by Calculated Risk on 9/02/2012 12:03:00 PM

Sunday, September 02, 2012

Hotel Occupancy Rate above pre-recession levels

From HotelNewsNow.com: STR: US results for week ending 25 August

In year-over-year comparisons, occupancy ended the week with a 4.9-percent increase to 65.7 percent, average daily rate was up 5.3 percent to US$105.43 and revenue per available room ended the week with an increase of 10.5 percent to US$69.30.The 4-week average is above the pre-recession levels (the occupancy rate for the same week in 2007 was 64.2 percent).

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

The occupancy rate will decline over the next month as the summer travel season ends. The next key period is for fall business travel.

The recovery in the occupancy rate has helped hotel profitability, from HotelNewsNow.com: Hotel profitability bouncing back

The U.S. hotel industry achieved a net income of approximately $33 billion, or 21.4% of total revenues, during 2011—a healthy increase of 15.7% over 2010 levels, according to STR through its Hotel Operating Statistics, or HOST, program. STR is the parent company of HotelNewsNow.com.Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Yesterday:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Restaurant Performance Index declines in July

by Calculated Risk on 9/02/2012 09:06:00 AM

From the National Restaurant Association: Uncertainty Over Future Business Conditions Dampens Restaurant Performance Index

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.2 in July, down 1.1 percent from June and the lowest mark since a reading of 100.0 in October. However, July still represented the ninth consecutive month that the RPI stood above 100, which signifies continued expansion in the index of key industry indicators.

“Although restaurant operators reported positive same-store sales for the 14th consecutive month in July, their economic outlook for the months ahead continued to soften,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Only 22 percent of restaurant operators expect economic conditions to improve in the next six months, the lowest level in 10 months.”

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.2 in July, down from 101.4 in June (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Yesterday:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Saturday, September 01, 2012

WSJ interview with Fed's Lockhart: Next Fed action could be a "package" of easing

by Calculated Risk on 9/01/2012 06:36:00 PM

Here is a brief interview of Atlanta Fed President Dennis Lockhart in the WSJ: Fed Official Says More Stimulus a 'Close Call'

"It's a close call" when it comes answering the question of whether the Fed should provide more aid to the economy, Federal Reserve Bank of Atlanta President Dennis Lockhart said.CR Note: If Lockhart is waiting for additional fiscal stimulus, it will be a long long wait. And the "fiscal cliff" will not be addressed until after the election.

...

"I'm increasingly of the view that we are on a track that you would, to simplify it, would say is about a 2% growth track with fluctuating job growth. But overall, not a strong enough pace to bring down unemployment to anything close to a notion of full employment in a reasonable time," Mr. Lockhart said.

"That's a very tough question. I am not highly confident in the ability of simply monetary action to jump-shift the economy onto a different track," ... "There really is a lot to be solved on the fiscal side to create the conditions, arguably, in which further monetary action could really boost the economy,"

...

If the Fed were to act, Mr. Lockhart said half-measures would not get the job done. While he didn't state what the steps could be, he said stimulus, if chosen, should be "a package. When I say package that means two or three things done at the same time to create maximum possible gains."

I think his most interesting comment is at the end about additional accommodation as "a package". That suggests that both extending the extended period until 2015 and another round of asset purchases might happen at the same time (perhaps conditional on the economy).

Earlier:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Schedule for Week of Sept 2nd

by Calculated Risk on 9/01/2012 12:57:00 PM

Earlier:

• Summary for Week Ending Aug 31st

The key report for this week will be the August employment report to be released on Friday, Sept 7th. Other key reports include the ISM manufacturing index on Tuesday, vehicle sales also on Tuesday, and the ISM non-manufacturing (service) index on Thursday.

On Thursday, September 6th, there is a Governing Council meeting of the European Central Bank in Frankfurt with a press conference to follow. ECB President Mario Draghi is expected to discuss how the ECB will help lower Spanish and Italian borrowing costs.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 14.3 million SAAR in August from 14.1 million in July (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the July sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the July sales rate. TrueCar is forecasting:

The August 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.2 million new car sales, up from 12.1 million in August 2011 and up from 14.1 million in July 2012.Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,287,603 new cars will be sold in August for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.5 million light vehicles.

10:00 AM ET: ISM Manufacturing Index for August.

10:00 AM ET: ISM Manufacturing Index for August. Here is a long term graph of the ISM manufacturing index. The ISM index has shown contraction for two consecutive months; the first contraction in the ISM index since the recession ended in 2009. The consensus is for an increase to 50.0, up from 49.8 in July. (below 50 is contraction).

10:00 AM: Construction Spending for July. The consensus is for a 0.4% increase in construction spending.

8:30 AM: Productivity and Costs for Q2. The consensus is for a 1.4% increase in unit labor costs.

10:00 AM: Trulia Price Rent Monitors for August. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 370 thousand from 374 thousand.

