the highest current unemployment rate. Only two states still have double digit unemployment rates: Nevada and Rhode Island. In early 2010, 18 states and D.C. had double digit unemployment rates.

I expect the unemployment rate in Nevada to fall below 10% very soon.

Even though Nevada still has the highest unemployment rate (tied with Rhode Island), the rate has declined in recent months, falling from 12.1% in August to 10.2% in December.