10:00 AM: ISM non-Manufacturing Index for August. The consensus is for an increase to 53.0 from 52.6 in July. Note: Above 50 indicates expansion, below 50 contraction.

During the day: Governing Council meeting of the European Central Bank with a press conference to follow.

8:30 AM: Employment Report for August. The consensus is for an increase of 125,000 non-farm payroll jobs in August, down from the 163,000 jobs added in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 125,000 non-farm payroll jobs in August, down from the 163,000 jobs added in July.The consensus is for the unemployment rate to be unchanged at 8.3%.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through June.

The economy has added 4.54 million private sector jobs since employment bottomed in February 2010 (4.00 million total jobs added with all the public sector layoffs).

The economy has added 4.54 million private sector jobs since employment bottomed in February 2010 (4.00 million total jobs added with all the public sector layoffs).There are still 4.3 million fewer private sector jobs now than when the recession started in 2007. (4.8 million fewer total nonfarm jobs).

Summary for Week Ending August 31st

by Calculated Risk on 9/01/2012 08:03:00 AM

The key event of the week was Fed Chairman Ben Bernanke’s speech on Friday at the Jackson Hole Economic Symposium. Here was my take on the speech: Analysis: Bernanke Clears the way for QE3 in September and a couple more views: Two more reviews of Bernanke's Speech: Weak Labor Market "a grave concern"

The economic data was still weak, but a little better than expected - since expectations are so low. Q2 GDP was revised up to a still weak 1.7% from 1.5% and personal income and spending increased in July. An important positive was that the Case-Shiller house price index turned positive on a year-over-year basis suggesting house prices might have bottomed earlier this year.

On the other hand, the manufacturing surveys were once again disappointing.

Even the “better” news was pretty weak – definitely not “substantial and sustainable strengthening in the pace of the economic recovery”. Next week the focus will be on the August employment report and the European ECB meeting.

Here is a summary of last week in graphs:

• Case-Shiller: House Prices increased 0.5% year-over-year in June

Click on graph for larger image.

Click on graph for larger image.

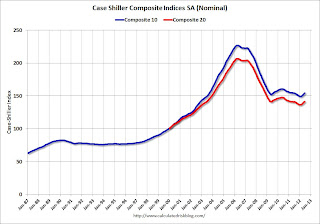

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.0% from the peak, and up 1.0% in June (SA). The Composite 10 is up 3.5% from the post bubble low set in March (SA).

The Composite 20 index is off 31.6% from the peak, and up 0.9% (SA) in June. The Composite 20 is up 3.6% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is up 0.1% compared to June 2011.

The Composite 20 SA is up 0.5% compared to June 2011. This was the first year-over-year since 2010 (when the tax credit boosted prices temporarily).

• Real House Prices, Price-to-Rent Ratio

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

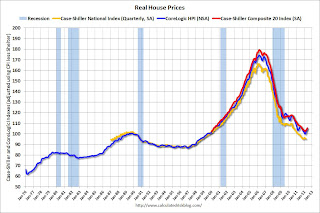

This graph shows the quarterly Case-Shiller National Index SA (through Q2 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q4 2010), and the Case-Shiller Composite 20 Index (SA) is back to July 2003 levels, and the CoreLogic index (NSA) is back to November 2003.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to June 2000, and the CoreLogic index back to October 2000.

As we've discussed before, in real terms, all of the appreciation early in the last decade is still gone.

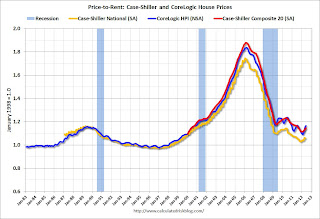

Here is a graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes compared to owners equivalent rent.

Here is a graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes compared to owners equivalent rent.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to August 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• Personal Income increased 0.3% in July, Spending increased 0.4%

This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. "Personal income increased $42.3 billion, or 0.3 percent ... Personal consumption expenditures (PCE) increased $46.0 billion, or 0.4 percent. ... Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in July, in contrast to a decrease of 0.1 percent in June."

A key point is the PCE price index has only increased 1.3% over the last year, and core PCE is up only 1.6%. The PCE price index - and core PCE - hardly increased in July.

• Weekly Initial Unemployment Claims at 374,000

"In the week ending August 25, the advance figure for seasonally adjusted initial claims was 374,000, unchanged from the previous week's revised figure of 374,000. The 4-week moving average was 370,250, an increase of 1,500 from the previous week's revised average of 368,750"

"In the week ending August 25, the advance figure for seasonally adjusted initial claims was 374,000, unchanged from the previous week's revised figure of 374,000. The 4-week moving average was 370,250, an increase of 1,500 from the previous week's revised average of 368,750"The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 370,250.

This was above the consensus forecast of 370,000.

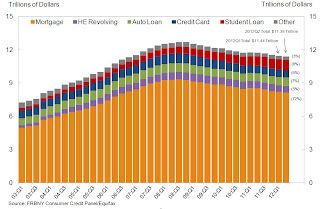

• Fed: Consumer Deleveraging Continued in Q2

From the NY Fed: Overall Delinquency Rates Down as Americans Paying More Debt on Time

From the NY Fed: Overall Delinquency Rates Down as Americans Paying More Debt on Time This graph shows aggregate consumer debt decreased in Q2. This was mostly due to a decline in mortgage debt.

However student debt is still increasing.

This graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

This graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed: "Overall delinquencies improved in 2012Q2. As of June 30, 9.0% of outstanding debt was in some stage of delinquency, compared with 9.3% at the end of 2012Q1. About $1.02 trillion of debt is delinquent, with $765 billion seriously delinquent (at least 90 days late or “severely derogatory”)."

• Other Economic Stories ...

• NAR: Pending home sales index increased 2.4% in July

• Fed's Beige Book: Economic activity increased "gradually", Residential real estate shows "signs of improvement"

• Chicago PMI declines to 53.0

• Fannie Mae and Freddie Mac Serious Delinquency rates declined in July

• LPS: Mortgage delinquencies decreased in July

Friday, August 31, 2012

Unofficial Problem Bank list declines to 891 Institutions

by Calculated Risk on 8/31/2012 09:27:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 31, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The FDIC released its actions for July 2012 as anticipated. This week there were 10 removals and three additions leaving the Unofficial Problem Bank List with 891 institutions with assets of $331.5 billion, down from 898 institutions with assets of $346.7 billion. About two-thirds or $10.0 billion of the $15.2 billion decline in assets came from updating assets with figures from the second quarter. For the month of August 2012, the list declined by a net of nine institutions after 11 additions, 16 actions terminations, three unassisted mergers, and one failure. The singular failure is the lowest monthly total since the list was first published on August 7, 2009. A year ago, the list held 988 institutions with assets of $403.0 billion. This week the FDIC released the Official Problem Bank List for the second quarter that included 732 institutions with assets of $282 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Actions have been terminated against Park View Federal Savings Bank, Solon, OH ($805 million Ticker: PVFC); Cornerstone Community Bank, Chattanooga, TN ($420 million Ticker: CSBQ); PBK Bank, Inc., Stanford, KY ($116 million); The First Bank of Greenwich, Cos Cob, CT ($88 million); Community First Bank, Rosholt, WI ($68 million); Select Bank, Grand Rapids, MI ($66 million); and The State Exchange Bank, Lamont, OK ($50 million).

Three banks were removed as they found merger partners -- BankAtlantic, Fort Lauderdale, FL ($3.8 billion Ticker: BBX); Valliance Bank, McKinney, TX ($68 million); and Texas Coastal Bank, Pasadena, TX ($27 million).

The three additions were The Peoples Bank, Eatonton, GA ($137 million); The Peoples Bank, Covington, GA ($113 million); and First Community Bank of Crawford County, Van Buren, AR ($97 million). The other change was the FDIC issuing a Prompt Corrective Action order against Banks of Wisconsin, Kenosha, WI ($155 million).

Not surprising the FDIC took the long weekend off. We wish a happy Labor weekend to all and hope that anyone seeking a job lands one soon.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Two more reviews of Bernanke's Speech: Weak Labor Market "a grave concern"

by Calculated Risk on 8/31/2012 06:29:00 PM

"The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years."

Fed Chairman Ben Bernanke, August 31, 2012

From a research note today by Andrew Tilton at Goldman Sachs:

In the most striking line of the speech, Bernanke professed “grave concern” about the weak labor market and the potential human and economic cost of persistently high unemployment. Although consistent with prior comments about long-term unemployment and the risk of hysteresis, these are very strong words from a Fed chairman. When one has a “grave concern”, action—quite possibly aggressive action─is appropriate.And from Tim Duy at EconomistsView: Bernanke at Jackson Hole

The Chairman’s remarks strengthen our conviction that the Fed will ease in September, most likely by pushing out its guidance that rates will remain “exceptionally low at least through late 2014” to mid-2015 or beyond. We now think the probability of an announcement of further asset purchases is close to 50/50 in September, though our base-case forecast is still that this is more likely in December or early 2013. When and if asset purchases do occur, we expect them to be concentrated in agency mortgage-backed securities, and on an open-ended basis (i.e. a monthly rate of purchases) with changes in the rate of purchases conditional on the economic environment. Our views could still change depending on how economic data and financial conditions evolve between now and the September 13 announcement.

On net, Bernanke's speech leads me to believe the odds of additional easing at the next FOMC meeting are somewhat higher (and above 50%) than I had previously believed. His defense of nontraditional action to date and focus on unemployment point in that direction. This is the bandwagon the financial press will jump on. Still, the backward looking nature of the speech and the obvious concern that the Fed has limited ability to offset the factors currently holding back more rapid improvement in labor markets, however, leave me wary that Bernanke remains hesitant to take additional action at this juncture. This suggests to me that additional easing is not a no-brainer, but perhaps that is just my internal bias talking.

LPS: Mortgage delinquencies decreased in July

by Calculated Risk on 8/31/2012 03:54:00 PM

LPS released their First Look report for July this week. LPS reported that the percent of loans delinquent decreased in July from June.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased in July to 7.03% from 7.14% in June. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.57%, so delinquencies have fallen over half way back to normal.

The following table shows the LPS numbers for July 2012, and also for last month (June 2012) and one year ago (July 2011).

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| July 2012 | June 2012 | July 2011 | |

| Delinquent | 7.03% | 7.14% | 7.90% |

| In Foreclosure | 4.08% | 4.09% | 4.12% |

| Number of loans: | |||

| Loans Less Than 90 Days | 1,960,000 | 2,012,000 | NA |

| Loans 90 Days or more | 1,560,000 | 1,590,000 | NA |

| Loans In Foreclosure | 2,042,000 | 2,061,000 | NA |

| Total | 5,562,000 | 5,663,000 | NA |

The total number of delinquent loans, and in foreclosure, dropped about 100 thousand in July from June.

The percent of loans less than 90 days delinquent is close to normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process are still very high.

Fannie Mae and Freddie Mac Serious Delinquency rates declined in July

by Calculated Risk on 8/31/2012 01:54:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in July to 3.50% from 3.53% June. The serious delinquency rate is down from 4.08% in July last year, and this is the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 3.42%, from 3.45% in June. Freddie's rate is only down slightly from 3.51% in July 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%. This is the lowest level for Freddie since August 2009.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates some progress, the "normal" serious delinquency rate is under 1% - and it looks like it will be several years until the rates back to normal.

Analysis: Bernanke Clears the way for QE3 in September

by Calculated Risk on 8/31/2012 12:33:00 PM

First from Jon Hilsenrath and Kristina Peterson at the WSJ: Bernanke Signals Readiness to Do More

Federal Reserve Chairman Ben Bernanke offered a robust defense of the effectiveness of the central bank's easy-money policies in his speech Friday at the Fed conference here, and left little doubt that he is looking toward doing more to give the economy a lift at the Fed's next policy meeting in September.As Hilsenrath notes, Bernanke argued: 1) QE has been effective, 2) Additional QE would be helpful, 3) the costs of additional QE "appear manageable", and 4) the economy is "far from satisfactory.

• In Bernanke's view, QE has been effective. From his speech:

How effective are balance sheet policies? After nearly four years of experience with large-scale asset purchases, a substantial body of empirical work on their effects has emerged. Generally, this research finds that the Federal Reserve's large-scale purchases have significantly lowered long-term Treasury yields. ... These effects are economically meaningful.• The costs of additional QE are "manageable":

... a study using the Board's FRB/US model of the economy found that, as of 2012, the first two rounds of LSAPs may have raised the level of output by almost 3 percent and increased private payroll employment by more than 2 million jobs, relative to what otherwise would have occurred. The Bank of England has used LSAPs in a manner similar to that of the Federal Reserve, so it is of interest that researchers have found the financial and macroeconomic effects of the British programs to be qualitatively similar to those in the United States.

To be sure, these estimates of the macroeconomic effects of LSAPs should be treated with caution. ... Overall, however, a balanced reading of the evidence supports the conclusion that central bank securities purchases have provided meaningful support to the economic recovery while mitigating deflationary risks.

[T]he costs of nontraditional policies, when considered carefully, appear manageable, implying that we should not rule out the further use of such policies if economic conditions warrant.• The economy is still very weak:

[T]he economic situation is obviously far from satisfactory ... The unemployment rate remains more than 2 percentage points above what most FOMC participants see as its longer-run normal value ... Further, the rate of improvement in the labor market has been painfully slow. I have noted on other occasions that the declines in unemployment we have seen would likely continue only if economic growth picked up to a rate above its longer-term trend. In fact, growth in recent quarters has been tepid, and so, not surprisingly, we have seen no net improvement in the unemployment rate since January.Bernanke's comments suggest QE3 will be launched very soon, perhaps on September 13th following the next FOMC meeting.

Unless the economy begins to grow more quickly than it has recently, the unemployment rate is likely to remain far above levels consistent with maximum employment for some time.

I thought the odds of QE3 in August were high - and the minutes of the meeting indicated they were very very close. It is possible that the FOMC in September will announce an extension of the extended period until 2015 (from late 2014), and wait again for QE3, but that would seem at odds with Bernanke's comments today.